It's Wednesday, and as usual I scout around various issues that I have been thinking…

Unaccountable central bankers once again out of controls

On August 27, 2020, the US Federal Reserve Chairman, Jerome Powell made a path breaking speech – New Economic Challenges and the Fed’s Monetary Policy Review. On the same day, the Federal Reserve Bank released a statement – Federal Open Market Committee announces approval of updates to its Statement on Longer-Run Goals and Monetary Policy Strategy. I analysed that shift in this blog post – US Federal Reserve statement signals a new phase in the paradigm shift in macroeconomics (August 31, 2020). It appeared at the time, that a major shift in the way central banking policy was to be conducted in the future was underway. A Reuters’ report (August 28, 2020) – With new monetary policy approach, Fed lays Phillips curve to rest – reported that “One of the fundamental theories of modern economics may have finally been put to rest”. At the time, I didn’t place enough emphasis on the ‘may’ and now realise that nothing really has changed after a few years of teetering on the precipice of change. The old guard is back and threatening the livelihoods of workers in their usual way.

Powell’s August 2020 shift meant that the central bank was to focus on creating “maximum employment” rather than sacrifice jobs growth because some measure of future expected inflation had risen above the desired rate.

It meant that the central bank would no longer tighten monetary policy as employment growth strengthens before there are inflationary effects – that is, they are rejecting all the ‘forward-looking’ bias that mainstream theory imparted that policy had to kill off employment growth before unemployment had fallen significantly.

After Powell’s apparent shift several other central banks followed suit with similar commitments to full employment and a more calm attitude to inflation dynamics.

And, unemployment fell all around the world, which is a good thing for workers.

Someone must have been reading Robert Louis Stevenson, because within the space of a few months Mr Hyde is back in town, more lethal than before.

The ECB has just run a conference in Sintra (Portugal) and Jerome Powell appeared yesterday (June 29, 2022) with ECB boss Madame Lagarde and basically confirmed that our hopes that a real change had occurred in 2020 were just a pipe dream.

Powell’s narrative took us back to the 1980s and onwards with talk about ‘soft landings’ and an ‘inflation first’ imperative.

He claimed that the Federal Reserve was now prioritising its fight against inflation and would be raising interest rates “just enough” to achieve that goal.

The problem is that central bankers do not know what ‘just enough’ is because of the inexact nature of monetary policy exercised through interest rate increases.

We have always known it to be a rather ‘blunt’ policy tool – which just means there are several reasons why impacts are ambiguous and subject to unpredictable time lags.

First, central bankers do not know whether interest rate increases take pressure of price rises. There is every reason, at least in the short-run to expect they worsen the inflationary pressures, especially if those pressures are the result of corporations exercising market power to pass on rising unit costs via their mark-ups.

Second, there are also counter distributional effects of interest rate rises, where creditors and those on fixed incomes enjoy a stimulus and debtors endure reduced purchasing power.

How those distributional impacts play out is uncertain.

Third, there are time lags that are unpredictable. Even under mainstream logic, the rate rises influence interest-rate sensitive costs and expenditures. They are not linear in impact.

People take time to adjust and may well, for example, just eat into prior savings before curtailing expenditure and borrowing.

Time lags make policy difficult to implement because if the aim is to influence the cycle and the policy intervention only starts to impact when the cycle has already shifted then the outcomes can be perverse indeed.

Fourth, eventually, interest rate levels will reach such a height that they cause recession and an escalation in unemployment, which discourages the firms from exercising that market power as costs drive bankruptcies and even OPEC oil sellers realise they are losing profits due to volume falls.

But the economic and social cost of that strategy is massive and unjustifiable.

At least according to my calculus.

But not, it seems to the likes of Powell.

He told the audience at Sintra:

Is there a risk that we would go too far? Certainly there’s a risk, but I wouldn’t agree that it’s the biggest risk to the economy … The bigger mistake to make, let’s put it that way, would be to fail to restore price stability.

He also said that there was “no guarantee” that the Federal Reserve would not create a recession as a result of the current policy shift.

So unemployment is not the biggest risk – which is the familiar narrative in the neoliberal era.

Deliberately creating recession – the worst of economic evils – is now back within the policy set – a sort of contagion outcome.

Unemployment is no longer a policy target to be kept low, but a deliberate policy tool to be used to keep inflation low.

Every time I have done the calculations on the relative costs and benefits of that strategy the answer is the same – costs massive, benefits low.

It can never be a responsible and efficient strategy to waste millions of income generating potential on a daily basis just to see inflation drop to low levels.

Powell also admitted that the inflationary pressures were coming from the on-going effects on the pandemic and more recently, the Russian invasion of Ukraine.

He didn’t mention the anti-competitive behaviour of OPEC who exert monopoly power to push up oil prices to suit their own ends.

But the point is that if it is true that these factors are driving the inflationary pressures, then how does raising interest rates solve the problems that those factors present?

By increasing the borrowing costs they might be able to influence demand, but will do nothing to influence the shipping disruptions, factory closures, increasing pools of sick workers from Covid, the Russian invasion, and OPEC.

There is no answer from the central bankers to this anomaly other than to return to script.

1. Inflation must be our priority.

2. Inflationary expectations might escape and become self-fulfilling.

3. The only tool we have is to drive the economy into recession, induce rising poverty, etc.

4. But we won’t comment on the obscene CEO salary increases that get reported each day in the financial press.

Back to the 1980s.

It is a complete contradiction of the August 2020 statement.

We are now back to the ‘forward-looking’ approach – where even before any expectational blowouts have been detected – the central bank hikes rates and drives unemployment up.

It is a very costly strategy.

What they are effectively saying is that even though there are supply constraints, they are prepared to reduce aggregate demand down to the reduced level of supply.

The question then is what happens when supply recovers as factories reopen, ships move around and so on?

Well then they will be left with a massive pool of jobless people, some of whom will have been forced to default on their mortgages and lose their houses as a consequence, some of whom will have committed suicide, not to mention the generation of workers leaving school who will face limited opportunities in the labour market to progress with.

A clusterf*xk!

It would be far better to understand that the inflationary pressures are transitory and to maintain low levels of unemployment while the transitory factors play out.

Powell and Lagarde told the Sintra conference that they had waited to raise interest rates because they through the rising prices were the “temporary result of supply chain” disruptions due to Covid.

And indeed they are.

The mistake they are making is to equate “temporary” with short-term.

Transitory does not have a time element. It has a causal element.

The causes will take time to work out that is beyond doubt.

But it is folly to add an additional (very costly) problem into the mix (recession) when those causal factors will dissipate eventually.

The other claim these central bankers made at Sintra was that there are plenty of private savings in the system which will act as a buffer against the rising interest rates.

In other words, deliberately create unemployment and income loss, and hope that expenditure doesn’t fall as much as the unemployed are forced to run down their wealth holdings to stay afloat.

All of which will devastate lower income households.

The only central bank that is holding firm at present against all this madness is the Bank of Japan. Smart.

The European Commission Spring Forecasts

If you go back and read the European Commission’s – Spring 2022 Economic Forecast: Russian invasion tests EU economic resilience – you will note that the inflation forecasts for 2022 and 2023 do not signify any entrenched inflation problem.

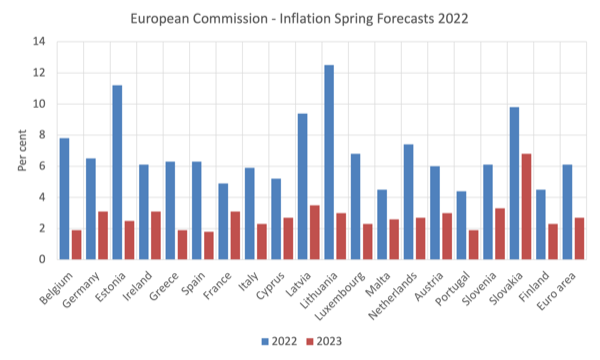

The following graph shows the forecasts for 2022 and 2023.

Spot any major on-going inflationary acceleration.

Now the Commission may be wrong (probable) but the way the ECB is now talking – lockstep with the irresponsible US Federal Reserve – one can clearly see a breakdown in policy coherence in Europe at least.

The Commission think inflation will dissipate quickly by next year – while the ECB is talking about being prepared to create a recession to ‘tame’ accelerating inflation.

Conclusion

Unaccountable central bankers once again out of control.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

Letter published June 24 in Globe and Mail (Canadian national newspaper) with footnote sent to Editor

Re The Government Can Do More On Inflation (June 22):

The agreement between the federal government and the Bank of Canada includes support for “maximum sustainable employment,” which I presume is the language columnist Andrew Coyne considers “extraneous.” For most Canadians, full employment is vital. If they keep their jobs and receive wage hikes in line with inflation, then rising prices are usually tolerable.

Unfortunately, the main operating tool of the central bank is to depress the economy through sharp rate hikes. When spending falls, more people are laid off and worried workers are unable to demand higher wages that match the rising cost of living.

A more sensible approach would be to maintain a fully productive economy, but the central bank seems determined to proceed otherwise. Their scorched earth policy will likely leave a destructive trail of impoverished workers, mortgage foreclosures and business failures.

Then the central bank will celebrate a victory over inflation, and throw a staff party.

Word count: 159

Copyright The Globe and Mail Jun 24, 2022

Footnote:

William Mitchell is Professor in Economics and Director of the Centre of Full Employment and Equity (CofFEE), University of Newcastle, NSW, Australia https://billmitchell.org/blog/?p=49990

“The logic is simple as it is asinine.

Inflation rising -> hike interest rates -> cause unemployment and squeeze workers and business income -> create sufficient misery that they stop spending -> eventually scorch the inflation out of the system.

***

The problem is that such an approach will do little to arrest the current inflationary pressures because they are endemic to the supply-side of the economy.

It is destructive to inherit a dramatically constrained supply and then aim to reduce the previously ‘normal’ level of demand back to this temporary constrained level of supply.

When the transitory inflationary factors evaporate, then you are left with a trail of destruction of insolvent firms, impoverished workers, house mortgage foreclosures, increased suicides and worse.”

Remember the framing and narrative from just a few months ago that central banks were causing asset inflation. That all you had to do was invest in the stock market or Bitcoin etc and you would be wealthy as the central banks were just pumping up assets. That assets were just going to keep going up in value supported by the central banks.

How did that work out?

It is amazing how easy it is for sensible people to get carried away by the framing and narrative if the financial press all say the same thing at the same time and every time there are low rates asset inflation becomes the headline topic.

Now that period of screaming asset inflation is over there is no reflection whatsoever if it was even true or not.

Looking at the Japanese stock market

https://tradingeconomics.com/japan/stock-market

From 1984 – 1990 everybody was screaming asset inflation. Yet, look what happened.

Compare the Japanese stock market with Japanese interest rates

https://billmitchell.org/blog/?p=50042

You wonder where they get this asset inflation narrative and framing from.

So you can be pretty sure the FED and ECB think by raising rates they are also looking to prick some asset bubbles that they think they created when rates were low. They are victims of their own propaganda. Their myths just reinforce their own bad behaviour.

I wonder who elected Lagarde to be THE policy maker of the EU?

I didn’t!

The pushback against MMT is in full swing. Reculer pour mieux sauter, I hope. Once recession hits (if it hits) in the west I wonder if they’ll still be blaming it on stimulus cheques and other financial gov interventions.

Re: ‘there are plenty of private savings in the system which will act as a buffer against the rising interest rates’ and ‘the unemployed are forced to run down their wealth holdings to stay afloat.’ The divide between the affluent who have such savings, + at least one mansion, often now on a gated private road (in the UK) + SUVs, and those in precarious employment with little to no savings, and more likely to cut down on food/heating and increase debt, is stark for those with awareness. Central bankers clearly belong to that first tribe for whom the second tribe are workers when needed but who otherwise should make themselves as unseen and with as few demands as possible.

Bill, can I point out a couple of typos: ‘the Federal Reserve was no prioritising’ and ‘Powell and Lagarde ..they through.. (should be thought). Best wishes.

The central bankers, treasury officials and their figurehead leaders are all manipulative bastards that allow the taps to flow or stop (monetary and fiscal) when it suits the political agenda of their masters in the worlds ‘capital markets’.

Trump was allowed to open the fiscal tap so that the rich could get a big tax cut; Reagan the same but for a spending spree on defence to sink the Soviet Union; Nixon for the Vietnam war; Bush, Obama and Trump for the ‘war on terror’ and Trump and Biden were allowed to dish out corporate welfare cheques and to keep many of the peasants alive during the pandemic shut downs so as to keep the markets in the black.

Whenever there was a hint of progressive reform whether from Carter, Clinton, Obama or Biden then the fiscal tap is shut and the monetary thumb screws are applied to quickly end that party.

The political class better not rock the boat and demand something that the bastards don’t want to deliver or otherwise the corporate and state media will demonise them relentlessly so that the electoral sheep will turn to someone else at the next election.

The same scenario played out in Australia, the UK, Canada, New Zealand and I suspect also in most of continental Europe to varying degrees. Even Japan has had moments of neoliberal stupidity at the political level but it does however appear that Japan’s and perhaps also China’s central bankers and treasury mandarins are better guardians of the national interest and therefore by default the material welfare of most of the peasants as well.

…. and Obama was given the fiscal space to bail out Wall Street following the crash of the global financial crisis BUT NOTHING FOR THE PEASANTS who lost their homes or jobs.

@Andreas Bimba re: ‘it does however appear that Japan’s and perhaps also China’s central bankers and treasury mandarins are better guardians of the national interest and therefore by default the material welfare of most of the peasants as well.’ I think of that there is no ‘perhaps’. Remember, China kept the engine running while Europe and the US were doing their post GFC austerity. Now the G7 are talking about trying to counteract China’s Belt and Road initiative. A bit late and let’s not expect anything more than a half-arsed neo-liberal post-colonialism.

@’Andreas Bimba’ central bankers could be paid wages based on whether full employment is achieved or not. They’d soon change their tune.

Money lender becomes job centre. They can keep the payments clearing responsibility I suppose (software maintenance).

@ Patrick I agree.

@ Bijou Yes that may help but they are probably thinking about their next lucrative job in the world of finance?

The board of the RBA should include representatives of the people and less corporate parasites but Bill would probably suggest that the RBA and Treasury act in accordance with the policy direction of the federal government and let the democratic process rule.

The RBA charter includes the following duties:

(a) the stability of the currency of Australia;

(b) the maintenance of full employment in Australia; and

(c) the economic prosperity and welfare of the people of Australia.

The problem is the RBA’s main policy tool is monetary policy and when inflation from whatever source is in total deemed to be too high they increase the cash rate until the economy (the people) start to default on their loans and lose their homes and businesses so the RBA betrays it’s duty to maintain (b) and (c). The Treasury act in the same way by imposing fiscal austerity but I haven’t checked their charter.

https://www.rba.gov.au/publications/annual-reports/rba/2015/our-charter-core-functions-and-values.html

“Indeed, the discretionary sectors of the {UK} economy have already been hammered, with business insolvencies in May running 80 percent higher than in May 2021, as consumers switch their spending to cover the rising price of essentials like food, household energy and fuel. Indeed, inflation in these discretionary sectors of the economy has already fallen close to its pre-pandemic levels. The headline 10 percent inflation figure is almost entirely due to the increased cost of food (fertiliser and imports), gas, electricity, petrol, diesel and second-hand cars – all items that neither the state nor the central bank can do anything about, and which will only reverse as a result of widespread “demand destruction” – i.e., mass company closures and unemployment.”

From: The Consciousness of Sheep {Facebook}.