It's Wednesday and today I consider the current yen situation which is causing some hysteria…

Where are all the economists? Its lucky they have gone AWOL

It’s Wednesday and so I write less on the blog to allow me to write more elsewhere. And, we get a chance to savour some music – today some of the best vibraphone playing that was recorded. Simon Jenkins wrote a column in the UK Guardian on Monday (August 8, 2022) – Who knows if Truss or Sunak is right on the cost of living crisis – where are all the economists? – which runs the line that my profession has gone to ground as the two Tory leadership hopefuls come out with diametrically opposed views as to how to fix the ‘cost of living crisis’ in the UK. Well, he could have answered his own question. Who would want the opinion of the ‘economists’ by which I mean the mainstream macroeconomists given they have an appalling record of prediction anyway. The majority are supporting the Bank of England’s kamikaze interest rate increases because they think monetary policy is an effective solution to inflationary pressures and they agree that unemployment should be a policy tool rather than a policy target. He might also have noted in his article that who gets a platform in the public debate about economic matters is heavily biased against those who might offer an alternative view. Try getting an Op Ed in the UK Guardian, for example, if you are non mainstream and not part of the ‘progressive, pro-Europe’ network in London. And on those cost of living pressures, no mainstream economist that the UK Guardian is likely to publish would propose nationalising energy supply, public transport, water supply and telecommunications anyway. Which is the best long-term solution to protect workers and low-income consumers. Further, the latest data from the US indicated that inflation has peaked and inflationary expectations are falling sharply. Did anyone mention the word ‘transitory’ around here?

Where are all the economists?

Well, in answer to the question that Simon Jenkins poses, he should be happy that they “have gone AWOL” because otherwise the debate would become derailed.

Suffice to say, the mainstream New Keynesian macroeconomists, even those who support the Labour Party, would be happy that the Bank of England is back in action using unemployment to stifle aggregate demand in their futile quest to bring the inflationary pressures down.

Futile – because it is not an aggregate demand problem as I have explained several times over the last year or so.

When New Keynesians see inflation, they propose interest rate increases.

That is it.

The current leader’s debate in the UK is juxtaposing Sunak who wants to reduce the fiscal deficit but target financial assistance to the lowest-income household and Truss who wants to give tax cuts that favour the highest income groups, who hardly need any special government assistance at this time.

Sunak also appears to favour tax cuts for the high income earners.

Truss wants to expand demand and push the GDP growth rate up.

Simon Jenkins writes:

Two members until recently of the same cabinet seem at opposite extremes of the economic spectrum. Both studied economics at Oxford. They must have attended similar lectures and read the same books. What’s their problem?

The problem Simon is that they both studied economics at Oxford and attended similar lectures and read the same books.

Most of which was a poor preparation for a professional life as a Chancellor or Prime Minister for that matter, if the aim is to introduce progressive policies that deal with the poly crisis facing the world.

The macroeconomics taught at Oxford is not educative. It is indoctrination into the world of Groupthink designed to defend a failed paradigm.

Simon Jenkins writes:

The latest dispute between Rishi Sunak and Liz Truss turns on whether the cost of living crisis is best met with caution and help for the neediest, or by slashing taxes and “going for growth”. Both cannot be right.

Of course, both are wrong.

And if the UK Guardian allowed for a diversity of economic opinion from professional economists then I could explain why.

The ‘cost of living’ crisis has structural dimensions – the privatised essential services etc which has spawned profiteering at the expense of service quality and scope and has been a problem for several decades now.

It also has a temporary dimension – Covid is still ravaging the labour force and stopping supply chains from returning to something like ‘normal’.

And then there is OPEC.

And Putin.

The best solution is to use fiscal policy to protect the poor in the short-term and to stop putting up interest rates, which just make the cost of living problems worse, without address either the longer-term and short-term factors driving the problem.

The inflation will dissipate.

But if a recession is deliberately created then the residual negative consequences will haunt Britain for a long time.

Going for growth is also not the solution because that will just come up against the supply constraints and introduce further problems.

At present unemployment is low in Britain and although the quality of jobs and pay needs to improve dramatically at least people have work.

So the government should just be ensuring that the ridiculous energy price rises I have read about that will chime in soon do not hurt those who cannot afford to pay them.

And then be working to nationalise the sectors that supply essential goods and services to ensure they return to public service and not profit gouging.

The other question Simon Jenkins avoids is who gets a platform in the public debate.

He should be arguing for more diversity within his own paper for a start.

A lot of people seem to agree with me that this is a transitory inflationary episode

On August 8, 2022, the Federal Reserve Bank of New York published a press release – Inflation Expectations Decline Across All Horizons – which informs readers that their latest – Survey of Consumer Expecations (July 2022) – shows that:

Median one- and three-year-ahead inflation expectations both declined sharply in July, from 6.8 percent and 3.6 percent in June to 6.2 percent and 3.2 percent, respectively.

Moreover:

Median five-year ahead inflation expectations, which have been elicited in the monthly SCE core survey on an ad-hoc basis since the beginning of this year, also declined to 2.3 percent from 2.8 percent in June. Expectations about year-ahead price increases for gas and food fell sharply.

Here is the graph for the one- and three-year ahead inflation expectations series.

The Survey also found that:

Median inflation uncertainty-or the uncertainty expressed regarding future inflation outcomes-declined slightly at both the one- and three-year-ahead horizons. Uncertainty at the five-year-ahead horizon decreased more substantially.

Which tells us that people are understanding this is a transitory phenomenon driven by a number of separate causes, but, which no propagation mechanism (like a wage-price spiral) is threatening to perpetuate.

More specifically, the survey found that:

1. “The median expected change in home prices one year from now dropped sharply to 3.5% from 4.4%, its third consecutive decrease and its lowest reading of the series since November 2020.”

2. More significantly:

Expectations about year-ahead price changes decreased sharply by 4.2 percentage points for gas (to 1.5%) and by 2.5 percentage points for food (to 6.7%). The decrease in expected gas price growth was the second largest in the series, just below the 4.5 percentage point decline in April of this year. The decline in food price growth expectations was the largest observed since the beginning of the series in June 2013.

3. The five-year median inflation expectation fell from 3.02 per cent in March 2022 to 2.35 in July.

The meaning of all this is that the supply constraints and energy gouging has pushed up the short-term expectations in line with the CPI pressure but these pressures are expected to dissipate fairly quickly.

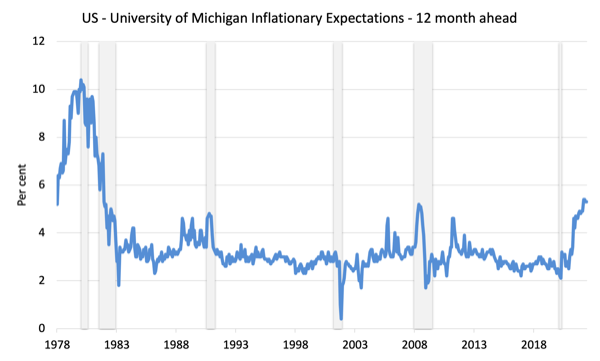

To see how different the current situation is I created this graph from the University of Michigan price expectations data which shows consumer expectations of inflation 12 months ahead.

First, the expectation has dropped 0.1 points since April 2022 (hard to tell on this graph).

Second, the decline back to the lower steady expected inflation in the 1979s took several years not months, as appears to be happening this time around as supply constraints ease.

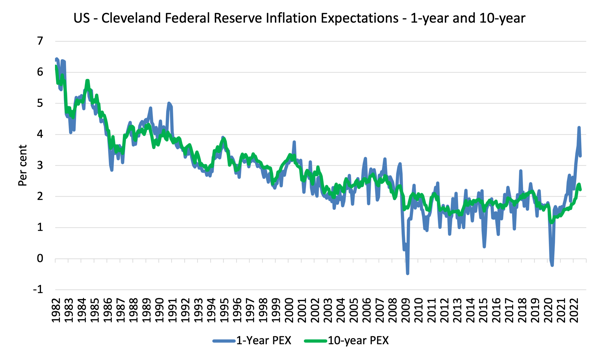

The Federal Reserve Bank of Cleveland also provides an inflationary expectations series back to January 1982.

In October 2009, the Bank released a discussion paper outlining – A New Approach to Gauging Inflation Expectations. It is a non-technical version of this 2011 paper – Inflation Expectations, Real Rates, and Risk Premia: Evidence from Inflation Swaps.

The latest data from the US Federal Reserve Bank of Cleveland released July 13, 2022 – Inflation Expectations – shows that:

1. The 1-year ahead expected inflation rate for July was 3.31 per cent, whereas in June 2022 it was 4.23 per cent – and looks to have peaked at that level.

2. The 10-year expected inflation rate for July 2022 is 2.22 per cent down from 2.4 per cent in June 2022 – that is, falling.

2. Their estimate of the inflation risk premium also fell from 0.47 per cent to 0.37 per cent between June and July 2022.

Thus the ‘financial market’ expects inflation to dissipate over the extended period.

Here is the graph for the 1-year and 10-year expectations from the Cleveland model.

The graphs are interesting because they show that long-term inflationary expectations have remain fairly stable around the Federal Reserve’s 2 per cent anchor.

The shorter term expectations which pick up a lot of the month to month fluctuations in energy and housing prices etc are much more volatile as a consequence and tend to follow the actual CPI series closely.

Music – Lennie Hibbert

This is what I have been listening to while working this morning.

Lennie Hibbert – was a Jamaican vibes player and bandmaster.

He recorded two albums for – Studio One – in Kingston, Jamaica.

He was a leading musician in the jazz scene in Kingston through the 1960s and a regular studio musician for producer – Clement ‘Coxsone’ Didd – in his house band – Sound Dimension.

This track was originally released by Jamaica’s Studio One on Lennie Hibbert’s 1971 album – More Creation.

The cover of the album contains very no information as to who are the backing musicians. It just says:

A dveoted music lover who masters just any kind of rhythm – rag, bop, ska, calypso, soul, rock-steady, jazz, etc. Lennie, one of today’s hottest Vibist, spent 11 years with the Jamaican Military Band, 15 years as Band Master, with the Alpha Band, and 18 years as an Orchestra Leader … In this newest album, you’ll hear more of the exciting sounds of Lennie Hibbert.

We’re convinced this will be the biggest album yet released by Lennie, and so will you. So stoke up your stereo and treat yourself to a generous helping of today’s most remarkable Vibist, Lennie Hibbert.

Ok, stoke it up.

A great album by the way.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

“The inflation will dissipate.

But if a recession is deliberately created then the residual negative consequences will haunt Britain for a long time.”

The problem is that the population don’t like inflation – as in prices going up, not true inflation. And they demand that it is stopped. They don’t want to have to go through the rigmarole of striking for better pay and conditions.

The Monetarists and the New Keynesians can stop prices going up. They just make people unemployed until prices stop going up. Just as the population demands.

The polls show that people want inflation dealt with first. Politicians follow trends and will listen to people with instant answers – whether they are the best long term ones or not.

Truss looks like she is influenced by the neo-monetarists, so we might see the BoE remit changed from inflation targeting to nGDP targeting.

That will cause some fun in unproductive Britain.

We keep forgetting that taxes don’t create wealth.

Raising taxes will not improve the outcome of a faltering economy.

Taxes redistribute wealth.

If the elites use their dominant position in the economy to rack up more wealth/income than what the masses are doing, it ought to be a function of government to tax the 1% top swath of the population, to fund public spending on infrastructure, relieving the 99% of many expenditures (health, education, transportation, etc.).

It so happens that the mainstream economists told governments to upend the redistribution function, from the 99% to the 1%.

It’s called reagonomics and was presented to the world by a comediant, more than 40 years ago.

The mainstream economists (are they really?) are telling the Portuguese government to cut taxes (meaning cut taxes to the rich), so the country can compete in the world championship of tax evasion.

It’s a race to the bottom.

Which means that mainstream economists don’t do anything related to economy.

They became accountants, working for the beneffit of the 1%, hoping one day to become one of them.

Economic policy avowed by these straw men is what bankers tell them to do and bankers are the 1%.

“Truss wants to expand demand and push the GDP growth rate up.”

M.E.T. is ‘following’ the ‘ideas’ of Professor Patrick Minford and his ‘voodoo economics’? Supply-side reforms {tax cuts} will be enough to rejuvenate the economy {increase productivity} and will reduce national debt!

please excuse me using the blog with a technical issue; since 25/07/2022 I have not been receiving the blog in my email despite remaining ‘subscribed’ (I’ve tried re-subscribing but the pop-up message informs I’m already subscribed). I have been pro-actively going into the blog as in this one today. In case this is a more general (generic) problem, I thought I should flag it up. If it is a problem particular to me, is there a way I can correct it. I have been following the blog since Bill’s lecture at the London School of Hygeine and Tropical Medicine in August 2015 (still available online). I thought it might be related to the recent change in the picture at the head of the blog or Bill’s slightly modified schedule due to his learning Japanese in advance of spending a prolonged period in Japan?

Dear Michael Galvin (at 2022/08/10 at 8:28 pm)

I am unaware of any problems at my end. If others are having the same problem as you maybe than they also comment and I will investigate further.

Michael – I hope you are still well and I miss my regular trips to the UK and catching up with you.

best wishes

bill

The right have cleary ran out of ideas so the right in America and the Right in England have stepped into a time machine and both have pivoted towards Art Laffer, Jude Wanniski and Robert Mundell sound money formula, “The Mundell-Laffer Hypothesis,” deregulation and supply side economics of Thatcher and Reagan.

You can see it everywhere you look On social media. Conservatives are screaming Thatcher and Republicans are shouting Reagan. The Trump crowd have even set up the Committe to unleash prosperity. With Art Laffer, Steve Forbes, Steve Moore of the Heritage Foundation and Phil Kerpen. Take a look at their website and you will see what I mean. Both George Osborne and Hammond of the Tory Party followed the ideology of this group when it came to balanced budgets and taxes.

This will be the driving force behind English and US right wing economic policy in the future and this includes changing the central banks as described on the Heritage Foundation website.

So if you are wondering where this is all heading the right is already organised and prepared for it.

Changing the central bank to what they call a stable money central bank giving them one mandate only.

Low flat rate of tax

Deregulation

Low or no Tariffs

Slash government spending

It’s Heritage Foundation 101 with Art Laffer leading it. They call it their playbook on their Committee to unleash prosperity website. Which is what Bremer did as soon as he took control of Iraq and the Bremer plan.

They’ve ran out of ideas so have repackaged an old fairy tale Hollywood style. All of which was rejected by voters on mass on both sides of the Atlantic after a few years of trying it. As they tried to rewrite history claiming it was the golden age of supply side economics.

Which for me shows the US just like the British before them is a failing empire. Which can only be a good thing for the rest of the world over the long term. However, very, very, dangerous over the short term as they try to cling to the American rules based order.

If you want a peak preview of what a right wing budget would look like as they have already put one together. You can view it here.

heritage.org/budget/pages/policy-proposals.html

I wouldn’t call the mainstream economists “accountants” Paulo – they’re more like priests, justifying the neoliberal regime to the masses on behalf of the 1% much as the priests of old justified Feudalism to the peasantry on behalf of the Aristocracy and Gentry.

eg, I’m sorry I insulted the accountant profession. “Priests” is better. My fault.

I’m not astute enough to comment on your blog towards the economic content. But I follow it and others learning what I can. But I must admit that as much as the knowledge I get from reading the intent of this blog, it’s the music that I glean from your great taste in. This latest example sends me scurrying off looking for possible procurement. Not so easy this time around. Thankyou for all.

Question for Tom Hickey

I have read this from PeterC and like the idea:

http://heteconomist.com/fairness-and-a-job-or-income-guarantee/

“. In lean form, the policy would give individuals without a job the option of either a job guarantee position or smaller basic income payment. In expansive form, universal basic income would be implemented alongside a job guarantee.”

Job Guarantee Its not just for unemployed according to Neil:

https://new-wayland.com/blog/the-job-guarantee-more-money-less-tax/

“If you are working part-time elsewhere, then you can ask for a top-up position from the Job Guarantee. You’ll never be short of work or a living wage.”

If I work for part time in private sector job can I still top up?

mean lean version.

Derek Henry wrote:

“The right have cleary ran out of ideas so the right in America and the Right in England have stepped into a time machine and both have pivoted towards Art Laffer, Jude Wanniski and Robert Mundell sound money formula, “The Mundell-Laffer Hypothesis,” deregulation and supply side economics of Thatcher and Reagan.”

Just yesterday I was thinking of posting a thread about how the last 41 years of economic history have clearly shown the “supply-side econ.” has never worked as predicted. That is, it never delivered *any* “trickle down” for the mass of the people and it didn’t cause an increase in GDP either. All it has done is to increase the deficit and make the rich hugely richer. IMO, both effects have been very bad for the economy. The mega rich don’t spend their income back into the economy, they save it. They don’t even invest it, and where they do invest some of it, it is invested overseas. And, the growing national debt has done nothing but increase interest payments and give the sound money experts something to cry wolf over while they work to increase the debt more. Lying a$$ holes.

They as inept with economics about the same ineptness is associated with how they conduct their foreign policy!

“If it is a problem particular to me, is there a way I can correct it.”

Check your spam folder. It may be that the spam filter on your email has accidentally flagged Bill’s blog and it is getting automatically moved there.

I get that a lot with emails from blogs and forums.

Dear Bill

I would be grateful if you or one of your colleagues would respond to this letter in the FT today – please let’s try to get a debate going amount those who claim to know how the economy works:

Carol Wilcox asks someone to explain why “increasing interest rates decreases inflation except via recession and unemployment” (Letters, August . Easy. It happens because higher interest rates reduce inflation expectations thereby allowing markets, especially for labour, to clear without the need for price rises.

For two years now, central banks and others have been saying that the higher inflation we have will soon go away. If they are right, and expectations adjust downwards accordingly, economies will not experience the skyrocketing unemployment of the 1970s and 1980s.

Paul Hallwood

Professor of Economics, University of Connecticut, Storrs, CT, US

https://www.ft.com/content/a6f43694-a064-493e-8cd1-7518eef6888e

Carol

The pervasive error in economics is the Keynesian macro-economic persuasion that maintains a commercial bank is a financial intermediary, serving as a conduit between savers and borrowers.

Banks don’t lend deposits. Deposits are the result of lending. An increase in bank-held savings shrinks R-gDp.

‘Check your spam folder’…thanks for the suggestion Neil; the problem persists and there is nothing in the ‘spam’. Meanwhile I can still access the blog, but miss seeing the (almost) daily email in my ‘inbox’…and thanks Bill for your good wishes…I keep well (recently recovered from covid despite 4 jabs). Whilst I’m here Neil I think you live in West Yorkshire; I belong to ‘Leeds Keep Our NHS Public’ and the chair of the Leeds Group is also co-chair of the national KONP. I intermittently (trying not to bore the group) remind us all that until the public realise that the ‘where is the money going to come from?’ (non)-question is meaningless it will continue to be an uphill (impossible?) struggle to ‘cut through’. I wonder if sometime you could be persuaded to talk at one of the Yorkshire ‘Health Campaigns Together’ rallies?