Yesterday (April 24, 2024), the Australian Bureau of Statistics (ABS) released the latest - Consumer…

A ‘broad agreement’ on the need for climate change action – doesn’t mean a solution is forthcoming

It’s Wednesday and I have been on the road most of the day so have had less time to write. A few issues are discussed below, including the problem that climate change is presenting central banks with, recent research on how an initial Covid infection appears to be causally related to a range of life threatening maladies. And then some music.

Climate risk

There was an interesting Speech given by a senior Reserve Bank of Australia official last week (August 24, 2022) – Climate Change Risk in the Financial System – which is certainly apposite given that approximately 33 per cent of Pakistan is now under water and rivers are running wild there, while not far away in Europe, the rivers are drying up and industry that relies on the water are having to shut down.

Some of the key points:

1. “there is broad agreement … that there are strong benefits to addressing issues related to climate change sooner rather than later. Delaying action will not only make climate change worse, it will make the implications for society, the economy and the financial system more severe.”

The problem here is that while there might be ‘broad agreement’ to act sooner – there is no agreement on how quickly the action should be implemented and how deep the changes should be.

Corporations have perfected the ‘green washing’ narratives to make them look as they are doing something.

Green groups talk about market-based solutions – trading schemes – but have no answers for how that will not be captured by big polluters who will get ‘offsets’ by going to poorer nations and imposing stupid technological developments on small communities to the detriment of the latter, while still polluting back ‘home’.

Politicians will not, so far, make hard calls – like – telling the coal industry they have 5-10 years max to close, like – closing down petrol engine cars within 5 years, like – introducing tougher building codes and funding the difference between the current, allowed, energy-terrible houses that developers chuck up everywhere (and in the process destroy local market gardens on the edge of cities etc), like making it illegal to sell meat products, like … we could go on.

Deep action is required now – which will drastically alter the way we live.

Not too many are prepared to do that.

So the ‘broad agreement’ is just a game we all play to look like we care and are dealing with the problem.

Zero net emissions by 2050 is an example and a total joke.

2. The Speech then concentrated on “what financial regulators are doing to create the framework that best enables participants in the financial system to manage climate change risks and opportunities, thereby assisting with the transition to a more sustainable future.”

My position is that the financial markets should be prevented from creating ‘green’ derivative products.

I wrote about that in this blog post – The financial markets should be kept away from the climate crisis solution (November 10, 2021).

Nothing good will come if the gamblers get in on the act and pursue speculative profits under the cloak of doing something about climate change.

3. The Speech talked about “transition risk” which is the “risks resulting from changes to policies, technology and people’s preferences that are brought about by climate change.”

Then we read “Transition risk will almost certainly involve changes to the structure of the economy” – which tells you how conservative the central banking thought is on the topic.

The way I would express it is that transition risk will definitely require massive, irrevocable and deep changes to what can be producted and consumed.

It is not an ‘almost certainly’ matter.

Deep changes will be required.

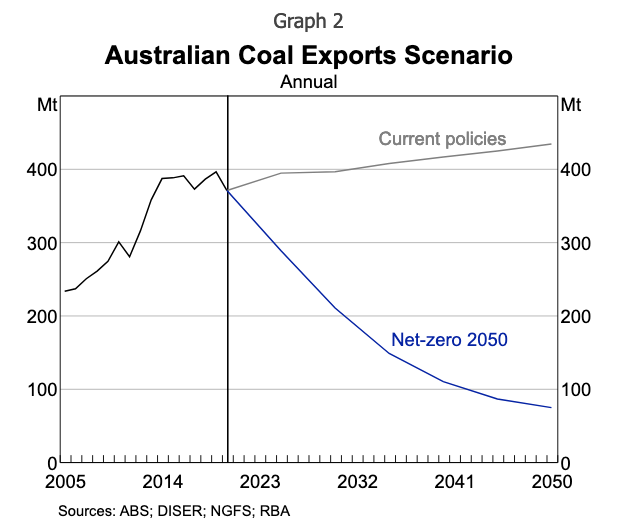

For example, Australia would have to STOP exporting coal – almost immediately – if we were serious.

The Speech provides a graph as below, which exemplifies how little policy is moving to deal with the problem.

4. An interesting aspect of the risk problem is the interaction between bank lending and home purchases.

We know that most people require large bank mortgage loans to purchase a house.

Banks require the borrowers to insure the assets while the mortgage is outstanding.

Increasingly, in Australia, for example, insurers are refusing to provide coverage to home owners in areas such as the coastal fringe and in river flood areas or bushfire prone areas.

That action, effectively makes the existing housing stock a stranded asset and also prevents the first-home buyer from accessing the credit.

This problem will worsen as sea levels rise and/or temperatures rise and will worsen the wealth inequalities which are already bad.

The Speech has other interesting points to make but I have run out of time today (a lot of travel all day has taken my time).

Those who seek to deny the Covid danger

One of the things one learns when dealing with data (and the behaviour that drives the numbers) is not to jump to soon.

A steady, measured approach to data movements is required because the time series dynamics are usually complex.

So when those Barrington Declaration characters started crowing about how right they were because humanity hasn’t been wiped out by Covid, I thought well let’s wait and see.

First, there is no basis for them to declare victory. In general, we were saved the worst by the restrictions which gave time for the vaccines, and even then the death rates have been high.

There was never a valid idea that we would reach some sort of herd immunity to this virus. That was a mad (early) idea that the likes of Boris Johnson pushed and quickly abandoned.

Second, as time passes and more evidence emerges, we are also learning why it is wise to avoid getting the virus in the first place.

There was an interesting article in the Financial Times this week (August 29, 2022) – The growing evidence that Covid-19 is leaving people sicker

Recent research shows that those who have endured Covid are more likely to come down with other life threatening maladies later – strokes, early dementia, brain shrinkage and many other conditions.

The conjecture is that:

Covid generated a kind of epidemiological aftershock by leaving people susceptible to a huge range of other conditions, threatening global health systems already struggling with insufficient resources and ageing populations.

Data from the UK and the US suggests that “even some people who had not been seriously ill with Covid had an increased risk of cardiovascular problems” later.

And: “Researchers found that rates of many conditions, such as heart failure and stroke, were substantially higher in people who had recovered from Covid than in similar people who had not been infected.”

Clearly the datasets are still relatively short in time span, so caution is needed before we categorically conclude anything.

What we know is that there is “a higher burden of disease in the population” now and we are not sure whether it is “from the increased susceptibility to serious illness after Covid” or is due to “the lingering, little understood impact of long Covid”.

Either way, to advocate a system that did not seek to reduce the infection rates in the broader population and only claim the responsibility was to protect the elderly and already frail, which is essentially the Barrington Declaration line, was incredibly irresponsible.

We already know that our workforces have been devastated by sick workers not being able to work, and then, as time past, many of them continuing to endure debilitating illness from Covid and being rendered disabled.

Now our hospitals are filling up with these derivative disease cases.

MMTed update

Enrolments are now open for the next offering of our edX MOOC – Modern Monetary Theory: Economics for the 21st Century.

The free, 4-week course will begin on September 14, 2022 and run until October 12, 2022.

There is a lot of video and written content to study, a Game Show for some light entertainment, things to do, research tasks, script writing opportunities, and interviews with many MMT people.

Further Details:

https://www.newcastle.edu.au/study/online-learning/modern-monetary-theory-economics-for-the-21st-century

https://www.edx.org/course/modern-monetary-theory-economics-for-the-21st-century

Music – Sly and Robbie

This is what I have been listening to while working this morning.

This was from a 1980 single – the B-side nonetheless – with the Mighty Diamonds Gates of Zion on the A-side.

Here we have the inimitable rhythm section – Sly Dunbar (drums) – and – Robbie Shakespeare (electric bass) – with a dub mix of the A-side, which was released as Zion in Dub.

Robbie Shakespeare died last December, which ended the best drum-bass partnership around.

Together, these guys defined the reggae sound as Ska and Rock Steady gave way to the smoother patterns of reggae.

They are on stacks of reggae recordings of other artists and released many albums together.

They make the best sounds.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

It’s possible it’s already too late to do anything about climate change, however it’s insanity not to try.

To leave much of a chance for future generations to have a comfortable life, the redesign and rebuilding of of our living systems has to begin now, not at some nebulous future date.

A viable future path isn’t going to resemble what we have gradually become accustomed to since the unleashing of large amounts of energy from fossil fuels began. Take away the source of the climate change, is to take away the means to even support the infrastructure needed to sustain this way of life; it’s not merely a matter of taking the petrol out of cars etc..

Procrastination, just makes the first steps we take all the harsher.

When we look at what makes people most vulnerable to covid, it really comes down in many cases to poor general health, due in large part to the lifestyle many of us are literally addicted to. Poor diet and the stress caused by living too far removed from the natural systems we evolved for, leads to obesity, diabetes, autoimmune issues, and so on and so forth, all of which leads to vulnerability to the harsher consequences of infection.

When we look at what makes us happiest, even in the face of relative poverty, it’s usually living closer to the land, and having social connections beyond what modern urban structure can support.

The capitalist system would be ill-equipped to fight climate change. Even though the capitalist system could find another Keynes/FDR duo (that saved the capitalist system 90 years ago), what we got now is very different – neoliberalism is nonsensical capitalism. No Keynes could be born out of neoliberalism.

Right now, the elite is planning to cull billions of cows, to curb methane/CO2 emissions. The aim is not to fight climate change, but to offset the GHG emissions of their ludricous way of life, their yachts, sports cars and private jets.

Economics lacks a theoretical framework within which to discuss “de-growth” (purposely shrinking the size of an economy). Such a framework would be a tremendous contribution to life on earth. (Since all economic activity pollutes, we cannot grow our way out of the climate crisis. If we try to do so, we’ll simply substitute the (horrific) pollution caused by the mining of metals (see the proposals for “deep sea” mining) for the pollution caused by burning fossil fuels.)

“Economics for a long time has not been the study of the economy. Economics has been the study of a method that was pioneered by the so-called marginalist theoreticians at the end of the 19th century and… The application of that method to subjects that don’t appear to be economic at all is regarded as economics and the study of the economy by some other widely different method, for example, the writings of the German social theorist Max Weber about the economy, are not regarded as economics.

…

“What it’s important to understand, is how economics exemplifies in a particular way the situation of contemporary social form.

If we examine the whole field of social and historical study, we see that there are three main tendencies in command. In the positive social sciences, including economics, what is in command is the rationalizing impulse. The attempt to explain the established arrangements as natural, necessary or superior. In the history of philosophy, we would call this right wing hegelianism. The real is rational. In the normative disciplines of political philosophy and legal theory, what prevails is the humanizing impulse.

The attempt to place a pseudo philosophical gloss on the homely arrangements of mid 20th century social democracy and social liberalism and to improve them by the management of the economy and by compensatory redistribution through tax and transfer on the one hand, and by the idealization of law in the vocabulary of impersonal policy and principle, on the other hand. So the two disciplines of power, the two normative disciplines are mainly occupied in this humanizing project. And in the humanities, what prevails is escapism.

Consciousness embarks on a roller coaster of subjectivist adventurism, disconnected from the imagination and reconstruction of society. The representatives of these three tendencies, the rationalizing, the humanizing and the escapist pretend to be adversaries, but they are, in fact, allies in the disarmament of the transformative will and the transformative imagination. So the fundamental characteristic that all of these impulses have in common is the suppression of structural understanding and of the imagination of structural alternatives. We think in science, in natural science, that to understand the phenomenon is to understand what can be done. But it is precisely this transformative insight that is suppressed in the contemporary disciplines.

So if we go back to the rationalising impulse and the positive social sciences, what we find is that each of them severs the vital link between insight into the actual and imagination of the adjacent possible in a different way. It’s the way that Tolstoy describes family life at the beginning of Anna Karenina. All happy families are alike but each unhappy family is unhappy in its own way. And the unhappiness of the social sciences is their prostration and they’re aversion from transformative insight.”

Roberto Mangababeira Unger,

Age of Economics,

29/11/2020

This sums up how I feel about learning from MMT progressives who don’t truely believe in your insight for change; preferring to work within the system.

“… insight is always transformative insight and if we don’t understand how the actual can be changed into something else, we don’t understand it at all. All we have is a retrospective rationalization under the disguise of an explanatory account.”

…

“… We should have the aspiration to achieve freedom in the economy and not simply freedom from the economy. And it’s for that reason that we should reorganize our institutions and reshape our way of understanding economic life.”

Roberto Mangababeira Unger,

Age of Economics,

29/11/2020

FT…

The writing you cited is interesting but it is not the reality we live in. Why….

First, there is nothing else to be changed into. MMT is the observation of how these so called “economic agents” interactions or exchange goods and services.

How we construct or reconstruct systems within that, and how we institutionalized each subsystem is bounded by our environment and reality, which at time, we might suffer from, as we can see, some nations are rich in resources both intellectual and physical, some not.

It doesn’t mean that we shouldn’t keep reorganizing our social institutions. We do even at the global level.

We have fixed exchange rate system, then, we have floating exchange system, then, we have the combinations of mixed system. In there, we have corresponding institutions that reflect them, which in turn people derive many other subsystems from, e.g., fiscal systems, and of various degree of ‘economics’ understandings.

Further, insight is not always transformative, it is only when we act upon it. Meaning, insight can be intellectual exercise but change is always a process. They may seem connected but it is not.

We have insight that heart disease is mainly due to our living habit, but when was the last time we count how much sugar, fat, meat, bread we consume recently, and now much exercise we have done?

Do they always reflect our ‘transformative’ insight?

No, Why, partly because we live in bounded reality which reflect the amount of freedom we can have.

MMTers are doing fine, but living in a pluralism world, we don’t always have the same agenda…

Vorapot, thanks for the feedback. I was careful to use the term MMT progressives i.e. progressives with an MMT lense.

Insight as “Intellectual exercise” is still transformative insight evidenced by the fact that there was insight to begin with; which is always transformative. However as stated above “…if we don’t understand how the actual can be changed into something else, we don’t understand it at all.” To use your example of heart disease, the transformative insight is that diet and life style habits also have affects on our hearts health, however, if we fail to understand that it is through more affective regulation that fosters healthier lifestyles and diets, then we don’t actually understand it all.

To use a more relevant example, there are MMT progressives (some who are economists) who support the insight that MMT brings to the conversation, but then struggle to conceive of the radical, transformative, equitable, change that it brings. For example, they promote basic income over/with a job guarantee at minimum wage, or prefer to not nationalise existential services.

You made the statement, “How we construct or reconstruct systems within that, and how we institutionalized each subsystem is bounded by our environment and reality…”. This is the central point of the talk, and what Bill, Heidi Dangelmaier, Lee Smolin, Lisa Miller, Friedrich Nietzsche and many many others have written about for decades. Our environment and reality are not infallible, they are also constructs of insights, transformed by our assumptions, ideologies, and beliefs which are seductive, shape shifting, and blurr our vision of the world; sometimes blinds us.

Don’t think that economics is alone in creating a fictional world where reality is basically collateral damage – physics, psychology, chemistry etc. are all suffering the same fate; hence why things are so fractured…

I have come to realise that M.M.T is not just a better lense…..IT IS A BIG BRIGHT LIGHT ON THE VALUE IN HOW TO LIVE.

M: odern societies value: what is life

×

M:ainstream economists value: for a life

×

T:heologians value: on a life

=

M.M.T values: how to L.I.V.E

L:everage through tax control

I:nspire through financial stimulation

V:alue through a job guarantee

E:quality through distribution