Today (March 20, 2025), the Australian Bureau of Statistics released the latest - Labour Force,…

Degrowth, deep adaptation, and skills shortages – Part 4

One of the ‘problems’ besetting the world at present, if the commentary in the mainstream press is anything to go by, is the existence of chronic skill shortages. Survey studies of the shifting demographics in Japan, for example, have produced ‘alarming’ results from a mainstream perspective. See for example, this OECD Report from 2021 – Changing skill needs in the Japanese labour market. I was at a meeting recently in Kyoto and it is clear that many firms in Japan are having trouble finding workers and many have even offered wage increases to lure workers to their companies. Further, many small and medium-size businesses are owned by persons who are over 70 years of age and that proportion is rising fast. The skill shortage scenario is tied in with the ageing society debate, where advanced nations are facing so-called demographic ‘time bombs’, with fewer people of working age left to produce for an increasing number of people who no longer work. The mainstream narrative paints these trends as major problems that have to be confronted by governments, and, typically, because of faulty understandings of the fiscal capacities of governments, propose deeply flawed solutions. I see these challenges in a very different light. Rather than construct the difficulties that firms might be facing attracting sufficient labour (the ‘skills shortages’ narrative), I prefer to see the situation as providing an indicator of the limits of economic activity or the space that nations have to implement a fairly immediate degrowth strategy. In the following two blog posts I will explain how this inversion of logic can become a crucial plank in the degrowth debate.

This blog post is part of a series I am writing on degrowth and adaption. The current series consists of:

1. Deep Adaptation – Part 1 (August 22, 2022).

2. Deep adaptation, degrowth and MMT – Part 2 (September 8, 2022).

3. Degrowth, Deep adaptation and MMT – Part 3 (October 3, 2022).

4. Degrowth, deep adaptation, and skills shortages – Part 4 (October 31, 2022).

Before we explore the ‘skill shortages’ as an indicator argument, there are some things that need to be cleared up.

Further, I am currently working in Japan and so are accumulating data and writing about the challenges facing that country as part of a larger project I am working within.

So I will use that data as an example but bear in mind that while Japan’s experience might be more extreme in these dimensions than other nations, the trend is common across most advanced nations.

Also bear in mind that in this post I am not discussing the nations where dependency ratios are high as a result of high birth rates, which increases the proportion of people who are below working age.

While in a degrowth narrative, the advanced and poorer nations are all implicated, for now I abstract from including the poorer nations in the discussion.

That integration will come in later blog posts.

Being suspicious when employers say there are skill shortages

I am always suspicious when conservative politicians (a cohort which also embraces modern social democratic parties as well these days) and corporate bosses etc complain of skill shortages.

There are two reasons for my distrust.

First, what masquerades as a skill shortage to an employer is really blatant prejudice – an unwillingness to employ a certain class of worker, where the differentiation might be by age, sex, ethnicity, perceived disability, socio-economic background, school one attended, or whatever.

There are many instances where workers with requisite skills or capacity to acquire the skills through appropriate skills-based training are available but cannot gain jobs while at the same time employers scream skill shortages.

The simple matter is that these workers are discriminated against through prejudicial views held by the employer.

Second, when employers tell me they are facing skill shortages and want the government, for example, to allow more immigration the simple question I respond with is whether they have offered higher wages to attract labour.

Mostly, they haven’t.

Which tells me that they haven’t really tested the market for adequate supply at all.

In many cases, firms cannot attract the requisite staff because they are not perceived to be a desirable employer, whether that reputation is because their wages and conditions are inadequate or for other reasons

The simple market test is to offer higher wages and then see what you attract.

Having said all of that, there are clearly situations where the demand-side of the labour market is growing more quickly than the available labour supply, which leads to shortages of workers.

In general, that is good for workers because it means job mobility is enhanced, wages should be attractive and unemployment and underemployment should be low.

It is hard to claim there are skill shortages when there is elevated levels of labour underutilisation – whether it be in the form of official unemployment or underemployment – and low wages growth.

Usually, the cry of skill shortages is just part of a ploy to engineer structural shifts in the labour market that are designed to keep wages growth down and profit extraction high.

Japan’s population is shrinking

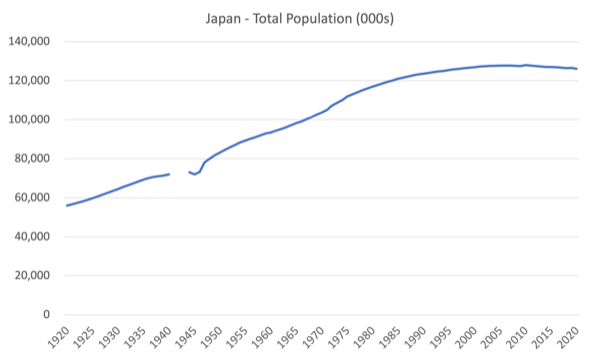

The following graph shows the total Japanese population from 1920 to 2020. During the WW2 years (1941-43) no data was collected.

The total population has been shrinking since 2010 as birth rates decline and death rates increase. Net immigration is very low by international standards.

There are many reasons for the declining and low birth rates – sociological and economic (insecurity etc).

Successive governments have tried policies to increase the birth rates (subsidies to young families, free preschool education, etc) but the scale of the change outpaces the impacts of the policy interventions.

Rising dependency ratios in Japan

The declining population growth, which leads to the ‘ageing’ society syndrome can be captured through the concept of the dependency ratio.

I previously discussed dependency ratios in Japan in this two-part series:

1. What is the problem with rising dependency ratios in Japan – Part 1? (October 28, 2019).

2. What is the problem with rising dependency ratios in Japan – Part 1? (October 29, 2019).

There are various dependency ratios that can be calculated:

- The standard dependency ratio is normally defined as 100*(population 0-15 years) + (population over 65 years) all divided by the (population between 15-64 years). Historically, people retired after 64 years and so this was considered reasonable. The working age population (15-64 year olds) then were seen to be supporting the young and the old.

- The aged dependency ratio is calculated as: 100*Number of persons over 65 years of age divided by the number of persons of working age (15-65 years).

- The child dependency ratio is calculated as: 100*Number of persons under 15 years of age divided by the number of persons of working age (15-65 years).

- The total dependency ratio is the sum of the aged and child ratios. You can clearly manipulate the “retirement age” and add workers older than 65 into the denominator and subtract them from the numerator.

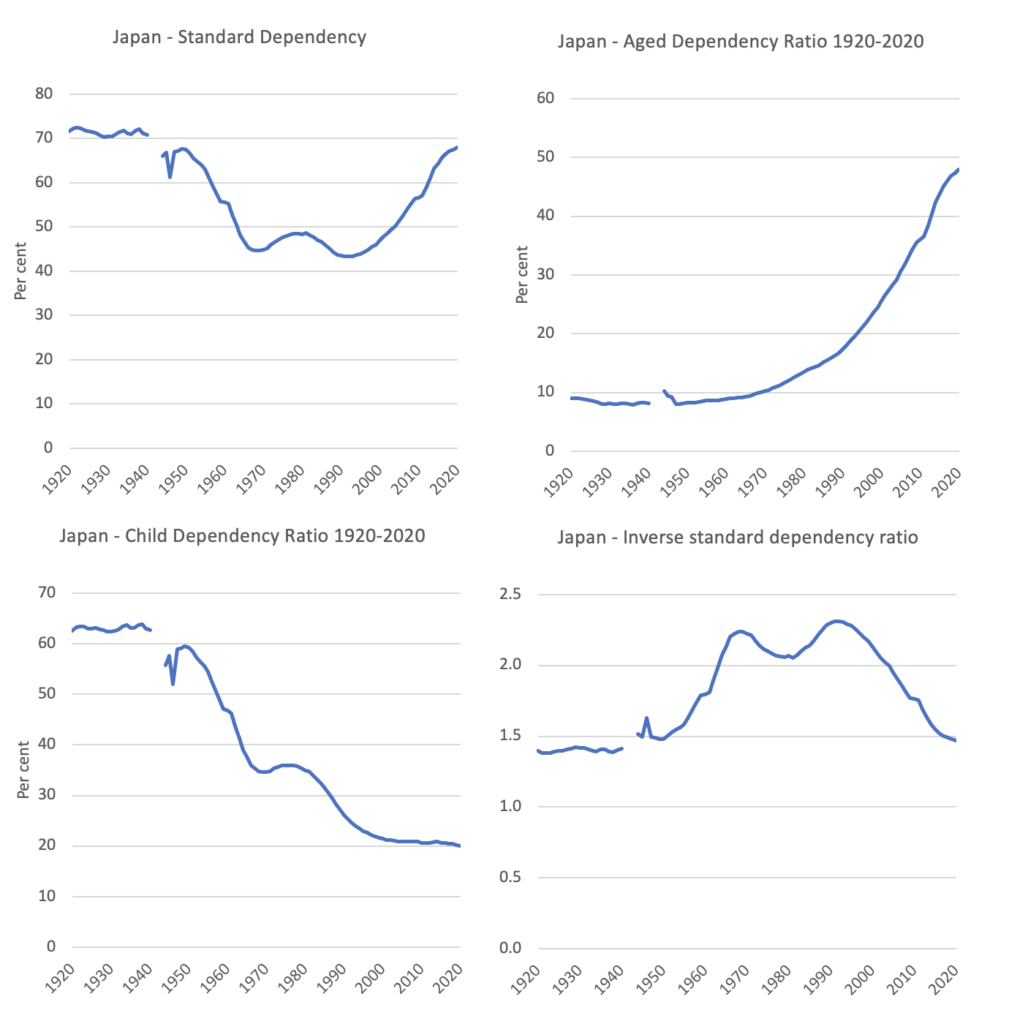

The following graph panel shows:

1. The Standard dependency ratio for Japan from 1920 to 2020, based on a working age population of 15-64 years (even though many Japanese workers have historically retired at 60).

2. The Aged dependency ratio over the same period. It has been rising since the early 1970s.

3. The Child dependency ratio over the same period.

4. The inverse dependency ratio, which tell us how many productive workers there are per non-productive person in the population.

For Japan this peaked at 2.31 in the early 1990s and was 1.47 in 2020 and falling.

And these ratios are projected to keep rising as time passes.

Based on various assumptions (birth and death rates, migration rates, etc), the dependency ratios are expected to continue rising.

In 2015, there were 1.56 workers for every dependent person in Japan.

By 2050, the UN estimates the inverse ratio will fall to 1.03 for Japan

That is quite a shift.

The SME dilemma facing Japan

The Small and Medium Enterprise Agency (中小企業庁), which is a Japanese government body that aims to enhance SMEs, regularly publishes a – White Paper – which details the state of the SME sector in Japan and the policy initiatives directed at it.

The 2019 White Paper – 2019 White Paper on Small and Medium Enterprises in Japan (Summary) – provides a mass of data to help us understand the sector and its challenges.

You can get the full version in Japanese – HERE.

99.7 per cent of all Japanese enterprises were classified as SME:

1. Small – 84.9 per cent.

2. Medium – 14.8 per cent.

3. Large – 0.3 per cent.

So it is a nation of predominantly small workplaces (maximum of 20 workers, but usually less than 5).

You see that in the myriad of tiny operations spread throughout Japanese cities.

While the large enterprises have become more profitable over time, the SME sector has experienced much more modest profits growth.

Capital investment is static as is growth in the use of technological innovations.

Most SMEs are experiencing a shortage of labour and find it hard to compete for a scarce pool of available labour with the larger corporations, who offer better conditions and advancement opportunities.

The other stark statistic is that the business owners are becoming older and the “number of businesses suspended, closed, or dissolved is increasing”.

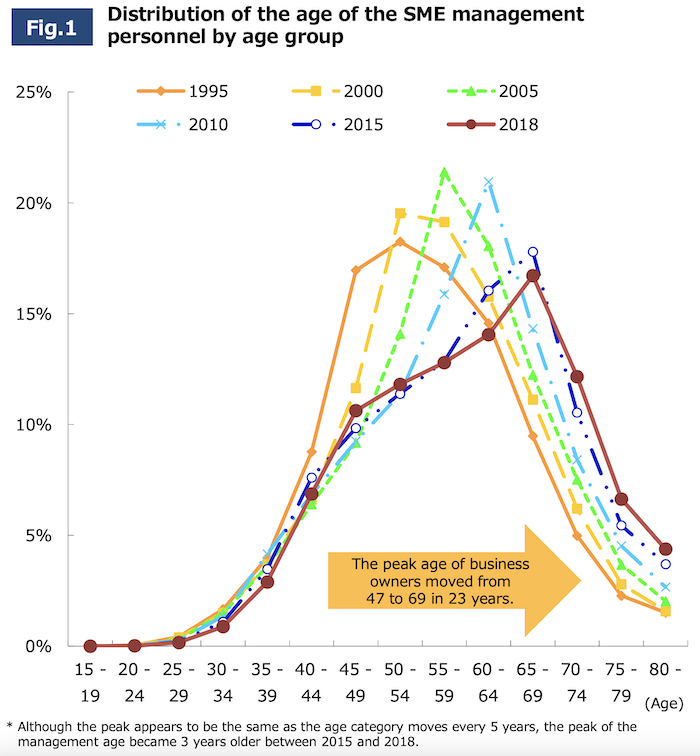

The following graph shows the shifting age distribution of SME owners in Japan since 1995.

The “peak age of business owners moved from 47 to 69 in 23 years) – that is, from 1995 to 2018.

Many businesses that are still solvent (assets exceed liabilities) simply close as the owner becomes too old and there is no viable succession.

In 2013, that number was 34,800 and by 2018 it had risen to 46,724,

The number will accelerate in the period ahead.

The Japanese government is working on and introducing policies aimed at making the succession easier particularly outside the owner’s family and relatives.

As you will read in what follows, in many ways, this policy strategy is misplaced.

While the Japanese government views this data as problematic, in fact, one could easily view it as an indicator of how a degrowth strategy could be implemented with less pain in the adaptation stages.

Rather than see the ageing society and accompanying skill shortages as a problem, I see them as a guide to how much space there is for relatively ‘painless’ contraction in economic scale, and therefore energy usage – the essential requirement of a degrowth strategy.

The non problem of rising dependency ratios

The contention that has become a common claim by mainstream economists and others, who seek to pressure governments to make cuts to social security and other government spending that doesn’t directly benefit them, is that governments will become insolvent as their tax bases shrink with the rising dependency ratios and their expenditure on aged care (pensions and health etc) rise significantly.

The claim is that if the ratio of economically inactive to economically active rises, then the economically active will have to pay much higher taxes to support the increased spending.

So an increasing dependency ratio will ‘blow the fiscal deficit out’ and lead to escalating debt – which will eventually become unsustainable.

In other words, the ageing society issue is just seen as a subset of the overall mainstream belief that currency-issuing governments face binding financial constraints which limit their spending and impose problems of fiscal sustainability (solvency) when the demands on that spending increase.

These claims should be rejected out of hand.

While rising dependency ratios can signal a problem, the issue is not related to financial solvency of government.

The mainstream approach exhorts governments to:

1. Introduce policies that force us to work longer despite this being very biased against the lower-skilled workers who physically are unable to work hard into later life.

2. Increase our immigration levels to lower the age composition of the population and expand the tax base – which just gives employers access to lower paid workers who typically are reluctant to join trade unions. It is largely a wage cutting exercise.

3. Cut back on the quality and quantity of the welfare services and pension entitlements that form the backbone of our civil society because they (allegedly) represent ‘living beyond our means’.

4. Introducing ‘work experience’ programs for tertiary and secondary school students – which just means employers get ‘free’ labour from students who should be paid for their work.

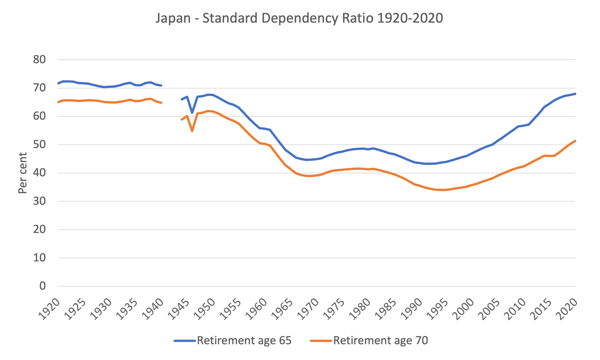

The next graph shows the difference in the standard dependency ratio for Japan if the retirement age was to be lifted to 70 years of age.

The gap between the two lines is diverging as more baby boomers pass into the above 65 years bracket.

As noted, the problem with these sorts of remedies is that they are typically very inequitable across the occupational structure because manual workers face great difficulties working into their later years.

However, all of these remedies and others miss the overall point.

From an Modern Monetary Theory (MMT) perspective, I have previously argued that in the case of the ageing population syndrome it is not a financial crisis for government that beckons but a real crisis.

The real problems are productivity and real resource availability.

For example, are we really saying that there will not be enough real resources available to provide aged-care at an increasing level over time?

That, of course, is never the statement made.

The reality is that as long as these real resources are available then it only remains a political problem as to where they are used.

There is no financial problem.

If there is a political will then the currency-issuing government (such as Japan) will always be able to bring the available resources into a desired use.

Primary schools investment will give way to aged care investment.

Investment in pre-school infrastructure and allowances will give way to pensions as the demography changes.

Yes, real resources have to be available.

But they also have to be used more wisely, which is a productivity challenge.

Conclusion

That sort of reasoning is just an application of a Modern Monetary Theory (MMT) understanding that considers the constraints on government spending to be real resource availability rather than financial capacity, the latter being the dominant constraint in the mainstream narrative.

In that sense, the ‘productivity’ challenge rather than the ‘financial’ challenge narrative is more sound.

The rising dependency ratios still signal that resources have to be used more productively into the future because there will be less people actually working and more requiring the goods and services that these workers produce.

So the policy challenge remains to improve education and training and investment in R&D and all the things that lift the skills base.

But, in the next post in this series, I will invert the logic further and explain how I now see skill shortages as an opportunity for nations such as Japan to really embrace the degrowth agenda and ensure the policy space reflects that.

If we embrace the reasoning I outline in that upcoming post, then I think the degrowth implementation is much less threatening and more feasible, than if we seek to understand the challenge within the current paradigm.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

Degrowth means the end of the capitalist system, born in europe in the middle ages.

The bourgeoisie slowly overturned the old rulling classes, the noble class, the clergy class and finnaly, the monarchy.

Not everywhere, of course.

Monarchy kept ruling where it did adapt to the new ages, like the UK.

It’s a very sturdy building to wreck, even if it stands already in ruins.

But, what about the third world, Africa, Latin America and parts of Asia?

They keep growing in population numbers and the pressure on the first world keeps rising, notwithstanding all the walls built on the borders of the rich.

Unless a catastrophe happens, the growing population of the third world will ruin all plans we can think of to turn the tide of history.

And that will only happen if we end colonialism and give the third world what they produce and the first world now takes for himself.

That’s the end of capitalism.

Can we do it?

The world in general faces this same problem not simply because of an ageing demographic but because Long Covid is taking an increasing number of people of varied ages permanently out of the workforce on a routine basis. It becomes daily more apparent the world as we’ve known it has gone. Japan goes before us in trying to adjust to this new paradigm. Let’s wish them well for all our sakes.

Capitalists can’t see it but, the world is running out of most resources. We must stop consuming nature and learn to live with it. The population needs to fall as rapidly as possible without a collapse. We need to consume less individually also. MMT is a huge part of the solutions.

The global population has grown dramatically since 1950. Science has made it possible, knowledge of health and hygiene has grown tremendously, and last but not least, the so-called green revolution has multiplied crop yields so a much larger population can be fed.

An unsustainable population growth model that constantly generates a surplus in active generations

We should ask where the level of balance is, and in Japan, what population level is long-term viable for these islands so that the inhabitants can live comfortably. What would be the dependency rate.

The “issue” of old folks is only temporary. They’ll disappear.

Will living in Japan be better or worse with, say, 75 million people as opposed to 125?

Someone calculated when we passed six billion in the late 90’s that with the growth rate then of 1.4 percent, it would take about 740 years to have one person per square meter of dryland. At some point, nature will eventually remedy that in its unflinching and stern manner.

Politicians in Europe regularly discuss the ageing population and dependence ratio, and when the GFC hit in 2008, they adopted economic measures that drove many young people into unemployment. Making people who are intended to produce for the older population less productive defies logic, to say the least. Young people who have a difficult time breaking into the workforce may end up being less productive throughout their entire working lives.

Replying to @Steve_American and @/lasse:

You two are peddling false Malthusian ideologies imho. The human population accounts for very little biosphere metabolic activity (most of it is bacteria). The problem is rate of population growth coupled with waste. Slow growth rates and eliminating needless waste is the proper solution, not “degrowth”.

Any living system grows sigmoidally, due to real resource limits, it does not mean a collapse has to occur. We’ve already long passed exponential rate of human population growth. The challenge is to manage the flattening of growth rate equitably. This is possible, it is a political problem, not a food technology problem. The higher quality healthcare, and lower the infant mortality rate, the smaller families become. And as Bill made clear, the resource problem is about productivity, not old age demographics. The solution is to eliminate bullsh*t jobs and yet still employ everyone willing and able to work.

@Bijou, I don’t think that you have seen the data about how the current population is consuming the living natural resources at an unstainable rate, for example over fishing desertification, and clear cutting forests. My expert sources assert that the population needs to drop to between 2 and 3 billion people, as fast as possible.

.

I always love the way MMT correctly frames the dependency ratio problem as a real resource and productivity problem not a financial one. I wish the mainstream media would recognise the current inflation “problem” is a really a real problem as well…caused by war and energy and covid supply issues. How are we to tackle the real resource challenges? Reduce demand in inflating sectors without cutting it in non-resource intensive areas? Austerity and “tight” monetary policy are being trotted out as the answers to inflation. But they are not the right tools. MMT is often accused of being in love with the mystical power of infinite money creation when actually it is the most pragmatically focused on real resources.

Productivity improvement can be problematic as a solution to the problem of the dependency ratio because productivity improvement (output per man-hour) is often increased through the deployment of machinery, which increases total energy consumption. We may need to use an alternative measure of productivity-something more akin to an efficiency metric-like output per kilowatt-hour.