Today (April 18, 2024), the Australian Bureau of Statistics released the latest - Labour Force,…

Older workers in Australia taking on more work, while in Britain they are bailing out

It’s Wednesday and a few items caught my interest in the last few days. I have been besieged with requests to comment on the Bank of Japan’s announcement yesterday to widen the range in which it conducts yield curve control for the 10-year Japanese government bond yield. Some of the besiegement (which means in English – aggressive pressure or intimidation) claims that the decision shows the private bond investors have finally won and is the last nail in the Modern Monetary Theory (MMT) coffin. If the senders were comics, they would be very funny. Otherwise, it signals a sad reluctance to face reality. It is called yield curve CONTROL for a reason. Anyway, I will analyse the decision for my readership tomorrow I think. Today, though, I saw two pieces of data that demonstrate the impacts of Covid and inflation on two different labour markets. In Australia, they are now calling it the ‘great unretirement’ as older workers flood into the labour market in recent years – allegedly, so the spin goes because of by “more favourable workplace conditions”. I think there is more to it than that. Over the other side of the World in freezing cold Britain, it appears that the impacts of Covid (“rising sickness”) have, in part, been responsible for an “exodus of more than half a million people from the British workforce”, which means the growth capacity is now more limited. These are interesting trends that need thinking about.

The so-called Great Unretirement

The Melbourne Age newspaper carried a story today (December 21, 2022) – The ‘great unretirement’ accelerates as jobless rate hits historic low – which essentially argues that:

Historically low unemployment and more flexible working arrangements since the pandemic have spurred tens of thousands of older people back into the workforce in a trend one economist has dubbed “the great unretiremement”.

The article says that:

Nearly half a million people entered the labour force in Australia over the three years to October 2022. But in an extraordinary demographic shift that accelerated when borders closed and the supply of foreign workers was curbed, about four of every 10 of the new workers were over the age of 55.

In fact, since January 2020 until October 2022, 430.9 thousand people have entered the labour force in Australia.

The following age breakdown is relevant:

1. 15-24 years: -97.6 thousand.

2. 25-34 years: -39.7 thousand.

3. 35-44 years: 260.7 thousand.

4. 45-54 years: 97.6 thousand.

5. 55-59 years: 13 thousand.

6. 60-64 years: 76.7 thousand.

7. 65+ years: 120.1 thousand.

8. Over 55 years: 209.9 thousand

So the actual percentage share of the 430.9 thousand accounted for by above 55 year olds since January 2020 to October 2022 is 48.7 per cent, which is much higher than the article suggests.

The next table shows the share of the change in employment by age groups between January 2020 and October 2022 and also shows the labour force share for each group as at October 2022.

Comparing the two shares for each group gives us an idea of the proportionality of the employment gains for each group relative to their overall ‘weight’ in the labour force.

Teenagers have improved their position but those who are in the next three age groups – 20-24, 25-34 and 35-44 – have gone seriously backwards.

The older prime-age workers (45-54) have gained jobs in proportion with their labour force share (about), while the 55-59 group have gone backwards

The real changes are in the above 60 years groups who have taken 26.6 per cent of the new (net) jobs created since the beginning of the pandemic but only account for 11.3 per cent of the labour force.

This is the trend the article is referring to.

| Age Cohort | Share of Labour Force | 2020-October 2022 |

| 15-19 | 6.2 | 15.0 |

| 20-24 | 9.1 | -7.1 |

| 25-34 | 22.3 | 3.5 |

| 35-44 | 22.5 | 39.0 |

| 45-54 | 19.8 | 18.1 |

| 55-59 | 8.3 | 4.9 |

| 60-64 | 6.4 | 11.2 |

| 65+ | 4.9 | 15.4 |

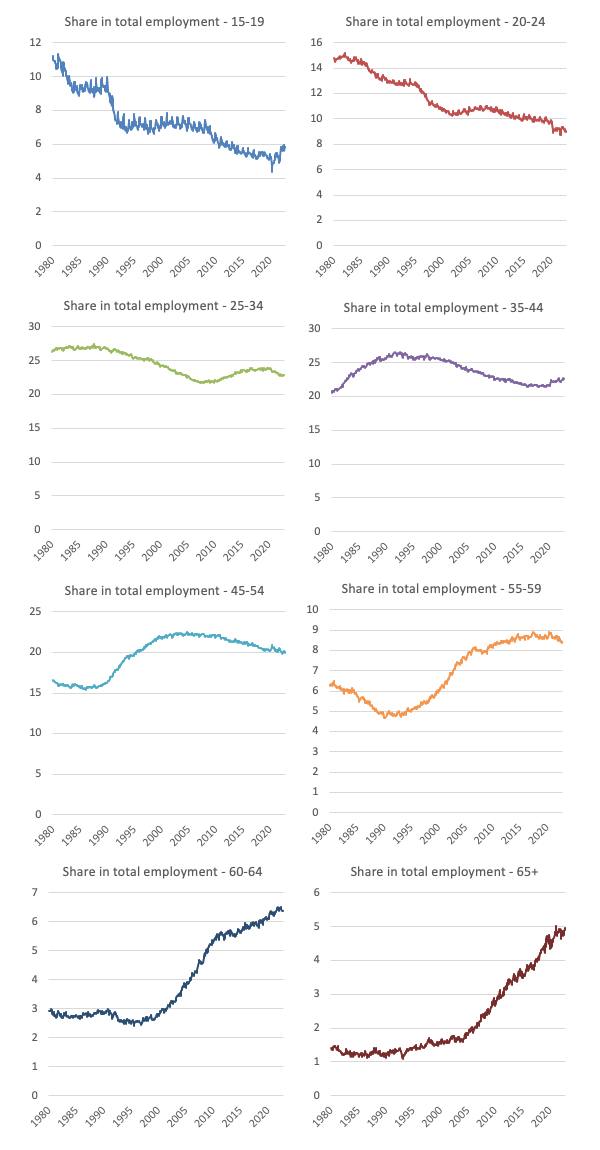

The first graph shows the employment shares by age categories from January 1980 to October 2022.

Some quite stark changes have taken place over that time and the trends that are being signalled as ‘recent’ have, in fact, been abroad for many years, including the increased participation of older workers and the declining participation of younger workers.

I have not controlled these graphs for population ageing – which would contribute to these shifts – but not as a dominant influence.

We are currently working on analysis to decompose the factors that are driving these trends including adjusting for shifts in age composition as the workforce ages.

Remember when the increased share of part-time jobs in the 1970s onwards was held out in the mainstream media as evidence of improved flexibility for women and an improved capacity to achieve so-called work-life balance, the reality was quite different with the rise of casualisation, increased job insecurity, the rise of the precariat and the underemployed.

Same story here.

Workers and families are being squeezed badly by flat wages growth, rising cost-of-living pressures and declining public services (privatised medical – less bulk billing; increased public transport fares; etc).

And many worker approaching retirement age or already retired, who were in market-based superannuation funds lost out badly during the Global Financial Crisis and have been forced back into the workforce by dint of money shortages to fund their sense of retirement.

The other aspect is that when the borders closed in 2020 to keep Covid at bay while the population were vaccinated, employers were faced with a dilemma.

To keep growing they had to find workers – given they had relied heavily on underpaid, short-term visa labour from abroad prior to the pandemic.

With that flow of workers available and unemployment and underemployment relatively high, employers could pick and choose who they wanted.

Now, with the foreign workers not yet flowing back in the same numbers and unemployment relatively low, employers have to can their age prejudices and take anyone they can get.

That has opened up opportunities for older workers who are trying to stay ahead of the cost-of-living pressures etc.

But just wait until the working age population returns to pre-pandemic growth rates.

Then the prejudice will return and age discrimination will once again see those older workers disadvantaged vis-a-vis the rise in foreign workers.

But older workers in the UK are bailing out

The UK Guardian article (December 20, 2022) – Exodus of more than half a million from workforce ‘puts UK economy at risk’ – demonstrates the ‘hidden’ cost of allowing Covid infection rates to flow through the society.

The GBD crew thought they were smart telling us all that we didn’t understand science and that they knew better claiming that we just had to ring-fence the aged and vulnerable and let Covid rip outside of those groups.

They never told us how that sort of sequestration was ever going to be practical – who would feed the aged care residents, for example.

Oh, the carers could be insulated as well.

What about their children and partners and friends?

Oh, hmmm.

And the rest of it.

But allowing Covid to spread throughout the population has seen so-called non-vulnerable groups develop long-term problems, even if their initial infection was relatively mild.

That is why I supported (and support) governments being extremely cautious about Covid.

We simply still do not know what the disease is doing to people and the evidence is mounting that it does bad and unpredictable things to a significant minority.

The UK Guardian article reports on a House of Lords analysis of the sharp rise in inactivity among workers in Britain.

Unlike Australia where older workers are disproportionately increasing their participation and working, the article reports that:

… earlier retirement among 50- to 64-year-olds was the biggest contributor to a rise in economic inactivity of 565,000 since the start of the pandemic.

They identify the drivers of this trend as:

1. “Rising sickness rates among working-age adults …”

2. “changes in the structure of migration after Brexit …”

3. “an ageing UK population …”

The British Office of National Statistics published a report (December 19, 2022) – Returning to the workplace – the motivations and barriers for people aged 50 years and over, Great Britain: August 2022 – investigated:

… people aged 50 to 65 years who left or lost their job since the start of the coronavirus (COVID-19) pandemic, and would consider returning in the future.

It found that:

1. “of those considering returning, 61% were aged 50 to 59 years; of those not considering returning, 33% were aged 50 to 59 years.”

2. “Among adults considering returning, those who reported a mental or physical health condition or illness were more likely to report the coronavirus (COVID-19) pandemic as a reason for leaving their previous job (21%) than those who did not (11%).”

3. “those considering returning were less likely to be able to afford an unexpected but necessary expense (61%), or own their house outright (57%) than those not considering returning (77% and 78%, respectively).”

4. “money was an important motivation to return for all age groups, but particularly for the younger cohort aged 50 to 54 years (69%), those who felt like they do not have the skills to get a job (68%) or who were paying off a loan or mortgage (68%).”

So, the economic squeeze is working in Britain too, but the net result is different to what is happening in Australia.

We need to investigate what is driving these differences.

That is, another research question joins my queue.

Music – Ryo Fukui

This is what I have been listening to while working this morning.

In the 1960s and 1970s, as Japan began to recover from World War 2, it also underwent a sort of cultural development in art and music.

All sorts of local and hybrid musical forms emerged and prospered.

It was a similar shift to that which occurred in the West with the emergence of R&B, jazz fusion, funk etc.

Jazz in all its forms really thrived in the Osaka scene, although that city has given way to Tokyo as the jazz hub of Japan.

One of the great Japanese jazz piano players was – Ryo Fukui – who died in 2016.

He hailed from Sapporo (Hokkaido) and made his name at the famous “Showboat” club in that city and which he owned with his wife.

I first encountered him in the 1970s, when he released his first album – Scenery (1976) – which was a live recording from Yamaha Hall in Sapporo.

It was a cult album at the time (meaning it was ignored in the US) but has enjoyed increasing popularity in recent years.

The song we are playing today is called – Horizon – and was on his second album – Mellow Dream – released in 1977.

Over the years, I regularly come back to this album.

It has subsequently been re-released (2018) as more people discover the magic of his playing.

His band at the time was exceptional:

1. Ryo Fukui – piano.

2. Satoshi Denpo – double bass.

3. Yoshinori Fukui – drums – Ryo’s brother.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

“We need to investigate what is driving these differences.”

I the UK the cheap foreign labour continues to flow – net immigration remains high at the behest of big money who need that labour to make the business models add up, and who really want the UK subsumed into a European superstate.

In Australia the border closure has forced a change of attitude.

ISTM that the UK has yet to require its business can its age prejudices and start coming up with new ways of doing things.

We’re still trying to do colonial appropriation, just as we have for 200 years or more.

My guess is it will be a combination of things.

In the UK house ownership took off with Thatcher and those mortgages are now getting paid off. A trend in the UK which you can see in every work place, is once people pay off their mortgage they reduce their hours. There are more opportunities for part time work compared to what there used to be. With more companies offering part time and flexible working patterns to reduce costs.

There has also been a shift in attitudes and that is older part time workers are more reliable than younger part time workers and will turn up and take less time off. As the pension age keeps increasing more workers are deciding to take their private pensions early.

They work out what their monthly overheads are and then figure out how much part time hours they need on top of taking their pensions early to live the life they want. Without paying any tax as they don’t hit their minimum tax threshold working part time.

Many see this a healthy lifestyle. As after taking retirement early it gets them out of the house for 16- 25 hours a week. Keeps them active and part of a social circle they can dip in and out of. With now more choice of what they will do for those 16-25 hours that isn’t hard labour. Many older workers who are now mortgage free are seeing this as an attractive option. It also helps to pay for a couple of holidays every year during their semi retirement.

Bills paid – social circle- keep active – money to go on holidays – mortgage free.

My guess is when all is said and done those 5 things are what drives the choices older people make. The biggest changes will show up in who is now the majority of part time workers and underemployed workers. A big shift will be identified in the age of part time workers. Add to that how difficult it is for younger people starting out trying to get a mortgage they need full time work. With older workers deliberately choosing to be underemployed and in part time work.

Not to mention how many older workers are choosing to sell their houses once mortgage free to move abroad and live in the Sun. Look for 16 hours a week to work abroad and live off what they got for their house and taking their pension early.

Demographics of house owners broken down into North and South in the UK will probably show who is working part time to live to pay the bills and who are working part time as a healthy lifestyle. This also decides who are the better off demographic when they move abroad. As those in the South get far more for their house than those in the North. Most Londoners are getting a million + for an old council house.

Those that don’t have any kids are also using the equity in their houses to be able to finish work early and part time work to get the lifestyle they want.

However, I’m only guessing that Thatchers house owners and 30 year mortgages being paid off are driving these changes within the older groups. From being in that group myself and watching the changes in part time work first hand in the different jobs I’ve had.

Will be very interesting to actually see the study to see what is really going on here.

This is what annoyed the middle class, liberal, metropolitan class the most about Brexit.

Nothing to do with trade or the £ or their narratives and framing. They have never cared for Europeans.

Brexit turned their retirement plans abroad upside down. They are furious about it, now that Europeans won’t be waiting on them and serving them cocktails as they push house prices up for the locals who can’t afford them.

I forgot to mention the empty nests.

As the kids move out some owners downsize. Again this gives them the opportunity to look at their working lives and the different options they have to finish full time work early and collect their pension early.

I’ve worked with a few of these people who decided to get rid of the stress of well paid jobs and were happy as Larry working 16- 25 hours a week without any responsibility and top up their tan several times a year. Clocked in and clocked out stress free, never taking the job home with them again. Always at the social events and helping to organise them.

Long covid is definitely a factor in the UK, and maybe a key difference between the UK and Australia. Housing as ever in the UK, and in this I agree to an extent with Derek Hendry, must also be a factor. To many mortgagees in the SE, just sitting in a house has been far more lucrative than earning a living. With mortgage paid off, their income need is so much less than that of renters, and many have also been enticed, following Osborne’s pension changes, to take reduced pensions early. Another win for the pensions industry I guess. Then there was Chancellor Sunak’s 2020 covid bung to house sellers and buyers with early inheritance help, in the form of stamp duty relaxation, which spiked a retirement to more affordable homes in the countryside. Absurdly large wage differentials are another reason to put people off returning to employment in lesser paid jobs.

I would suggest that middle class Britain is, with media encouragement, concerned about the £ following Brexit. They want their cheap foreign holidays to last forever. Subsidised by others. There has never been a bigger lie than ‘We are all in it together’.

Meanwhile, let’s see how the global economy copes with the covid explosion in China, hitting a population not well vaccine protected.

As an Australian citizen who has been resident in North Wales for the last 30 years, I know of plenty of contemporaries in this same age group in both countries who are thinking of or who already have left full time employment for early retirement. The main difference in my experience is the universal state pension that is available to the UK group, other factors being pretty well equal. It is almost like a very large UBI experiment, and I think it at least partly explains the difference in aggregate effects between the two countries.

@ Johnny G I doubt that the UK state pension explains people withdrawing early from the Labour market. The earliest the pension for men has been available is 65, with people reaching 60 a year or two ago, now having to wait till 66, and those reaching 60 this year having to wait till 67. Women now also have to wait till 65. Worse, many (like me) who paid into a separate public service pension have had our entitlement to unreduced pension moved from 60 to 67. The government would like us to keep working or take our non-state pension early (which is unlikely to lead to a comfortable life of leisure in our 60s. The state pension, though somewhat inflation proofed in recent years, is hardly enough to live on unless it tops up another pension, and unlike a UBI which is citizen related, the pension depends on many years past NI contributions. For those who haven’t managed to make contributions over many years or don’t have any other pension provision, there is a means tested supplementary pension, but if you’re receiving that, you aren’t enjoying a luxurious retirement.