I have received several E-mails over the last few weeks that suggest that the economics…

Living standards fall and labour wastage rises … but its that time again

It is on days like today that you see how far away from the mainstream economic opinion my macroeconomic thinking is. Why today? For overseas readers, the central bank (RBA) started hiking its official cash rate target by 0.25 basis points to 3.25 per cent. What is wrong with this? There is around 14 per cent of available labour resources currently underutilised and rising. Last month full-time employment continued its collapse. The only signs of activity in the labour market are some casualised, low-skill, low-paid jobs being created. My conclusion: neo-liberal paradigm remains intact. Stay tuned for the next crisis.

This is what the RBA Governor said today when the announcement was made:

The global economy is resuming growth … The expansion is generally expected to be modest in the major countries … Prospects for Australia’s Asian trading partners appear to be noticeably better. Growth in China has been very strong, which is having a significant impact on other economies in the region and on commodity markets … Overall, growth through 2010 looks likely to be close to trend … Underlying inflation should continue to moderate in the near term, but now will probably not fall as far as earlier thought … Housing credit growth has been solid and dwelling prices have risen appreciably over the past six months … Business borrowing has been declining … the exchange rate has appreciated considerably over the past year, which will dampen pressure on prices and constrain growth in the tradeables sector … With growth likely to be close to trend over the year ahead, inflation close to target and the risk of serious economic contraction in Australia now having passed … it is now prudent to begin gradually lessening the stimulus provided by monetary policy. This will work to increase the sustainability of growth in economic activity and keep inflation consistent with the target over the years ahead.

We will have to wait two weeks before the Minutes of the October meeting are made available to learn more.

But the RBA Governor has been making these noises for some weeks now arguing that our “economic emergency is over” and all the investment bank economists and others have lapped it up. Which emergency exactly are we talking about here?

Well apparently the share market is on the rebound and that shows us that the crisis is over. Apparently home prices are rising again and that shows the crisis is over.

But the message is clear – we need less aggregate spending not more. They have bundled the political rhetoric into this notion that rates (at 3 per cent) have been at “emergency levels” and a return to the normal (or natural) rate is required. You might like to read the blog – The natural rate of interest is zero! – to see what I think of that nonsense. A related blog – Another sorry chapter in RBA history is looming.

It is now common place to hear the investment bankers mimicking this (Austrian) language. One investment banker was quoted by the ABC today as saying:

If the Australian economy continues to strengthen – in particular, if the downtrend in full-time employment tends to stabilise and then reverse – we can expect the RBA over an extended period to move through its various policy settings, from emergency (3 per cent) towards easy (4 per cent) and then neutral (5 per cent or so) … Restrictive (6 per cent plus) will come much later on if things go really well over coming years.

When you think about this logic something doesn’t add up. If they are trying to take the heat out of the asset market then they must be thinking a slight rise will take a bit of heat out. But the language in use would have us believe that monetary policy is still expansionary. So the asset price boom will just boom more slowly? They will claim that they are sending a signal that in a year or so rates will be considerably higher than they are now and that should stop people in their tracks now. But that is a very inefficient way of managing an economy. More later on that.

We also should not overlook the fact that the big four banks, now a protected group operating, have been making profits as a consequence of the government subsidy (guarantee). They have also not fully passed on the previous cuts in the interest rates by the RBA over the course of the crisis citing increased funding costs. So the extent to which mortgage rates had eased anyway is not as much as might be thought.

All the media is focusing on the fact that the RBA is (according to the ABC today):

… getting increasingly worried about the stimulatory effect low interest rates are having on housing prices, with first time buyers taking on record levels of debt and becoming more vulnerable to the inevitable rate rises as the RBA returns to more normal settings over future years.

Amid all the non-growth that was outlined in the RBA’s statement today, the Governor did say that “housing credit growth has been solid and dwelling prices have risen appreciably over the past six months”

But a significant chunk of that is the first home owners’ scheme which was just a subsidy to sellers (went into prices) and that scheme (thankfully) is being unwound. It should never have been part of the fiscal stimulus strategy and was inherited from the previous government who designed fiscal policy in the recent years to win favour as its electoral standings were plummeting.

If the federal government was on top of the crisis it would have acted to target the specific assets that may inflate over the period ahead along the lines that I outlined the other day in this blog – Asset bubbles and the conduct of banks.

The beauty of fiscal policy is that you can target the initiatives so as to contract specific areas of the economy and expand other areas (including overall spending). In that way the government can transform the composition of spending. Monetary policy is like an antibiotic – it kills good and bad (inasmuch as it kills anything).

The so-called experts (not!) have been using today’s RBA meeting to write copy for some weeks now. As recently as yesterday, Sydney Morning Herald Economics Editor, Ross Gittins was talking this up. After rehearsing the RBA logic for them about neutral rate levels and that “the official rate can’t stay at its lowest in 50 years for very long”, he said this:

But why is it desirable to put rates up, even if only by a bit? Because it’s no longer prudent to have rates so exceptionally low. It runs risks it’s not necessary to run to ensure the economy has sufficient stimulus to get back on its feet.

The risk – inflation. In his 992 words (not including title line and attribution) Gittins didn’t mention unemployment once – this is not a risk apparently that needs to be considered when monetary policy is being discussed. It just shows how far we have lost the plot over the last three decades or so that this sort of reasoning is considered reasonable.

Gittins went on:

More broadly, business investment is surprisingly strong and export volumes are still growing …

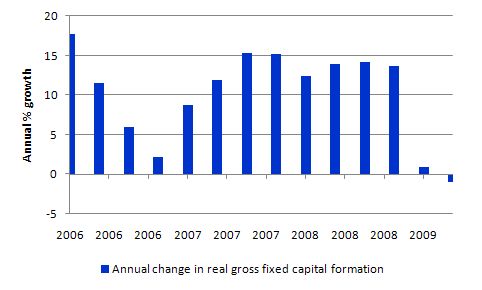

Not by my reckoning. The following graph is the annual growth in real business investment since 2006. It doesn’t look strong at all to me.

We are now increasingly hearing that we avoided a “technical recession” – meaning two consecutive quarters of economic growth. And this is why rates have to start going up.

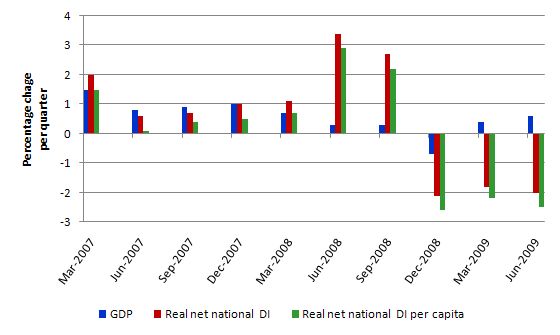

Well it depends on how you measure it even if you stay within the national accounts domain. The June National Accounts showed that while seasonally-adjusted GDP grew by 0.6 per cent in the June quarter and was also 0.6 per cent over the year from June 2008, Real net national disposable income collapsed by 2 per cent in the June quarter and was 3.2 per cent down over the year from June 2008. The following graph shows quarterly growth in GDP, Real net national disposable income and Real net national disposable income per capita since March 2007

As you can see the income growth measures have been negative for the last three quarters. So our material living standards have fallen (in income terms) over the last year quite substantially. Our wealth has also fallen sharply (see ABS data for evidence). This is what I wrote about it previously – One good reason for the government to remain in office

To understand what this means go to this ABS Page. The ABS say that:

Real net national disposable income is the capacity of the Australian community to buy goods and services, save and invest. It is the value of total production in Australia (less that needed to replace depreciated capital) plus primary income received from overseas (less primary income generated in Australia but paid overseas) plus current transfers received from overseas (less current transfers paid overseas). It can be spent on goods and services by households or governments, or saved and used by households, governments or businesses to add to the stock of machinery, buildings and other produced capital.

The broader view of a recession relates to how the labour market performs rather than sticking to the “technical recession” definition. The fact that total labour underutilisation is now around 5 per cent higher than it was in February 2008 when the downturn began here is suggestive of something bad … if that is what the term recession is meant to invoke.

My view is simple – the unemployed and underemployed casual workers – which are increasing in number by the day – don’t buy shares and cannot, largely, afford to buy houses anyway … no bank would lend to them at present even if they wanted to participate.

So while the financial emergency might be over for those with wealth and financial assets but it is just starting for those who are facing the prospect of long-term unemployment and suppressed real wages and job insecurity.

I was out west the other day (Brewarrina) on a field trip. The indigenous Australian who live in this town has the lowest life expectancies of any people in Australia and it is falling! There is very little work and certainly no housing boom. Why should they pay higher interest rates for what the speculators are doing in Sydney, for example? Not that anyone would lend them a penny. Which is a problem in itself.

With monetary policy you cannot target. It is a mindless policy to rely on.

It is true that monetary policy is of dubious effectiveness anyway – but increasing interest rates still hurt some people in society. It also puts in peril those who remain over-committed to debt. The reason we haven’t seen mass bankruptcies in this downturn is because they reduced interest rates. If they are now tightening again, more households will go over the edge and that will be deflationary.

What it signals to me is that the discredited macroeconomic policy regime that helped get the world into this mess – a dominant inflation-targetting monetary policy and a passive, surplus-oriented fiscal policy is still in vogue. Governments will be rushing to get their deficits down next. And all we will be doing is setting out the conditions for the next crash.

The surpluses will force the private sector in Australia (given our external deficits) increasingly into debt for a time to fuel growth or else the households will continue their attempts to save and a double-dip recession will hit us before we can wipe the smirk of the policy makers faces.

Finally, as a matter of historical fact, the RBA was legally constituted to pursue full employment as one of its three goals (price stability and general welfare being the others). The functions of the RBA Board are set out in Section 10 of the Reserve Bank Act 1959. However, the RBA has been significantly influenced by the NAIRU concept and it conducts monetary policy in Australia to meet an openly published inflation target.

In my view – and if I was a lawyer I would pursue this – there is a strong case to be made that the RBA is acting illegally according to the 1959 Act by using unemployment as a policy tool. A class action brought against them on behalf of the unemployed and underemployed (now 14.5 per cent of the labour force) would at least force them to argue that full employment was associated with an official unemployment rate of anywhere between 5 and 10 per cent and underemployment of over 4 per cent.

It would interesting to cross-examine their economists about their knowledge of how a modern monetary system works. We could all have a laugh each night watching the news.

Any pro bono silks out there?

I am curious about this apparent growth in housing prices. How is this calculated? Are properties rising in price right accross the spectrum?

Purely anecdotaly, they don’t seem to be rising here. Everyone I know who has been trying to sell their house over the past 12 months has given up and decided to stay put for now – they can’t even get what they paid for it.

I actually thought that the RBA might have left rates on hold today. With rising underemployment, tighter credit standards and an increased private sector desire to repair their household balance sheets and get back to some measure of saving – prompted every other day over the airwaves by Kochie – I can’t for the life of me see where this heat that needed to be let out of the economy could possibly be coming from.

Bill,

I have been looking forward to your response all day since the announcement. I was also wondering where the source material for some of the graphs above come from. You don’t appear to cite them. Thanks.

Lefty,

I agree with you. I am quite surprised at the rate rise today basically for the reasons Bill mentions. My understanding is that they are doing it because the IMF recently told them to nip bubbles in the bud before they begin by raising interest rates.

I would imagine that housing prices are calculated by the rise in prices across the major metropolitan centres. That said in my regional area, probably classified as rural, housing prices have been static for as long as I can remember now. I have noticed in the last few weeks though in the lesser attractive areas with what I would consider a mid size rent for the area have dropped significantly. I do not know what that might signify.

As an aside, I’d appreciate it if you could send me an email – fairly simple to track mine down.

Regards,

Senexx

Unfortunate that Central banks are obessed with the Taylor Rule. And what about Mr. Taylor himself ? He writes blog posts like http://johnbtaylorsblog.blogspot.com/2009/10/beautiful-model-clear-prediction.html From the Modern Money Perspective, its a clear failure to understand modern money. Increased government spending increases aggregate demand, minimum wage criteria decreases wage per hour per person and hence employment (which is directly proportional to aggregate demand and inversely proportional to wage per hour per person) increases.

lefty wrote

this is certainly the case in the UK. Where many sellers have become so-called ‘accidental landlords’ as they fail to achieve the 2007 peak asking prices, and by choice or forced by the equity position they’re in decide to rent out properties instead. Low IR’s have also allowed these sellers to stay put reducing dramatically the number of forced sales and repossessions. There has been some targetting of policy to safeguard homeowners, the interest policy has been a catch-all policy and has created something of a logjam in the housing market. Fewer now meet the lending criteria, sellers don’t have to sell due to lower mortgage repayments, chains breaking down etc. A case of who blinks first occurs, and on the evidence of the recovery of the last few months, buyers have blinked first.

And now the danger of a reflating of the bubble must be guarded against. Although it’s far too early to conclude whether the uptick can be sustained at current rates of increase.

In an interview with Business Spectator at the end of September, Michael Hudson said that an interest rate hike would attract foreign capital, thereby increasing Australian reserves, which in turn would attract corporate raiders to empty them out, leaving the burden to the Australian tax payer.

Could someone please explain – in terms a novice like me could understand – what he means by this, whether he is correct, and whether I (as an Australian tax payer) should be concerned?

Newspapers/editorials here in the US are lauding RBA’s decision and “preemptiveness” to nip a bubble in the bud. @Ramanan: I read that blog and also the WSJ editorial. As Bill says Policy Makers have completely lost the plot. Unfortunate!!! Here is James Hamilton discussing Fed Repos, concluding

Is this a feasible interim plan for handling the liability side without increasing either the money supply or interest rates? In a mechanical sense I believe the answer is yes. But the nature of inflationary pressures that we should be watching at the moment would arise from a depreciation of the dollar relative to other currencies and increase in the dollar price of internationally traded commodities. A modest move toward a weaker dollar and slightly higher inflation would be welcome. But the concern in my mind is whether a flight from the dollar could become more precipitous and destabilizing. It may not be the most likely scenario, but it is one for which I hope there has been some contingency planning.

And if the Treasury and the Fed think they could prevent that simply by borrowing even more without raising interest rates, they are mistaken.

Is inflation so much more important than unemployment? Very Very unfortunate for the world. Fortunate for them that they have their jobs still.

hi bill,

this is my first post here,

ive spent the last six months annoying steve keen on his blog, so i thought i’d explore fresh opportunities 🙂

besides ive to taken a bit of shine to neo chartilism, so your lucks run out 🙂

i first took an interest in neo chartilist ideas when i came across your “deficits 101” paper. it was a eureka moment , and since then i have been pointing others to it any chance i get,

re your latest post re the reserve decision,

wayne swan has the power to overide rba decisions

the relevent sction is

“11 Differences of opinion with Government on questions of policy

(1) The Government is to be informed of the Bank’s policy as follows:

(a) the Reserve Bank Board is to inform the Government, from

time to time, of the Bank’s monetary and banking policy;

(b) the Payments System Board is to inform the Government,

from time to time, of the Bank’s payments system policy.

(2) In the event of a difference of opinion between the Government

and one of the Boards (the relevant Board) about whether a policy

determined by the relevant Board is directed to the greatest

advantage of the people of Australia, the Treasurer and the relevant

Board shall endeavour to reach agreement.

(3) If the Treasurer and the relevant Board are unable to reach

agreement, the relevant Board shall forthwith furnish to the

Treasurer a statement in relation to the matter in respect of which

the difference of opinion has arisen.

(4) The Treasurer may then submit a recommendation to the

Governor-General, and the Governor-General, acting with the

advice of the Federal Executive Council, may, by order, determine

the policy to be adopted by the Bank”

i’m not so sure the problem lies with the rba per se,

i think the problem is the convention( not law) thats developed around government non interfearence in rba board decisions.

politicians are generally a medelsom bunch, so for them to butt out of anything is highly unusuall, nespecially when they have the legal and hence the moral authority to do so

but it just goes to show the pervasive impact of the neo classical agenda over the last 25 years, ever since hawke and keating, that sees governments wash their hands of economic tactical decision making in the form of setting the interest rate framework

no man is an island, and so wayne swan is dependent on advice. its clear by his inaction that he has taken on board parts of the neo classical agenda

by the way i came across a post by your good self, were you talk about jeff beck,

big fan myself,

dont suppose your a fan of a bit of home grown talent in the shape of frank gambale

3% rates were fine for building the British Empire, but something in the air in the 21st century has turned them into “unnaturally low”? Absurd.

Hi Bill and all,

But Glenn Stevens’ press release, in my opionion, did suggest (a candid slip, perhaps?) why the interest rates were raised:

“Unemployment has not risen as far as had been EXPECTED. The weaker demand for labour over the past year or so nonetheless has seen a MODERATION IN LABOUR COSTS”. (My emphasis)

This may be sheer paranoia, but I almost could hear a note of regret in those lines, as if unemployment had not risen as far as had been hoped and “moderation in labour costs” (a.k.a. decreasing wages) needed to go farther.

This is the relevant link:

http://www.rba.gov.au/MediaReleases/2009/mr-09-23.html

Hi Senexx.

I will try to do that soon, I am experiencing some pretty serious computer trouble at the moment and may be offline for some time.

cheers

Dear Marco

Yes, they always think that when employment rises there will be a wages breakout which will turn into a wage-price spiral of the sort we saw in the mid-1970s.

They haven’t worked out that they have smashed a lot of trade union capacity and that real wages growth has been slinking along the zero axis for years.

best wishes

bill

Dear Mahaish

In general I don’t like the speed playing that Frank is known for. Peter Green is my favourite player – lots of space, lots of vibrato and beautiful mixing of major scales with minor pentatonics.

best wishes

bill

Dear Mahaish

In general the idea that the RBA is independent is mythical. The Board in appointed by the Government of the day and as you point out the treasurer can overrule the RBA Board’s decisions if they wanted to. They would be reluctant to do that for political purposes given the independence and transparency arguments are core neo-liberal mantra.

But you saw the previous treasurer in the lead up to the last federal election speaking daily in the press about why the RBA should have held off increasing rates. They didn’t but the government could have stopped them. But, of-course, it was too late for them by that stage and we turfed out the following month.

So it is the ideological battle that we confront here … nothing more.

best wishes

bill

Dear vinodh

Thanks for the insights from the US. That country is really caught up in the grip of a Larry Summer’s-motivated spiral downwards. The only inflation threat that could occur in the US is if the Saudis hike the oil price. I doubt they are going to do that. And if they do it will not have any thing to do with the US deficits.

best wishes

bill

Dear Vestan

The quote you refer to is as follows:

The first part is correct. The “carry trade” refers to the fact that investors seek speculative returns by borrowing currencies where yields are low (say USD) and lend into currencies that generate high yields (say, AUD at present). The speculative component enters because the bet is subject to exchange risk – so when the loan is due the investor is stuck with a depreciated currency and having to pay back an appreciating currency. Carry trades put downward pressure on the borrowed currency and push up the value of currencies lent.

So our higher interest rates encourage foreigners to park their savings in AUD-denominated financial assets which does push up the value of the currency via the foreign exchange transactions necessary to facilitate this. But the exchange rate effect has the opposite effect on investment attractiveness here.

But that is as far as I would go with his argument even though he is now located at UMKC where Randy Wray works.

What exactly are the “corporate raiders” going to raid? Assume they start buying a range of financial assets here (they do this all the time anyway) what are they going to do with them? Also I wouldn’t compare a physical commodity (which is relatively immobile) with finacial asset speculation.

So are they going to push up our asset prices, sell and leave with profits. It happens all the time anyway.

But there is nothing arising from that which would force the Australian government to raise taxes – unless there was widespread price inflation arising.

best wishes

bill

Dear lefty

You may want to explore ABS House Price Indexes page. They explain how they compute the various indexes they publish in great detail.

The point you make is important. In depressed Gladstone struggling families paying a mortgage do not want to have to also face higher interest rates. They are not causing an asset price bubble in Sydney and shouldn’t have to suffer as a result. That is why monetary policy is a poor stabilisation tool. It has no ability to regionally or demographically target its impact.

best wishes

bill