I have received several E-mails over the last few weeks that suggest that the economics…

When a country is wrecked by neo-liberalism

Today’s meeting in Almaty will be discussing how the CAREC countries, that I are working with at present via the Asian Development Bank, can best achieve regional cooperation and integration. The region is very interesting and I will report more fully when things are more clear. But the challenges these countries face are exacerbated by the grip that market liberalism has on them. This is especially to be understood in the context of the Soviet heritage of most of these countries. There is a curious mix of past and present which makes market liberalism even more dangerous. So what? Well, I have been asked by many readers about Latvia, another former Soviet satelite. The deep crisis that economy is enduring is a good example of how market liberalism has failed. Yet, depressingly, the solutions proposed involve more of the same. Modern monetary theory (MMT) clearly offers an alternative and much more productive alternative recovery path.

Earlier this year, we started to read stories about how Latvia, considered to be one of the World’s so-called economic success stories (along with Ireland), was now on the “brink of bankruptcy” (Source).

In response to street riots earlier in the year across Latvia, the prime minister-designate said that:

The receipt of further financial support depends on budget amendments being passed soon … [and] … on the budget deficit being reduced to the level agreed … [with the IMF and EU] … The alternative is state bankruptcy … [he added that the treasury would run out of money in] … a couple of months … We need agreement among our political parties to cut the budget . . . There are no easy decisions here …

On June 11, 2009, as the newly appointed Latvian Prime Minister, he made a national public radio address and said that his country had to accept major cuts in the budget because they would allow the country to receive the next installment of its IMF/European Union bail-out loans. He said that “the signals we have been getting from the European Commission are positive …”

This is one of those times when the English language fails. Positive means a “plus: involving advantage or good” (Source). Harsh cuts to the budget of a national government which issues its own currency at a time when aggregate demand (and real income growth) is falling of a cliff are a negative involving severe disadvantage or bad outcomes. No definition of postive is consistent with causing more hardship to an already afflicted situation.

So what happened in Latvia and what is the solution? Modern monetary theory (MMT) provides insights into Latvia which highlight why the mainstream approach has failed and why most of the current proposed solutions will undermine the country further. The same sort of reasoning applies to Iceland.

First, the Latvian case demonstrates the dangers involved in making transactions across currency zones when you have a fixed exchange rate.

Latvia surrendered its currency sovereignty by pegging its currency against the Euro. What this means it that it has to use monetary policy to manage the peg and the domestic economy has to shrink if there is are downward pressures on the local currency emerging in the foreign exchange rates. So instead of allowing the currency to make the adjustments necessary, the Latvian government actually handles the “implied depreciation” by devastating the domestic economy (public sector pay has been cut by 40 per cent over the last year and pensions cut by 10 per cent). The collapse in income and the rise in unemployment has pushed the current account back into surplus which takes the pressure of the exchange rate but at huge costs to its citizens.

You get a feel for how mainstream economic thinking has crippled the capacity of the Latvian government to advance public purpose in that country by considering the way in which the central bank manages the peg. The rules laid out by the EMU exchange rate mechanism require any currency peg to snake within a 15 per cent range up or down. The Latvian central bank volunatarily tightens that band and manages the peg within a 1 per cent range up or down against the Euro. This is extremism.

The currency peg is nonsensical even though devaluation would be severely disruptive given the current nominal contracts held by the Latvian private sector. Around 80 per cent of all private borrowing in Latvia is in Euro with the Swedish banks being the most exposed in Latvia. The proponents of keeping the peg argue that the Latvia banking system would be bankrupted if there was a rapid depreciation. They also say that the other Baltic economies (Lithuania and Estonia) would have to depreciate (why?) which would then hit Bulgaria (currency also pegged) which would then multiply throughout central Europe.

They also say that devaluation would undermine Latvia’s ambitions to join the EMU (which I see as a good but they see as a bad). The debate in Latvia about the EMU is that it will provide financial stability for the country. The fact that membership destroys their fiscal sovereignty is never raised in the public debate which is disturbing – but then the debate is dominated by neo-liberal mainstream economic thinking.

Depreciation would also add inflationary pressures which would, in part, be self-correcting because imports would decline and there would be incentives for local import-substitution to develop. While exports are not large in Latvia (insignificant manufacturing base), opportunities do exist for tourism which would be stimulated by the lower exchange rate.

The other aspect of the Latvian currency that is relevant is that it is not a strongly traded currency and is probably immune from speculative attacks as a consequence. The foreign exchange market for lats is very thin.

The mainstream response has been predictable. The role of the IMF is as usual a disgrace. It has withheld its loan support and, while initially considering a devaluation was required is now supporting the country to maintain the currency peg. But in this context, the IMF demanded further cutbacks in public spending and refused to handover further support until the Latvian government had agreed. For example, to maintain the currency peg, the IMF required higher taxes and harsh cut-backs to health care spending.

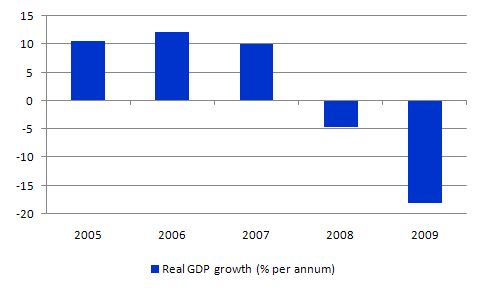

But to see why cutbacks in public spending are the last thing that Latvia needs consider the evidence (access to Source). So it is quite a demise and the income losses are extremely damaging especially to the most disadvantaged workers and their families in Latvia. So there is no sense that this is not a real crisis and urgent action is required. But whether the $US7.5 billion IMF bailout and the harsh domestic fiscal measures that the Latvian government is now pursuing (aided and abetted by the IMF) are necessary is the question.

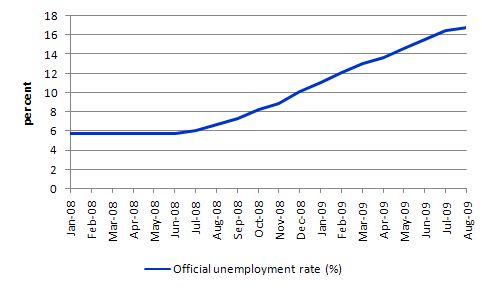

To see what this means for people, the next graph is the evolution of the offiical unemployment rate since the beginning of 2008 to August 2009. The hardship

Several things have contributed to the demise. Like the crisis elsewhere, the Latvian crisis has been a long-time in the making. They embraced all the elements of market liberalism that swamped central Europe after the collapse of the Soviet Union. They aped the West which was by then in full-speed neo-liberal mode – cutting government regulation and fiscal capacity and allowing the financial markets to go crazy with no oversight.

International banking (particularly Swedish) gained a huge presence in Latvia and began to dominate mortgage origination. The financial engineers pushed credit out at a pace and the housing price bubble that followed was spectacular as was the crash that began in early 2007 (for example, apartment prices fell between 35 and 45 per cent between 2007 and 2008).

The government burst the bubble by contracting the economy using tax rises and public spending cutbacks. Remember its interest rates had to follow the EMU rates because of the peg. So fiscal policy had to deal with inflation rather than monetary policy which was tied up maintaining the peg.

Maintream analysis (IMF) claims that the low interest rates and budget deficits were to blame. But fiscal policy was hardly excessively expansionary given that unemployment remained around 5 per cent during the boom period. It was perhaps not well targetted and should have addressed the housing boom much earlier. See this blog – Asset bubbles and the conduct of banks to see how I see fiscal policy targetting an asset price bubble).

The questions that were never asked include: Why did the government not place restrictions on the home mortgage market? Why did it allow around 80 per cent of mortgages to be written in foreign currency (dominated by Swedish loans)? Why did it not regulate the foreign banks that swamped the Latvian financial sector?

MMT would instead, point to the failure to regulate the financial sector appropriately (particularly the role of banks) which allowed to many households to take on ridiculous levels of foreign currency debt to maintain the real estate boom.

In terms of solutions, it is obvious that the crisis is deep. Which means that the adjustments will be harsh. But there are some rules that should be applied which are being eschewed by the mainstream economists who dominate the debate.

The October 15, 2009 edition of The Economist carried a story entitled – Lessons of the lat. They say that

There is no easy solution to Latvia’s mess. Whatever happens, its living standards will decline because real wages have to fall. But it must decide what to do about its currency. The government wants to keep the peg, as do a large majority of Latvians. But many investors are doubtful: despite a bail-out worth several billion euros from the European Union, the International Monetary Fund and others, rumours of devaluation abound. Many economists reckon Latvia is simply a replay of Argentina’s mess in 2001, when a quixotic effort to keep a pegged exchange rate ended in devaluation and default.

Here is what MMT would indicate.

First, like Argentina in 2001, Latvia should abandon its pegged exchange rate. While this is not seen as an option by the mainstream, in terms of MMT – it is the only option. The painful adjustments that will follow have to be managed in other ways. It should not “devalue and re-peg against the euro at a lower rate” (The Economist). While this would spread the country’s foreign reserves further, it would still involve a loss of currency sovereignty.

The Economist also claims a “better option would be for it to join the euro now, which would remove the premium Latvia pays for currency risk.” This is also to be understood in the context of the claims that devaluaing and retaining the peg would damage Latvia’s EMU aspirations are irrelevant.

They should definitely not join the EMU. It would be better for all (economically perhaps not politically) for the EMU to disband or reform to align fiscal and central banking responsibilities. Please read this blog – Euro zone’s self-imposed meltdown for an explanation of this point. Joining the Euro would be a terrible option and Latvia would lose its fiscal sovereignty.

Second, the government should default on all foreign currency loans. The international community is also talking tough. The Economist reports that “Sweden’s finance minister … said outsiders’ patience was “limited” (his country and its Nordic partners are due to provide 10 billion Swedish kronor, or $1.43 billion, in a loan tranche in early 2010).”

The Argentinean default case study demonstrates why the foreign community is hardly in a situation to talk tough. Please read this blog – Why pander to the financial markets? – to understand why I say this. Argentina provided the model to all countries that had built up massive foreign currency debt and then floated its exchange rate in response to a currency crisis. It demonstrated, much to the chagrin of the mainstream financial bullies, that default allowed it to resume growth and advance public purpose via a domestic policy emphasis.

It showed that financial investment returned to provide productive capital despite threats from the first-world governments, the IMF and first-world lenders. It also showed that recovery from a crisis such that Latvia is enduring can occur without bending to the harsh conditions that the IMF imposes.

Once a nation defaults, the problem shifts to the lender rather than the borrower. In defaulting the Latvian government might offer terms to the creditors such that the loans could be expressed in terms of the lat rather than the foreign currency. Rejection of this offer would then lead to the Argentinean solution.

Third, the Latvian government should immediately legislate wide-scale reform of its banking system. Please see this blogs – Operational design arising from modern monetary theory and Asset bubbles and the conduct of banks – for a full explanation of how to manage the banks.

No bank should issue foreign currency loans and all assets should be kept on their balance sheets for the continuation of the loan.

Once floated, the currency will depreciate and this will cut real wages and undermine the capacity of many Latvians to service their loans. So what should the Latvian government do to minimise the damage to mortgage holders?

I do not advocate the government interfering with repossession processes. A private contract is a private contract. But the government should consult with the defaulting private owner to ascertain if they want to keep their house. If so, the government should purchase the house in lats form the bank that is foreclosing at the fire-sale price.

The government should then rent the house back to the former owner for some period – say 5 years. At the end of this period the former owner would be offered first right of refusal to purchase the house at the current market price.

The government would also offer the former owner guaranteed employment in a Job Guarantee, to ensure they are able to pay the rent and reconstruct their personal finances.

This option does involve setting up an administrative process but in terms of the primary goal of a sovereign government to advance public welfare, this proposal is vastly better than the alternative – widespread defaults, fire-sales and banks pursuing homeless indebted people. There is no subsidy operating (market rentals paid, repurchase at prevailing market price); no interference into private contracts, and people stay in their homes.

Fourth, they should expand fiscal policy to underwrite domestic saving and to stimulate employment and output growth. This is contrary to what The Economist thinks:

… the problems are grave. The government squabbles openly with the central bank. A decade of neglect of the public finances has left the state bloated and feeble … The weak coalition government, overshadowed by powerful tycoons and party barons, has not been able to push through the spending cuts promised in return for an $11 billion bail-out agreed on with the IMF, EU and other lenders in December. Reforms to the state bureaucracy as well as to public services such as health and education are necessary. (Latvia employs many more teachers and doctors than it needs) …

An urgent initiative for the Latvian government is to introduce a Job Guarantee to stop the rising unemployment and the downward spiral in aggregate demand which only worsens the credit pressures.

The best way for a country to work its way out of a private credit binge is to ensure people can save and that means they have to be in employment. The worse thing for Latvia is to drive unemployment up further; undermine the capacity of workers to pay their way; and withdraw essential personal care services (particularly health care) at a time when the stresses would indicate more of these services are required.

Once the exchange rate is floating then fiscal policy can be used to promote activity in the domestic economy and to encourage import-substitution and investment in productive activity. MMT tells us that the Latvian government can always afford to spend. The slump in tax revenue does not reduce its spending capacity. As the economy recovers, the tax revenue will recover via the automatic stabilisers anyway.

It is a mess but a MMT solution is vastly superior to the program that is currently being outlined for Latvia by the mainstream of my profession.

Credit ratings agency irrelevance

A Reuters report said that some senior Moody’s analyst said that:

The Aaa rating of the U.S. is not guaranteed … So if they don’t get the deficit down in the next 3-4 years to a sustainable level, then the rating will be in jeopardy … Raising taxes is never popular and difficult politically so we have to see if the government can do that or cut expenditure …

Ok, downgrade away … they did it to Japan several times (see this blog) – and nothing happened. The Japanese government could still issue as much debt as it likes at the price it wanted.

Essentially, the US Government should enact legislation to required ratings agencies to be accountable for its ratings of private debt. Everytime it makes a mistake (provides higher ratings than are justified) a formula should be applied to force the agencies to return profits. That would soon get rid of them and firms would have to ensure that investors had better information about the quality of the debt they were issuing rather than “buying off” the corrupt ratings agency industry to get ratings that bear no relation to quality.

Words we need to expunge from our vocabulary:

This is a new series (which I just thought of). I am compiling a list of words that we should expunge from our nomenclature.

Today’s word: taxpayer-funded

The reality is that taxpayers do not fund anything. When we pay taxes to the government they do not get any extra capacity to spend. The transaction is accounted for and our legal liability is relinquished and we have less purchasing power but that makes no difference to the government’s capacity to purchase goods and services now or later.

Changes to tax rates are used by governments to modify aggregate demand – to allow households etc to have more or less purchasing power – but that has nothing to do with funding government spending. A sovereign government “funds” its own spending as it is the monopoly issuer of the currency. In that sense, the term “funding” is a non sequiter and should also be banned from our vocabulary when used in relation to government spending.

Re: Latvia — whatever happened to “The Other Cannon”? The website doesn’t show much activity for the last few years, but I know that they had some connection at least with Estonia. I think those favorable to OC arguments would also be favorable to MMT, as there seems to be a common Post Keynesian root there.

Good luck with the Central Asians — a few more Argentian-style examples, and the world will notice.

“A sovereign government “funds” its own spending as it is the monopoly issuer of the currency.”

This sentence is an example of why I’d be sorry to see the word “funding” disappear. It works for me.

Discouraging the word generally makes it more awkward/restricted to speak/write easily about balance sheet management. I sometimes find myself struggling with ways to describe balance sheet dynamics without appearing to imply the wrong causality through use of useful words like “fund” or “finance”. It’s a bit of a drag. E.g. I think of government issuing debt as the “refinancing” of already created reserve liabilities (or maturing debt), which still suggests or at least doesn’t contradict the correct causality. After a while, if you understand what you’re talking about, you should be able to use “financing” or “funding” in that sort of context as well.

The real problem, of course, is not the word itself. It’s the misuse of the word in association with the answer to the following question:

“Where is the government going to get the money?”

The incorrect answer is something like, “We don’t know. And we’re concerned about it”.

The correct answer is that the government gets the money from itself as currency issuer. It creates the funding for its spending from its spending. The government is self-financing. I think of the US current account deficit in a parallel way. And of course loans create deposits.

But I guess the point is that if you can’t use a word properly, don’t use it. Unfortunately, that positions neoclassical economists as misbehaving children, scolded not to say “bad words”, because they are unable to learn their correct usage. I don’t have a problem with that, although those who understand the correct context and usage should be able to do so. I think in any event these troublesome words will persist at least in quotation marks as used by even the purist of PK purists – because they’re actually useful in proper context.

I agree with your proposal on assisting foreclosed homeowners – but should there not also be some corresponding incentive for current homeowners to maintain ownership. The offer of government purchase and rental could result in unintended foreclosures.

If these emerging economies were to pursue an MMT-inspired policy, how might this affect their ability to import goods, particularly capital goods? I understand how an economy as large as Argentina could do this, but Latvia? I imagine there would be a “financial embargo” placed on these countries. How would they import oil, for example. I imagine that exports would be be the only source of FX revenue and that exports could not be embargoed very effectively.

In lieu of such a “radical” solution (which I agree would be preferable), is there a possibility that Latvia might pursue a course similar to Iceland – limiting their payments to a percentage of GDP and structuring incentives so that their currency is not manipulated?

It’s very strange that in the US we have this uproar about foreign countries “funding” our deficits (I prefer the word “facilitating”, but apparently that is the only solution offered for emerging economies.

The role Of Neo-Liberalism, in widening the income gap between the rich and the poor.

June 5, 2010 by politicalsnapshots.wordpress.com

The role of Neo-Liberalism, in widening the income gap between the rich and the poor.

“One of the most pronounced effects of Neo liberalism is to create wealth inequality within national borders and between states. Within a decade of adopting free market policies, the class divide in the US and UK became significant.” Professor G. William Domhoff. UC @ Santa Cruz.

It is just another indictment of Neo liberalism and its multi-faceted destructive policies encumbered upon people of the world. It is very fascinating to note, that the income gap between the poor and the rich has more pronouncedly been evident in the US and UK, the joint creators of Neo liberalism.

This enormous income gap between the rich and the poor in the US has concentrated more power in the hands of the rich and has created a feeling of helplessness on the majority of American citizens who have been marginalized by Neo liberal policies.

Consequently, sooner or later, the question will arise, whose country is it anyway? It is obvious that the widening of the income gap in the US is close to the breaking point. It is not if, but when it breaks, no one can forecast how it might end. It is just that the Corporations are blinded by greed, and our representatives are muzzled by big business.

Writing on the subject of Neo liberalism’s impact on social cohesion, David Coburn, from the University of Toronto writes: “While it has been asserted that neo-liberalism produces a lowered sense of community it might also be argued that the rise of neo-liberalism is itself a signifier of the decline of more widespread feelings of social solidarity. The political rise of neo-liberalism is freighted with a more individualistic view of society and, perhaps, itself reflects a decline in the notion of we are all in the same boat. Not only do neo-liberal policies undermine the social infrastructure underlying social cohesion but neo-liberal movements themselves are partial causes of the decline of a sense of social cohesion.”

It is absolutely frightening, what Neo liberalism is doing to societies. It is corroding the very fiber that societies are built upon. Neo liberalism is cancerous. It is undermining our Democratic system. When a government becomes a by stander when millions are practically becoming paupers, while the few are amassing billions, then, the people have no protector. Laws, Rules and Regulations are in the books only to protect the interest of the rich.

In a wonderful article entitled, “Skewed Wealth Distribution and the Roots of the Economic Crisis”, David Barber, a Professor at the University of Tennessee, wrote:

“And what is true in the United States of the unequal distribution of wealth, and of the consequences of that unequal distribution, is true again on a world scale. This super-poor mass of humanity, from whose soil is ripped vast amounts of mineral and agricultural wealth, and out of whose labor the world’s manufactured goods increasingly come, are almost wholly excluded from participating in the world’s market economy”. So, what is to be done?

While a number of social scientists have forwarded divergent solutions for anarcho-capitalism to save itself, Professor Michael Rustin at the University of East London suggests the following points are “made necessary by the implosion of the neo-liberal system in the current financial crisis, and are needed to construct a new post-neo-liberal phase of democratic capitalism”.

The five points he has put forward are the following:

(1) A more active role for governments in regulating markets, and especially global financial markets

(2) Constitutional reforms which enhance democratic processes and civil liberties, and create more representative and pluralist systems

(3) Policies, which reduce inequalities, and give greater weight to social justice and social inclusion.

(4) The enhancement of the capacities of international institutions, and especially the EU, to maintain economic stability and growth

(5) Programmes to address the problems of climate change.

Very sensible, are they not? But Wait!!! We have to see which governments have any backbones left in them to try and regulate the market, and do away with thirty years of destruction of the people that started with Reagan and Thatcher.

As I am ready to post this article, I hear a news story that stated that “Hungary might default on its debt”. What is the world coming to. Wasn’t Hungary the darling of the West? Didn’t it do everything that it was asked to? It privatized everything. It reduced government employment. It cut welfare as it was told to do by “free Market Reform” advisors. Hungary did everything a good and obedient follower of Neo liberalism is supposed to do. Yet, it is threatening to “default” on its debt in spite of a $24 billion IMF and EU loan few months back. This is the fruit of Neo Liberalism.

Do you wonder, which devoted and submissive follower of Neo liberalism will bite the dust, next?

Professor Mekonen Haddis.