I have received several E-mails over the last few weeks that suggest that the economics…

I have found an inflation threat

I read a news report today – 13,000 riot police, troops guard Obama. Hmm, I thought it might finally be the groundswell of people imbued with the logic of modern monetary theory (MMT) and anger over rising disadvantage, who had decided to take action. Especially after hearing the President’s latest foray into the media as an “expert” on matters fiscal. And only 13,000 troops … good odds I thought. But he was actually in South Korea and the report says that the assembled crowds were chanting “We love Obama”. Don’t they know anything … these people? Didn’t they hear or read his latest interview?

Fox News called me up today and asked if I would be the expert panellist for their interview with the US President about debt and fiscal matters among other things. I agreed and this blog provides the edited transcript of the interview.

If you want to see the complete record then here is the full transcript of of the Fox News interview on November 18, 2009.

The interviewer was Fox White House correspondent Major Garrett and there were some pleasantries to begin with. Michelle, Sasha and Malia received xmas wishes from Garret and the President said “That’s so nice, I appreciate it, to the Fox family let me say the same”.

I interrupted at that stage and asked Obama whether he thought the millions of workers, suffering because of his policy failure, would have a lovely … so nice … xmas.

An uncomfortable silence ensued before the interview continued:

GARRETT: Very good, a couple on the economy, you have a jobs summit next month. You want a jobs bill in 2010. Will that jobs bill raise the deficit or will you demand that it be deficit neutral?

OBAMA: You know, our first job was to get the economy to recover; and, we’re now seeing that. We’ve seen economic growth; we anticipate economic growth next quarter as well. I always said the job growth would lag behind economic growth. The question now is: how can we accelerate it?

There may be some ways that we can accelerate it without spending money. For example, one of the keys to this Asia trip is to start promoting the notion of balanced growth where the US is an exporter again. This is a region where right now we’re sending about 25-26 percent of our exports. If we just boosted our share of exports by one percent, that might be 250,000 well paying jobs in the United States. So export promotion would be an example of something we could do without spending money.

There may be some tax provisions that can encourage businesses to hire sooner rather than sitting on the sidelines; so, we’re taking a look at those. I think it is important though to recognize that if we keep on adding to the debt, even in the midst of this recovery, that at some point, people could lose confidence in the US economy in a way that could actually lead to a double-dip recession.

And so one of the trickiest things we’re doing right now, is to on the one hand make sure the recovery is supported and not withdraw a lot of money either with tax increases or big spending cuts — and states, for example, need a lot of support to keep hiring teachers and so forth — at the same time, making sure that we’re setting up a pathway long-term for deficit reduction. It’s about as hard of a play as there is, but it’s what we have to do and whatever jobs, additional jobs legislation comes out, has to fit into that broader framework.

BILL MITCHELL: Can I just interrupt again Mr President? I wonder what your conception of the problem that your nation is facing?

Consider these facts:

- US capacity utilisation rates are around 70 per cent and even lower in Manufacturing (Source).

- The official unemployment rate was 10.2 per cent in October 2009 (Source).

- The BLS U6 broader labour underutilisation rate is at 17.5 per cent in October … can I repeat that … 17.5 per cent (Source).

- Foreclosures are still rising and are at dangerously high levels in terms of the viability of the overall housing market (Source).

- “US children face the worst poverty of all in the in Western world (Source).

Why would you try to fudge this question from Garrett? Why not just tell him that the US Government of which you are the President is a monopoly issuer of the US dollar and is not revenue-constrained? The facts I presented above would tell anyone who knows the slightest bit about how your currency operates that anyone who talks about “neutral deficit” outcome at present is an irresponsible lunatic.

You have a housing market on the brink of total collapse. Your factories are not working because no-one wants to buy the goods they are capable of producing. You have millions of workers (17.5 per cent of them) without enough work – totally idle in most cases with insufficient income support and no potential to spend anytime soon.

Your children are increasingly being fed by food stamps. In some black neighbourhoods “around 90 per cent live in homes that receive food stamps at one stage or another” (Source).

Further, why put your hope in a strategy that will worsen the material standard of living of your citizens when you have the capacity to address the malaise domestically? Why would you want to turn your citizens into losers by increasing exports? Last time I checked you needed millions of jobs not 250,000 thousand anyway.

And I was particularly interested in your claim, Mr President, that “if we keep on adding to the debt, even in the midst of this recovery, that at some point, people could lose confidence in the US economy in a way that could actually lead to a double-dip recession”.

Where did you get that idea from? Did Larry read it out to you from Mankiw or something? People have already lost confidence in the US economy – that is why they are not spending. That is why your deficit has risen sharply mostly via the automatic stabilisers as your revenue side collapsed.

Now don’t get the idea you need that revenue to allow you to spend. Not in the least. All I am noting is that in an accounting sense, your revenue has fallen off a cliff and your net spending has risen which is a good thing because the automatic stabilisers are not called that for nothing. They start adding to demand as soon as they start working to push your net spending up.

You think that people will lose confidence in your Government and somehow that will stop them spending even more because your spending is helping to put some semblance of a floor into aggregate demand which is retarding the jobs loss somewhat? If you think that tell Larry to close Mankiw for a while and learn something about how your monetary operations actually work.

I guess you are rehearsing the tired line that the “bond markets” will stop buying your debt and that will stop you spending and then disaster strikes – the double-dip scenario you outline. So which people are going to stop buying your paper? Why would they do that given you face no solvency risk – your paper is about as rock-solid a guaranteed investment that anyone could make?

I would actively work towards changing the legislation relating to your fiscal operations and stop selling debt anyway. The debt doesn’t “finance” anything and you are now paying interest on overnight reserves, so you do not need a reserve drain to defend a positive Fed funds rate.

And I would have thought you would understand that given the the USD is the default reserve currency what do you think will happen if you try to reduces its availability by trying to reduce your external deficits? The answer is obvious. It will backfire on you.

I would note that your attempts at deficit expansion to date have been pitiful. There has been very little focused on creating jobs and a lot spent on the top-end-of-town. If I was to give your stimulus package a score out of 10 for effectiveness it would be around 2/10. Doesn’t that tell you something about your advisors and the sort of connections they have and the theories they are using to design policy initiatives?

Why design inefficient fiscal interventions that have benefitted Wall Street enormously despite the fact they create very little real output or employment and then turn around with this lame story that the Chinese are to blame because your citizens voluntary buy the junk they make?

Perhaps you need to stimulate your public education sector more to educate people to appreciate a higher quality lifestyle and stop buying cheap Chinese imports.

At any rate, what you desperately need to do is to increase your deficit by several percentage points of GDP and offer public sector jobs to all those who want one. Some of those jobs might be in professional areas where you will compete at market rates for the staff. At present the intensity of the competition is very low and so there are no inflation risks, but if you succeed to get the economy rocking again then you should be mindful that everytime your government pays market rates for any resource you risk setting off inflation.

But by far the majority of the unemployed workers could be offered a minimum wage job to work on community and environmental care projects for as long as they desired. I would suggest you raise the minimum wage so that everyone has access to decent housing and health care etc. But the scheme – which I call a Job Guarantee – would only be offering a wage to workers who have no market bid for their services by definition. It will give them a job, some income security, will add to aggregate demand and help stimulate a broader recovery and, in itself, will not be inflationary.

[At this stage, Garrett was getting a bit edgy and looked back at the President and resumed his questioning …]

GARRETT: Does it raise the deficit or does it not?

OBAMA: Well, the …

GARRETT: Or you haven’t made up your mind on that?

OBAMA: We haven’t seen that, and that’s part of a reason why I think we want to take a look at the summit.

BILL MITCHELL: You have to raise the deficit to address the basic facts I outlined above. If you do not raise the deficit you are risking a double-dip recession and a very devastating meltdown of your property (both residential and commercial) markets.

If you don’t raise the deficit you will have whole regions without work … falling into poverty. America the great will become a shadow … That will be the legacy your Administration will leave behind …

[End of edited interview … it went on but I lost interest]

The aftermath …

Well there has been a lot of press following this Interview and today I have received lots of E-mails about it as well.

The conservatives are cheering from their pulpits and focusing on the “people will lose confidence” because the US government might default if the debt gets too big. We have examined these propositions in the past. The insolvency claims are based on the false analogy mainstream economics makes between the household which uses the currency and the national government which issues it.

The former cannot become insolvent and would be unlikely ever to default. I cannot imagine any circumstances under which it would have to.

At this point the conversations get interesting. Because the mainstream snake starts to slither (slimy like) and decides to make up new definitions.

One very senior international commentator/journalist proposes that (his name remains confidential because the E-mails are private):

Inflation is default. Surely that is obvious to everybody. When the economy finally recovers, the government will end up with a very large debt. Such debt is owed to bond-holders and serviced by taxpayers. Politicians who are elected by the latter will want to default on liabilities to the former (particularly if many of them are foreigners) and provide taxpayers with goodies, instead. A burst of inflation is how they have always done it. End of story.

See how the definition of default now guarantees that the mainstream will be able to conclude that the US government (and all sovereign governments with public debt outstanding) are insolvent. Unless every nation keeps its inflation rate at zero forever.

If this nonsense wasn’t so serious and uttered by very influential people you would just treat the claims as a pretty weak comedy sketch.

First, default is the failure to make payments on contracts that have been previously agreed and voluntarily entered into. Last time I looked, the US government nor any government, had ever entered into a contract with their citizens to ensure there would be zero inflation. Zero inflation would be nigh on possible to achieve, which is not the same thing as saying the goal of stable inflation is unattainable for a national government. The latter is clearly attainable and a Job Guarantee would provide an effective nominal anchor while still ensuring employment levels are high when private spending is low.

Second, what is a very large level of public debt anyway? How do we determine whether it is large, very large, gargantuan or otherwise? What we do know is that it will be some percentage of GDP and that fraction will have risen over the last year. But that just reflects the extent to which private spending has collapsed.

When private spending resumes the growth in debt will decline.

Third, how much do we know about debt-servicing? Not much if the comments by this journalist are anything to go by (not that he doesn’t know – he just chooses to write to the deficit-hysteria crew who buy the newspaper that pays his salary).

Debt is owed to the bond-holders by the nature of the contract the government entered into when it sold the bit of paper to the private entity which might include a foreign government. The agreement is that the government will at some specified time return the principle and pay some agreed interest return.

How might the government do that? Well, when it sold the bond it ran down some bank reserves (which the deficits had added in the first place in equal amount to that “borrowed”) and made some book entries and posted the bit of paper (the bond).

When it comes time to service the interest payments it adds an amount electronically to bank reserves to the favour of the bond-holder. End of story.

But of-course, the reserve add might reflect aggregate spending that is growing too fast for the capacity of the real productive sector (given resource utilisation rates etc) to respond via higher production levels. The US is not remotely at that point now (refer back to my facts above) but at some point this could be an issue.

What is the issue? Inflation? At that point the government has some options. It can cut other forms of spending and/or it can increase taxes. The taxation increase is to ration purchasing power in the non-government sector and has nothing to do with “financing” the debt servicing payments or any other government spending.

Taxpayers do not fund anything! They pay taxes because the government wants them to have less purchasing power or because it wants them to stop buying certain things (for example, in the case of tobacco taxes etc).

It is of-course not impossible that a venal government will seek to manipulate intergenerational transfers of real goods and services via inflation. So the current generation will enjoy a better deal than their kids who will see their real futures eroded by inflation. That is entirely possible. Some might point to the Weimar Republic in the 1920s and Zimbabwe in recent history as an example of this. But I would read my blog – Zimbabwe for hyperventilators 101 – before I leapt into making these conclusions.

Only a government that failed to understand their monetary system would even contemplate something as stupid as this as a deliberate strategy. In countries where the ballot box allows the citizens to get rid of governments this would not be a wise strategy.

Finally, inflation is always a risk in running a high pressure economy. Net public spending, private consumption and investment spending, and, yes, booming net exports can drive nominal spending growth to such a level that the production system cannot respond anymore in real terms. There is nothing intrinsic about public net spending that makes it more inflationary per $ spent.

All $-spending that pushes the economy beyond its real capacity to produce is a risk. So the net export growth strategy is just as likely to run the risk of inflation (if it was successful and for the US it will never be strong enough to support full employment budget surpluses) as net public spending.

The size of the public debt tells you very little, of itself, about any possible inflation risk. When the US is producing at stronger levels and resources are no longer idle then the US government has some decisions to make about rebalancing fiscal policy which might just mean increasing taxes. That is a long way off yet.

Anyway, just in case there is an inflation threat emerging out there I have done some research … and I found that ….

Inflation is already becoming a danger to credibility …

Inflation is defined as a continuous increase in a level and in economics is usually associated with a nominal aggregate like a price. The inflationary process is usually taken to mean a diminution in the value of the particular thing that is inflating.

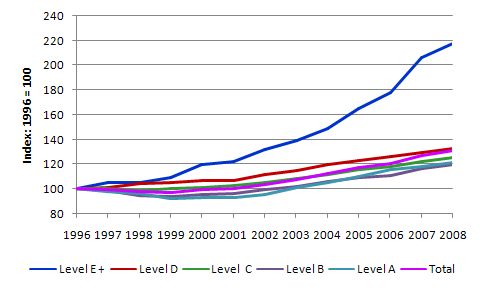

Take a look at this graph. It shows movements in indexes (1996=100) from 1996 until 2008. Australian academics will probably immediately hit upon what the data is about but others will not so easily identify the categories. More soon on that.

While the total series has moved from 110 to 130.8 over the 13 years, an average of 2.36 per cent growth per year, the Level E + series has moved from 100 to 217.9 and average rate of 9.1 per cent per year. The categories Level A and Level B grew on average over the 13 years by 1.66 and 1.51, respectively, well below the total growth. The Level C category grew just above average at 2.53 per year.

So the Level E + would seem to fit our definition of inflation.

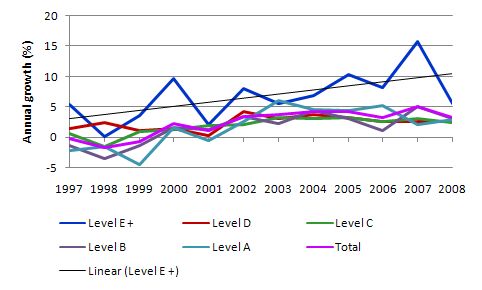

To see that more clearly, consider the next graph, which shows the annual percentage changes in the different categories to give you an idea of the trend in inflation in this data. The black linear trend line is associated with the Level E + category. While the “inflation” rate is relatively constant for the other classes (and was actually negative in some years) there is definitively inflation occurring in the Level E + category.

Okay, so what is this all about?

The data came from Department of Education, Employment and Workplace Relations and Universities Australia, which is the peak body. The former doesn’t break down the Level E and D categories, separately but does provide data from 1996-2008. The latter only covers the period from 1996 to 2005.

To extend the sample to 2008, I just assumed the Level D growth for the last 3 years (2006-2008) was equal to the average over the 1996-2005 period and then divided the longer sample “Above Senior Lecturer” observations into Level D and Level E +. The + is that there might be some VCs and DVCs in the data (but they have been at a constant proportion of the total so do not distort the trends).

So the data is the total academic staff numbers in Australian universities by level. Level A is Associate Lecturer – the old tutors rank which was really an apprentices job to help subsidise doctoral studies. The academic union some years ago became beguiled by management-speak and agreed to incorporate the tutors rank which was outside the tenure system into the main structure – for a pittance of a salary increase. The upshot – previously Level B Lecturer was the entry level after PhD. Now the entry level is Level A and it forces PhD holders to spend longer at the lowest levels. Plain stupid decision. One of many the academic union has made in this country.

Level A and Level B are thus the junior ranks and shoulder a heavy teaching and administration load. Level C is the Senior Lecturer which was in the past the “career” position to aim for. Very few academics went beyond that and one was considered to have succeeded if they retired as a Level C.

Level D is Associate professor which became the aggregation of the old Reader and Associate Professor positions, the former being awarded for research excellence while the latter was usually handed out for some beyond the call commitment to senior teaching and administration without the person having much of a research track record.

Level E is what we call a Professor here or a Chair holder. In the US, they call this person a Full Professor. Level E is the highest academic rank attainable in Australia.

To attain the position of professor in an Australian university one used to have to demonstrate that they had achieved an international level research record to a rather demanding appointments panel made up of people external to your University as well as senior insiders. This was typically demonstrated by an extensive publications list and a significant record of research grant success from national competitive funding sources and elsewhere. Other achievements were also required – quality doctoral supervision outcomes etc.

Only disciplines like accounting appointed professors in those days who were not necessarily up to scratch in this regard. They claimed “market forces” were responsible for this. My response was always to argue we just shouldn’t teach accounting at a university and leave it to “night schools” but that takes us into another debate.

But because it used to be an onerous process, very few people became Level E appointments as a result. That is, until now.

In this week’s Higher Education Supplement there was a story Professors proliferate amid quest for prestige, which reported on the recent trends in professorial appointments in Australian universities.

The news story which was discussing a Report (which is not publicly available as yet), said that “University managers without high-level academic achievement are winning the title of professor for “authority needs””.

The author of the Report was quoted as saying:

Professorships today are not only conferred on the basis of academic standing but are often awarded to denote management seniority and authority … In cases like this an extensive academic record or even a research higher degree aren’t necessarily required … Universities confer the title because the position requires a certain status, and status in universities has traditionally come through the use of titles …

The Report also noted that the “professors” who get there via the “senior management route” then use the status to leverage research advantages (funding etc) “even though they may not have a corresponding professorial-level research record”.

The fact is that Australian universities have become managerial organisations at the expense of collegiality. There is no longer a sense of democracy in the university system and managers determine all the major policies. They also pay themselves handsomely and, increasingly, reward the managerial class with these titles, which the Report says they would not otherwise be able to attain in the traditional manner.

Further, there has been a proliferation of private tertiary providers in recent years in response to the privatisation and competition policies foisted on the sector by neo-liberal governments who seem to think it is sensible to debase our educational standards to make a buck selling degree while they withdraw from their own funding responsibilities. It is only a matter of time before staff in those second-rate (or worse) colleges are bestowed the title of professor. As an aside, these colleges are starting to fail spectacularly and damaging our “export education” market as 1000s of overseas students are being stranded as shonky operators close their doors allegedly insolvent. All courtesy of a government that doesn’t understand its own monetary system.

The degradation of standards is also to be witnessed in the proliferation of so-called Doctor of Business Administration degrees. These are nothing akin to a full doctoral research program that allows a person who successfully completes it the right to use the title Dr. The graduates from the former program which is not much more than an MBA are now allowed to use the title Dr. which has seriously blurred the standing of PhD holders. There are thousands of DBAs graduating now.

So I was thinking about John Lennon handing in his MBE. Should I hand in my Level E title, which was gained the “old” way? The only problem with the John Lennon strategy is that I then would have to quit my job!

But it is clear that the title is now being used differently and the public are none the wiser to what has been going on in our so-called august apexes of research and teaching excellence.

The simple fact is that a professor is no longer necessarily a person who has the research record sufficient to be capable of “professing their discipline” in the way that we used to consider this role.

Next time you run into a Level E at a party grill them on how they got their title. Ask them how many Australian Research Council grant successes they have enjoyed in the last 10 years. The answer should be several (more than 5). That will usually sort the real ones out from the ….

E-mail update

No reply from Layard.

“Inflation is defined as a continuous increase in a level and in economics is usually associated with a nominal aggregate like a price. The inflationary process is usually taken to mean a diminution in the value of the particular thing that is inflating.”

Bill, your example illustrates that inflation involves a relationship between notational valuation and real value. This can occur in two ways. Either notational valuation can increase relative to real value, or vice versa. A lot of inflation that’s taken place has been the latter.

For example, to “pay” for tax cuts Ronald Reagan eliminated spending that would otherwise have occurred by deferring infrastructure maintenance. Similarly, US businesses have been cheapening their brands by reducing quality, decreasing volume, shortening warranties, and other such surreptitious ploys, while maintaing prices. Degree mills have also cheapened the value of an academic degree. The rating agencies cheapened the value of an AAA rating. The list goes on. For a while people don’t notice, but eventually they do, when just about everything is substandard in comparison with recent memory and prices are the same or higher.

Dear Tom

Good point. I was twisting the meaning for a bit of fun of-course. But the clue was in the second sentence you quoted from the blog – diminution of value.

best wishes

bill

Yes, I realized that you were being somewhat facetious, and I wanted to say that there is definitely something similar to your example going on pretty much across the board here. This has not been adequately noticed, and it is important. In the US, the the US Bureau of Labor Statistics publishes the CPI index monthly, which is used as a measure of inflation, e.g., in figuring the annual Social Security COLA. So a figure that underestimates inflation has a real impact on the welfare of millions of people.

This index is continually being revised to reflect current conditions. Recently, the board decided to include a hedonic index. in particular to compensate for increasing quality in relation to price, e.g, with respect to IT goods like personal computers. However, the general decline in quality that has taken place almost across the board in both goods and services is systematically ignored. This produces a skewed result, and lot of people are no longer being fooled.

The reason that this is especially relevant to MMT is that a lot of the finagling with the index to keep it as low as possible happens in order to hold down increases in cost of living allowances. The US Social Security COLA figure is huge, and it’s only going to get larger as the baby boomers reach the age at which they begin drawing benefits. According to current thinking, this creates a need to “fund” the added outlay unless the COLA is controlled. And the yearly COLA is added to the “unfunded obligations” of Social Security going forward, increasing the supposed “mountain of future unfunded obligations” used to scare people. So there is an incentive to keep the inflation index as low as possible while frightening seniors into not complaining very loudly for fear of provoking benefit cuts in the future. Or even insolvency of the fund.

The propaganda around this sort of thing is fierce. I wrote a letter the editor today correcting a syndicated op/ed by two economics professors saying that the US needs to “repudiate” its debt. Incredible, but true. And it’s appearing in newspapers around the country, especially in small cities with limited staff that must rely on syndicated content like this.

If MMT were implemented, then the erroneous idea of unfunded obligations would go away. Hopefully the index could be designed to report what it purports to, since there is no reason to “save money,” especially on the backs of seniors when they most need it. And if we started to include decline in real value in relation to notional valuation, then firms would have a more difficult time concealing their agenda to lower quality and maintain price. And we wouldn’t have to forego infrastructure maintenance and improvement to “save money” or “keep from having to raise taxes,” a form of hidden inflation that some people are even paying for with injuries or even their lives when bridges collapse and roads deteriorate.

Good one! This blog is hilarious!