I have received several E-mails over the last few weeks that suggest that the economics…

Labour market discrimination rising

One of the advantages of running the economy at “high pressure” – that is, with low unemployment is that some of the more malevolent aspects of human behaviour are suppressed. We know that when the economy goes into a downturn, firms increase their hiring standards because they have the upper hand – lots of workers are unemployed and so the firms can pick and choose more readily. One of the worst aspects of these adjustments is that pure prejudice begins to reveal itself more openly. The most recent data from the US suggests this is the case.

The most recent discrimination data from the Federal Equal Employment Opportunity Commission in the US shows that charges have escalated by some 15 percent in the last financial year from 82,792 to 95,402. This is the highest claim rate surge since data was first collected by the EEOC in 1965. With the recession deepening in the US, it is expected that the claims will rise significantly before they fall again.

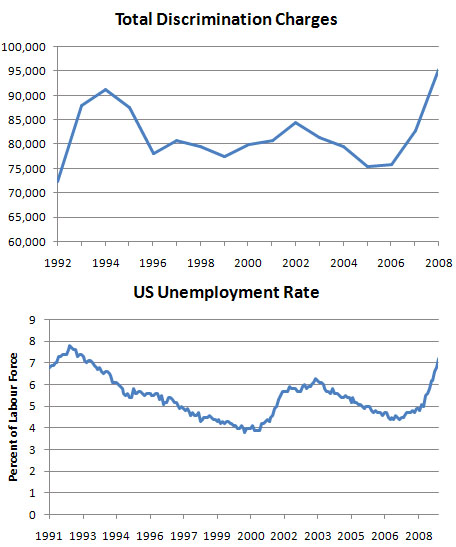

I constructed the following graph from the official US data. The discrimination data comes from the EEOC and the official national unemployment rate is from the Bureau of Labor Statistics. The EEOC data is for financial years whereas the BLS data is monthly (and seasonally adjusted). The graph shows clearly that the spikes in EEOC claims coincide cyclically with the spikes in the UR. In tight labour markets, firms have to ensure they can get labour and have less scope to engage in prejudicial hiring behaviour – lest they lose market share. The greed for profit overcomes the pettiness of prejudice. Things change when unemployment rises. Labour is easy to come by and employers broaden the types of hiring “screens” they use to include colour, age, gender, ethnicity and more.

Just in case you think that the data reflects strategic behaviour by workers who are trying to insure themselves against legitimate layoffs, which is a possible ploy in times of recession, the data shows that the significant majority of claims are concluded as reflecting “no reasonable cause” on the part of the employer. In the words of the EEOC, this means “that discrimination occurred based upon evidence obtained in investigation. The charging party may exercise the right to bring private court action.” Only a tiny fraction of cases are dismissed as having reasonable cause for employer behaviour. So the data appears to reflect demand-side rather than supply-side behaviour.

The following table breaks the aggregate EEOC data into major reasons for filing a claim (noting that complaints can be filed in multiple categories). The data shows that age discrimination claims experienced the largest surge in the last year (up 28.7 percent to 24,582). This is consistent with known facts from previous recessions. Older workers, particularly males, suffer badly as firms shed full-time work and restructure their workforces with higher proportions of casual and part-time employment.

| Category | FY 2007 | FY 2008 | Percent change |

| Total charges | 82,792 | 95,402 | 15.2% |

| Race | 30,510 | 33,937 | 11.2% |

| Retaliation | 26,663 | 32,690 | 22.6% |

| Sex | 24,826 | 28,372 | 14.3% |

| Age | 19,103 | 24,582 | 28.7% |

| Disability | 17,734 | 19,453 | 9.7% |

| National origin | 9,396 | 10,601 | 12.8% |

| Religion | 2,880 | 3,273 | 13.6% |

| Equal pay act | 818 | 954 | 16.6% |

It is highly likely that as employment growth falls further in Australia and the jobless queues rise, firms will behave in a similar way to their US counterparts. Arthur Okun long ago talked about unemployment being the “tip of the iceberg” that accompanies major economic slowdowns. What lies below the water is lower labour productivity (mainly due to labour hoarding); lower labour force participation, and suppressed real wages growth. He didn’t mention – but we can add another bit of the below-water iceberg – the human waste and inefficiency involved in the increasing discrimination that also occurs.

The message for the Australian government is that now is not the time to be watering down any industrial relations legislation. The Federal government should be strengthening unfair dismissal legislation to make it difficult for employers to capriciously sack workers on the basis of prejudice. Unfortunately, it seems the Government is bowing to the right-wing lobby and keeping the unfair dismissal aspects of Workchoices more or less as they were – pitched heavily in favour of the employers.

Role of journalists – redux

I am thinking of creating a bogan journalist register to monitor those who don’t know what they are talking about but still insist on talking nonetheless.

As a postscript to my journalist blog yesterday I read another classic today. Gerard Henderson in the Sydney Morning Herald has the solution to the crisis. It is clear he knows a thing or two about the way the economy operates. Not! He wrote:

The correct economic policy would seem to turn on limiting real wage increases, or perhaps cutting real wages, with employees compensated by large income tax reductions. That’s the way to maximise employment and minimise unemployment.

Same old same old. When are these characters going to understand that these sort of remedies were tried in the 1930s and the depression became deeper? It was only the large fiscal spending to prosecute Hitler’s militarism that really sorted out the spending gaps which maintained the high unemployment in the 1930s. Employment growth is driven by demand for goods and services. Firms will not hire workers, no matter how cheap they become, if the production the workers create cannot be sold.

The policy response is to ensure the spending gap that causes the problem in the first place is filled. If the private sector won’t fill it at present because they are scared and want to save then it has to be filled by government spending. Cutting real wages (even if there are tax adjustments) will only work if it reduces the propensity of the private sector to save sufficiently to fill the spending gap. I have seen no empirical evidence ever that shows that would ever be the case. Rather the evidence shows the opposite. Cutting real wages (even with tax adjustments) will more than likely reduce the existing level of aggregate demand.

And you know what that means – more unemployment.

Great article Bill.

Good idea about the bogan Journalist register but perhaps it would be easier just to list the good one(s) when they finally arrive.

cheers