I have received several E-mails over the last few weeks that suggest that the economics…

Oh my darling … mystery phenomenon spreads!

There is a mystery phenomenon and it appears to be spreading. The dangerous phenomenon is well understood by experts but the contagion is proving difficult to contain. Fortunately there are built-in checks and balances that will arrest the contagion … the only question is will the inflicted show any signs of life once the arrest is made. On Friday, we learned that the US government was running out of money. Overnight, the nasty syndrome has jumped across the Atlantic and the sovereign UK government is signalling that they are short. I suspect the contagion will spread more widely and inflict most sovereign governments before too long. Anyway, all I could do about it was to break into song …

Oh my darling, oh my darling,

Oh my darling Alistair

You are lost and gone forever,

Dreadful sorry, Alistair

My identification of the spread started early this morning when I read that a VAT rise to 20% could ‘choke’ economic recovery and fuel inflation, say leading retailers.

The UK Guardian reported that:

One VAT increase, on 1 January, is already certain, as the … [UK] … government reverses the cut made from 17.5% to 15% last December as an emergency measure to encourage consumer spending in the wake of the credit crunch. But retailers now fear an increase in VAT to 20% as the government seeks to plug a deficit expected to top £175bn this year.

Plugs go into holes to stop liquid flowing out. The analogy is that the government budget is like a drain which needs to be blocked. Once you understand how fiscal policy actually operates on a day-to-day basis you realise the it is a very poor analogy. Government spending and taxation receipts are flows between the government sector and the non-government sector.

A budget deficit arises when the flows into the non-government sector arising from government spending are greater than the flows from out of the non-government sector arising from taxation payments. The “drain” thus has to be open at all times and just the relative flows altered if you want the net outflow to be reduced.

And what exactly is the emergency in Britain that this tax rise is addressing?

The November data from from the UK labour force survey showed an unemployment rate of 7.8 per cent which was still rising from previous periods and 2.0 per cent up on last year. Around 490,000 less jobs are available in November than the corresponding period last year. There are now 629,000 more people unemployed compared to November 2008.

Unemployment was just below 2.5 million despite a “surge in the number of young people staying on in education to avoid the dole”. So the labour force exits serve to suppress the true rise in official unemployment.

Further, unfilled vacancies are not rising and there are almost 1 million people “working part-time because they can’t find a full-time job”. The November quarter recorded a “further large fall in the number of under-25s in work, with the unemployment rate for 18-24 year olds now at a record high.”

All that sounds like an emergency. But it is a real crisis and not one that engenders any financial crisis for the national government.

My economics training tells me that anything that reduces aggregate demand in this environment will further damage employment. If people have less purchasing power then employment falls. Increasing taxation, specifically, will reduce aggregate demand.

Are these characters serious?

The Guardian continued:

For the Treasury, the cash that would be raised is a compelling argument for a 20% rate: the increase would bring in some £12bn – the same as 3p on income tax and it would be an annual boost, rather than a one-off benefit.

What does the British Treasury want extra cash for when it issues the currency under monopoly conditions. The British government should be wanting the non-government spending to have more purchasing power at present not less.

One commentator from the retail industry said:

We understand politicians have got to adopt a credible plan to deal with the deficit, and that is likely to mean an increase in taxes. But significantly hiking VAT would damage demand, stifle recovery … undermine consumer confidence and be a big upward pressure on inflation.

So the deficit has to be cut. Any way you do that will damage demand. But then anything that damages demand will stifle recovery by undermining consumer confidence and … this commentator wants to throw everything into the melting pot … then you get “big upward pressure on inflation”.

It is enough to make one give up being an economist and instead turning to becoming a Saggar maker’s bottom knocker, except I am probably too old. Perhaps they might have a training program for older workers.

First, a VAT increase does not constitute inflation, which is a continuous increase in the price level. A once-off price rise does not constitute inflation.

Second, it is clear that you cannot cut the deficit without undermining demand unless you have some perverted model that says cutting public net spending stimulates private spending – which in this case would be saying – increasing the price of consumer goods is welcomed by consumers and they buy more. This is not plausible under any reasonable set of assumptions.

But, if that reasoning is hard enough to fathom then try this statement reported by Guardian to have been made by the boss of a big department store who said he:

… would not rule … [another increase] … out … {because the UK is] … skint as a country …

There you have it. The business sector thinks Britain has run out of money. If that is so, where will the extra taxes come from anyway?

But what does the British Government think?

After that article I read of Chancellor Alistair Darling’s £40bn cut in public spending. So it is not just a tax hike the British government is considering but deep spending cuts as well.

The Times article said:

Alistair Darling will this week tell government departments that the money has run out and they face a three-year cash freeze on spending. The message, the toughest to be delivered by a chancellor since the last Labour government was bailed out by the International Monetary Fund in the 1970s, will mean public sector pay freezes and big job cuts. The cash freeze in Whitehall will mean a “real” cut of nearly £40 billion in spending over three years.

So the Department store manager was right … not only is the country skint but the British Government itself has run out of money. Which led me to immediately ask the question … why plug a hole that is not going to leak any more if the flow has run out?

I am sorry to be flippant about this clear issue. The British government has run out of money. That is serious. Especially when it is a sovereign government which issues its own currency under monopoly conditions – which means it should never run out of that currency.

So there is something mysterious going on. How could it run out of money I thought? Perhaps all electronic cables between the government and non-government sector might have been cut so that the Government keyboard operators couldn’t credit bank accounts any more.

I hadn’t read anything about that in the papers. So perhaps, there has been a terrorist attack on the cables and the Government is keeping it quiet to avoid scaring the population.

Then again perhaps all the keyboard operators have quit. But then why wouldn’t they just post cheques directly to the non-government sector. Perhaps they have run out of paper to print the cheques on?

More likely I thought as my mind was racing with ideas on how the British government had run out of money … they had run out of stamps to put on the envelopes that they were going to place the cheques in and the post office had already shut down for the weekend. That must be it.

So on Monday, things will be fine again. They will order some new cables and hire some new keyboard operators and in the meantime they will buy some stamps and start posting out cheques again.

See, things will be fine over there after all. I might let President Obama know that since I read his plaintiff plea that the US Government was running out of money I have been considering sources of their plight – cables, keyboard operators, envelopes, stamps etc. This intelligence might help them also.

A good day’s analysis – no?

I read some more of the Darling report … in between repeating the refrain

Oh my darling, oh my darling,

Oh my darling Alistair

You are lost and gone forever,

Dreadful sorry, Alistair

The Times reported that:

* Brown wants deeper cuts to ease debt fears

* Hospitals ‘must share the pain of cuts’

My medical knowledge is limited but I would assume that the patients in the hospitals are already in a bit of pain from their surgical cuts. So what is the government planning to do to make this worse?

Yes, the first of the “sub-headlines” gives the game away. The British PM wants the surgeons to make deeper cuts to ensure more patients die on the operating table which will then make it easier for the hospitals to claim the outstanding fees (debts) from their deceased estates. That sounds like a dastardly public health plan.

I am sorry, I cannot make any more sense out of these two “sub-headlines” than that. Sorry. We move on.

The Times continued:

Darling is said to believe that public sector workers will have to match the sacrifices made by private sector employees during the recession in which government jobs and pay have continued to grow.

The chancellor’s tough message comes as a new report predicts that Britain will slide alarmingly down the global league table in the coming years.

The Centre for Economics and Business Research (CEBR) says Britain, which was the world’s fourth largest economy as recently as 2005, has slipped to seventh this year behind America, China, Japan, Germany, France and Italy.

By 2015, it predicts, Britain will be outside the world’s top 10, behind Russia, Brazil, India and Canada. Slow growth and a weak pound will be responsible for the slide.

All this speculation is in the context of the Chancellor’s Pre-Budget Report which is due on December 9, 2009. The 2009 GDP forecast is expected to be -4.75 per cent (annual) (Source).

That means the UK economy has shrunk by nearly 5 per cent in 2009. This is why the labour market data summarised above is so bad. Further, there is very little business activity emerging in the UK at present.

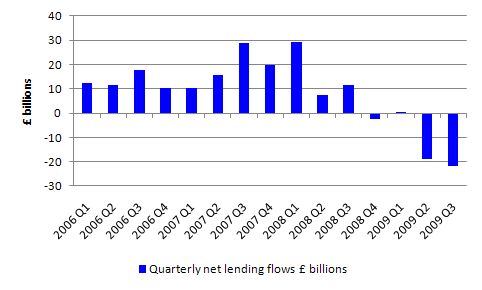

This graph tells you something about the state of confidence in the UK economy at present. It is taken from the Bank of England’s Trends in Lending, 2009. It shows the net lending flows in £ billions from the first quarter 2006 to the third quarter 2009. There has been a dramatic decline in the provision of credit.

While the Bank of England has spent £200bn on its quantitative easing programme and still shows no signs of abandoning this mostly ineffective strategy (having extended it by £25bn in November) banks are still not lending. Only mainstream economists who do not understand how the monetary system operates would be mystified by this.

Commercial banks were always able to make loans. They were not in need of reserves. What they needed and which remain in short-supply given the trends in the data are – credit-worthy customers seeking loans at the current rates on offer. QE was never going to increase the number of these customers. The best way to stimulate lending is for the government to stimulate overall economic growth which remains negative.

From my understanding it is lucky there has not been discretionary cuts in the public sector. Why would any government in its right mind want to recess the public sector every time private spending forced unemployment to rise in the private sector?

It is not a game of “sharing the costs of recession”. The correct response of the British government should be to minimise the costs for those bearing them and that doesn’t mean you impose costs on others.

And what of this new report from the CEBR who (I don’t care to link to them) claim they are pretty smart cookies who understand the quantitative dimensions of the economy?

It is possible that Britain will shrink as much as they claim and slip down the GDP rankings. As an aside I don’t think the size of the economy is particularly important as a stand-alone measure. There is a huge debate about concepts such as Genuine Progress Indicators, for example.

But I probably agree, if the UK government allows the economy to continue shrinking then per capita incomes will fall and things will get grimmer.

So what does the CEPR say? Well the Times quotes its spokesperson as saying:

Public opinion in the UK has not yet caught up with the potential impact of this change … It means that, whether we like it or not, we are going to have to be prepared to put up with economic, political and social decisions made in other countries.

Maybe in political terms if as this character claims “Britain would find it hard to maintain a seat at top diplomatic tables” decisions will be made by others that will influence Britain.

But from an economic and social perspective, the British government is sovereign. It can reduce unemployment and stimulate domestic economic growth irrespective of what other nations think of it.

The claim is spurious and tells me about the so-called “independent” status of the CEPR rather than anything about constraints that might exist on the British government’s capacity to stimulate the economy and improve social outcomes.

The fact is that the British government has as much spending capacity as it needs to improve the outcomes for its population. All this talk about needing to cut back is ideologically-based and unfounded in terms of an understanding of the monetary system it is at the apex of.

The Times article analysed how the Government might best cut the deficit and said the Government

… have played down the prospect of a “soak the rich” budget, however. Wednesday’s statement is not expected to include any changes in capital gains tax or a new raid on pensions.

Well we couldn’t let the rich take any cuts in corporate welfare. That would be decidely unfair.

Further, why I would not vote for the current PM Gordon Brown to retain office is captured in his latest podcast where he

said the “pre-budget report would set out”:

… the further savings needed to protect our frontline services, cut the budget deficit and go for growth.

Cutting the budget deficit will damage savings because it will reduce aggregate demand and national income will fall. Savings are a funciton of GDP (national income).

Cutting the budget deficit when you have a current account deficit and the private domestic sector is desiring to increase its saving ratio will undermine growth.

The crazy thing about all this is that if they understood the relationship between aggregate demand and income adjustments then they would realise that the strategy they are outlining, given how flat private activity is in the UK at present, will likely result in higher budget deficits as activity declines further.

If they are really worried about public debt levels then they would be better advised to get the economy moving quickly so that tax revenue can outstrip the debt interest servicing component.

They must understand that. So if they do then they are making political statements to assuage the UK electorate as the national election approaches. But then they are going to have to follow through and make the cuts to maintain credibility in this “political context”.

If they do that they must be hoping the worst of the ramifications start manifesting after the election. You would then conclude that they are shameless crooks.

My bet is they are getting terrible advice and are pursuing an ideological game to look resolute. Pity the poor Brits.

Oh my darling, oh my darling,

Oh my darling Alistair

You are lost and gone forever,

Dreadful sorry, Alistair

Dear Bill,

Your argument is supported by a recent announcement by RBS:

‘Our customers are generally seeking to repair their balance sheets, not to increase borrowing. As a result, the demand for our lending is muted, especially from business customers,’ .

See: http://www.citywire.co.uk/personal/-/news/markets-companies-and-funds/content.aspx?ID=366669&re=7449&ea=227150

Is Niall Ferguson a closet Austrian? Maybe its catching and explains why these sovereign governments are “running out of money.”

http://blog.mises.org/archives/011168.asp

Watching some kids playing – clearly they understand their own economy: first there is joy in playing the game; then there is TRUST; next credits and debits are remembered honestly (or if complex the score written down); accounts are always settled to maintain relationships; and finally they never ever run out of ‘money’ (the power to credit another) else the game breaks down!

Hi Bill,

I’m not educated in economics–geology (occasional lurker). I see you’re attempting to pull up some theoretical weeds by the roots. Thank you for your blog and commitment.

I’m struggling with a point in what you say. An MMT axiom seems to be; the private sphere is always money-constrained, but a Govt that issues fiat currency is never money-constrained.

The contingency I can’t reconcile is that national deficits (larger than real-GDP growth) generate NET true public debt increase, and this debt requires servicing. The servicing comes via taxation (and/or public asset sale) but taxation comes via private (money-constrained) transfer, and these private taxpayers must have sufficient money to service the NET public debt, created by high Govt deficits.

In the course of events a Govt can in practice become money-constrained via what the private sphere can afford in tax to service public debt growth.

That applies particularly during a protracted GDP recession, where already low or unbalanced tax receipts fall, and a ‘new-normal’ lower tax revenue from lower employment, lower production and sales, lower incomes, plus record public spending and deficit becomes the hand that must be played. So a Govt may become more or less money-constrained in a destabilised scenario, although the Govt tends to act like it isn’t, leading to political and social tensions.

The old-normal’s growth inertia is gone, replaced by new-normal resistance to private growth, that must be combated via public spending.

But destabilised times means taxation payment constraint increases for the private sphere, that could eventually render on-going public debt-servicing untenable. The Govt is imposing stealth-taxation on the private sphere’s future prosperity. The private arena may accept this trade-off, in a major war, but resist it in times of peace. If they don’t accept it, he public can try voting or strikes in an attempt to convince the Govt to knock-off the debt servicing growth. National level demonstrations may persist. If the Govt acts repressively sustained riots can emerge to force the Govt and Cronies to stop stealing from the citizen’s potential future worth. The money-constrained private sphere will win that battle if they perceive that they must, except when a Govt becomes self-destructive, then you get civil conflict and a loss of control over rebelling tax payers, so the national Govt still becomes money-constrained, plus looses credit backing and business investment, and eventually power.

A Govt that is forced to accept money-constraint will turn to budget austerity, as Govt impunity to ‘misallocate’ public taxes on increased debt servicing, is removed for the duration. So any sovereign nation issuing fiat can become money-constrained in extremis. The same could happen if a Govt indulged non-essential QE or debasing, triggering onerous rises in price. Citizens can again force Govt to desist from making their paypackets inadequate-and definitely will. Thus Govt profligacy is constrained by the taxpayers capacity, or willingness, to service public debt growth, or to accept excessive inflationary policies.

MMT’s foundations must (I hope) give a clear accounting of such contingencies, given its more radical positions. Underlaying axioms are usually the weakness in applying advanced theory to anything actual. As I’m unqualified and you are Bill, I’m probably missing key parts that you can enlighten.

But if I’ve got this about right, in essence, then I venture a more lurid extension.

If Govt can thus become money-constrained, then the notion that involuntary sovereign bankruptcy can’t occur (which some insist) will in practice be just theoretical wishful thinking when tested in peak extremes. Thus, involuntary sovereign default, of one form or another, must still be expected, once the private sphere can’t and won’t sustainably service accrued public debt. That would normally rarely occur, but for when budgeting restraint is absent, and protracted NET debt growth occurs during BOTH bubble and bust, and that is what has occurred.

In Japan the capacity to pay tax to service public debt is falling, as public debt is rising. It’s clear to me that debt servicing costs can still money-constrain any fiat issuing government. Dismissing this by saying Japan has heaps of reserves, does not escape at all the fact that a point is going to be reached where the tax rate has to go up, or else the debt servicing cost will go up, because the deficits must go up. That is a debt-servicing trap, where soverign default becomes increasingly likely, as the capacity to raise sufficient tax revenue depletes. This seems likely to keep occurring well into the next upturn.

How does an automatic stabiliser get you out of such a trap?

I think we’d all be clearer about the possibility of soverign debt default, minus theoretical encumbrance, if cogitating the dilemma whilst waiting in line at a soup kitchen in 2018. But I’d rather we were clear about the chsnces of it now (with testable theory proposals).

Understanding what’s likely to occur if ‘x’ occurs is what matters-it’s the reason for such theory. A theory’s cuteness doesn’t help if in extremis the theory breaks down, and people expect nothing much will go wrong–but it does. (CDO’s for instance were supposed to be a stabiliser but instead proved they can become the biggest destabilisers of all-so why is MMT impervious to being wrong?).

No theory guides realistically, at the moment of truth.

We all have a current stake in what could take place. In Oct 2008 it was clear that mainstream economic ‘experts’ did not understand what was going to happen, even though some fringe economists detailed the crisis’s unfolding years in advance.

Does MMT accurately describe the dynamic features in extremis?

As you know, Steve Keen is attempting to develope dynamic modelling (I found Fisher and Minski very enlightening to put 2007-2009 into context). But I’m acutely aware of the dangers of models, and naive or adamant quantitative modellers routinely neglect observations and measurements, and refuse to recant in the face of real-world mismatch. Nevertheless, five-day cyclone vector and intensity forecast models have become remarkably accurate over the past decade, so complex models can be very helpful in providing guidence. Realistic testing of economic theory and models is the insurmountable problem.

But MMT itself is disturbing. If a large number of national politicians come to an overly generalised view that advanced theory argues that a national Govt is never fiat money-constrained, and that deficits are really the solution, and not going to become a serious problem – then my brain says these politicians could, in the course of events, create such a financial, economic and geopolitical mess, that humanity may never fully recover former levels of wellbeing.

That could happen without MMT’s influence, but I think you must acknowledge Bill, that MMT represents a high-risk of catastrophic economic failure if it proves false in extremis, and politicians and economists come to believe it won’t fail. And we know they would form that view over time. It’s the same hubris mentality that said the Titanic was unsinkable, because theoretically, in most reasonable situations, it wouldn’t sink. That axiom lead to very high-risk behaviour, they cut the safety margin to the bone-crunch, glug.

I don’t want to gamble on a mere economic belief system because the underlaying axioms could be faulty (and probably are) but no one realises it, or discount the danger with “we modelled it and it’s not going to happen”, i.e. as per mid-2007. I can’t think of another field where a novice can consistently outperform an experienced professional, and that should be warning enough. It’s extremes I want to understand, because if we do the panic-phase is replaced by calm.

Doctors once didn’t understand disease mechanisms and now they mostly do. They can test, detect and diagnose, and work out what to do-no panic. But there are regular observations and experimental opportunities to learn quickly. With economics there aren’t major extremes often so economic theory development is stagnant compared to other fields. However, if the implications of Irving Fisher were taken seriously since the 1930’s the current situation need never have occurred.

Would you put your child’s life in the hands of Surgeon Bernanke? Of course not! He’s a dangerous ostentatious quack, disciple of previous dangerous ostentatious quacks, who may destroy your child’s health, prevaricating, buying time, treating symptoms and failing to recognise or identify disease progression, and act with aptitude. But on the fringes there are people who understand the symptoms and disease considerably more clearly. Several persons did foresee 2007-2009 events, and characterised the disease and its development a few years in advance. Such persons offer a way to get ahead in understanding and study to identify effective treatment, plus develop simple but effective economic ‘hygiene’, to prevent disease spread.

So I’m interested in documentation or links that show MMT foresaw and characterised the current crisis and its development and severity.

Suitable study links/comments would be very much appreciated Bill.

Thanks