I have received several E-mails over the last few weeks that suggest that the economics…

Being shamed and disgraced is not enough

Today I continue my theme from yesterday which focused on how retired politicians and bureaucrats in the US are massing using resources from rich conservative interests to undermine the capacity of the US government to fulfill its legitimate responsibility to increase employment and raise living standards. In today’s blog I reflect on an excellent US PBS Frontline program which looks back at the days when the neo-liberals led by Alan Greenspan and his gang were ruling the world. The current crisis that has undermined the employment and income prospects for millions around the world is directly attributable to their ideological zealotry. The unfortunate thing is that the gang members are either still in power or reinventing themselves as credible commentators. It doesn’t augur well.

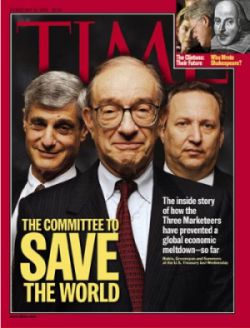

On February 15, 1999, Time Magazine carried this front cover extolling the virtues of the Committee that Saved the World – Robert Rubin (then US Treasury Secretary), Alan Greenspan (then Federal Reserve Chairman) and Lawrence Summers (then Deputy US Treasury Secretary). Summers took over from Rubin in 1999.

Events have caught up on the “Committee”. In October 2008, Greenspan admitted to a US Congressional Committee that his ideological world was shattered by the crisis. Greenspan’s ideological connection with Ayn Rand and her extremist views is seen by reasonable people (such as myself) as being a key component of the financial anarchy during his reign as Federal Reserve Chairman which finally manifested in the collapse of the world financial system and the ensuing rise in unemployment and income losses. His dirty hands are well and truly all over the collapse.

For his part, Rubin was a senior member (then Chairman) of Citigroup after his political career ended. He left just before its near collapse amidst criticism of his performance. In 2001, he used a mate in the US Treasury Department to try to put pressure on the bond-rating agencies to avoid downgrading Enron’ debt which was a debtor of Citigroup.

In January 2009, he was named by Marketwatch as one of the “10 most unethical people in business”.

Finally, Lawrence Summers continues to humiliate himself and damage his fellow citizens via his inability to design policy that will advance public purpose. Instead he consistently champions policies that hand over billions of public money to the rich guys on Wall Street.

I recalled the Time article (which covered the Russian and Latin American debt crisis) as I watched the US PBS Frontline program The Warning which went to air in the US on October 20, 2009. It is available via the Internet now and is worth viewing if you have the time. It documents that struggles that Brooksley Born, who became the head of the US federal Commodity Futures Trading Commission had with the Committee that Saved the World.

I especially liked the segment which described Born’s first lunch with Greenspan after she was appointed as Head of the Commodity Futures Trading Commission. Apparently, Greenspan expressed a “disdain for regulation” and when she raised the issue of the problem of financial fraud Greenspan said that “the market would take care of the fraudsters by self-regulating itself”.

So never mind the real damage caused to people’s life savings or life-time employment entitlements (pensions etc) or jobs – the market will see to it that a monumental failure driven by fraud (for example, Enron) is sorted out. And … meanwhile … very few of the fraudsters ever really get rounded up and punished.

Born had wanted to regulate the growing and secretive Over the Counter (OTC) derivatives market and met with great resistance from Rubin, Greenspan and Summers. She told the program that “Alan Greenspan at one point in the late ’90s said that the most important development in the financial markets in the ’90s was the development of over-the-counter derivatives”.

When asked if Greenspan knew what he was talking about, Born replied “Well, he has said recently that there was a flaw in his understanding”. The last comment is in relation to testimony that Greenspan gave to the US Congress in October 2008 which I discuss below.

Born got involved in the law suit filed by filed by Procter & Gamble against Bankers Trust. It is clear that BT were screwing Procter by selling them derivatives that were too complicated for them to understand the risk. The program reveals audio-tapes of Bankers Trust brokers talking about their deliberate “intention to fleece the company” (Procter). One said “This is a wet dream” while there was a lot of laughing about how smart BT was in “setting up” Procter as a pigeon (victim).

At that stage Born saw the need for government regulation of the financial sector (particularly the banks) but she met incredible resistance from the Adminstration and Greenspan.

But Born’s efforts to seek ways of regulating the OTC market didn’t stop the awesome trio – The Committee to Save the World. She sought to develop a “concept release” – a plan for regulation within the legal jurisdiction of the CFTC.

The Committee to Save the World with another came out publicly on May 7, 1998 which this Press Release from Rubin, Greenspan and Levitt (SEC Chair) issued by the US Treasury:

JOINT STATEMENT BY TREASURY SECRETARY ROBERT E. RUBIN, FEDERAL RESERVE BOARD CHAIRMAN ALAN GREENSPAN AND SECURITIES AND EXCHANGE COMMISSION CHAIRMAN ARTHUR LEVITT

On May 7, the Commodity Futures Trading Commission (“CFTC”) issued a concept release on over-the-counter derivatives. We have grave concerns about this action and its possible consequences. The OTC derivatives market is a large and important global market. We seriously question the scope of the CFTC’s jurisdiction in this area, and we are very concerned about reports that the CFTC’s action may increase the legal uncertainty concerning certain types of OTC derivatives.

The concept release raises important public policy issues that should be dealt with by the entire regulatory community working with Congress, and we are prepared to pursue, as appropriate, legislation that would provide greater certainty concerning the legal status of OTC derivatives.

This New York Times article from last year – Taking Hard New Look at a Greenspan Legacy provides a good summary of the events. It documents the fierce opposition that Greenspan, Rubin and Summers put up against any notion of regulation of the financial markets.

The PBS program shows us that Rubin set his attack dog … Deputy (Summers) onto Born. Summers made the incredible statement (that should have disqualified him from any further office given the developments that were to follow). In a phone conversation where he claimed there were 13 angry bankers in his office berating him, Summers shouted at Born:

You’re going to cause the worst financial crisis since the end of World War II.

He now cannot recall that conversation or ever making the statement.

Soon after, in the US summer of 1998 and unbeknown to the government, Long-term capital management collapses. Born captured her feelings when she found out:

… None of us, none of the regulators had known until Long-Term Capital Management phoned the Federal Reserve Bank of New York to say they were on the verge of collapse.

Why? Because we didn’t have any information about the market. They had enormous leverage. Four billion dollars supporting $1.25 trillion in derivatives? Excessive leverage was clearly a big problem in the market. Speculation? I mean, this was speculation, gambling on prices, on interest rates and foreign exchange rates of a colossal nature. Prudential controls? I mean, all these big banks had in essence … extended unlimited loans to LTCM, and they hadn’t done their homework. They didn’t even know the extent of LTCM’s exposures in the market or the fact that the other OTC derivatives dealers had been lending to them as well.

This was massaged away by the neo-liberals as nothing to worry about and they continued to resist regulation. By 2000, the Commodity Futures Modernization Act [CFMA] that took away all regulative jurisdiction for over-the-counter derivatives from the CFTC.

Greenspan disqualifies himself from making any further credible statement in public

On October 23, 2008, Greenspan appeared before a US Congressional Committee of Government Oversight and Reform hearing. His Testimony – all 1133 words – was somewhat remarkable given that previously he had been the king-pin when he had appeared before this Committee.

Greenspan said:

… those of us who have looked to the self-interest of lending institutions to protect shareholder’s equity (myself especially) are in a state of shocked disbelief …

The consequent surge in global demand for U.S. subprime securities by banks, hedge, and pension funds supported by unrealistically positive rating designations by credit agencies was, in my judgement, the core of the problem. Demand became so aggressive that too many securitizers and lenders believed they were able to create and sell mortgage backed securities so quickly that they never put their shareholders’ capital at risk and hence did not have the incentive to evaluate the credit quality of what they were selling.

But it was the grilling he received from the Committee that was most telling (see full transcript.

The Chair of the Committee (Waxman) started the interrogation by quoting back some of Greenspan’s previous official statements:

- “There’s nothing involved in Federal regulation which makes it superior to market regulation.”

- “There appears to be no need for government regulation of off-exchanged derivative transactions.”

- “We do not believe a publíc policy case exists to justify this government intervention (made after Enron collapsed in 2002).

- “Bank loan officers, in my experience, know far more about the risks and workings of their counterparties than do bank regulators” (made in early 2008 just before the collapse).

After Waxman asked him “where did you make a mistake”, Greenspan replied:

I made a mistake in presuming that the self-interest of organizations, specifically banks and others, were such is that they were best capable of protecting their own shareholders and their equity in the firms …

So the problem here is something which looked to be a very solid edifice, and, indeed, a critical pillar to market competition and free markets, did break down. And I think that, as I said, shocked me. I still do not fully understand why it happened and, obviously, to the extent that I figure out where it happened and why, I will change my views. If the facts change, I will change.

There were many interchanges like this between Waxman and Greenspan. It was clear that Waxman was trying to push blame onto Greenspan. In another interchange Waxman said:

The question I had for you is you had an ideology. You had a belief that free, competitive – and this is shown – your statement, “I do have an ideology. My judgment is that free, competitive markets are by far the unrivaled way to organize economies. We have tried regulation, none meaningfully worked.” That was your quote. You have the authority to prevent irresponsible lending practices that led to the subprime mortgage crisis. You had the authority to prevent irresponsible lending practices that led to the subprime mortgage crisis. You were advised to do so by many others … Do you feel that your ideology pushed you to make decisions that you wish you had not made?

Greenspan’s reply, in my view, tells us that any further “expert commentary” he might ever try to make in public should be assessed as having zero credibility. He said:

Well, remember, though, whether or not ideology is, is a conceptual framework with the way people deal with reality. Everyone has one. You have to. To exist, you need an ideology The question is, whether it exists is accurate or not. What I am saying to you is, yes, I found a flaw, I don’t know how significant or permanent it is, but I have been very distressed by that fact … I found a flaw in the model that I perceived is the critical functioning structure that defines how the world works, so to speak.

Chairman WAXMAN: In other words, you found that your view of the world, your ideology, was not right, it was not working

Mr. GREENSPAN. Precisely. That’s precisely the reason I was shocked,

14 months later, Greenspan is back and wanting to be heard

After acknowledging that disgrace – considering the millions of Americans who are without work now and heading south into poverty, not to mention the millions of workers around the world that have lost their jobs and savings and more – any reasonable person would avoid the public limelight. But not Greenspan. He is larger than life still and making regular appearances in the media and in official government inquiries.

This tells me that the neo-liberals are basically not shamed by their actions. They laid low for a while – a few made some concessions (such as Greenspan above) – but now they are coming out of the slime again larger than ever.

It is commonplace for a Night of the long knives to follow the overthrow of a particular government by the opposition. Although the expression historically refers to the unsavoury and criminal way the Nazis purged their opponents in the early 1930 to pave the way for Hitler to concentrate his power base, it is also used more generally.

In the more general sense, it refers to a newly elected government sacking all the “political” appointments in the senior bureaucracy and then running a subtle campaign to disgrace them.

The problem in the US at present is that the Obama transition just continued the Wall Street influence in top levels of government. So those who should be hanging their heads in shame are still on the payroll designing and implementing policy.

Anyway, after being disgraced last October before the Congressional hearing, Greenspan still thinks he has something to say that we want to hear.

Last Sunday (December 13, 2009) Greenspan appeared on the US NBC Meet the Press program program – Netcast – Transcript. The presenter is David Gregory and the focus was the economy.

One interesting part of the discussion with Greenspan, from a modern monetary theory (MMT) perspective, went like this:

MR. GREGORY: Let me turn to another question about the role of government, and that is the role of the Federal Reserve. Dr. Greenspan, Paul Krugman, liberal economic economist for The New York Times columnist, wrote this this week about what the Fed ought to do …. Does the Fed have more to do?

DR. GREENSPAN: I think the Fed has done an extraordinary job, and it’s done a huge amount. There’s just so much monetary policy and the central bank can do, and I think they’ve gone to their limits at this particular stage. And you cannot ask them to create more than is physically possible. They, they stopped what essentially was a major financial collapse by interposing sovereign credit for private credit for commercial paper, for essentially blocking a number of problems which emerged especially, incidentally, in conjunction with the Treasury, the so-called TARP program, where they put capital into banks …

… The difficulty is there is a limit. And if the Federal Reserve does not, in fact, pull in all of the stimulus it’s put into the economy, then down the road is inflation. It’s a long way down the road and it’s not immediate. But the question is, you cannot ask a, a central bank to do more than it is capable of doing without very dire consequences.

I have discussed why Paul Krugman’s continued claims that quantitative easing will provide banks with more capacity to lend is false in this blog – Building bank reserves will not expand credit. Krugman reveals a failure to understand how the monetary system actually operates.

But Greenspan also reveals the same ignorance in his statement above. He also further thinks that the reserves constitute a stimulus to demand and will be inflationary “unless they pulled in”.

I cover that errant proposition in the second part of my billogy – Building bank reserves is not inflationary.

So in this single statement that quantitative easing is inflationary you realise that Greenspan – ideology aside – doesn’t understand the way the monetary system actually operates.

I had an interesting conversation a few weeks ago with a highly ranked banker who repeated the often-heard statement that Larry Summers is a really bright guy. So he said that calling these guys stupid is not an option. The same sort of claim is made of Greenspan.

However, if you read their books and articles and analyse their public statements then consider that they are talking about a modern monetary system – it is easy to conclude they are either stupid (that is, do not understand the operations of the system) or, alternatively, they are aiming to deliberately mislead the public (to advance their ideological agenda).

It is a fair bet to say they are not stupid. So they must just be ideological warriors prepared to distort public perception. After all, the extremist Ayn Rand was the intellectual light for Greenspan.

The PBS program shows her in 1959 being asked to encapsulate her philosophy. She said:

I am opposed to all forms of control. I am for an absolute laissez fair free unregulated economy. Let me put it briefly I am for the separation of state and economics.

In relation to Rand, wrote in his book (The Age of Turbulence)

Ayn Rand became a stabilising force in my life … It hadn’t take long for us to have a meeting of the minds mostly my mind meeting hers.

The PBS program also interviewed Joseph Stiglitz, who said in the context of the Greenspan association with Ayn Rand, that Greenspan’s decision to take the job as Federal Reserve Chairman was a:

Little bit curious for a central banker, because what is central banking? It’s a massive intervention in the market, setting interest rates. So to me, that kind of perspective, to say, “I believe in free markets, but I’m going to accept the job at central banking,” is a contradiction. You almost have to be schizophrenic.

Greenspan most recently appeared before a current Senate Committee on Homeland Security and Governmental Affairs hearing. You have to give it to the Americans – they are a nation apart. The title of the Senate Committee hearing is Safeguarding the American Dream: Prospects for Our Economic Future and Proposals to Secure It. Only the Americans would come up with that sort of title.

Well the American Dream has been trashed well and truly by a sequence of very poor governments and their economic advisors who systematically demonstrate by the policies that they advocate that they do not work for public purpose.

Greenspan’s testimony is revealing. He said:

For more than two centuries, we have been able to hold the level of U.S. federal debt to well below our long-term capacity to borrow. But for the next decade or two, on some reasonable sets of assumptions, our borrowing cushion shrinks significantly, threatening to test our capacity to raise funds to finance unprecedented deficits.

Only if the Congress blocks bills to raise the limit or (preferably) the US Government abandons the law that requires it to borrow to net spend.

I also like the use of the phrase “some reasonable sets of assumptions” – which was also underpinning the Pew-Peterson Report I examined yesterday. When you actually get down to analyse the reasonableness of the assumptions you find they usually have some extreme assumptions and some wrong-headed reasoning.

Greenspan certainly does not spell out his forecasting environment.

He continued to talk about the future challenges and homed in on the US Medicare and Medicaid system. He said that in these areas “in-kind entitlements” are determined by “individuals’ particular medical needs”. Yes we can agree on that.

He considered forecasting the exact future need is difficult because there are technological changes going on all the time. He then said:

Short of some form of market price or administrative rationing (a political third rail), ever rising medical services will eventually strain the physical capacity of our economy … The simple fact is that we have promised resources which by any reasonable projection we will not have – a morally untenable position. Those who will retire in the years ahead depend on government’s promises to plan their future.

We are not dealing with a simple problem of finance, solved with the addition of appropriated dollars. It is a physical resource crisis. If the dollar share of GDP devoted to medical services is rising, so is the share of medical workers in our labor force and medical hardware in our capital stock. Importantly, a dollar of the nation’s scarce saving employed to finance a new medical technology investment is a dollar not available to fund other critical non-medical cutting-edge technologies that enhance our material wellbeing.

So this is interesting. He is largely talking about the physical availability of real resources. It is not a public finance problem. If there are real resources available in the future to be put to work in the health care industry then the national government will be able to purchase them at any time such availability is present.

The nuanced “we are not dealing with a simple problem of finance” should have read – the intergenerational health issue is not a problem of the inacapacity of the national government to spend.

It is clear that if resources are fully utilised then choices have to be made on appropriate use. These choices will be political in nature. The national government will always be able to afford the spending choices dictated by the political mandate it receives.

After spending more time on the health issue, Greenspan concluded his statement by saying:

The recommendation of Senators Conrad and Gregg for a bipartisan Fiscal taskforce is an excellent idea. I trust any such taskforce will address the very thorny issue of the asymmetrical consequences of too much or too little fiscal restraint. In the former case, too much restraint is not a risk, and would, in any event, free resources for other initiatives. The dire consequences of a failure to tighten sufficiently to balance our books, however, calls for policies that err significantly on the side of restraint. I understand that this is politically very difficult to do. But our nation has never before had to confront so formidable a fiscal crisis as is now visible just over the horizon.

It is really hard to map this ridiculous statement back into the main theme he was developing. It was almost as if he really wanted to get the budget hysteria going but strayed for a little while on other issues.

Conclusion

It is clear that reinvention and historical revisionism is the order of the day. More and more of these neo-liberal zealots are speaking out again – after being initially shamed and silent.

The irony is that fiscal policy has reduced the damages their actions (or inaction) caused yet they are doing their best to undermine it. Given their links to the top-end-of-town which has clearly profited massively from the public handouts, it is no surprise that they want to stop the fiscal expansion in its tracks for fear that some of the largesse might be spread a little further to the unemployed.

It is a pity the ordinary Americans couldn’t see it within their powers to redux their revolution when they threw the British (and French and Spanish) out. This time their targets should be Wall Street and all its connections in the political sphere.

Saturday is near …

Which means that the Saturday quiz will be back … this time with steel teeth!

RollingStone had an article on Rubin et al recently:

http://www.rollingstone.com/politics/story/31234647/obamas_big_sellout/2

One of your recurring themes Bill, not stated explicitly, seems to be that the American neo-liberals are more interested in defending “concepts” rather than people. Their concept of money as something that should have a value that is defended, their concept of inflation as a boogey man around the corner and their concept of government debt as equal in nature to private debt are three of the most obvious examples. I really wonder if there is any hope of ever altering their conceptions of these things? That seems to be at the core of the schism. You have correctly termed this thinking as religious in nature and religious people do not easily become “atheistic”.

It seems that the only hope is for China and the EU to embrace MMT principles and simply tell the US; ” Go jump in a lake, impoverish your own if you like but we will not put unnecessary restrictions on our treasuries just because you or the IMF say so.”

The Fiscal Task Force is here : http://budget.senate.gov/republican/pressarchive/BipatisanTF.pdf

Unbelievable how they refuse to understand anything.

Great post as usual, Bill.

I unearthed an interesting factoid: the recently deceased Paul Samuelson was Larry Summers’ uncle (father’s side).

And apparently, Kenneth Arrow is his uncle on his mother’s side.

Probably well known to most Billyblog readers, but it was news to me.