Today (April 18, 2024), the Australian Bureau of Statistics released the latest - Labour Force,…

Labour underutilisation now over 11 per cent

Today’s labour force data revealed the the world recession is starting to impact directly on jobs in Australia. Last month’s data surprised people because it suggested the labour market was resisting the global trends. At the time I indicated that the inaccuracy in the data due to the large sample errors was likely to be a factor. Today’s data also carries some surprises although the trends it is indicating are clear enough.

First, total employment actually increased by 1,800 jobs between January and February with full-time work declining by a significant 53,800 and part-time work jumping by 55,600. That is quite a turnaround. A closer examination of the data reveals that the 95 per cent confidence interval around the 1,800 jobs is -58,800 to +62,400. In other words, we can be 95 per cent sure that total employment either declined by up to 58,800 jobs or grew by up 62,400. Somewhere in between is the “truth”. It is not very comforting when you are confronted with intervals of that size.

Second, participation has risen in the month. Normally, participation falls off first as discouraged workers start giving up the hunt for jobs that are not there and opt out of the labour force for a while. There is some argument around that the meltdown in the superannuation industry has so damaged older workers prospects that they will hang about in the labour force despite losing their jobs because they intend to work longer than they might have desired. Normally in ta recession, a significant proportion of older males (particularly) who are retrenched take early retirement. We will have to wait for more detailed aged breakdowns before we know but it looks that it is females who have increased their participation over the last few months.

Third, with the labour force growing slightly in the last few months unemployment increased by 47,100 to 590,500 with an ovewhelming number of the jobless looking for full-time rather than part-time work.

Fourth, the unemployment rate is now at 5.2 per cent up from 4.8 per cent in January. There is no doubt that employment growth will continue to decline over the coming months and the unemployment rate will continue to rise.

Taken together we now have nearly 1.3 million Australians who are either unemployed (not working at all) or underemployed (working part-time but want more hours). That constitues a total labour underutilisation rate of 11.3 per cent. That is already obscene and the Federal government should be pulling out all stops to directly create employment. Paying pensioners in Auckland who are British citizens does not seem like a very good plan if you want to create work here!

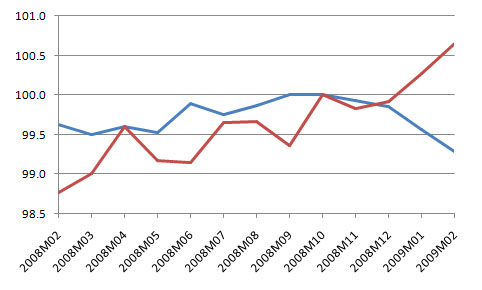

Some more detailed insights are possible. Total employment appeared to peak (in seasonally adjusted terms) at 10,820.6 in October 2008. I constructed graphs from 6 months before that peak for total part-time and full-time employment and broke those categories down by gender. I indexed all series to 100 as at October 2008 (the peak in total employment) and then expressed each month accordingly. The first graph (from February 2008 to February 2009) clearly shows the usual job dynamics that accompany the downturn. Full-time employment (blue line) is plummetting and part-time employment (red line) is rising. It is clear that employers are rapidly adjusting hours of work on offer. So for now, underemployment will be rising strongly and official unemployment will rising modestly.

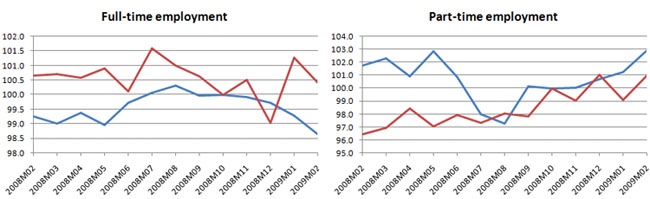

The second graph shows full-time employment for males (blue line) and females (red line) on the left hand panel and part-time employment for males (blue line) and females (red line) on the right hand panel. It is clear that the overall decline in full-time employment is being driven by a dramatic loss of male jobs. Both males and females are experiencing rising part-time work at present although, surprisingly, male part-time job growth is stronger than it is for females. These patterns are, however, not inconsistent with what we expect in the early stages of a serious downturn.

Overall, males have lost 68 thousand full-time jobs since the peak in October 2008 and overall have lost 42 thousand job slots. At the same time, females have gained 11 thousand full-time jobs (a surprise) and 32 thousand overall jobs (another surprise). Official unemployment has risen by 66 thousand for males and 28 thousand for females, the latter being driven by the fact that female labour force has grown over the last 5 months by 60 thousand. The participation responses are the surprising aspect of the latest data release and will bear more analysis next week when the detailed age-gender breakdowns are available.

Data updates from CofFEE

1. CofFEE’s own labour market indicators will be udpated soon once the ABS releases the detailed labour force breakdowns for February and the hours breakdowns for part-time workers are available.

2. On Tuesday, March 17, we will publish a new labour market indicator which we are calling the Employment Vulnerability Index which is an indicator that identifies those suburbs that have higher proportions of the types of jobs thought to be most at risk in the current economic climate. The EVI is computed for Capital Cities (2593 metropolitan suburbs) and the suburbs located in the Australian Bureau of Statistics non-Metropolitan regional centres with more than 20,000 residents. In some cases this does not include suburbs in outer areas of regional cities as they are not included as part of the ABS’s urban centre categorisation. The results cover over 75 per cent of the total Australian population which reflect the high degree of urbanisation in Australia.

The EVI divides suburbs into four categories depending on its EVI score: (a) Red alert – High risk; (b) Amber alert – Medium high risk; (c) Medium low risk; and (d) Low risk.

An interesting WWW site is being constructed with maps and other features to allow for a full analysis by readers. We expect to launch the EVI Tuesday morning.

Hi Bill,

Could the increase in female participation be an additional worker effect ?

cheers, Alan

Dear Alan

I think that is entirely possible. The big differences between this downturn and the 1991 downturn is that households are now laden with record levels of debt, the wealth that was “earmarked” against some of that debt build up is diminished if not evaporated entirely, and underemployment is at record high levels (measured at the top of the boom). Taken together it is very likely that the discouraged worker effect is being overwhelmed by the added worker effect, which is unusual. The two effects are always present in a cyclical event like this but usually the former is stronger empirically. We will have some interesting equations to estimate sometime in 2 years or so once more data is in.

best wishes

bill

I think the meme that “we’ve avoided recession because our unemployment figures are OK” just ignored the fact that unemployment is always a lagging indicator. Contrary to myth, most employers wait until conditions are really bad before they start taking an axe to their workforce (labour hoarding and all that). Underemployment usually rises before unemployment – so watch average hours worked.

All this will be exactly mirrored when recovery eventually comes by people talking about a “jobless recovery”. There’s always a long period where business conditions have improved but employers have not yet adjusted to that in their hiring and firing behaviour. The number of people working long hours starts rising well before the number employed does.