Today (April 18, 2024), the Australian Bureau of Statistics released the latest - Labour Force,…

Looking beyond the peak

Today the ABS released the Labour Force data for December 2009 and it confirms that the Australian economy is still recovering under the steam of the fiscal stimulus. Total employment has grown by three times more than expected and participation is constant. Which means that unemployment has started to fall although underemployment hasn’t budged. While the media commentators today (including myself) have been fairly upbeat I have been reminding the public in media interviews that I have done that broader labour underutilisation (sum of unemployment and underemployment) remains at 13.5 per cent. But optimistically the trend is now looking as though the aggregate unemployment rate may have peaked. So it is now to start looking beyond the peak.

The summary ABS Labour Force data results for December are:

- Employment increased 35,200 (0.3 per cent) with full-time employment accounting for 21 per cent of the increase.

- Unemployment decreased 10,600 (-1.6 per cent) to 639,400.

- The official unemployment rate decreased 0.1 percentage points to 5.5 per cent.

- The participation rate remained steady at 65.2 per cent but is still well down from its most recent peak (April 2008) of 65.6 per cent. So the approximate number of workers that have dropped out due to falling hours of work in the downturn (that is, the rise in hidden unemployed) is 71 thousand persons.

- Aggregate monthly hours worked decreased 1.0 million hours (-0.1 per cent) which is still 0.7 per cent below the September 2008 peak.

- Total underemployment (ABS persons-measure) remained constant at 7.8 per cent.

- Total labour underutilisation (sum of official unemployment and underemployment) declined in line with the fall in the unemployment rate to 13.5 per cent.

- Total labour underutilisation for 15-24 year olds remains at 26.3 per cent. Our gift to the next generation courtesy of an idle government.

Most of the press reaction has focused on the next Reserve Bank meeting in February and most commentators are now saying that it is inevitable that interest rates will go up again.

I gave an interview on for national ABC News Radio program this afternoon (you can hear the audio here) and was asked whether I thought the unemployment rate had now peaked. Each month the press seek an answer to this question. I noted that employment had grown for four consecutive months now which had to be considered a trend.

So unless we get a further negative shock coming from the world economy or the government gets pressured into a really harsh May 2010 budget I am of the view the the unemployment rate has peaked.

I also told the Financial Review today that I thought that the recovery would be marked by a rise in underemployment as unemployment shrunk. Over 2009, full-time work overall contracted by 37.5 thousand while part-time employment rose by 149.6 thousand (see next Table).

During the recovery period after the very deep 1991 recession, it took 15 years and a few months to get the unemployment rate back to what it was before the downturn began (in November 1989 the low-point unemployment rate was 5.5 per cent and it took until January 2004 to get back to that level). Most of the growth in employment in that period was part-time and biased towards the lower end of the hours spectrum.

As a consequence the claims that the economy was adding jobs during the recovery failed to reveal that while unemployment was falling it was being replaced by rising underemployment, such that at the top of the boom (February 2008) the latter was higher than the former adding up to a total labour underutilisation rate of around 8.9 per cent after 16 years of growth.

So I expect the same will happen in the current recovery given that the labour market has been significantly deregulated over the last decade (and the new government has not reversed the changes as significantly as they should) and it is now much easier to get rid of workers without cost.

I was also asked today by several journalists whether the calls by the Federal Opposition to immediately wind back the fiscal stimulus was responsible given the better than expected labour market data. I replied that a harsh May budget would set us up for a double-dip recession because private spending remains fairly weak.

Yesterday’s housing finance data from the ABS also showed that the housing market is not heading into an “red hot” asset bubble. That data was contrary to the “asset bubble terrorists”, who now think the slightest upward movement in prices is the signal that hyperinflation is about to descend on us.

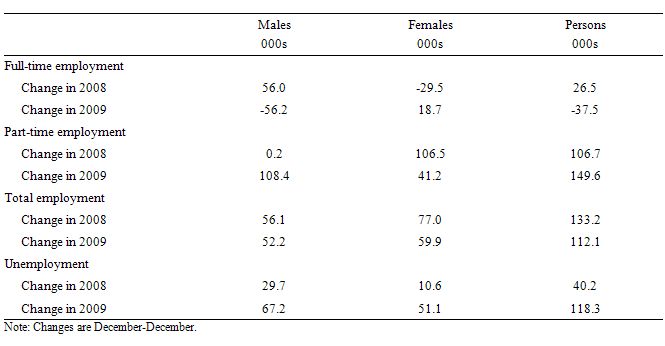

The following table summarises the net changes (000s) over the last two calendar years. The downturn started impacting negatively in March 2008. I have already drawn attention to it in the prior discussion.

Things to note before we get too euphoric about today’s figures.

Unemployment is now higher by 118.3 thousand persons compared to how we started 2009. Unemployment rose by 3 times the magnitude that it increased in 2008 as the downturn was gathering pace.

All of the net change in employment in 2009 (112.1 thousand) were part-time jobs given that full-time work fell by 37.5 thousand in 2009.

Males were the big losers in 2009 – losing 56 thousand full-time jobs which were replaced two-fold by 108 thousand part-time jobs – but with higher rates of underemployment and reduced pay outcomes and reduced job security.

Unemployment

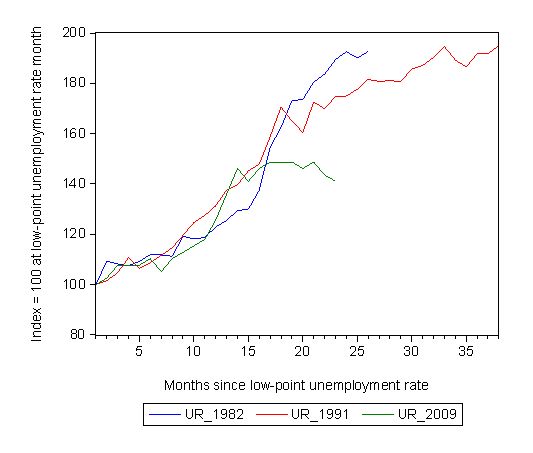

The following graph updates my 3-recessions graph. It depicts how quickly the unemployment rose in Australia during each of the three major recessions in recent history: 1982, 1991 and now 2009. The unemployment rate was indexed at 100 at its lowest rate before the recession in each case (June 1981; November 1989; February 2008, respectively) and then indexed to that base for each of the months until it peaked. It provides a graphical depiction of the speed at which the recession unfolded (which tells you something about each episode) and the length of time that the labour market deteriorated (expressed in terms of the unemployment rate).

From the start of the downturn to the 21-month point (to December 2009 – the length of the current deterioration since February 2008), the official unemployment rate has risen from a base index value of 100 to a value 141 – a 41 percent rise. At the same stage in 1991 the rise was 69.9 per cent and in 1982 83.7 per cent, and both indexes were still rising. So things are clearly very different this time.

While the unemployment rate was tracking the severity of the 1991 recession up until month 16, it is now clear that it is rising more moderately compared to the rate of decline back then. Note that these are index numbers and only tell us about the speed of decay rather than levels of unemployment. Clearly the 5.5 per cent at this stage of the downturn is lower that the unemployment rate was in the previous recessions at a comparable point in the cycle.

The graph suggests that we might have seen the peak of the unemployment rate – that is, in the absence of any further negative shocks and as long as the fiscal stimulus is not prematurely wound back. That would be a very good result and it would be hard not to credit the effectiveness of the fiscal stimulus.

Hours worked

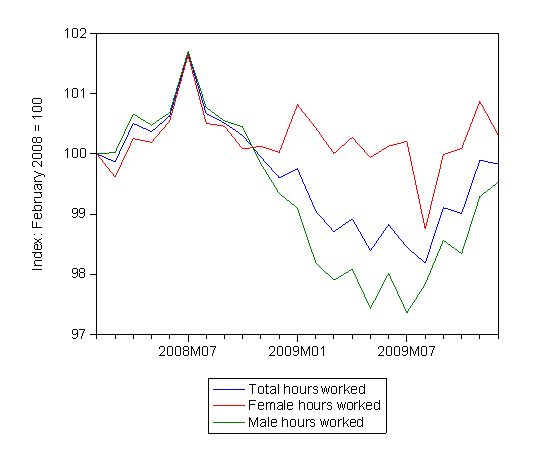

One of the hallmarks of this recession has been the sharp decline in hours worked as firms reacted to the falling sales by adjusting their offering of hours rather than laying off workers. This decline in hours worked started to reverse in September (as employment resumed growth) but in the last month 1 million hours have been lost.

All the lost hours were in female employment – especially evidenced by the significant loss of full-time work in December (8.6 thousand jobs). Further, males are now commanding an almost equal share of the growth in part-time work which further reinforces my view that the recovery will not reduce underemployment.

Broad labour underutilisation

What about underemployment? The ABS published their fourth-quarter data for 2009 for underemployment and broader labour underutilisation (the sum of unemployment and underemployment). Remember this understates the full extent of labour underutilisation because it ignores the hidden unemployment (who are not counted in the labour force).

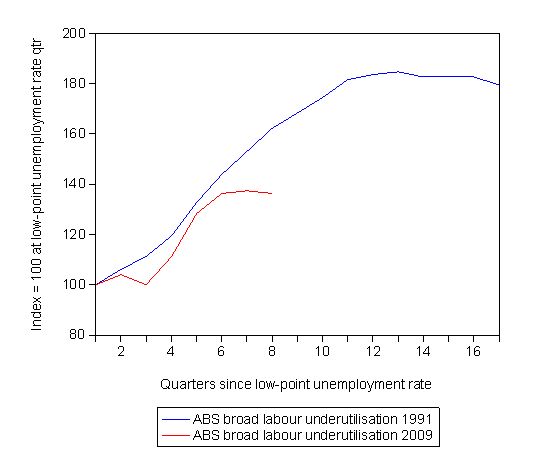

The following graph my 2-recessions graph for broad labour underutilisation (as measured by the ABS). It compares how quickly the broad labour underutilisation rose in Australia in the 1991 recession and the current episode. The broad labour underutilisation was indexed at 100 at its lowest rate before the recession in each case (November 1989; February 2008, respectively) and then indexed to that base for each of the quarters until it peaked. It provides a graphical depiction of the speed at which the recession unfolded (which tells you something about each episode) and the length of time that the labour market deteriorated (expressed in terms of the unemployment rate).

The shorter duration of the current downturn is significant relative to the protracted meltdown in 1991.

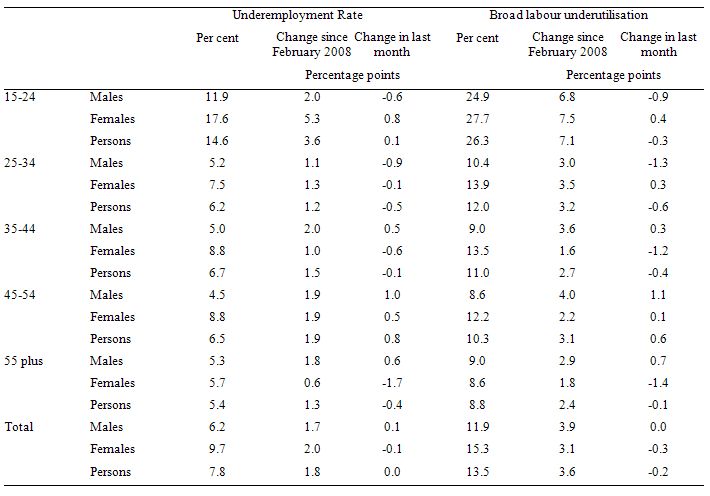

The following table was constructed from the ABS Labour underutilisation by Age and Sex data as at December 2009. It shows the underemployment rate and the broad labour underutilisation rate (in percent) for the difference age and sexes. It also shows the percentage point change between February 2008 and December 2009 and the change in December.

The points to note include there has been no change in underemployment in the last month and it remains at 7.8 per cent. However, underemployment for the 15-24 year olds has risen (all due to the sharp rise in female youth underemployment).

A journalist asked me today whether I thought the youth labour market was improving (given there was a modest reduction in their unemployment rates in December). I noted the juxtaposition between the joblessness result (a good one) and the rising underemployment. It is likely that youth underemployment will rise in the recovery as the bias towards part-time job creation is maintained.

Further the youth participation rate fell which means the reductions in the cohort’s unemployment is ambiguous.

Broad labour underutilisation remains stuck at 26.3 per cent for the 15-24 years aged group and this is still being largely ignored by government policy. I consider this the worst legacy (burden) that we are leaving our future generations.

Conclusion

The trend towards consistent employment growth is now fairly clear. In that sense it suggests that we are looking beyond the peak of the downturn now into the recovery phase.

This is a much better outlook than we were looking at this time last year. What will not please the neo-liberals is that the Australian economy has been kept afloat by net government spending.

The significant rise in the budget deficit underwrited aggregate demand and prevented the labour market from following the path it took in 1991. You can see from the first graph presented that the turning point (when the rise in the official unemployment rate started to flatten out) coincided with the early impacts of the fiscal packages.

You cannot escape that conclusion.

But just because the policy intervention has significantly reduced the damage, it remains that we have added 160 thousand extra persons to the unemployed pool and underemployment has risen by nearly 2 per cent. When the recession started in February 2008 in Australia, we were already burdened with a total labour underutilisation rate of 8.9 per cent.

So even at the height of the last boom we were wasting a huge quantity of available and willing labour resources. At that point we should have been running deficits but were obsessed with increasing the federal surplus.

My view is that a further fiscal expansion is required to really eat into this labour underutilisation now that growth is resuming. I am about the only commentator in the public debate here now who is saying this.

So I am either crazy or actually understand the way the monetary system operates and realise that the government still has the capacity to drive the economy to an inflation-free full employment state even though its budget deficit has risen as part of its response to the crisis.

I err on thinking the latter assessment is correct.

That is enough for today!

Good news.

How much of this would you put to large capital works in the minerals sector? We are seeing record mining tonnages and large developments kick into full steam of late.

This is the first time I have put a comment on the blog, but this blog is one the I visit regularly to get a more informed point of view of what is happening in the Australian economy.

Although I support a low inflation full employment objective. I don’t see this ever being a policy of government no matter who is elected. If you have a situration of full employment it would mean that the person on the street would be able to demand higher wages. This is something many employers would not see in their interest nor government as they would argue that this would drive up inflation.

Observing the RBA and the reasons that it uses to raise interest rates, low employment is one of the criteria that the RBA justify in higher interest rates. The Reserve board know that this puts a upward pressure on unemployment.

From my own personal observations and reading a variety of sources, the impression I get is that the Australia is heading more towards casual employment. The latest job figures seem to indicate that this is the case. The notion of having a job for life has gone out the window some years ago and a much more competitive labour market has emerged which puts downward pressure on wages.

Except for a few well publicised exceptions and bias reporting in the media, most wages and conditions I believe are going backward. It is true in more highly skilled industries you may see a greater demand for higher wages. But overall I think Australia is taking on more of the U.S model of low skilled workers.

Australia may of avoided the worst of the Global Economic Crisis, but the realtiy for many Australians the future is grim. The notion of having a job is better that not having a job, is an over simplication of a complex problem. If your job does allow you to pay your rent or morgage, put food on the table or pay for your utilities. Then what is the point of having the job in the first place. A job should not only allow you to pay for basic necessities, but it should allow you to put something away for a rainy day and for emergency such as a sick child.

Paul said : “Then what is the point of having the job in the first place.”

Where to start? Positively contributing to your community; building skills and relationships; social stability and inclusion; mental health and welfare; the list goes on….

Have you read Bill’s last post entitled “The daily losses from unemployment”?

If you talk to long-term unemployed people I think you’ll find that being employed is about far more than simply having an income to pay for daily expenses.

Regarding your example of a sick child too, programs like Medicare and the PBS are designed exactly to assist with those kinds of situations.

Hi Bill

Sorry to be slightly off topic – but lets hope that the world can mobilise its idle economic capcity to not only to limit the Haitian people’s misery due to the earthquake but make meaningful steps in lifting more Haitians out of abject poverty.

Unfortunately, I beleive that this unlikely to be the case as I am not aware of Obama (or any head of state – I picked the US because its proximity) giving the State Department the authority to acquire what ever (and I mean what ever – not subject to any spending limits) resources (manpower, construction equipment, medical equipment & supplies, building materials (start stockpiling for use when the eventual rebuilding starts), temporary accommodation).

Such a relief stratgey would be a win-win wouldn’t it – giving people work to help another country of destitute people. Maybe this is happening behind the scenes and we don’t see it- we can only hope that it is. Maybe some of your readers from outside OZ can enlighted us.

As far as I am aware, our government’s response, has been to give $10m- which is probably appropriate at this stage given that we would possibly not be able to get rescue crews there in time to help. But the government can start helping with the reconstruction stage by putting in orders with our building supply company’s to buy building materials to be donated to the Haitian government at that time.

Given our record in the reconstruction of East Timor I don’t hold much hope of this happening (there may also be constraints in the building supply companies to supply the materials anyway but I think the question needs to be asked):

– ET unemployment (per CIA factbook) is estimated at 20% in urban areas and 40% in rural areas (hence the need for us to maintain approx. a battalion of soldiers there for security purposes);

– ET is revenue constrained – it is uses the USD$ as its currency.

-70% (per the CIA factbook) of the ET’s infrastrure was destroyed in the 1999 violence – so there should be plenty of job opportunities for the East Timorese

– Australia was the lead country in securing East Timor

– If INTERFET had had an “invasion” currency (I use the term invasion currency because I cannot think of a better term. However, Indonsia would probably agree with the term)(with appropriate measures in place to cause demand for the currency and hence give it value) (Japan had invasion currency printed up for Australia in the event that they needed to invade. I also believe that the Allies provided their troops with similar for the liberation of Europe) than maybe the situation would have been different because UNTAET may have continued to use this “invasion” currency instead of electing to use the USD$, and then the new ET government would more likely to have continued with “invasion” currency rather than continuing to use the USD. ( I would assume that the central banks around the world (particularly, Fed Reserve, BOJ, ECB/Portugese CB, and RBA ) would have to provide some support to this new currency. Any ET currency acquired this way could be donated back to the ET government/governing authority giving them ability to deficit finance the reconstruction of the country without the exchange rate importing inflation. (Would this effectively be a tax imposed on the capital leaving the country?)).

Sorry if I have waffled on a bit, but am I correctly thinking through the application of MMT and how it could be applied? Am I missing anything.

Paul: I agree with you that capitalists and capitalist governments resist full-employment policies. This point is well recognised by the MMT crowd. For instance, it is discussed in the following working paper, which contains reactionary quotes of capitalists and politicians to make your hair stand on end:

Author Victor Quirk – The Problem of a Full Employment Economy

But just because capitalists don’t like something, that doesn’t mean we have to let them get their way. My own view – coming from a Marxist background – has been that it is necessary to get rid of capitalism altogether. I’ve become aware of the MMT work only recently, and it has changed my perception of the social possibilities open to us. Personally, I still think capitalism should go, but MMT shows that by exerting sufficient political and industrial pressure, we could choose as a society to follow paths not driven by the logic of capital. If we have the political will, the only constraints are our resources.

I get annoyed now when I read left-wing economists or commentators (including Marxists) talking about “uncontrollable public debt” or “out-of-control deficit spending”. They may as well be orthodox economists with this type of analysis. I understand why they want to present it. They think it shows that capitalism is crisis prone and must make way for socialism. Well, I agree, capitalism is crisis prone, and in my opinion should make way for socialism, but fiat money offers a way out of this crisis-prone system. The fact that a sovereign government is not financially constrained means that we can do things as a society that capitalists would never do following the dictates of profit. The result is something other than pure capitalism. And the more things we do that ignore the logic of capital and the profit motive, the less like capitalism the system will become. How far society chooses to go down this path is a political choice. I suspect that if people get a taste of freedom from the dictates of capital, they will increasingly want more such freedom. Future generations may well see no legitimate role for capital whatsoever. But maybe that’s just me.

Marxists are likely to retort that capital is what drives – and is most fundamental to – the existing system. But MMT makes clear that in a fiat-money system, government and fiat money are logically prior to capital, and that fiat money is apart from capital, and not contingent on the existence of capital. I do think capital drives – and is fundamental – to the sphere of capitalist activity. In the absence of fiat money, this capitalist activity tends to encroach on all other activities, subsuming them into its logic or eliminating them. But fiat money is external to capital, and is not – or, rather, need not be – subject to the same pressures as capital, and so need not be subjected to its demands. Fiat money can do as it pleases – as we please – and capitalists can like it or lump it.

All this makes me think that the adoption of fiat money with no convertibility into gold or some other commodity actually represented a significant concession on the part of capital, forced by circumstances and the inability of capitalism to resolve its own internal contradictions other than through crises and war. Fiat money has opened up a real possibility of progressive change, and I think capitalists and capitalist governments know it, at least instinctively, and it frightens the bejesus out of them. That may go some way to explaining the intensity of the propaganda drive of the past thirty-five years, which has succeeded in creating the illusion of a government financial constraint and produced a general feeling that there is no alternative to the neo-liberal policy agenda, even though, objectively, the breakdown of Bretton Woods has given us more policy freedom. It also may help to explain the increasing resort to authoritarian measures to quell unrest and the clawing back of previous gains in liberty, democracy and freedom. Once we see through the illusion, anything seems possible. Brute force becomes capital’s only recourse.

alienated, this has been my reading of the situation, too. It has seemed to me that public ignorance about the progressive policy implications of a fiat monetary regime aren’t entirely an unfortunate accidental holdover from gold-standard thinking. On can only conclude that the financial oligarchs are well aware of the reality of the situation and are not only being disingenuous but also manipulating public opinion, sowing disinformation through propaganda, and using their ancient technique of bribery (now legalized as campaign donations and lobbying) to effect their agenda. I, too, fear that terrorism is being exploited to curtail rights and put in place total information awareness and security deterrents to prevent opposition from causing unrest. It extremely difficult to reverse this course politically when the majority of people are hoodwinked into voting against their own interests. It also doubly difficult when MMT seems counterintuitive to many because of the “self-evidence” of the government-household budget analogy that they are buying into unawares. But, let’s keep on truckin’ anyway. It must have looked pretty impossible for the American colonialists to take on the mighty British Empire.

I think that the essence of the matter for modern Marxism to take into account is that the government as the monopoly currency provider not only has the prerogative of currency issuance but also the responsibility to issue the correct amount to keep nominal AD in balance with real output capacity. There is nothing wrong with using capital with respect to creating real output capacity, but it is a mistake to think that therefore capital is the only factor of production that really counts, giving capitalists the cover to extract what they can from the economy at the expense of prosperity for all. The problem with capitalism in the assumption that capital is determinative and therefore economic efficiency determines policy. As Peter F. Drucker said, “Efficiency is about doing things right, effectiveness is about doing the right thing.” The provision for the general welfare as established in the Preamble is the right thing, and government has this power through its monopoly prerogative of currency provision. The people have ceded this power to the financiers through the largely private constitution of the Fed in the US, and the politicians, media academics, etc., that the oligarchs employ.