I have received several E-mails over the last few weeks that suggest that the economics…

Some will rob you with a six-gun, and some with a fountain pen

In sub-Saharan Africa alone some 15,000 children die every day from poverty-related diseases. Yet still the governments are required to pay out some $US30 million every day to the World Bank, IMF, and rich creditor nations. Every $US1 that’s given to that region in aid, $US1.50 goes out to cover debt repayments (source: The Debt Threat: How Debt is Destroying the Developing World). I have been thinking about that in the light of the current situation in Haiti, the poorest nation in the western hemisphere and a nation that has been burdened with debt since the time it escaped the chains of slavery. This blog looks into these sorts of issues.

I borrowed the title of today’s blog from the great song Pretty Boy Floyd by Woody Guthrie about an outlaw who redresses social disadvantage, in part, brought on by debt obligations. The last two lines of the song go “You won’t never see an outlaw, Drive a family from their home.” Only banks do that!

The context of the blog is that I am currently working on a book which will present a modern monetary theory (MMT) critique of the current state of development economics and attempt to provide a new blueprint for poverty reduction based around employment creation programs and an emphasis on responsible fiscal policy, which has nothing to do with the concepts of fiscal sustainability that the IMF and the World Bank bandy around. My co-authors are Jesus Felipe and Randy Wray.

I have written about fiscal sustainability before – in this two-part series – Fiscal sustainability 101 – Part 1 – Fiscal sustainability 101 – Part 2. It might interest you to brush up on those arguments.

Since the disaster in Haiti there have been some calls to cancel all the debt that it owes as a nation. More generally, there has been a robust debate centring on the effectiveness of debt cancellation or debt relief (they are not the same). The mainstream approach (exemplified by the IMF and World Bank) has been to negotiate some relief and some cancellation but only if strict conditionalities are met. Harsh fiscal austerity is always one of the nasty package required. The imposition of these conditions is largely ideological and has largely failed to improve real living standards.

There is another group that claim that aid and debt relief (and certainly debt cancellation) is positively harmful. Such writers are Bill Easterly and Dambisia Moyo fall into this camp.

Then there are those who demand total debt cancellation (for example, the Jubilee organisation). I am more in this camp although I have sympathy to some of the things that Easterly, for example says.

In terms of the immediate problems facing Haiti, one hopes that governments around the world will see beyond the fiscal terrorism that they are currently succumbing to – to the detriment of their own populations – and provide very significant support to the nation to restore basic systems. As things become clearer, all sovereign governments should participate in a reconstruction plan using their own fiscal capacity – net spending – to deliver real goods and services to the country.

For example, the US government could place orders for hundreds (thousands, whatever) pieces of machinery, hospital supplies, building components etc from companies in the US that are currently unable to employ American workers because there is no demand for their output. The machinery should then be given to Haiti as a gift.

Governments around the world can soak up their excess capacity to deliver massive support in real goods and services without creating an inflationary impulse. MMT tells us that this expansion will benefit not only the home economies that are currently wallowing in recession but also the mostly destroyed Caribbean nation.

There is no financial constraint on any sovereign nation to provide such a emergency then redevelopment assistance. The only constraints are real – getting enough goods and services into the small nation and re-creating basic urban infrastructure and housing. The rich nations should not tarry though and worry about deficits.

There are massive quantities of unused resources in the rich nations at present just waiting for some aggregate demand to bring them back into productive employment.

Further, prior to the earthquake, the unemployment rate in Haiti varied between 50 and 75 per cent – the data is pretty unreliable and these are estimates only. So once the medical emergency is sorted out, there is a huge pool of labour available that could be immediately employed at decent wages in the local currency to work on reconstruction projects.

The government of Haiti with the support of all the rich nations once it is functional again should announce a national employment guarantee and a minimum wage job for anyone who wants to work on national reconstruction. The jobs would be permanent given how long it will take the nation to rebuild. The vision should be to rebuild beyond the capacity it had before the earthquake which was run-down in the extreme.

Providing the real resources to ensure this reconstruction process can proceed without localised inflation and create the capacity to work with the local labour under the employment guarantee scheme is a primary responsibility for the governments of the rich nations. All these transfers should be given as gifts not loans.

Then the question turns to the debts that Haiti (and more generally, the poor nations) holds.

At the end of September 2008, Haiti’s public external debt was around $US1885 million according the IMF. It GDP was $US6.95 billion (Source: World Bank, World Development Indicators). So heavily indebted.

Prior to the crisis there was an interesting exposition of Haiti’s debt problems in the UK Sunday Times, published May 17, 2009. There you will read that:

Haiti was the only country in which the ex-slaves themselves were expected to pay a foreign government for their liberty. By 1900, it was spending 80% of its national budget on repayments. In order to manage the original reparations, further loans were taken out – mostly from the United States, Germany and France. Instead of developing its potential, this deformed state produced a parade of nefarious leaders, most of whom gave up the insurmountable task of trying to fix the country and looted it instead. In 1947, Haiti finally paid off the original reparations, plus interest. Doing so left it destitute, corrupt, disastrously lacking in investment and politically volatile. Haiti was trapped in a downward spiral, from which it is still impossible to escape. It remains hopelessly in debt to this day.

After the French, came the Americans, who lent millions of USD to the Duvalier dictatorship (father then son) knowing that most of the funds were being siphoned off into private bank accounts. The remainder went for extremely “lucrative contracts to American corporations” which created a littering of “half-built and abandoned schools, hospitals, bridges and roads.”

You can read the latest Jubilee report on Hait’s debt here.

The estimates are that the “the debts incurred by the Duvaliers make up 45% of Haiti’s total current debt” However “none of the creditors finds the fact of their complicity a compelling argument for cancellation. Those creditors include the Inter-American Development Bank, the World Bank, the IMF and the governments of the US and France.”

The Inter-American Development Bank is the main creditor. The IDB’s non-borrowing members include the United States, Canada, Japan, Israel, the Republic of Korea, the People’s Republic of China, and 16 European countries: Austria, Belgium, Croatia, Denmark, Finland, France, Germany, Italy, The Netherlands, Norway, Portugal, Slovenia, Spain, Sweden, Switzerland and the United Kingdom. So all rich nations that can easily forego the capital they have put into the fund.

British academic Noreena Hertz who wrote The Debt Threat: How Debt is Destroying the Developing World (which is worth reading) recorded an interesting interview with Democracy Now! (January 13, 2005), just after the Tsunami struck in December 2004.

At that time the so-called Paris Club, which is an “informal group of official creditors whose role is to find coordinated and sustainable solutions to the payment difficulties experienced by debtor countries” as long as the debtor nations “undertake reforms to stabilize and restore their macroeconomic and financial situation”.

Interestingly, on July 9, 2009 the Paris Club creditor countries cancelled all of the debt owed to them by the Republic of Haiti – some $US214.8 million. Note that Haiti’s total public external debt was estimated to be $US1.8 billion in September 2008 (Paris Club).

Anyway, Hertz was asked about the impact of external debt on the poorest nations in the world. She said:

Well, what happens is that the world’s poorest countries, if you look at Sub-Saharan Africa, for example, it is paying out $30 million every single day on debt service. This is a region where 26 million people are HIV-AIDS infected. Where 40 million children will lose a parent to HIV-AIDS within the next ten years, yet this region is having to pay out four times what it can afford to spend on health care, on debt service. The rich countries of the world, the World Bank and the IMF are insisting that they are put before lives, before education, before basic human needs.

In her book she details the operations of so-called debt vultures who she describes as the “scum at the bottom of the pond”. How do these financial institutions operate?

These are guys who buy up the debts of the world’s poorest countries on the secondary market. You can go buy debts of a country like Peru, for example, at a real discount. Why? Because people think that the debts won’t be repaid. So, you can buy Peruvian debt worth a dollar for ten cents, for example. What these guys do is, they buy out lots and lots of this debt at this big discount and then they go to the country in question and they say, ‘We’re going to sue you, unless you repay your debts at face value.’

She was then asked whether poor nations “should simply refuse to pay back debt” to which she said that in Latin America, particularly, it would be an option if the nations created a block. But in the case of Africa it would be more complicated because:

African countries are actually paying back for every dollar that they receive in aid, approximately the same amount in debt service. So, they’re much more kind-of linked, and they’re really, really dependent, though, on aid coming in; and were they to default, all aid from the World Bank and I.M.F. would freeze immediately.

A good treatment of the debt cancellation view is expressed in the Debt relief: as if justice mattered, which was published by the Jubilee research programme.

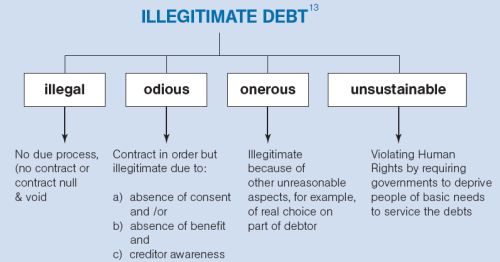

They particularly highlight the concept of illegitimate debt. The following figure is taken from their Odius lending report and presents a typology of illegitimate debt.

They particularly focus on the notion of odius debt, which was discussed above in the Time article and by Noreena_Hertz. Jubilee say that:

It seems inherently unfair if a blatantly corrupt and dictatorial regime can take out loans in the name of its country, but without the consent of the people, steal the proceeds and then leave the unfortunate inhabitants and their children to pay back the creditors, without those creditors taking any responsibility for knowingly lending to these odious regime (Source).

This raises issues about the responsibilities of the creditors who are making these loans. Surely nations or organisations that keep lending to a nation with the clear knowledge that significant proportions of the funds are being misused by corrupt governments has some responsibility.

Former World Bank official, Bill Easterly is one of the most vocal opponents of debt relief. In Think Again: Debt Relief, which was published in the November/December 2001 edition of Foreign Policy Magazine, you can pick up the flavour of his argument. It is anti-government/pro-market.

He rejects the illegitimate debt concept saying that “there are few clear-cut political breaks with a corrupt past”. He believes that for the “legitimacy argument to be at all convincing, the countries in question must show a huge and permanent change from the corruption of past regimes” and correctly points out that the first world has mostly been concerned with imposing “economic conditionalities” (read: fiscal austerity) as a guide to change. Easterly would rather see also include political and rule of law factors.

But the point is who is lending the nation these funds? What are the responsibilities of the creditors?

Easterly generalises his rejection of the legitimacy argument into a case against debt forgiveness. His basic proposition is that:

Debt relief has become the feel-good economic policy of the new millennium, trumpeted by Irish rock star Bono, Pope John Paul II, and virtually everyone in between. But despite its overwhelming popularity among policymakers and the public, debt relief is a bad deal for the world’s poor. By transferring scarce resources to corrupt governments with proven track records of misusing aid, debt forgiveness might only aggravate poverty among the world’s most vulnerable populations.

He claims that it is a fiction that debt burdens crush a nations capacity to grow because “(w)henever debt service became too onerous, the poor nations simply received new loans to repay old ones.”

I disagree with this view. Continually rolling over debt just means there is a continual burden up to the point of crushing the capacity of the nation to pay. And each time the roll over occurs some new conditionality enters the picture which further hamstrings the fiscal capacity of the nation (corrupt or otherwise).

Easterly also claims that “debt relief advocates should remember that poor people don’t owe foreign debt-their governments do” so:

Poor nations suffer poverty not because of high debt burdens but because spendthrift governments constantly seek to redistribute the existing economic pie to privileged political élites rather than try to make the pie grow larger through sound economic policies.

While this might be true, it is the people who suffer the poverty. Governments in all countries have a tendency to favour political constituencies but only in the poor countries does this mean that a majority endure grinding poverty.

He also claims that debt relief would just be followed by more loans or a run-down of the nation’s assets to benefit the elite. I consider this issue to one of the central reform pillars required to ensure that the world economy is stable and delivers outcomes that are people-oriented rather than serving the sectoral interests of a few.

International financial system reform should embrace the notion of banning the loan sharks who prey on poor nations and provide the funds to these corrupt leaders.

They should also ban first-world companies from dealing with corrupt regimes unless there is a clear and real social dividend provided to the nation’s populace.

Easterly also rejects the claim by Jubilee that debt relief would provide more fiscal space to expand health care, education and job creation.

His response was predictable – governments won’t spend it on that anyway. But then he says:

… the very idea that the proceeds of debt relief should be spent on health and education contains a logical flaw. If debt relief proceeds are spent on social programs rather than used to pay down the debt, then the debt burden will remain just as crushing as it was before. A government can’t use the same money twice-first to pay down foreign debt and second to expand health and education services for the poor. This magic could only work if health and education spending boosted economic growth and thus generated future tax revenues to service the debt. Unfortunately, there is little evidence that higher health and education spending is associated with faster economic growth.

However, he is only talking about relief. That is why debt relief has to be debt cancellation rather than suspension of payments or some other rescheduling.

There has been a long history of “debt relief programs”. In recent decades two broad programs have emerged. In 1996, the Heavily Indebted Poor Countries (HIPC) programme run jointly by the IMF and the World Bank was launched “with the aim of ensuring that no poor country faces a debt burden it cannot manage”.

In 2005, the HIPC was supplemented by the so-called G8 Gleneagles Multilateral Debt Relief Initiative (MDRI), which proposed “100 percent relief on eligible debts by three multilateral institutions – the IMF, the World Bank, and the African Development Fund (AfDF) – for countries completing the HIPC Initiative process.”

Accordingly, if a country has completed the HIPC process and has a “per capita income below $380 and outstanding debt to the IMF” will “qualify for debt relief” if they have been maintaining payments to the IMF and “demonstrate satisfactory performance in”:

– macroeconomic policies

– implementation of a poverty reduction strategy

– public expenditure management.

Any debts incurred after January 1, 2005 do not qualify.

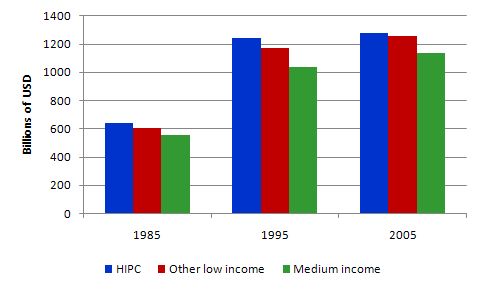

The reality is that these programs have not worked. The following graph is taken from Figure 1 of the Jubilee Report and shows the escalation of debt in HIPC, other poor countries and medium income countries between 1995 and 2005.

Jubilee say that the problem is that:

The present approach is marred by the involvement of creditors as judge, prosecution and jury in direct conflict with natural justice and by the failure to take into account either the human rights of the people of debtor nations or the moral obscenity of odious debt. Creditors use the debt relief process to further their own agenda of privatisation and trade liberalisation. It is all too little and too late.

The major problem with these programs is that they impose harsh conditions on the poor nation in return for some debt relief (sometimes cancellation). The structural adjustment programs imposed by the IMF have been dismal failures.

Easterly agrees that the approach centred on structural adjustment programs (IMF) and other conditionalities have not worked. He says that:

The lesson of structural adjustment programs is that reforms imposed from the outside don’t change behavior … It would be better for the international financial institutions to simply offer advice to governments that ask for it and wait for individual countries to come forward with homegrown reform programs, financing only the most promising ones and disengaging from the rest.

A fundamentally different approach to development based on MMT and the fiscal space it provides poor nations which are often rich in natural and human resources is required to harness those capacities.

Further, to strengthen the currencies in the poorer nations, first world governments should provide real goods and services to the nations on contracts specified in the local currency rather than $US.

But here we get into one of the difficult areas of development economics. Paternalism. While the goal is to empower the populace with education and first-class health services in some ways the only way that this might be achieved would be through closely supervised and tied grants (not loans).

The danger then, as Easterly notes, is of the “rich nations telling poor countries what to do”. But this is almost inescapable if progress is to be made because “(c)ivil society remains weak in most highly indebted poor countries, so it would be hard to ensure that debt relief will truly benefit the poor unless there are conditions on the debt relief package”.

I agree with that assessment and a significant amount of effort has to be provided to build the human capacities in poor nations through first-class health and education systems.

So it comes down to the conditions that are imposed. Harsh conditions that constrain fiscal space are not the way to proceed. Forcing countries to use foreign labour and particular contractors is also not likely to help.

In general, local labour with acceptable wages and conditions should be trained and used on projects paid for with tied grants rather than debt.

But the same arguments used against debt relief are used to claim that foreign aid is bad for development. This claim has been most emphatically made by Dambisa Moyo in her book Dead Aid. Both Easterly and Moyo suggest that foreign aid “guarantees economic failure”.

However, Moyo’s analysis ignores the reality. In terms of Africa, where she is most focused, the nations receiving over 10 per cent of their GDP in aid have recorded robust real economic growth in the last 10-15 years.

There is no unambiguous evidence that aid and growth are antithetical.

Finally, the so-called moral hazard argument is the most common case made against debt relief. The story goes that if debtor countries know they will get debts cancelled if they get into trouble then they will act immorally in the accumulation of debts – that is borrow without regard for the risks.

In terms of the moral hazard argument, Easterly says that “the commercial and official lenders who offer financing at market interest rates will not want to come back to most HIPCs any time soon. These lenders understand all too well the principle of moral hazard: Debt relief encourages borrowers to take on an excessive amount of new loans expecting that they too will be forgiven. Commercial banks obviously don’t want to get caught with forgiven loans.”

While this may be true it makes the urgency to provide large foreign grants to poor nations all the more pressing. These grants should be made available within the framework of transparency and approaches that reinforce the non-inflationary use of the fiscal space that a sovereign currency provides each nation.

Further, I always think of the moral hazard argument in the context of third world debt in the reverse. All the incentives are in place at present via the World Bank and IMF programs and the failure of the rich nations to accept the concept of illegitimate debt to encourage risky lending to poor nations.

When Argentina defaulted in 2001 the rich government backed their banks and the multilateral agencies issued the threats. Not one of them questioned the viability of the “currency board” system the US had foisted on the Argentinean government (or pressured them to adopt), which guaranteed the disaster would happen. The arrangements that were serving the interest of the first world stripped the Argentine government of its currency sovereignty and set it up for default.

Where was the moral hazard there?

Further, a lot of poor nation debt reflects deals made with rich nations who are pursuing geopolitical strategies which serve the rich nation’s interest rather than economic development for the poor nation. The Jubilee report says:

This creates a serious moral hazard for the creditors – they know that regardless of how recklessly they lend to oppressive, kleptocratic, corrupt and incompetent regimes they can still expect to have their loans repaid by successor governments, at the cost of the continuing impoverishment of the people in whose name (and ultimately at whose expense) these odious debts were ostensibly incurred. The population loses out at least twice: the first time from the oppression and corruption of the odious regimes supported by the loans, and a second time from having to service and pay back the loans used to oppress them and enrich their oppressors.

So the moral hazard argument is never straightforward.

And as an aside, the moral hazard argument didn’t stop governments around the world spending billions saving Wall Street and banks elsewhere from themselves. And in the last few days, Goldman have announced huge bonuses after receiving public monies at the height of the crisis.

Today’s UK Guardian “livedraw” (an animated cartoon) by Patrick Blower – Relief effort? Only bankers need apply is apposite. He asked the question “If an earthquake rocked the City … [London financial district] … would the delivery of aid to bankers be more efficient than it has been to the people of Haiti?”

Conclusion

So a brief excursion through the minefield of development economics and debt cancellation.

While wishing to avoid the trap of paternalism and clearly not agreeing with the type of conditionalities that the IMF and World Bank impose on debtor nations when debt cancellations are negotiated, I think conditions still have to apply.

It is clear the budget allocations within the nation should be directed to agreed poverty reduction programs and public infrastructure development.

I also support the idea that government transparency on allocations be required.

Further I would ban “predatory lending” of any kind to poor nations and avoid using loans at all. Tied grants are the preferred method of delivering real aid.

That is enough for today!

Postscript – Monday, January 18, 2010

The idea that grants are tied is not unlike the practice in many federal systems where the currency issuing national government provides funds to the state governments for specific projects sometimes on a $-for-$ sharing arrangement.

Dear Bill,

After companies like Disney Corporation, Kmart, Walmart, JC Penny, and others were found to be exploiting Haitian labour their operations were pretty much moved to Asia where the eyes of the world were no longer able to see how corporate America exploits the developing nations.

Once the transnational capital auction launched itself into action corporate USA and the government that supports them had little if any incentive to help or support the Haitian people in any way.

Disney who are worth billions just donated …wait for it $100,000 to the Haite earthquake victims.

http://news.moneycentral.msn.com/provider/providerarticle.aspx?feed=AP&date=20100113&id=10986391

For the people here who have genuine concern for all human beings the follwing link will have their blood boiling

http://www.democraticunderground.org/discuss/duboard.php?az=view_all&address=103×510364

What an absolute disgrace given how much money and effort Disney extorted from the Haitian people over many years.

Disneys Megatex plant was so dire that locals referred to it as Mousewitz and yet for a piss poor $100k Disney try and cash in on the tradgedy.

Anyone who wants to learn a little more about how poorly Haitians are treated by corporate USA might like to follow these links.

http://www.thirdworldtraveler.com/Global_Secrets_Lies/WorkingForRAt_DisneyHaiti.html

http://www.globalissues.org/article/141/haiti-and-human-rights

http://hartford-hwp.com/archives/43a/289.html

http://www.clrlabor.org/archives/Newsletter/news8.html#4

Sorry to hijack the post Bill but I thought it was relevant to your post – if not by all means remove it.

Cheers, Alan

I just discovered your blog, so I have a lot more to read! I am particularly interested in your thoughts regarding a State Bank, as I am a supporter of Ellen Brown’s efforts in that regard, but I am also coming around to the – mind-blowing – notion supported by you, and in an indirect way, by Stephen Zarlenga and Ellen Brown, that a sovereign government can produce the money it needs to fund things under MMT without inflation IF those monies are put to productive use – which is certainly NOT the case in the oft-cited Zimbabwe examples (I think Zimbabwe’s bankrupt economy will be used to counter-argue against sovereign money creation for some time, until there is a real world example of the latter leading to public good).

Anyway, I found this article to be so on-point with regards to Haiti that I quicklinked it for Op Ed News, where I am a Senior Editor and writer. The link is here: http://www.opednews.com/populum/link.php?id=105104

Dear Scott

Thanks very much for the exposure. However, I would prefer you to just link back to my server please rather than create a full version of my work within your own portal which includes advertisements. I don’t like my work being associated with commercials of any kind. Can you therefore please withdraw the “Read the rest of the story HERE” link? The readers can click the title you have provided and they will come back to my own advertisement-free server. Also google will get confused by having the same text within your frame structure as appears on my server.

best wishes

bill