I have received several E-mails over the last few weeks that suggest that the economics…

The progressives have failed to seize the moment

The news that the Democrats lost their long-held and iconic Massachusetts Senate seat has had the news services in apoplexy this week. One gets the impression from listening to the mainstream media, which is becoming more right-wing by the day, that the US President is on his last legs. The so-called progressive reaction seems to be that the “reform” agenda now has to be scaled back and a fiscal consolidation is required to steady nerves. While it is hard to actually see a progressive reform agenda in any country anyway, the more immediate danger is that the fiscal support that has been keeping our economies afloat all around the World will be withdrawn. The share markets are back, Goldman have record profits … so the crisis is over … That message dominates the business news. That the progressive side has not been able to take overwhelming command of the public debate, given the scale of the crisis and the fact that the neo-liberals/neo-cons etc have all been caught red-handed, is a stunning reflection of its obsequious and disorganised organisation. We need something very different to happen if things are not to revert to where they were.

Out of all the news and commentaries this week, my favourite was The Daily Show with Jon Stewart, which shows that perceptive commentary is alive and well in the US. I especially liked his analysis of the super-majority nonsense. Americans are always quoting their constitutional yet the use of the filibuster appears to be just a convention which can be voted away at some appropriate point if the Democrats have the nerve.

I laughed a lot when he took the Democrats into his confidence:

If this lady loses, the health-care reform bill that the beloved late senator considered his legacy will die. And the reason it will die … [taking a deep breath] … Let’s get deep … the reason it will die is because if Coakley loses, Democrats will only then have then an eighteen-vote majority in the Senate, which is more than George W Bush ever had in the Senate when he did whatever the fuck he wanted to do. In fact, the Democrats have a greater majority than the Republicans have had since 1923. But for Democrats apparently a majority of 100 … is 60. I need my inhaler.

You can watch the segment here:

Evidently, the filibuster, which the Republicans will use to derail anything that is remotely sensible (including the health care reform bills), can be eliminated if the Democrats take the initiative. Apparently, after the mid-term elections, the new Senate can vote on this and only 51 senators (or 50 senators plus the Vice President) are needed to ban the filibuster. Sounds simple. This recent article in the New York Times by Thomas Geoghegan was interesting in this respect.

The point that emerges from this incident is that the political mind set all around the advanced world has become so conservative over the last few decades that it is hard to see anything sensible emerging from our governments any more.

Stewart put it in rather macho terms but the sentiment was sound:

It’s not that the Democrats are playing checkers and the Republicans are playing chess. It’s that the Republicans are playing chess and the Democrats are in the nurse’s office because once again they glued their balls to their thighs.

You may also like to watch Stewart’s follow up, where he declares Scott Brown the US President-elect. Equally funny.

Modern monetary theory (MMT) allows you to understand that all this sovereign debt beat-up is nonsensical and getting in the road of advancing broad-based policies that will help societies rather than some segments in society to prosper.

In that regard, while I don’t buy into any of the arguments made by the conservatives, the way the governments around the World have performed is pathetic.

Why so-called progressive governments hire mainstream economists as their advisors is beyond me. What else will they get but deficient policy design?

Why so-called progressive governments continue to operate within the neo-liberal constraints that were implemented to stop broad-based social policy agendas from being pursued in the first place is beyond me. I refer here principally to the voluntary constraints that governments place on their net spending. They do not have to issue debt $-for-$ to match their net spending.

After all they are just borrowing back what they spent in the first place. They are the issuers of the currency and so face not financial constraints. Why would they issue debt when they know what the neo-liberal media will do to their credibility?

The obvious reply is that the outcry would be worse if they didn’t. Then the inflation fears would be even more rampant than what they already are. Probably true … but that just leads me to think that this period has been wasted.

The progressives had the upper-hand going into this crisis. The banks were being nationalised, the neo-liberals were hiding, the mainstream economists were silent for fear of sounding stupid, and the public outrage of the “Wall Street” syndrome was huge.

How did the progressive side lose the initiative so badly? Why didn’t they use that goodwill period to make some fundamental changes which would have been hard to unwind and which would have demonstrated as living case studies that the sky doesn’t fall in if you net spend without matching it with debt issuance?

Further, given that the concept of a budget deficit scares the bjesus out of the so-called mainstreet I would have placed a premium on delivering outcomes that maximised the mainstreet welfare for the minimum deficit expansion. Not that I care about the size of the deficit – that is, unless the inflation index is rising sharply.

Why did the US and the UK governments, for example, spend so much on so little? Why did they not seize the moment – when they had the neo-liberals on the ropes – and introduce, for example, a Job Guarantee which could have significantly quelled the rise in unemployment for a fraction of the budget outlay?

It is all about the policy priorities.

The answer to my questions I guess is that there is no real progressive politics in the advanced countries remaining. The neo-liberal years have contaminated all sides of politics and even so-called progressive institutions (research centres etc) start mouthing off the neo-liberal mantra of fiscal conservatism and the rest of the baloney.

I noted that Paul Krugman’s latest column (January 17, 2010) – What Didn’t Happen – indicates that he is also rejecting the view being proffered by the conservatives (which includes Democrats) that the President “tried to do too much – in particular, that he should have put health care on one side and focused on the economy”.

He said:

I disagree. The Obama administration’s troubles are the result not of excessive ambition, but of policy and political misjudgements. The stimulus was too small; policy toward the banks wasn’t tough enough; and Mr. Obama didn’t do what Ronald Reagan, who also faced a poor economy early in his administration, did – namely, shelter himself from criticism with a narrative that placed the blame on previous administrations.

He agrees that the US government hasn’t done enough to stop unemployment from rising – “the administration’s program clearly wasn’t big enough to produce job gains in 2009”.

He also sheets the blame home to “Mr. Obama’s top economic and political advisers … [who] … concluded that a bigger stimulus was neither economically necessary nor politically feasible … The administration wasn’t distracted; it was just wrong.”

In terms of policy priorities, the treatment of the banks attracts Krugman’s disdain.

Some economists defend the administration’s decision not to take a harder line on banks, arguing that the banks are earning their way back to financial health. But the light-touch approach to the financial industry further entrenched the power of the very institutions that caused the crisis, even as it failed to revive lending: bailed-out banks have been reducing, not increasing, their loan balances. And it has had disastrous political consequences: the administration has placed itself on the wrong side of popular rage over bailouts and bonuses.

I agree with this. What we need is wholesale reform of the financial system. Not tinkering around the edges but a dramatic change in the way the financial system operates, who it benefits and what the expectations of reasonable returns (and salaries) are. Please read my blog – Operational design arising from modern monetary theory – for more discussion on this point.

However, I disagree with Krugman that “(a)t this point Mr. Obama probably can’t do much about job creation”. If that is a political statement then perhaps that just reflects the dead-end “progressive” politics has found itself in.

But if we are not to revert back to where we were then political leadership and a defiance of the mainstream view has to be shown. Krugman is correct in saying that the public anger has not been exploited enough by the Democrats (and their counterparts around the World).

If they bow down to the mainstream assault just because they fumbled one Senate seat election then times will be very tough indeed for progressive agendas.

More madness comes courtesy of a Bloomberg report today where you read that the “U.K. Has Worst Debt Ratio Damage of G-7”. That is, public debt. The report says:

Britain has suffered the sharpest deterioration in its public finances among Group of Seven nations since the financial crisis struck, International Monetary Fund data show …

Some bank economist told the journalist that Britain’s debt is “a potential drag on growth, and underlines the need also for a general rebalancing in the economy away from an excessive dependence on domestic demand fuelled by debt …”

Of-course, the article then mentions as an aside that “Britain’s ratio of debt to GDP … was still the lowest in the G-7 at the end of 2009”

An earlier article in the UK Telegraph really demonstrated a capacity to understand how the system operates.

The journalist opened with this:

Something important happened this week: for the first time since the start of the financial crisis, investors demanded a bigger premium in return for holding British debt than Spanish. Indeed, the cost of our government borrowing – as measured by the interest rate – is rising so quickly that within a month it could be higher than Italy’s.

The amazing thing about all this is that we allow “financial markets” to behave in a totally absurd fashion, yet treat their judgements as if they are from a higher intelligence.

How can we have allowed a situation to occur when the current credit default spreads on UK sovereign debt are higher than those for any single Eurozone nation (and this includes Germany and France if you want) and that we take this as a serious constraint on the UK government’s capacity to improve the standard of living of its citizens when the private business sector has temporarily thrown in the towel? (CDS latest).

How is that we allow a nation with zero solvency risk to be put into this situation relative, to say, Germany, which is always facing solvency risk because they surrendered their currency sovereignty to the European Central Bank?

The UK Telegraph journalist then really sets out the priorities for us. After rambling on about how financial markets have increasingly demanded indexed debt and that the Bank of England would not allow inflation to exceed their target rate, which all adds up to Britain not being able to inflate away their “debt crisis”, the journalist concludes:

And a good thing, too. As tempting as it is for profligate governments, permitting double-digit levels of inflation inflicts a baleful cost on households and companies. If we have forgotten this lesson from the 1970s – where the cost of the strategy was economic chaos and an IMF bail-out – it is just as well that these restrictions ought to prevent, or at least impede, the Government from taking that approach. No, the solution to today’s fiscal crisis is the same as it has always been: to cut spending, reduce the deficit and learn to live within our means.

Try telling that to the millions of workers who are now unemployed and are becoming increasingly impoverished by the failure of the government to prioritise its fiscal intervention towards jobs.

Something has to give. There has to be a way that the citizens can actually take back the debate and steer it towards forcing policy makers to pursue broad public purpose rather than narrow sectoral interests.

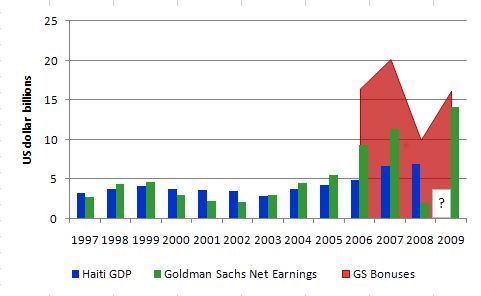

On the questions of getting things into balance and priorities well-ordered, the following graph shows Haiti’s GDP (Source: World Bank Development Indicators) and Goldman Sachs Net Earnings figures (Source: GS Financial Data) both in billions of US dollars. I didn’t have a figure for Haiti’s 2009 GDP.

The foreboding red area that dwarfs the GDP of an entire country of 9.7 million residents represents the bonuses that Goldman Sachs have paid out in recent years.

Anyway, all is not lost. A tiny nation maybe the example to us all. This NPR story on Iceland is interesting. You can hear the segment HERE and get a transcript HERE.

At one point they interviewed the Finance Minister who is part of the government that is trying to foist the ridiculous “pay back” agreement on the Icelandic people and thus opposes the President’s recent action to put the issue to a referendum so that “the people of the country will have the final say on law.”

The Finance Minister told NPR that “whether a referendum happens or not, there’s something deeper going on in Iceland, moving away from what he calls the culture of neo-liberal greed that had taken hold, and returning home to its Nordic roots”. He said:

I can be very frank about it: What we need to abolish is this neo-liberal greed philosophies that were driving things in the bubble years. What we want to build – re-establish in Iceland is a strong Nordic welfare society with equal justice and equality.

Paul Ormerod’s Death of Economics makes the point (page 202) that in the post WW2 period:

A perfectly feasible outcome for the Western economies … would have involved a much higher average level of unemployment, with everything else remaining the same: Marshall Plan, monetary stability, high investment, rapid growth. The sole difference would have been that those in employment would have become even better off than they did, at the expense of the unemployed.

He is talking about the period when the Gold Standard made it harder for Governments to maintain high levels of employment. The situation now is that the freedom of non-convertibility has given the national governments the ultimate capacity – they can simply offer a job to anyone who wants one.

Ormerod says that the nation’s that maintained low unemployment after the 1970s OPEC crises all “exhibited a high degree of shared social values, of what my be termed social cohesion, a characteristic of almost all societies in which unemployment remained low for long periods of time (page 203).”

He then concludes (page 203) that avoided the plunge into high unemployment maintained a:

sector of the economy which effectively functions as an employer of the last resort, which absorbs the shocks which occur from time to time …

So an employment buffer stock, which is the basis of the Job Guarantee approach to full employment and price stability.

Ormerod also says that social cohesion has been:

under siege from the relentless pressure of the value system of free market economic theory, of the attempt to convert market economies into market societies, in which every transaction, every act of social intercourse, must take place within the nexus of cash and of self-interested individualism … Innovation, entrepreneurship and profits are still essential … But economic success can be achieved, and achieved more successfully within a broader and more beneficial framework than that driven by the pure, individual rationality of the economics textbooks.

So while I see my work as providing technical and economic understandings for progressives to arm themselves with to ensure they are not dudded by the arrogant aggression of the mainstream economics debate, the need for progressive action goes well beyond achieving that understanding.

Mobilisation is required. Truly progressive think-tanks are required and have to be well-funded – just like the right-wing mobs that are well-organised and extremely canny in the way they promote the lies.

Saturday Quiz

Back tomorrow as usual – it will appear some time during the day. I plan to make it hard (-:

I think most of this is correct but then the us supreme court made most agreemnts mute.

Bill, what’s happening in the US now is a revolt against the Establishment, which controls both parties. It has been more successful on the right than the left so far, because the right-wing base has threatened to confront Establishment incumbents if they don’t vote extreme position. This is not the case on the left, where the progressive caucuses in the House and Senate aren’t able to counteract the Establishment, which is entrenched, especially in Obama’s White House. Progressives realized the game was over for them when the president appointed Rahm Emmanuel to the influential position of White House Chief of Staff, and then this was confirmed when Obama named Tim Geithner to Treasury, Larry Summers as Chief Economic Advisor, and renominated Bernanke to chair the Fed. The progressive haven’t lost. They never had a chance, and so far still don’t. The progressive base is not yet active enough to make a difference, as the populist base has on the right. Unfortunately, many if not most progressives are still operating under the spell of “sound money” and “fiscal responsibility,” which is undermining their position without their seemingly being able to do anything about it. Sad.

Tom, you are spot on regarding the American progressive movement. Hell, I’m having a hard time getting my fellow Obama voters to think out side of gold standard terms. Im making some headway with a few but these economic memes have been spread for years and people just dont realize the amount ‘religious’ thinking this whole neo liberal paradigm depends upon.

Someone needs to fund a campaign that gets people like Bill, Randall Wray, Scott Fullwiler, Marshall Auerback or Warren Mosler out on the talk show circuit offering the “other side” to this debt debate. We need to see them on the Daily Show, Rachael Maddow show, Dylan Ratigans show, Bill Moyers Journal or Charlie Rose. This paradigm can be presented in some very effective terms and start to poke holes in the deficit terrorists claims. Certainly someone sympathetic to MMT has the means and connections to get this done.

Dear All,

I’m re-reading deficit spending 101 and I’m hoping some of you reading this post could help with a few questions.

A commercial bank (A) faced with what it deems to be an excess of reserves can either a) lend it in the interbank market (leaving the overall level of reserves unchanged) or possibly b) buy treasury bonds (TBs) offered for sale, if any, by the central bank (resulting in a decrease of reserve). So far so good? How is it certain that option b) is preferable to a) from the standpoint of A, so that the Fed can actually influence the interbank rate?

Bill uses interchangeably “sell” and “issue” TBs. These two terms are traditionally reserved for secondary (security changes hands) (2) and primary (1) markets operations (increases the stock of securities), respectively. I think it is the treasury that issues bonds (2), not the Fed, right?

If we treat treasury + Fed as a fused entity it doesn’t matter. Yet, to relate this to the real world, it would help to know how decisions are coordinated. When the treasury announces that it will auction a certain volume of bonds over say one year, does it follow instructions from the Fed? Is it irrelevant anyway because the Fed can sell (can it run out of stock, though?) or purchase at will to offset, if necessary, the actions of the treasury?

Re: Why so-called progressive governments hire mainstream economists as their advisors is beyond me. What else will they get but deficient policy design?

They do it because what alone counts is wealth transfer. See today’s Counterpunch for some articles on the Supreme Court decision.

From Paul Craig Roberts:

The lobbies of greed rule America. The White House, Congress, even the federal judiciary are impotent in the face of capitalist greed. The recent Supreme Court decision permitting corporations to use shareholders’ money in corporate treasuries to influence elections increases the control that corporations have over the outcome of elections and the decisions of the government of the United States.

There is no government of the people, for the people, by the people, only the rule of private interests.

Toward the beginning of this post Professor Mitchell uses the term “inflation index,” stating he doesn’t worry about budget deficits unless the inflation index is rising sharply. I am curious, does this term refers to a specific metric modern monetary theorists use to gauge inflation? Or is it just “core inflation,” as measured by the C.P.I.?

Often when discussing inflation with friends or colleagues I find most simply associate inflation with the price of gasoline. If the price of gas is rising then there is inflation. If not, then everything is honky-dory. Simple as that. If I try to bring up the distinction between economy wide demand pull-inflation versus cost-push inflation in a particular asset class I usually get blank looks. I also usually point to Japan as a good example that running large deficits relative to GDP doesn’t necessarily lead to hyper-inflation, but the response I get to that is the U.S. is different from Japan because a large portion of the U.S. debt is held by foreigners and the citizens of the U.S. have such a low savings rate compared to the citizens of Japan. This seems like a bit of a non-sequitur to me, but I still have trouble responding to it. I’m always looking for more rhetorical arrows to add to my argument quill so another concrete measure showing inflation is not something to be worrying about right now would be helpful. Especially if it’s something besides core inflation because most of the people I argue with dismiss core inflation out of hand do to the fact that it excludes the price of gas and food. Thanks in advance for any advice.

I guess (but if someone wants to correct me, he/she is welcome), the question I raised is for the most part resolved as follows :

As per deficit spending 101, “since the supply of treasury securities offered by the federal government is always equal to the newly created funds. The net effect is always a wash”.

So crediting banks with G-T>0 adds to liquidity but because banks purchase exactly G-T worth of bonds, the net effect is zero, so there is no need for the Fed to do anything.

I would think, in practice, though, that net payments of G-T at any given time do not exactly coincide with treasury auctions, so the Fed still has to intervene by buying or selling bonds in the secondary markets to offset any discrepancy?

i have proposed the boe sell credit default insurance in the market place and drive the price down to maybe .05 where it would remain and remove the illusion that there is actual risk of a financially driven default

bx12,

This is how it works in the Australian money markets.

The RBA has a general idea what level of reserves the banks want to hold in their Exchange Settlement Accounts. Each day they estimate the net change in ES balances, which occurs due to payments between the government sector and the private sector (tax payments, government employee salaries, welfare payments, government borrowing and so on).

The RBA will enter into repo transactions to offset the change in ES balances. The banks can apply to take part in these transactions with the RBA, or they can sort out their reserve balance excess / shortfall between themselves.

If the total ES balances are more or less than the banks want to hold, then banks will attempt to lend or borrow in the cash market. This will put pressure on the cash rate, and it might diverge from the cash rate target as set by the RBA.

The Federal Reserve system operates in a similar fashion, although there are some differences, such as minimum reserve requirements (which we don’t have in the Australian system).

Warren

How would that credit default insurance work? Isnt credit default insurance bought by those you might default on(I know default is not a real possibility with BOE)? So the holders of the bonds would be the ones to buy it but if they dont are you suggesting that third parties could purchase it?

Couldnt the bond holders just say no if they really want to act in concert to bully the govt and force non debt holding parties to buy the CDS? Wouldnt this simply be transferring the insurance of the risk from the bond holders to the non bond holders and giving the bondholders? This just seems like making the non debt holders spend money they dont need to to restore the “illusion” of solvency for the bond holders.

Help me here Im sure Im missing something.

Gamma, thanks for sharing your insight.