I have received several E-mails over the last few weeks that suggest that the economics…

Another intergenerational report – another waste of time

Today I have had the misfortune of reading the latest Australian Government Intergenerational Report, which is really a confection of lies, half-truths interspersed with irrelevancies and sometimes some interesting facts. Why an educated nation tolerates this rubbish is beyond me. The media has been making a meal of the latest report and all the doom merchants – those deficit terrorists – a claiming we have to get into surplus as soon as possible. They seem to be ignoring that we are still embroiled in a major economic crisis requiring on-going fiscal support. But more importantly, they haven’t a clue what their policy proposals actually would mean in a modern monetary economy where external deficits are typical and the private sector overall is desiring to increase their saving. Anyway, read on … its all downhill.

The neo-liberals have created their own dilemma – again. By engendering an environment where older workers were basically scrapped by employers facing an on-going aggregate demand ration. Now the government is calling all the rejected older workers to come back – take some training levy and do a bit of casual work for the nation. What a load of nonsense all this is. This all relates to the so-called intergenerational reporting that the Australian government now engages in.

Yesterday, the Government via the Treasury released its latest Intergenerational Report, which is a confection of lies, half-truths interspersed with irrelevancies and sometimes some interesting facts.

The genesis of these reports goes back to the Charter of Budget Honesty Act 1998, brought in by the previous conservative government, who ironically were one of worst lying governments in our history.

The Act was neo-liberalana at its best as you will glean from its Purpose:

The Charter of Budget Honesty provides a framework for the conduct of Government fiscal policy. The purpose of the Charter is to improve fiscal policy outcomes. The Charter provides for this by requiring fiscal strategy to be based on principles of sound fiscal management and by facilitating public scrutiny of fiscal policy and performance.

Section 12(4) has been used often by the past treasurer to suppress information.

Anyway, Part 6. Section 20 of the Act says that:

The Treasurer is to publicly release and table intergenerational reports as follows:

(a) the first intergenerational report is to be publicly released and tabled within 5 years after the commencement of this Act;

(b) subsequent intergenerational reports are to be publicly released and tabled within 5 years of the public release of the preceding report.

The first Intergenerational Report came out in 2002, which the then government published (as part of the Budget Papers) to provide a justification for their pursuit of budget surpluses. It was the first major document to promote the ageing population-fiscal burden nexus. We are now into IGR Mark 3 and the message is the same.

Given they were meant to be released every five year – the second was in 2007 – why the hell are they wasting our time putting another nonsensical report out this year rather than wait until 2012? The fewer the better I would think.

On page 2 of the 2010 Report we read:

Failure to act now to tackle intergenerational challenges will result in severe economic, fiscal and environmental consequences.

The steps we take today will reduce future adjustment costs and the economic and fiscal consequences of ageing.

I agree that government has to always be forward looking and accept that its fiscal position will reflect changing challenges in terms of providing adequate public services and infrastructure while always be seeking to ensure that aggregate demand is sufficient to maintain production at the levels required to fully employ the available workforce.

But that is not what the current government thinks. It went on (page 2):

The fiscal strategy will keep real growth in spending to 2 per cent, when the economy is growing strongly, until the Budget returns to surplus. It will bring structural improvements to the Budget, reducing the fiscal pressures of ageing and escalating health costs.

Further, in the Treasurer’s Speech introducing the IGR he said:

… our fiscal position will deteriorate as underlying structural pressures that have been built into the budget over a number of years are magnified by the effects of an ageing population.

Left unchecked, these pressures would push government spending up from the middle of this decade by about 4¾ percentage points to around 27 per cent of GDP by 2050. And by 2050, spending would exceed revenues by about 2¾ per cent of GDP – that’s what economists call the fiscal gap.

Faced with these pressures, we need to ensure our budget is sustainable, or the quality of government services and public infrastructure will suffer …

The lesson here is obvious: we can’t just set our budget position only for the good times; it needs to be robust enough to deal with more difficult circumstances as well. And it needs to be cognisant of the other big challenges out there, including some very big ones like climate change and health reform, and the need to lift productivity so we can grow the economy.

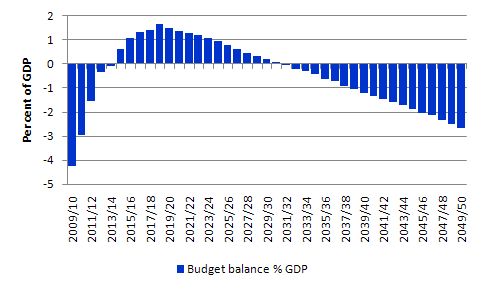

On Page 7 of the IGR (which the Treasurer referred to in his speech – at the point he mentioned “the fiscal gap” was this graph. It is presented as if it means something. It could be a set of vibes for all that it matters. Except the music would be sweeter if it was.

I reproduce the graph here (using Enguage to rebuild the dataset) and note that the accompanying text says “If steps were not taken to close the fiscal gap over time, the Budget would be in deficit by 3¾ per cent of GDP and net debt would grow to around 20 per cent of GDP.”

Notice this graph is introduced without any mention of what the net spending would be achieving or what the non-government sector might be doing by way of debt-retrenchment and saving. It also assumes that the surpluses in the immediate coming years are attainable.

From the perspective of Modern Monetary Theory (MMT) perspective, federal finances can be neither strong nor weak but in fact merely reflect a “scorekeeping” role. We have learnt that when Government boasts that a $x billion surplus, this is tantamount to saying that non-government $A financial asset savings recorded a decline of $x billion over the same period.

Thus if the Government is really believing it will achieve the surpluses shown in the graph then they must be wanting the non-government $A financial asset savings to decline by an equal amount.

Given that we will be running current account deficits over this period, the Government is claiming it is fiscally responsible to drive the private domestic sector (as a whole) into further indebtedness. That is a consequence of their projections.

Of-course, it is highly unlikely that they will achieve these surpluses if the private domestic sector continues to move back into positive saving. Then the external balance would have to swing into a large surplus which is not likely at all.

So the consequences of a policy strategy that aims to generate those surpluses will be chronic slowdown in growth and rising or persistently high unemployment.

The ambition which seeks to reduce net public debt is also equivalent to saying that non-government holdings of government debt will fall by the same amount over this period. In other words, private sector wealth will be destroyed in order to generate the funds withdrawal that is accounted for as the surplus.

In a financial sense, this is madness.

Once we appreciate these equivalents we would conclude that this draining of financial equity introduces a deflationary bias that will constrain output and employment growth and keep unemployment and underemployment at unnecessarily high levels. It will clearly also force the non-government sector to rely on increasing debt to sustain consumption.

It is an unsustainable growth strategy and the last thing you should be doing when faced with the dependency ratios that I will talk about later.

The entire logic underpinning the intergenerational debate is flawed. Financial commentators often suggest that budget surpluses in some way are equivalent to accumulation funds that a private citizen might enjoy. This has overtones of the regular US debate in relation to their Social Security Trust Fund.

This idea that accumulated surpluses allegedly “stored away” will help government deal with increased public expenditure demands that may accompany the ageing population lies at the heart of the intergenerational debate misconception. While it is moot that an ageing population will place disproportionate pressures on government expenditure in the future, it is clear that the concept of pressure is inapplicable because it assumes a financial constraint.

A sovereign government in a fiat monetary system is not financially constrained.

There will never be a squeeze on “taxpayers’ funds” because the taxpayers do not fund “anything”. The concept of the taxpayer funding government spending is misleading. Taxes are paid by debiting accounts of the member commercial banks accounts whereas spending occurs by crediting the same. The notion that “debited funds” have some further use is not applicable.

When taxes are levied the revenue does not go anywhere. The flow of funds is accounted for, but accounting for a surplus that is merely a discretionary net contraction of private liquidity by government does not change the capacity of government to inject future liquidity at any time it chooses.

The standard government intertemporal budget constraint analysis that deficits lead to future tax burdens is ridiculous. The idea that unless policies are adjusted now (that is, governments start running surpluses), the current generation of taxpayers will impose a higher tax burden on the next generation is deeply flawed.

The government budget constraint is not a “bridge” that spans the generations in some restrictive manner. Each generation is free to select the tax burden it endures. Taxing and spending transfers real resources from the private to the public domain. Each generation is free to select how much they want to transfer via political decisions mediated through political processes.

When modern monetary theorists argue that there is no financial constraint on federal government spending they are not, as if often erroneously claimed, saying that government should therefore not be concerned with the size of its deficit. We are not advocating unlimited deficits. Rather, the size of the deficit (surplus) will be market determined by the desired net saving of the non-government sector.

This may not coincide with full employment and so it is the responsibility of the government to ensure that its taxation/spending are at the right level to ensure that this equality occurs at full employment. Accordingly, if the goals of the economy are full employment with price level stability then the task is to make sure that government spending is exactly at the level that is neither inflationary or deflationary.

This insight puts the idea of sustainability of government finances into a different light. The emphasis on forward planning that has been at the heart of the ageing population debate is sound. We do need to meet the real challenges that will be posed by these demographic shifts.

But if governments continue to try to run budget surpluses to keep public debt low then that strategy will ensure that further deterioration in non-government savings will occur until aggregate demand decreases sufficiently to slow the economy down and raise the output gap.

As a matter of priorities consider this statement from the IGR:

Real GDP per person is projected to grow at an average rate of 1.5 per cent per year over the next 40 years, compared with 1.9 per cent over the previous 40 years.

In a nation that is among the hardest working of them all, with rising divorce rates, rising youth suicide rates why should we care about a modest slowdown in real GDP per person. That doesn’t mean penury given our already high material standard of living (overall).

All the projections used by the IGR are detailed HERE. In the Metholodogy Appendix you learn that a constant tax-to-GDP ratio of 23.5 per cent (the historical average) from 2019-20 is assumed. So tax revenue grows in proportion with GDP and they tweak the tax scales to ensure average tax rates do not rise (as is implied by a no policy change rule). It is all rubbery though.

Then there is an elaborately detailed explanation of how they have come up with the spending projections across health care, aged care, income support, education, defence, climate change etc. This analysis is all extrapolation based on past trends and other factors.

Spending on health for example is largely linear extrapolations (with some exponential trends included) which means the government thinks that the increasing trend to obesity especially among children is a satisfactory basis for making these sorts of policy projections.

But you would have thought the most important question should have been at the forefront of their concerns. You would have been wrong.

Not once in the Report is the questioned asked: will there be enough real goods and services available for sale to absorb these projected expenditures? If the answer is yes then there is no policy problem – the national government will be able to afford the projected standard of health care if it decides politically that that is a sensible allocation of real goods and services.

Even under the section on Climate Change you read: “Consistent with the treatment of all other revenue heads, the IGR models CPRS receipts to 2019-20 then incorporates them into the long-term assumption of a fixed tax-to-GDP ratio based on the historical average. CPRS-related compensation payments are incorporated into modelled income support payments”.

So nothing about whether climate change is going to impinge on our ability to make real goods and services available to the citizenry. Which is really the only thing that matters when considering the challenge of demographic change.

You also note that they are assuming that the unemployment rate will remain at 5 per cent for the next 40 years “based on the rate that can be sustained without generating upward pressure on inflation, that is the non-accelerating-inflation rate of unemployment (NAIRU)”. They admit that it “cannot be measured directly” and is just assumed and “held constant in the projections”.

What sort of policy aspiration is that? But then we learn categorically that this level of unemployment is what the current government believes to be full employment:

As a result, employment growth from 2014-15 (where the economy is projected to return to full employment) onwards reflects growth in the labour force. Employment growth is projected to slow in line with a gradual decline in labour force growth, associated with a falling total participation rate and slower growth in the working-age population.

They also make no assumptions about the trends in casual employment and therefore ignore totally the wasted labour resources that arise from this pathology.

So does the dependency ratio matter?

It surely does but not in the way that is usually assumed.

The IGR assumed that the aged dependency ratio now at 20 per cent wourld rise to 37.6 per cent by 2050 and the child dependency ratio would remain constant at around 28.5 per cent. So they were using the standard measures based upon the ABS Series B which assumes medium fertility, medium migration and medium life expectancy.

The standard dependency ratio is normally defined as 100*(population 0-15 years) + (population over 65 years) all divided by the (population between 15-64 years). Historically, people retired after 64 years and so this was considered reasonable. The working age population (15-64 year olds) then were seen to be supporting the young and the old.

The aged dependency ratio is calculated as:

100*Number of persons over 65 years of age divided by the number of persons of working age (15-65 years).

The child dependency ratio is calculated as:

100*Number of persons under 15 years of age divided by the number of persons of working age (15-65 years).

The total dependency ratio is the sum of the two. You can clearly manipulate the “retirement age” and add workers older than 65 into the denominator and subtract them from the numerator.

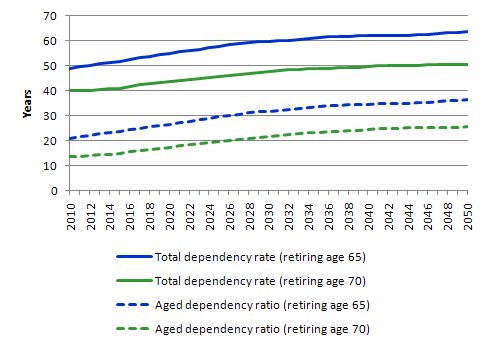

The following graph uses the ABS Series B demographic projections and computes dependency ratios based on a retirement age of 65 and then if the retirement age rises to 70.

The three projected ratios for a retirement age of 65 at 2050 would be 63.8 per cent (total); 27.3 per cent (child) and 36.5 (aged). However, if you raised the retirement age to 70, the numbers drop to 50.6 per cent (total); 25.1 per cent (child) and 25.5 per cent (aged). As an aside, there is no legal retirement age in Australia but it typically means when you can qualify for a state pension and it also has a meaning in terms of superannuation rules (entitlements don’t compound after that, typically).

So you can see why the push is on to increase the retirement age. The Government has already signalled it will rise to 67 in 2023. With longer life-expectancies the pressure will be on to work longer.

While there is a lot of hysteria about the dependency ratio what it means is that in 2010 there are 2.05 people of working age to every person who is not of working age. This will fall to 1.57 in 2050 on the basis of ABS demographic projections.

However, if we want to actually understand the changes in active workers relative to inactive persons (measured by not producing national income) over time then the raw computations are inadequate.

Then you have to consider the so-called effective dependency ratio which is the ratio of economically active workers to inactive persons, where activity is defined in relation to paid work. So like all measures that count people in terms of so-called gainful employment they ignore major productive activity like housework and child-rearing. The latter omission understates the female contribution to economic growth.

Given those biases, the effective dependency ratio recognises that not everyone of working age (15-64 or whatever) are actually producing. There are many people in this age group who are also “dependent”. For example, full-time students, house parents, sick or disabled, the hidden unemployed, and early retirees fit this description.

I would also include the unemployed and the underemployed in this category although the statistician counts them as being economically active.

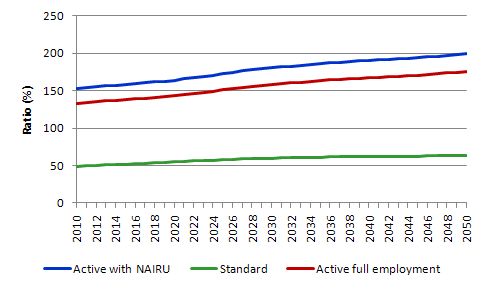

If we then consider the way the neo-liberal era has allowed mass unemployment to persist and rising underemployment to occur you get a different picture of the dependency ratios. The following graph takes the participation rate profiles assumed in the IGR (so from 65.1 per cent in 2010 falling in a linear fashion to 60.6 per cent in 2050. Assuming no-one over 65 works (and at present it is a very small percentage) I then computed what the labour force would be for the working age population.

Then taking the NAIRU assumption (5 per cent constant) and assuming underemployment remains constant at 5 per cent (it is currently nearly 8 per cent) you can compute the active dependency ratio with the NAIRU assumptions. I also computed the same using the full employment assumption of 2 per cent unemployment and zero underemployment.

The following graph shows you the differences when compared to the standard dependency ratio. So in 2010, the standard dependency ratio is 48.9 per cent whereas if you consider the approximate effective ratio under the NAIRU assumption it is actually 153.4 and if the government achieved true full employment it would fall to 133.4.

By 2050, the projected dependency ratios would be 63.8 (standard); 199.5 (active with NAIRU) and 175.8 (active with full employment). That puts a different light on things. The greatest initial gain that can be made to reduce dependency ratios would be to restore true full employment.

Not stupid policies like those announced yesterday by the Treasurer to encourage older workers to do a bit of casual work for a pittance. But a serious attack on those who are unemployed; hidden unemployed and underemployment in the 15-64 year age bracket would have a significant impact on the dependency ratios.

The reason that mainstream economists believe the dependency ratio is important is typically based on false notions of the government budget constraint.

So a rising dependency ratio suggests that there will be a reduced tax base and hence an increasing fiscal crisis given that public spending is alleged to rise as the ratio rises as well.

So if the ratio of economically inactive rises compared to economically active, then the economically active will have to pay much higher taxes to support the increased spending. So an increasing dependency ratio is meant to blow the deficit out and lead to escalating debt.

These myths have also encouraged the rise of the financial planning industry and private superannuation funds which blew up during the recent crisis losing millions for older workers and retirees. The less funding that is channelled into the hands of the investment banks the better is a good general rule.

But all of these claims are not in the slightest bit true and should be rejected out of hand.

So you get all this hoopla about the fiscal crisis that is emerging. Apparently we have to make people work longer despite this being very biased against the lower-skilled workers who physically are unable to work hard into later life.

We are also encouraged to increase our immigration levels to lower the age composition of the population and expand the tax base. Further, we are told relentlessly that the government will be unable to afford to provide the quality and quantity of the services that we have become used too.

However, all of these remedies miss the point overall. It is not a financial crisis that beckons but a real one. Are we really saying that there will not be enough real resources available to provide aged-care at an increasing level? That is never the statement made. The worry is always that public outlays will rise because more real resources will be required “in the public sector” than previously.

But as long as these real resources are available there will be no problem. In this context, the type of policy strategy that is being driven by these myths will probably undermine the future productivity and provision of real goods and services in the future.

It is clear that the goal should be to maintain efficient and effective medical care systems. Clearly the real health care system matters by which I mean the resources that are employed to deliver the health care services and the research that is done by universities and elsewhere to improve our future health prospects. So real facilities and real know how define the essence of an effective health care system.

Further, productivity growth comes from research and development and in Australia the private sector has an abysmal track record in this area. Typically they are parasites on the public research system which is concentrated in the universities and public research centres (for example, CSIRO).

For all practical purposes there is no real investment that can be made today that will remain useful 50 years from now apart from education. Unfortunately, tackling the problems of the distant future in terms of current “monetary” considerations which have led to the conclusion that fiscal austerity is needed today to prepare us for the future will actually undermine our future.

The irony is that the pursuit of budget austerity leads governments to target public education almost universally as one of the first expenditures that are reduced.

Most importantly, maximising employment and output in each period is a necessary condition for long-term growth. The emphasis in mainstream integeneration debate that we have to lift labour force participation by older workers is sound but contrary to current government policies which reduces job opportunities for older male workers by refusing to deal with the rising unemployment.

Anything that has a positive impact on the dependency ratio is desirable and the best thing for that is ensuring that there is a job available for all those who desire to work.

Further encouraging increased casualisation and allowing underemployment to rise is not a sensible strategy for the future. The incentive to invest in one’s human capital is reduced if people expect to have part-time work opportunities increasingly made available to them.

But all these issues are really about political choices rather than government finances. The ability of government to provide necessary goods and services to the non-government sector, in particular, those goods that the private sector may under-provide is independent of government finance.

Any attempt to link the two via fiscal policy “discipline:, will not increase per capita GDP growth in the longer term. The reality is that fiscal drag that accompanies such “discipline” reduces growth in aggregate demand and private disposable incomes, which can be measured by the foregone output that results.

Clearly surpluses helps control inflation because they act as a deflationary force relying on sustained excess capacity and unemployment to keep prices under control. This type of fiscal “discipline” is also claimed to increase national savings but this equals reduced non-government savings, which arguably is the relevant measure to focus upon.

Conclusion

The idea that it is necessary for a sovereign government to stockpile financial resources to ensure it can provide services required for an ageing population in the years to come has no application. It is not only invalid to construct the problem as one being the subject of a financial constraint but even if such a stockpile was successfully stored away in a vault somewhere there would be still no guarantee that there would be available real resources in the future.

Discussions about “war chests” completely misunderstand the options available to a sovereign government in a fiat currency economy.

Second, the best thing to do now is to maximise incomes in the economy by ensuring there is full employment. This requires a vastly different approach to fiscal and monetary policy than is currently being practised.

Third, if there are sufficient real resources available in the future then their distribution between competing needs will become a political decision which economists have little to add.

Long-run economic growth that is also environmentally sustainable will be the single most important determinant of sustaining real goods and services for the population in the future. Principal determinants of long-term growth include the quality and quantity of capital (which increases productivity and allows for higher incomes to be paid) that workers operate with. Strong investment underpins capital formation and depends on the amount of real GDP that is privately saved and ploughed back into infrastructure and capital equipment. Public investment is very significant in establishing complementary infrastructure upon which private investment can deliver returns. A policy environment that stimulates high levels of real capital formation in both the public and private sectors will engender strong economic growth.

If we adequately fund our public universities to conduct more research which will reduce the real resource costs of health care in the future (via discovery) and further improve labour productivity then the real burden on the economy will not be anything like the scenarios being outlined in the “doomsday” reports. But then these reports are really just smokescreens to justify the neo-liberal pursuit of budget surpluses.

What the financial market experts actually do

Today’s interest rate decision (to leave rates at 3.75 per cent) spawned a bevy of commentators from the investment banks who love to parade in front of the cameras with their logos shining and basically uttering gibberish.

Today we learned once and for all what goes on in the trading rooms at the big banks. In this case, Macquarie Bank in Sydney had the stage floor on Channel 7 news and guess what we saw the analysts doing?

Check it out – it is hysterical – Youtube expose

Hi Bill,

I guess its the same everywhere! You can find this quote by the US President from the website budget.gov:

You’ll be pleased to see that this idiocy persists in the Northern hemisphere as well. How can we compete against the reporter’s father-in-law??

http://www.marketwatch.com/story/massive-debt-threatens-to-impoverish-our-children-2010-02-02

The implication of Ms Mantell’s article is that she and her father-in-law should stop their spending today so that they can put their hard earned dollars away in some sort of mythical “lock box” to be “saved” and then Edward’s granddaughter can spend that money.

Which I guess means that we have even less growth today, higher unemployment and even larger deficits…hmm, not quite what the doctor ordered here.

I guess next Edward will be suggesting that he should be sending his current economic output back to his grandparents to repay them for all of the consumption they deferred during the second world war.

Well, Bill, I had a crack at this yesterday. It’s your turn!

The “intergenerational conflict” supposedly emerging in the US because of the multi-trillion “unfunded obligations” due to SS and Medicare is what’s driving the political debate over the size of the deficit and national debt. It’s a bogus issue that plays into the party of “fiscal responsibility” hands and the liberals and progressives are buying into it because they don’t know anything about modern (post-1971) monetary economics based on national income accounting and don’t want to know anything about it as far as I can see from the response I get to my posts on progressive sites. Sad. I guess the US is going to have to learn the hard way.

Here’s a post by David Sirota today about what happens when the anti-tax crowd takes over in a locale. Looks like this is what is coming.

Anti-Tax Bastion Colo. Springs Shows What America Would Look Like If Conservatives Have Their Way

Tom, I know how you feel. I’ve been doing my best at the Baseline Scenario and Ezra Klein’s site with the limited understanding I’ve gained over the past month and a half or so reading this blog, The Economic Perspectives from KC blog, and Warren Mosler’s site, but mostly I just get ignored. A lot of so-called progressives in the U.S. take their cue from President Obama so it’s really sad to see him repeating John Boehner’s talking points that the U.S. government should tighten its belt just like ordinary families have to. And in the State of the Union no less. Depressing.

Why shouldn’t the gov’t sector be a “user of currency” just like other “sectors” of an economy?

Fed Up, good question that gets to the basis of MMT. Most people that come to MMT are confused about this at first, because they don’t get the vertical-horizontal relationship of the government to the commercial banking system. Most people just figure that money is money, and it all the same. It’s not. The currency that the government issues is different in important ways from bank money created by lending.

Here’s a shot at clearing it up. The US government is the currency issuer. It’s the monopoly provider. Unless the government issues currency, there are no non government net financial assets, because the commercial banks create bank money from lending (loans create deposits), and this means that all bank money nets to zero – one person’s “money” is another person’s loan obligation. This not clear because we use the unit of currency (dollar in the US) as the unit of account and medium of exchange instead of separate entities for currency and bank money. So it may seem that banks can create money in the same way that the government can, when they cannot. This involves what MMT calls the vertical-horizontal relationship of the government as currency issuer through disbursement by crediting reserves and the commercial banking system as creator of bank money through lending. The former generates no corresponding offsetting obligation in the commercial system, which loans-deposits do. This is a key point in understanding MMT and the national accounting on which it is based.

Of course, the government uses the currency it issues by disbursing it into the economy in a variety of ways, some in purchasing goods and services, like bombs, planes, guns and ships from the defense industry, etc. But that money comes from currency issuance, not commercial borrowing. Why would the government want to borrow from commercial banks and pay them interest, when it can issue it’s own currency? You will object that the government pays interest on its issuance of Treasury securities. However, this too is a government disbursement that creates non government NFA and adds to national savings.

See Bill’s post, Stock-flow consistent macro models

Tom Hickey said: “Here’s a shot at clearing it up. The US government is the currency issuer. It’s the monopoly provider.”

I was asking why not remove this currency issuance from the U.S. gov’t (AND definitely from the fed) and give it some entity that answers directly to the people.

Just some more points to add to what Tom Hickey said.

Currency (or reserve money) has the following distinguishing features which credit money can not perform:

1. goal of reserve requirements

2. tool of interest rate policy

3. means of inter-bank settlements within central bank

Uh, Fed Up, the US government is responsible to the people through democratic elections. That’s what democracy is all about. How do you propose to make the currency issuer responsible to the people otherwise?

I would prefer to see the façade of the Fed as a quasi-governmental organization done away with. The CB should be a governmental agency that is clearly responsible to the people and not connected to the private sector, whose responsibility is to shareholders, at all.

Tom Hickey said: “Uh, Fed Up, the US government is responsible to the people through democratic elections. That’s what democracy is all about. How do you propose to make the currency issuer responsible to the people otherwise?”

By making it a separate entity elected by the people for that sole purpose. I would guess that at least 99% of the people voting base their vote on other issues. I want to ELIMINATE gay marriage, abortion, war, security/terrorism, and/or any other “issue of the day” from the mix.

By making it a separate entity elected by the people for that sole purpose.

If I understand you correctly, the central bank would be a separate non-government, non-private entity elected by the people. How would it be constituted and funded if it is non-government and non-private? It would have to fall under the Constitution, so it w seems it would have to part of the government. A fourth branch? Likely to require a constitutional amendment to institute. Interesting concept, but there are a lot of loose ends here you need to clear up for me.