Yesterday, the Australian Bureau of Statistics released an extraordinary press notice – Statement from the Australian Statistician on the Labour Force estimates – which aimed to help everyone understand why the Labour Force data has been so weird lately. A lot of readers E-mail me seeking help understanding what seasonal adjustment is all about. It…

Some neighbours arrive

The other day I introduced a simple model of how a monetary economy works. The model was centred on the payments of my personal calling cards to elicit labour from the kids that live in my house. All the basic national accounting results that apply in a real economy were present. The simplicity extended to considering only two sectors – the kids (private) and the “house” (public). In terms of modern monetary theory (MMT) we start by examining the broad relationships between the government and non-government sector, where the latter comprises the private domestic and foreign sector. Some readers have suggested that the results obtained would not apply if I had have explicitly modelled the cross-border flows (that is, the external sector). Well today, I have some news … some neighbours have arrived next door to my place and the kids from each house are jumping fences.

To get back intp the scheme of things here is a brief recap of where we left my simple personal calling card economy. As background reading I suggest the following blogs – A simple personal calling card economy and What causes mass unemployment?.

Recap

The following briefly refreshes our memory of the model presented in this blog – Barnaby, better to walk before we run. I strongly recommend you re-read (or read) that blog to see the most simple exposition of the model. You will see that things get more complicated in the model I present today.

Recall that:

- I devise a plan to get my children to work around the house which involves me offering them by worthless personal calling cards each month as wages. The children are disinterested in the plan initially but soon realise they have to pay me taxes each month in personal calling cards. The imposition of the tax creates a demand for my otherwise worthless cards.

- All wage payments, taxes and interest payments are demoninated in cards and transacted via entries into a spreadsheet we keep on our home computer system.

- The kids cannot pay their taxes until I spend the cards on wages. Taxes are not levied to raise revenue. I am totally free to create as many personal calling cards as I choose.

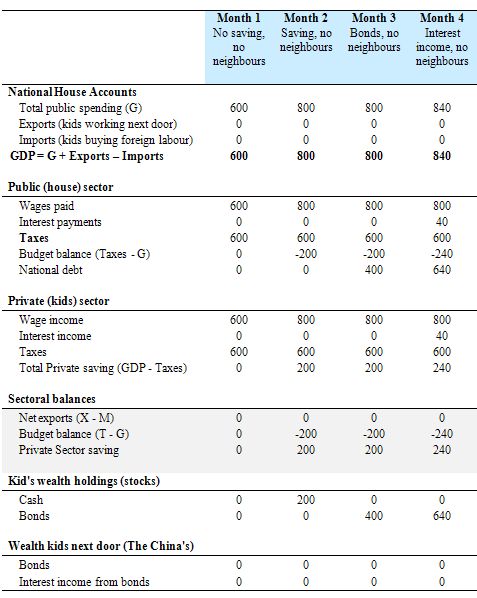

The following Table summarises the main results of the system before trade enters the picture. For a large printable version of the 9-month sequence that is discussed click HERE. It is best viewed in a landscape format.

You will notice it is a bit more complicated than the spreadsheet tables presented in the companion blog last week. The spreadsheet we keep in the house now defines the overall spending aggregates – public spending (G) which is total wages and interest payments; exports (X) and imports (M) (more about which later). Total output in the family is equal at this stage to total public spending.

You then see the public spending and revenue accounts, the fiscal balance [Taxes (T) – Total Public Spending(G)] and the national debt (outstanding bonds issued).

The next set of entries relates to the kids accounts. They can earn wage and interest income but pay taxes. Total private saving (S) is the difference between total house income and taxes.

The next set of entries details the so-called sectoral flows. We have three sectors interacting: (a) public (me); (b) private domestic (kids); and (c) external (relations with our next door neighbours although in Months 1 to 4 they house next door is empty.

The national accounting rules relating to these sectoral flows ensure the balances (correctly specified) sum to zero. So S + (T – G) – (X – M) = 0. This is not an idea or theory but an accounting rule that always holds in any economy. That is, it cannot be wrong.

The final two sets of entries relate to the wealth accounts of the kids and the next door neighbours. Our kids can choose to hold their accumulated saving in the form of cash (in cards) or purchase a bond (also specified in cards).

Once trade begins you will see that the kids next door can also buy bonds that I issue as long as they have my personal calling cards – remember I am the only person who issues these cards. The kids next door will also receive interest payments denominated in my cards for any bonds they buy off me.

Recap: Months 1 to 4

In Month 1, I run a balanced fiscal position, which is, from inception, the MINIMUM that can be spent, without a continuous deflation. That is, the kids would not be able to earn at least as much as they needed to pay taxes.

If the fiscal position is balanced there can be no net saving or net accumulation of financial assets.

In Month 2, I agree to the kids’ desire to save some personal calling cards so they can temporally arrange their work load and have holidays. The children’s desire for thrift forces me to run a deficit as a matter of course. They cannot save in the currency unless I am spending more than I tax them.

So the desire increases the level of activity in the economy by 200 cards per month and the extra employment generates higher incomes and permits the children to save 200 cards a month.

The principles now understood include the finding that public deficits allow the private sector to net save in the fiat currency and accumulate financial assets. In this case the saving is in the form of non-interest earning personal calling cards.

Further, the accumulated saving of financial assets is the stock of wealth and reflects the accumulated fiscal deficits. The stock of past savings as it stands do not earn any interest. Another way of looking at this is that there is excess liquidity (spare cards) in the overall system and the rate of interest is zero.

To reward thrift, I introduce a new financial asset – a bond in Month 3 which will pay 10 per cent on all cards saved. The payments are made with respect to last period’s stock of bonds. So all accumulated cash (card) savings are converted to bonds (400 in Month 3). The bonds are recorded in the spreadsheet and have instant maturity (that is, can be converted back into cards at any time).

In Month 4, I start paying interest income on the outstanding stock of bonds so in addition to wage income (800 cards) I pay 40 cards in interest income. The payments are made in the same way as all spending – I just calculate the amount owing and enter the number in the spreadsheet. Just an accounting entry. The kids notice that their non-wage income has increased which allows them to further accumulate wealth.

Seems as though everyone is happy. I am using my fiscal capacity to deploy otherwise idle labour which created income. The income, in turn, generates the capacity to save as long as I run deficits which I am happy to do. The only cost to the household in all of this are the real resources being consumed in the the process of generating the income. The spreadsheet entries are all costless.

What we all realise in this household is that the accumulated public deficits equal the accumulated private savings, which, in turn, sums to the accumulated stock of financial assets. This stock of financial assets can be split between cards and bonds as per the preferences of the children.

It is also clear that the rate of interest would be zero unless I issue the bond or agreed to pay an interest rate on the saving balances. The bonds cannot be bought by the kids unless I have previously spent an equal sum of cards. The bonds do not “finance” my personal calling card spending in any way at all.

Here is the spreadsheet accounts describing the first four happy months of our household. I assess the kid’s have as much work as they desire and so the household is at full employment. There is enough demand to allow them to save cards for future use (like buying some other labour to allow them a holiday in one month or more).

So far so good.

Some neighbours arrive

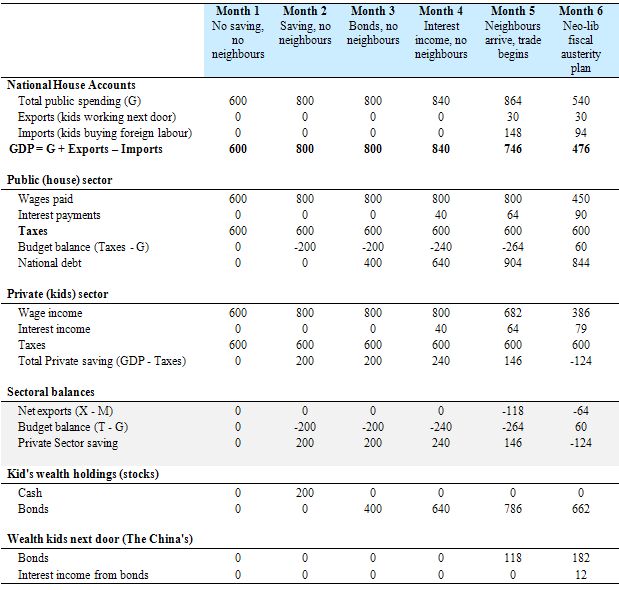

After lying empty for 4 months or more, the house next door suddenly became occupied at the beginning of Month 4. Yes, a lovely family arrived to take up occupancy.

I believe they are called the China family. Their kids are very eager to work and my kids are very eager to use some of their income (cards) to pay them to work.

Further, Dr. China (the female parent next door) has introduced a similar scheme to the one that has been successfully operating in my place for the past four months – she is paying and taxing her kids in her personal calling cards to motivate them to work around her house.

Given the fences are easy to jump over, what emerges in Month 4 is that our kids and the China Family kids start doing deals. The work in each house is not identical. Our kids are happy to work over there and they have found the next-door neighbours kids are happy to work in our house doing things.

The work our kids do next door amounts to our house resources earning income next door which we might call Export (X) income. They are paid in China personal calling cards (CBC) which they can hold in that denomination or convert at the fence into my personal calling cards. I abstract from the inner workings of the foreign exchange market that operates on the fence perimeter. That is another story but does not undermine any of the main results here.

I am happy to allow my kids to pay the China Family kids to work in our house in my personal calling cards that they either earn or have saved. This allows them to work less if they desire. So it is like substituting saving for leisure. The work that the China Family kids do around our house amounts to us leaking some of our domestic spending (income) over the fence and we might call this Import (M) expenditure.

The China family kids convert my cards into CBC or hold them as they see fit. I am also happy to allow the China Family Kids to buy my bonds and earn interest in the same way that my kids can if they want to hold their accumulated saving in this way. Of-course, I only accept my cards in return for a bond and all my interest payments are in my cards.

All transactions are maintained in my spreadsheet system which the kids call the “central bank” because they learned at school that they can keep their accumulated saving in a “bank”.

An exchange rate (the relative price between my cards and CBC) emerges and reflects the relative demand and supply of the two types of personal calling cards. So if exports are less than imports (which we might call net exports (NX) < 0)) then there are more of my cards being supplied in exchange for CBC and so the price of my cards relative to CBC falls – we might call this a depreciation. The opposite holds. Initially the parity is 1 but that soon changes due to “market forces”. That is, we decide not to peg our exchange rates because it would tie up our days worrying about it. Each family aims to maximise welfare using its respective card fiscal policy and to keep it free from having to worry about pegs.

I soon noted that, in general, the willingness of my kids to pay the China Family kids to do work in our house rose with total income but fell somewhat when my cards were depreciating against the CBC and vice versa. Note: the capacity to export might also rise when my cards depreciated against CBC but for simplicity I have made this sensitivity zero. It doesn’t alter anything of substance.

At the outset, I notice that both sets of parents are happy that their kids are being industrious and jumping the fence to earn each other’s cards. However, the China Family appears to have a curious attitude – they are happy to “export” more labour services to our house and accumulate my personal calling cards than the labour services they get back in return.

It is clear to me that exports are costs (my kids could be working around our place instead of next door) while imports are benefits (the China Family resources improving our welfare). So it was curious that the China Family would want to give us more real resources than we had to give them just to accumulate my personal calling cards. No telling though … people are different.

But the China Family attitude certainly enhances our welfare – we get more net real resources and I am happy that lots of work is being done around the house and my kids are happy that someone else is doing it.

To understand the impact of the neighbour’s arrival we also have to redefine total income produced in our household per month (a flow). Prior it was just my spending (on wages and interest payments). Now, we earn “export” income which has to be added to the “public” spending (G) but we lose the “import” spending to the China Family.

So we define the total household GDP to be equal to G + X – M, which is something I read in some textbooks as well!

Month 5 – trade begins

As you will see, things now get more complicated.

Given the China Family attitude to importing and exporting and my kids’ attitude to substituting leisure for work in Month 5 a trade deficit soon opens up. We export our labour worth 30 cards and they provide us with 148 cards worth of work which leads to a trade deficit of 118 in Month 5. The exchange rate depreciates as a result which has some attentuating impacts next period.

I am still paying out 800 in wages and now I am paying 64 cards in interest servicing payments (because the kids had accumulated 640 cards as bonds at the end of Month 4).

So total house income (GDP) in Month 5 = 864 + 30 – 148 = 746. So you can see that the household economy contracts because of the leakage in imports outweighing the injection from exports but my kids are working less by choice.

The public deficit rises to 264 cards (spending = 864 and taxes = 600). This deficit is now not fully added to the national debt because the kids use some of the potential saving to purchase imports. So they save 146 cards in Month 5 courtesy of my fiscal deficit (minus their import spending) and their bond holdings (wealth) rises by the same amount.

Notice also that the China Family kids have also accumulated 118 of my cards which they also convert into bonds. I create some new rows on the spreadsheet to record this and give them copies. These bonds will earn interest for them next period but all spending on this will remain in terms of my cards and inject extra cards into the household economy.

Overall, the national debt is now 904 cards (sum of my kids’ and the China Family kids’ bond holdings).

You will also clearly appreciate that the China Family kids (or their parents) have played no role in allowing me to spend my 864 and run a deficit of 264 cards in Month 5. I would have still run a deficit by choice and if they didn’t want to allow us to import as much then domestic income and saving would be higher and my deficit would be slightly lower.

Finally, the sectoral balances are more complicated than before trade was introduced. We will consider them separately in the next main section. But you can see that the sum of the balances still adds to zero, as is dictated by the national accounting framework.

Month 6 – a neo-liberal inspired fiscal austerity program begins

As we learned in the simple model without neighbours, one night I started to read about the dangers of public spending and deficits. I spend the whole night while the kids were safely sleeping on the Internet reading neo-liberal economics literature.

The literature was at odds with what I was observing. Everyone seemed to be happy and working hard and enjoying life around the house and I was certainly getting the tasks I wanted done performed by the kids.

But the economists and some Youtube videos I watched (by someone saying they were from the Austrian gold standard libertarian school of thought) were really scary.

My fiscal position was about to blow out and become viral. The interest rates I would have to pay on the debt would sky-rocket because no-one would want to hold it at 10 per cent. Funny I thought, I don’t actually care if they hold cash balances or bonds. I thought I was doing the kids a favour offering them a interest-bearing asset. But that is not what the literature said. Viral!. Okay, that’s scary.

It was also clear from the literature that I had become hostage to the China Family who were now funding my deficits and would pull the pin on me anytime soon because they wouldn’t want to hold anymore of my bonds. Funny, I thought – my spreadsheet was encrypted so they couldn’t hack into it. I just sat there typing in numbers each month to determine by wage payments. They were my personal calling cards after all – the China Family had their cards (CBC) but mine were mine.

But the liberatarian person – I actually had to turn the volume down while listening to him down because he had such an abrasively whining voice that sounded as if he knew nothing – but he had said the China Family would undermine our welfare. I didn’t want that.

The literature also said I would have to impose punitive taxation on my kids to get my fiscal deficits down and into surplus and pay back the national debt. Paying back the debt had to my priority it said. Further, high taxation would undermine the incentive of the kids and they would just refuse to work.

Funny, I thought, they were really happy to be working at present and using the increased income, savings and wealth to buy in real resources from elsewhere to make things even better.

They also were really pleased to buy the debt I offered them because they got a little extra reward for their saving. Also if they refused to work how would they pay the taxes anyway? The fact they had to get by cards to pay the taxes and therefore remain living in the house was the reason they offered to work in the first place.

The literature was adamant. I read newspaper columns and IMF papers. I bought Mankiw – which I learned was a famous textbook. I couldn’t believe how expensive it was but it must be worth reading at that price.

All these sources were telling me … I needed a credible exit strategy!

So in Month 6, I follow the advice and implement a fiscal austerity plan by cutting back on the amount of work I am prepared to pay for. I only offer 450 cards in that month to my kids. I note that exports (the amount of work my kids do over the fence) does not change (they can earn of my 30 cards when converted).

The dramatic decline in income plus the depreciating exchange parity between my cards and the CBC work together to reduce the trade deficit. Yes, I had also read that the trade needed to be rebalanced and I could not longer keep running a trade deficit, even though I had always thought they were delivering net real benefits. Anyway, imports (the China Family kids working here) falls to 94 and net exports falls to a deficit of 64 (down from 118).

The literature indicated that some short-term income losses would occur but in the long-run demand (fiscal) policies were not determining in terms of income growth. So I wasn’t concerned that our national GDP had fallen from 746 cards to 476 cards per month in Month 6. This was going to be a short sharp shock to get everything back on track.

But I must admit I hardly gave the other aggregates much attention because I was noticing I was back into a fiscal surplus. With total G = 540 and T = 600, I turned in a beautiful number – a 60 card surplus in Month 6. All other issues were rather insignificant given my goal to get back into surplus. The exit plan was working.

I call a family meeting and said:

We have had to “pull our belts in” and that it was time to be fiscally responsible. I had to set the household economy back on the path to fiscal sustainability. This surplus will underpin future growth once I get the national debt off our backs.

I quoted Mankiw about all of this but no-one knew what I was talking about.

The kids just looked on edge and said something about their savings were drying up and they couldn’t get as much work as they wanted and the China Family kids were now staying over their side of the fence a bit more. They also said that in Month 6 they had to sell 124 cards worth of bonds they were holding to meet the shortfall between income and tax obligations.

So they claimed they were not as well of as before. I told them “we all have to pull our belts in and do our bit to get this house economy back on track”.

When I examined the spreadsheet further I noticed that I had indeed retired 60 cards worth of the national debt – by buying back 124 card bonds from my kids while still selling 64 card bonds to the China Family (as a result of the on-going current account deficits).

But there was still 844 cards of debt outstanding.

I also noticed the China Family had accumulated even more debt as a result of the on-going trade deficits and this needed to be addressed. I had to get rid of the trade deficits as well as the national debt.

I also noticed my interest payments were still rising. That signalled to me that next month even tougher measures were required or I might go broke as the neo-liberal literature had been warning me.

However, if I had stayed reading billy blog I would have realised that:

- Budget surpluses squeeze the private sector for liquidity and the private sector is forced to run down wealth through negative saving in order to meet their tax obligations.

- Budget surpluses destroy private wealth!

- When the government is in surplus and the external sector is in deficit, the private domestic sector must be dis-saving and running down their wealth.

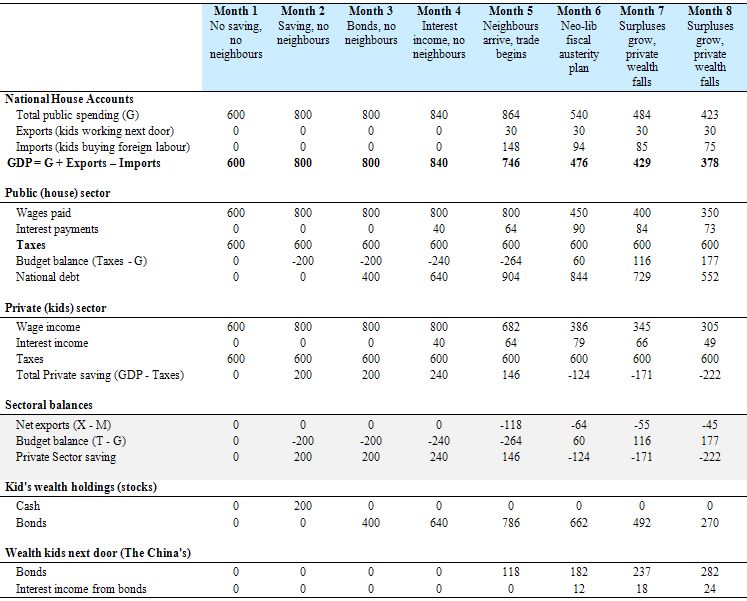

Months 7 and 8 – fiscal surpluses grow, private (kids’) wealth falls

From the neo-liberal perspective, my strategy as the government of the household has been exemplary. I am now generating surpluses and retiring debt. I am no longer living beyond my means. I fail to notice that the kids’ (private sector’s) wealth is being destroyed and they are unable to work as much as they want.

However, I read in one of the articles that it was highly likely that the kids didn’t want to work anyway – they probably had attitudinal problems or were demanding excessive earnings. So if the rising unemployment was voluntary anyway and the kids were enjoying leisure more what is the problem?

I also fail to notice that the kids who hadn’t accumulated any wealth are facing rising debts. They seek to borrow from other kids because their work opportunities are being limited and they have to pay their taxes still.

Anyway, bouyed by all my economic reading and the events in Month 6, I decide that I should try to wipe out all the national debt. So in months 7 and 8 I extend the fiscal austerity and cut spending to 400 then 350 cards per month. I also note that my interest servicing payments on the outstanding debt are falling (84 then 73 cards per month). All this is heading in the right direction.

I thus enjoy increasing surpluses of 116 (Month 7) and then 177 (Month 8).

I also read about the twin-deficits thesis which said that fiscal deficits drive up current account deficits and so you have to reverse that process. I note in this regard that the trade deficit is narrowing dramatically as total house economy income (GDP) falls from 429 to 378 over the two months.

In Month 7 I retire a further 116 card bonds (national debt) – buying back 171 card bonds from my kids but selling 55 card bonds to the China Family. I note that the foreign component of this debt is falling too. Good! Even though this debt is denominated in my cards, I read that foreign debt would force me to default more quickly than locally-held debt. It didn’t make sense, but then who was I to question.

In Month 8 I retire a further 177 card bonds (national debt) – buying back 222 card bonds from my kids while selling only 45 card bonds to the China Family.

At the end of Month 8, national debt is at 55 card bonds down from the unsustainable level of 904 at the end of Month 5. My kids now hold 270 card bonds and the China Fmaily 282. More work is needed.

I don’t make the connection that the fiscal surpluses are forcing my kids to increasingly dis-save and run down their wealth to stay solvent. All I am motivated to do is to get the debt monkey of my back.

If I had have stayed reading billy blog I would have known that:

- The reductions in outstanding public debt is systematically reducing the income-earning opportunities for the kids. So not only does the austerity plan reduce employment opportunities it also erodes private fixed-income capacity.

- The fiscal surpluses continue to destroy wealth by squeezing the private sector of liquidity.

- Some kids will be becoming increasingly indebted.

- The introduction of a trade deficit doesn’t alter this result.

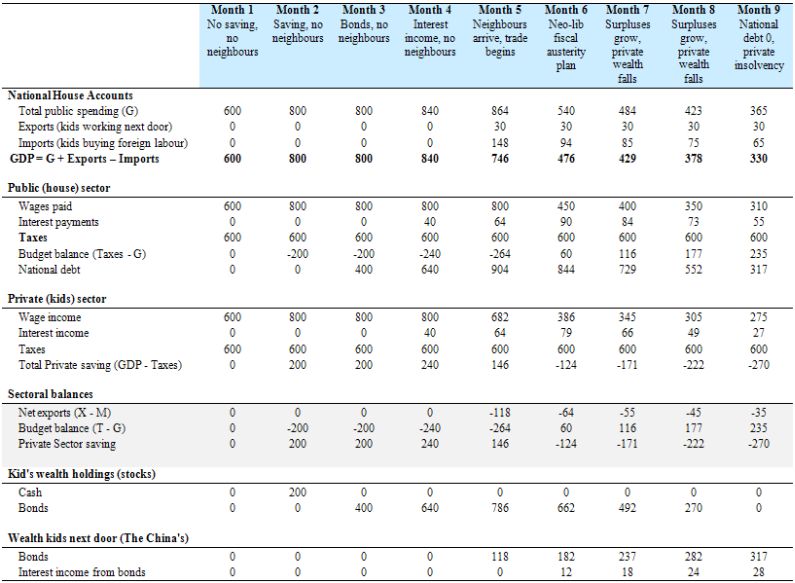

Month 9 – National debt falling, private (kids’) sector insolvent

In Month 9 I make further cuts in my wage spending to really drive down national debt. I want to push the net exports position into surplus and stop the foreign debt rising and I want to extinguish all locally-held public debt.

That idiot on billy blog starts accusing me of being a “deficit terrorist” – but what would he know anyway?

Anyway, the austerity plan continues and I cut my wage bill to 310 cards per month and my interest payments on outstanding public debt fall to 55 cards.

The exchange rate is starting to appreciate as the trade balance narrows and the IMF indicated this was a desirable growth strategy. Problem is that total house economy income (GDP) has fallen further to 330 cards and there is no longer much work being done around the house. The garden is in a sorry condition and rubbish is piling up. Moreover, some of my longer term projects – I called them public infrastructure development projects – like painting the house are now abandoned.

But this is all temporary – that is what the message from the mainstream economics writings is. Clearing out the debt and getting the deficits down will pave the way for growth.

My fiscal surplus is now a wonderful 235 cards but needs to be higher because there is still outstanding national debt.

The kids now dis-save a further 270 cards (their total income is 330 and they have to pay 600 in taxes). They get the shortfall by selling me back their bonds. It just happens that they had exactly 270 card bonds left so I have retired all locally-held national debt. That is a cause for me to call another family meeting, rather like going on national TV, and announcing that:

The household economy has now retired all its locally-held debt. We will not have to pay higher taxes to pay the interest servicing payments and now we are running surpluses, the deficits have all been paid back too.

The kids look at me with a distant gaze – they seem troubled by this news – I don’t realise they are now underemployed and insolvent.

For next period, they will default on their tax obligations given they have no sectoral wealth left and they cannot earn enough income to cover their obligations. I tell them that they will have to work for less card income if they want to get more work. They wonder how that will work when I am still only paying 310 cards per month and expecting 600 back!

I also note that the current account is heading into surplus (a small deficit remains) which will allow me to start retiring the foreign-held national debt. Before long our household economy will be debt-free, running external surpluses and will continue to run fiscal surpluses. Everything that the design of the credible exit plan I read in countless articles specified.

I just have to convince the kids to save more so they can pay their taxes in the coming months. I have done as much as I can to get the tax and interest payments monkey off our backs!

But more can be done and I start to read about Greece and the need to avoid sovereign default on outstanding held by the China Family. More fiscal austerity is called for.

If I had continued to read billy blog I would have realised:

- The accumulated fiscal balances equal the accumulated savings in the non-government sector. The distribution of these accumulated savings between private domestic and external depends on the size of the external deficit. The prior local accumulated saving was achieved by cumulative fiscal deficits and the external deficits. The fiscal surpluses destroyed the private wealth and offset the earlier deficits (which had created private wealth).

- Running surpluses thus forces the private sector to dis-save and private wealth holdings are destroyed as a consequence.

- For a time the kids were able to borrow from each other to maintain their spending (and tax payments) but eventually, their saving is compromised by the falling national income (household wages plus interest payments). The fiscal austerity in each of the last 4 months causes recession and increasing unemployment and ultimately mass insolvency in the private sector.

Sectoral balances – another perspective

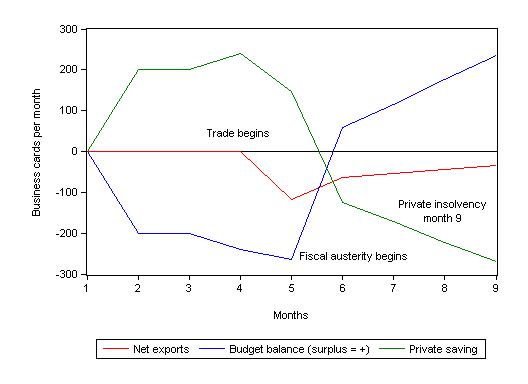

The following graph shows the sectoral balances from the Table to allow you to understand the relationships more clearly. You can observe the different stages of fiscal dynamics.

These balances are derived from the National Accounts and in summary (in our simple model without private investment) the condition that has to hold is that:

S + (T- G) – NX = 0

So private saving (kids) plus the fiscal surplus minus the external surplus has to sum to zero. It is easy to see that

S = -(T-G) + NX

So if the public balance is in surplus and there is an external deficit (NX < 0) then S must be negative by construction of the national accounts. You cannot escape that conclusion. In this example, we have seen how a wilfully designed fiscal austerity program in the presence of a current account deficit systematically undermines private saving.

At the outset, with a balanced fiscal position and no trade, there is also no private saving overall. All income is being taxed away. As the personal calling card deficits expand, the boost to total income allows the kids to save from month 2 at a steady rate. Note the graph is showing flows per month. In months 2 and 3, saving is 200 cards per month (a flow) which accumulate after month 3 to 400 cards of assets or wealth (a stock).

In Month 4, the neighbours arrive and imports rise faster than exports and so the kids are spending some of their income outside the economy which reduces their saving and the total income available. The net exports (current account deficit) rises but private saving is still strongly supported by the fiscal deficits.

Then the fiscal austerity program begins and the negative impact on total income is such that private saving now plummets in the negative zone. The current account deficit narrows as imports are hit hard (they are a function of total income). The kids can only meet their tax obligations now by selling up their bonds and using the liquidity to meet the shortfall.

As the fiscal surpluses continue to ravage income, the kids continue to dis-save. By Month 9, they have no wealth left and cannot pay their bills. They are broke and the system grinds to a halt with massive unemployment and poverty.

Conclusion

You can see that when the neighbours moved in certain distributional changes occured in the accounting relationships and the situation became more complicated. But the basic principles summarised by the sectoral accounts remain intact.

I could have extended the model to have a period of external surpluses. If they had have been large enough then private saving could have been supported even though the public fiscal positions were in surplus. This is the Norwegian case. But very few nations are in this situation. Most of the nations are in the situation presented in this model. Current account deficits are the norm.

This typical model allows you to see that under these normal circumstances, fiscal surpluses undermine income generation, reduce the capacity of the private domestic sector to work and save, and destroy the wealth holdings of the latter. Ultimately this sort of strategy will generate insolvency and crisis.

The introduction of the next door neighbours should also dispel any notions that the “closed economy” version of this model was hiding something important. It was not. The sectoral balances are very clear when you add the external sector.

Further, you should be able to clearly understand that the China Family is not funding the public spending in this model. How can it? I issue my own personal calling cards and they issue their cards. I spend in my cards.

Further, I don’t need to sell any bonds. All that would be different is that the bond holdings rows (local and external) would be zero and the cash holding rows would record the asset accumulation. Should either the local kids or the China Family kids not want to hold this cash then they could spend it in various ways and this would reduce my deficits anyway and help support growth and income generation.

I have also conducted this in real terms. It wouldn’t make much difference if I did it in nominal terms with a price level incorporated. In the growth phase as long as capacity was growing then inflation would not have been an issue and in the recessionary phase, deflation would likely occur and make matters worse.

But the underlying sectoral relationships and the fiscal-driven dynamics shown here would all still occur.

Most of the so-called experts who care to wax lyrical about exit plans and national debt never reveal they understand anything about these sectoral relationships or fiscal dynamics. Most of what they say would never “add up” nor is it stock-flow consistent.

What this simple model allows you to do is see the basic relationships clearly and how the spending, income and saving flows in each period impact consistently on asset stocks held. You will find very few mainstream economists who will entertain that level of consistency in their analysis.

In addition to the background reading I suggested above to map this model into the real world I would recommend you read the following trilogy: Deficit spending 101 – Part 1 – Deficit spending 101 – Part 2 – Deficit spending 101 – Part 3.

That is enough for today!

Professor –

are you going to extend this example into the opposite scenario – where instead of trying to balance your budget you continue to spend with a growing deficit? I think that might be illustrative.

I have another question/scenario – your kids, at the end of month 9, are no less solvent than they were to start with at month 1 – so you repeat the cycle all over again, except of course now you are spending a little more to pay interest on the Chinese Neighbor’s bonds… Maybe you fail to learn your lesson, and you do this exact same cycle (deficit –> surplus) (the interest component will change, though, of course)… At the end of a number of cycles, your kids will always end up with no savings, while the Chinese Neighbor’s savings grow and grow and grow until one day:

The Chinese Neighbor’s kids, after 10 cycles of 9 months each, are starting to grow up and want some independence. Even better, they have a lot of Billy Business Cards saved up to spend. They come over to your house and say “hey bill, I hate living in close quarters with my bro, I want to rent a room in your house. I’ll pay you 650 cards a month for it”

of course, you’re a rational person – 650 is better than the 600 your kids are paying… and then we get: INFLATION.

Kid Dynamite – the business cards are of little inherent value to the central bank. Remember, the CB can print them at will. The CB wishes to generate work from its internal population. Also, the next door kids need to make their deals with the other kids – private sector to private sector.

Doesn’t mean that the CB wouldn’t accept the offer (after all he is reading Mankiw), but then we would need to introduce another element to the model – a military – to oust the kids from their bedrooms.

I prefer that the next chapter be that an uncle come to town to stay for a while – he agrees to the business card structure on the condition that he is given a charter to act as the CB agent to facilitate lending to the kids – and of course advising the CB on monetary and fiscal matters. What would happen next?

Kid Dynamite,

Inflation would only ensue if all the work done by Bill and the China family’s children over the ten cycles of nine month periods did not result in any extra production of real resources. If over that time period the child labor had been used to build say an extra room, there is no reason why inflation would be a necessary consequence of having the China family’s kids move into Bill’s house when they turn eighteen. Whether or not Bill is capable of directing his child labor force to increase productive capacity is a different story. Although, if the alternative is zero-productivity unemployment I would assume any work completed under Bill’s direction would be preferable.

Rereading my previous statement I find the phrase: “under Bill’s direction,” to be misleading. This implies Bill is controlling the labor force directly, which is not specified in the hypothetical scenario described in this blog. A better phrase would be “on Bill’s behalf.”

Interesting post by Dani Rodrik on globalization. (h/t Yves Smith here on EU/Greece)

The inescapable trilemma of the world economy

I have an “impossibility theorem” for the global economy…. It says that democracy, national sovereignty and global economic integration are mutually incompatible: we can combine any two of the three, but never have all three simultaneously and in full.

But why are your kids paying the same amount of tax that they were paying before their incomes fell? And what is happening to their expenses- are you charging them the same amount for food, rent, and utilities? If they are trading with each other why are the prices of trade-able goods and services not falling along with the supply of business cards? Perhaps the prices are staying high because China Family is spending the cards that they accumulated, buying up all of your kid’s Vegemite.

You describe the economy: “there is no longer much work being done around the house. The garden is in a sorry condition and rubbish is piling up.” Why are your kids so lazy? Or is it that the Draconian Emperor (you as the govt) running the economy stubbornly refuses to bring their expenses down proportionately with income?

What happens when we introduce Arab Family who just discovered their house sits atop a geothermal energy source. They supply both your family as well as China family with heat and electricity. The winter is particularly cold and China family desires more heat so they send more of their spare cards to Arab Family in exchange for more heat. But Arab family only has a fixed supply and tells your family that they will have to either pay more for heat or get less heat. Your family would rather forgo a snack than be cold so they pay the higher price for heat. But now they have less to pay for Vegemite and so your kids are forced to go into your pantry so they can sell more Vegemite to China family so that they won’t have to go over the fence and work.

Last Mile update: Meteor Blades and BarbinMD, influential bloggers at Daily Kos, have cited Randy Wray in several posts. Daily Kos is a widely read progressive Democratic site.

When prices are stable in the face of productivity enhancement that allows for the production of 3-4% more goods with the same resources/effort, that IS inflation. The hidden cost of inflation is being masked by higher productivity (or cheap labor from, say, China). So your inflationary policies are robbing some citizens of 3-4% purchasing power increase every year. Of course for every loser there is a winner and someone is benefiting from that inflation. Those someone’s are most heavily concentrated in DC and on Wall St.

Thanks for the alert, Tom Hickey. I’m headed over. Glad to see the modern money principles being more widely discussed…

Dear Kid Dynamite

Or I act as an entrepreneur anticipating they will want to live at my house and I make extensions and increase “productive capacity”. Once I cannot do that then inflation might be an issue but I can then simply put the tax rate up to choke of excess demand.

best wishes

bill

Dear Bill,

Of course your model is valid – but it is valid because of the assumptions you made. Adam Smith defined the goal of all the economic activities as maximising consumption. Your kids are trying to do exactly that. What if in your model you have a not a Chinese but a German family believing in “Der Merkantilismus” and their children not only work on your property but also keep marching in their backyard to the sounds of Parademarsch?

One day they will cross the fence with a tank made of cardboard and take away a piece of your backyard claiming that they need more space and they have accumulated enough of your bonds to make they claim justified – and your kids won’t be able to do anything because the German kids grew stronger. You made them stronger.

(To all the German readers: I only refer to the stereotype valid in period circa 1860-1945).

Dear Adam (ak)

The model is a reflection of the way the modern monetary system operates. The assumptions are entirely applicable to the real world we live in unlike the assumptions that drive mainstream economic theory.

On top of the monetary system, lies a political system and national agendas. Of-course, they can deliver negative consequences of the type you outline. But those considerations are beyond my professional expertise and irrelevant to the point I was making with the model – it is a learning device to allow people to resolve difficult issues in monetary economics.

best wishes

bill

Dear Kid Dynamite

You said:

Yes they are. The difference is before Month 1 there was no monetary system and so need to work to pay taxes. At the end of Month 9, the monetary system is in place and they have legal obligations (600 cards per month) which I have forced them to default on by not supplying enough cards.

best wishes

bill

This “model” is nothing close to how the modern monetary system operates Bill.

Name one country in the world that imposes taxes first, and requires citizens to pay regardless of income. A tiny proportion of taxes operate in this way (council fees, land tax, perhaps).

This and its predecessor is a fantastic presentation of mmt basics. Could it be extended to the creation and resolution of inflation, the utility of interest rates in controlling inflation, worker-capital disputes leading to stagflation, politically uncuttable expenses leading to excess spending, etc., private fractional banking with credit creation, and resource shocks? Or just one of the above? Thanks!

Name one country in the world that imposes taxes first, and requires citizens to pay regardless of income. A tiny proportion of taxes operate in this way (council fees, land tax, perhaps).

The colonial British actually did this in Africa to force the natives to work. Don’t have the citation off-hand. Perhaps someone else remembers.

Dear Gamma

I could have made taxes a function of national income and therefore introduced some automatic stabilisation into the model. But it would have been more complicated again and you would still get the same result. A lack of fiscal support undermines private saving and if carried out long enough will drive the private sector into insolvency.

The accounting dynamics and stock-flow mechanisms in the simple model are exactly the same as those operating in modern monetary systems. Most commentators in the media fail to demonstrate an understanding of these underlying mechanics.

We need to walk before we can run!

best wishes

bill

Dear Burk

Thanks for the comment. It could be extended in many ways but then I would be getting beyond the scope of the purpose which is to illustrate the underlying national accounting relationships and their dynamics. I will think about extensions though that don’t muddy the waters too much.

All your suggested extensions are important considerations that overlay the basis stock-flow relationships that my little play model illustrate. Many of them are in the politicial rather than monetary sphere, which is not to say their manifestations don’t have monetary implications (they clearly do).

best wishes

bill

Dear Tom and Gamma

Imposing a poll tax was often used by colonialists to force a currency onto an otherwise “independent” nation of people. Then the complexities of the tax system that Gamma noted followed.

best wishes

bill

bill wrote, in a comment reply:

“Yes they are. The difference is before Month 1 there was no monetary system and so need to work to pay taxes. At the end of Month 9, the monetary system is in place and they have legal obligations (600 cards per month) which I have forced them to default on by not supplying enough cards.”

then reduce taxes! you’ve balanced the budget after all, why continue with this surplus? better yet, why not remove your monetary system – just declare your currency worthless, end taxes and salaries, totally screw the chinese neighbors who have saved up your business cards, and let your kids go back to watching tv and eating Cheetos.

i am eagerly looking forward to the example where you show what happens when deficits balloon and you illustrate why it’s not a problem

Kid Dynamite and bill, I think you need to distinguish between deficit spending with currency and deficit spending with gov’t debt.

At the beginning, I think you need to add some steps.

1) An “entity” prints currency (600).

2) The “entity” gives the currency (600) to the gov’t.

3) The gov’t then deficit spends the currency (600).

“If the budget is balanced there can be no net saving or net accumulation of financial assets.”

Assuming no debt, does that mean there is no private spending either?

I would like to see private spending and wealth/income inequality (possibly even including “retirement” inequality) included.

Off topic but…

For JKH and anyone else who would like to comment.

From:

http://macroblog.typepad.com/macroblog/2010/02/the-punch-bowl-the-party-the-exit.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+typepad%2FRUQt+%28macroblog%29

“Here’s the way I think about the options addressed by the Chairman in his prepared remarks. Let’s start with a well-traveled metaphor for how “policy accommodation” works:

Step 1: The Fed fills up the punch bowl (by buying assets and lending funds to financial institutions, which corresponds to a like quantity of liabilities on the central bank’s balance sheet, which includes bank reserves).

Step 2: Bankers spike the punch (by leveraging the quantity of bank reserves outstanding into a multiple quantity of loans to the private sector).

Step 3: The party’s on (as businesses and individuals support production and consumption from the credit provided).”

“By Dave Altig, senior vice president and research director at the Atlanta Fed”

I think you need to distinguish between deficit spending with currency and deficit spending with gov’t debt.

The government is the issuer of the currency, which it uses for its disbursements. It does not borrow in order to spend. It does not tax in order to spend. Government spending is the way the government issues currency into the non-government economy by government purchases of goods and services and other disbursements.

Debt issuance is a monetary operation rather than a fiscal one. Debt issuance transfers the excess reserves generated by deficit spending through currency issuance into savings of non-government net financial assets when the debt is purchased by non-government entities. It is a transfer of one government liability/non-government asset into another. It’s a wash.

Winterspeak has a short summary of MMT here that explains how it works clearly and concisely.

Would it be possible to eventually have deficit spending with currency thru the interest on the national debt?

At the beginning, I think you need to add some steps….

1. The Fed credits the Treasury’s reserve account at the Fed (600).

2. The Treasury disburses that amount through spending on goods and services and other disbursements (600).

This occurs through writing checks, e.g., SS, and electronic transfers. No cash is involved. This is not the way that cash enters the banking system. Banks exchange reserves for cash as demand at the window.

Through the settlement process the 600 in the Treasury’s reserve account is transferred into the reserve accounts of the commercial banks that the recipients of the Treasury disbursements use. Then these banks credit the respective deposit accounts of there customers who spend, save or invest the funds as they chose.

Note that reserves themselves are never spent into the economy. They are for settlement purposes in the FRS only.

Would it be possible to eventually have deficit spending with currency thru the interest on the national debt?

Interest payments on the national debt are made through currency issuance and increase non-government net financial assets. Interest on national debt is part of the budget, so yes, deficit spending can occur through interest payments. They are government disbursements, just like other government disbursements.

“Here’s the way I think about the options addressed by the Chairman in his prepared remarks. Let’s start with a well-traveled metaphor for how “policy accommodation” works:

This conceptual model misrepresent what happens operationally. It is based on the erroneous money multiplier that presumes incorrectly that banks “lend reserves,” or lend on reserves.

Tom Hickey, I don’t know if it will work out, but I’m trying to come up with a wealth/income inequality scenario (table like here) with positive price inflation targeting where the gov’t does deficit spend with gov’t debt (the national debt).

Dear Fed Up

I will reply to your points later but if you want my spreadsheet to help you with your innovations send me a real E-mail and I will post it to you.

best wishes

bill

“i am eagerly looking forward to the example where you show what happens when deficits balloon and you illustrate why it’s not a problem”

Please define “balloon” so that there’s no misunderstanding. Do you mean a very large deficit in the pursuit of full employment? Continued deficits after full employment is reached? Something else?

Thanks.

Tom Hickey said:

“1. The Fed credits the Treasury’s reserve account at the Fed (600).

2. The Treasury disburses that amount through spending on goods and services and other disbursements (600).

This occurs through writing checks, e.g., SS, and electronic transfers. No cash is involved. This is not the way that cash enters the banking system. Banks exchange reserves for cash as demand at the window.

Through the settlement process the 600 in the Treasury’s reserve account is transferred into the reserve accounts of the commercial banks that the recipients of the Treasury disbursements use. Then these banks credit the respective deposit accounts of there customers who spend, save or invest the funds as they chose.

Note that reserves themselves are never spent into the economy. They are for settlement purposes in the FRS only.”

Under that scenario, it seems to me that anything other than currency is some type of debt. Assuming that, I would say 600 of some type of debt is created and less (possibly a lot less) currency is actually printed.

Tom Hickey said: “Would it be possible to eventually have deficit spending with currency thru the interest on the national debt?

Interest payments on the national debt are made through currency issuance and increase non-government net financial assets. Interest on national debt is part of the budget, so yes, deficit spending can occur through interest payments. They are government disbursements, just like other government disbursements.”

Good. I’m hoping that I’m starting to get what the model looks like.

Tom Hickey said: “Here’s the way I think about the options addressed by the Chairman in his prepared remarks. Let’s start with a well-traveled metaphor for how “policy accommodation” works:

This conceptual model misrepresent what happens operationally. It is based on the erroneous money multiplier that presumes incorrectly that banks “lend reserves,” or lend on reserves.”

Is this possible and thoughts? Under some past scenarios and if the fed electronically “printed” excess reserves, the banks would just say give us the currency. Then the banks would use this currency as bank capital to make loans. The bank capital multiplier would look like the reserve multiplier.

“Excess reserves” means in excess of the reserve (liquidity) requirement. The banks still need the reserves for settlement, when they credit their customers’ deposit accounts and the customers then write checks on these accounts that are deposited in other parties accounts. The reserves are the bank’s liquid assets that it uses to meet its liabilities, like the checks drawn on customer’s deposit accounts.

Bank assets offset bank liabilities, and bank assets are different from bank capital, which is the equity of the bank. Here is an explanation. Basically, reserve assets involve liquidity, and bank capital determines solvency.

Dear Kid Dynamite

Thanks again for your comment.

You asked:

It is not the monetary system that is the problem but the misunderstanding of it which leads to the abuse that I demonstrated. Why continue the surpluses indeed! The economy was fine running deficits which were supporting saving.

The reason why I would not scrap the monetary system is because it is capable when properly managed create public and private wealth and advance welfare for all the citizens. When it is misused it destroys the same.

I am not sure the neighbours were of Chinese ethnicity. Their name was Dr and Dr China!

You then said:

As Scott said we need a definition. But if I may anticipate – yes, I could have a situation where all real resources in the house were fully employed and no further output was possible in the economy. Then if I kept increasing the deficit beyond that point then I would be misusing the fiscal capacity and I would illustrate to you that it is a problem.

But prior to that, under the circumstances I outlined (the sectoral balances) the deficits were adding wealth and income.

Why don’t you start the discussion on those terms and let me know if you disagree with those propositions. All sorts of horror scenarios can be dreamed up where I become an idiot and misuse the monetary system I am in charge of and bad outcomes occur. Definitely – and that happens in the real world too. We can also imagine military invasions by the China Family as one comment conjectured. Sure – the US invades nations often.

But why not start on my terms and work through the model as it is and see if we disagree on the stock-flow consistency and the national accounting. That would be a good place to start.

best wishes

bill

Under that scenario, it seems to me that anything other than currency is some type of debt. Assuming that, I would say 600 of some type of debt is created and less (possibly a lot less) currency is actually printed.

Well, I suppose you could say that the Treasury’s being provided reserves from the Fed corresponding to its currency issuance means that the Treasury has a liability to the Fed, but the Fed as central bank and the Treasury are both the government, and the government cannot “owe” itself anything except as a fiction of accounting to satisfy accounting identities. There is nothing “real” going on though. It’s just bookkeeping that records what government does internally. It doesn’t impact the real economy other than to facilitate the flow of funds through settlement in the FRS.

It definitely is not like the Fed lends the money to the Treasury and then the Treasury spends it into the economy, which is, I suspect, what you may be thinking. There is a widespread conspiracy theory that the Fed is a private bank that creates money and lends it to the Treasury at interest. This is completely bogus.

I see where you are going, though. You might say, then, where does the Fed get the reserves? Does it “borrow” them from someone? If where does that someone get them, and so on ad infinitum. The government doesn’t borrow from anyone when it issues currency. The reserves provided by the Fed are simply for liquidity purposes. There aren’t two real things, reserves and currency. These are numbers in spreadsheets, reserves in the interbank system, and currency in the commercial banking system. Some of the government money in the commercial bank system is cash, but this is a very small proportionally. The banking system is essentially spreadsheet containing constantly changing numbers.

Reserves just make the currency liquid so that it can flow. “Reserves” were physical (gold) when there was convertibility but now with a fiat currency, which is by definition non-convertible, nothing real corresponds to reserves. Nada. Zip. You can’t convert dollars into reserves. They are spreadsheet entries used only for interbank settlement. Reserves are an accounting fiction for settlement purposes only . Government issues currency through disbursements and reserves at the Fed provide the liquidity for settlement in the interbank system (FRS).

Fed up, when I say that “You can’t convert dollars into reserves,” I mean you as an individual, not a generic “you” that signifies that it is not possible to convert cash into reserves and vice versa. But only banks can do this, because only they have access to the interbank system, along with government.

Next time, you’ll have to introduce credit and the horizontal relationships, to give us another big piece of the puzzle!

Is it only me that worries that we are giving China too much US treasury savings? I mean they are acquiring some serious purchasing power, that they might some day use. Hell, at the rate they’re going it won’t be long before they can live off interest alone.

I also wonder how the rest of the world’s banking system will survive if the expansion of US debt stopped or contracted.

Bill –

thanks for the replies. look – it’s fairly simple to illustrate that you can’t have sustained surpluses in your business card economy when you start from month 1. without even bothering with the shenanigans, you can just try to tax at 600 cards and spend 400 cards in wages – then you get insolvency in month 1. I think what people like me are having a much harder time understanding is if you’re suggesting that because sustained surpluses don’t work then it implies that sustained deficits must then work. This seems clearly and obviously wrong, and I don’t even think it’s your point – but it is what “we” non-MMT’ers hear (correctly or incorrectly) when MMT practitioners argue against reducing the deficit – we hear “the US doesn’t need to balance their budget because government debts are different from household debts, the government doesn’t need to fund its spending with taxes or debt, and surpluses lead to bad things.” We turn around and reply “but that doesn’t mean we can accumulate endless debt and deficit – it has to end badly at some point” – IN THE REAL WORLD!

I’m not sure I really want to debate this next point with you, although i don’t think it’s really true. you wrote:

“It is not the monetary system that is the problem but the misunderstanding of it which leads to the abuse that I demonstrated. Why continue the surpluses indeed! The economy was fine running deficits which were supporting saving.

The reason why I would not scrap the monetary system is because it is capable when properly managed create public and private wealth and advance welfare for all the citizens. When it is misused it destroys the same.”

Things were fine in your household before you introduced an artificial currency and monetary system, weren’t they? you clearly don’t need business cards to get them to do the chores – the business card economy doesn’t create any wealth or advance welfare for your kids does it? couldn’t they just have a list of chores to do instead – and consequences if they don’t do them?

as for your question for clarification from me: what is the definition of full employment in your house? your kids are fully employed as early as month 2 aren’t they? perhaps you can show both in your next example: how continued deficit spending WITHOUT full employment isn’t a problem, while continued deficit spending WITH full employment is a problem.

you also made a reference earlier to “productive capacity”… i’d love a more detailed discussion of that point. Trying to bring it back to real world relevance again: i’m still confused as to what you are suggesting in terms of full employment as it relates to the USA. would it be ok if the government paid all unemployed people to dig holes and fill them in again? or do the jobs have to be “productive.” if the jobs don’t have to be productive, then instead of paying people to dig holes and fill them in, why not just pay the people to sit at home and do nothing? (and nevermind the fact that this may sound like unemployment insurance, although it may be relevant!”). Would it be ok if the government spent a billion dollars creating jobs that produced a fraction of that in “capacity” ??

Hi to everybody, fascinating blog indeed! Will spread the word around to everybody I know!

Here is a question:

What makes the Chinas’ kids eager to work for foreign currency in their neighbor’s household?

Maybe they have some spare time which they prefer to spend working second job, and they weren’t able to find such in their own household? What makes the foreign business cards valuable for them as they don’t need them to pay their own taxes – the possibility that they can exchange it for domestic money?

Hey Kid

I remember you commenting on an article of Randall Wrays and I’m glad you are over here participating in this discussion. It shows you think what these guys are saying is worth exploring otherwise you would just ignore it. This is the first step to understanding.

I’d like to comment on your discussion with Bill but correct me if I put views into your head which you dont have.

You commented that Bill didnt need the business cards to get the work done all he needed was the authority to punish them if they didnt do the chores.This is absolutely correct and Im sure Bill would not disagree but I think its kind of a weak point. Here is why. You are essentially saying that a simple economy doesnt need money. Nothing earth shattering there. All of us who have considered economics in any depth know that to be true. One could even argue that it is technically not even true in our real world economy that we need money but no one would argue that our modern system of money has not made our world much better (efficient?) at getting things done. But without credit that is measured in some “unit of account” that we all adhere to our world would be a vastly different place (maybe better I dont know) but I hope you are not arguing to do away with it completely. I think its also safe to say that a system without monetary authorities capable of enforcing use of a currency we would have a system more likely to be anarchic and unstable. The real question is how can monetary authorities behave responsibly or maybe what is the responsibility of monetary authorities?

Bills simple example demonstrates the operational realities of our current monetary system, thats all. It shows what “deficits” measure. It shows how taxation, trade and savings function and how they are accounted for . Thats all it does. However, this model can also be expanded and lose none of its usefulness because the principles apply no matter how big the economy is and how many people are participating. There is no “fallacy of composition”. What holds in the simple example also holds at the larger level.

Your criticism does suffer from the fallacy of composition however because while true his little economy doesnt need a monetary authority or money at all, OUR real world economy does need it or in the very least DOES HAVE IT. SO again the only question is how should a monetary authority behave?

Many are uncomfortable with the idea of authorities issuing money and enforcing taxation AT ALL, while ALL OF US agree that there is a limit to how much authority we wish the authorities to use, these are political differences. I’m putting you in the former category so I would ask you ; What do you propose? A return to the gold standard? 100% reserve banking? Do you have a coherent idea of what changes these would lead to in the real world?

You seem to think that our monetary authorities dont do enough to control inflation whereas I would argue jut the opposite, they do waaaaay too much. Not only that they go about the wrong way by forcing unemployment on the system to keep aggregate demand down. They have a predominate view of inflation and they use a socially dislocating tool to enforce it.

I would argue that the answer to your question about digging/filling holes is yes. Not because its “productive” (is a Wal Mart greeter productive by your definition) but because occupied working people are less likely to engage in anti social behavior which could COST us real resources in building jails and staffing it with more “security” types. However if digging/filling is all we can think of to use our unemployed for I’d say our problems are different, like a LACK OF IMAGINATION. I trust we could “imagine” a whole lot of socially useful things for them to do.

Greg –

“What do you propose?” again – i think the problem with MMT that non-MMT’ers have is that what we hear (even if it’s not what you’re saying) is that “Deficits don’t matter.” Now, i do NOT think this is the view of MMT. It’s quite clear to me that it is impossible to run ever increasing debt and deficits beyond your economic capacity – even if you’re the immortal USA. MMT is arguing that deficits are not themselves the problem – but i feel it’s semantics – they certainly are the problem AT SOME POINT – right? What is that point? that’s the money question. Again, the concern is that we’re much nearer to that point than we’ve ever been (we = USA). And this business card economy example is not showing how deficits are not the problem. it’s showing how constant surpluses ARE a problem.

i think your final paragraph is way off base – i don’t think your MMT economic model, or any economic model, contains variables for anti-social behavior. That’s a qualitative argument, not an economic one. I think the problem of productive jobs is EXACTLY the issue, and every time the president talks about job creation i almost have to laugh and think of no-show jobs on The Sopranos. After all – how can you CREATE jobs?!?! Markets create jobs. Governments don’t create jobs – at least not PRODUCTIVE ones. I don’t think it’s a lack of imagination – it’s a lack of capacity – by definition, doesn’t technology increase efficiency and decrease the need for employment? Combine that with immigration, and the concept of full employment makes no intuitive sense to me. Also, note that past bubbles created FALSE demand, and jobs that were clearly NOT economically productive – that’s why they no longer exist! Did we need mortgage brokers? or real estate brokers? or home builders? CERTAINLY not in the numbers that we had them – we were staffed to bubble demand also!

Now, can governments foster demand by giving out money? Yes – Bernanke’s helicopter could drop kajillions of dollars all over our country, and that might increase market demand for goods and services – and new price bubbles and new asset bubbles – it’s no solution. Inflation is clearly the result there – it doesn’t matter that “governments don’t need to fund their debt” or that they can just create money – sure – i agree – that doesn’t mean there are no consequences.

Note, by the way, that in both the real world and the business card economy, the people who are hurt by inflation are the SAVERS – the value of their savings (in terms of purchasing power) decreases with inflation.

The other day I was having a discussion over at the baseline scenario about how government deficits provide the financial assets the private sector uses to conduct its day to day affairs and that if deficits are continuously cut the private sector will have fewer and fewer assets when someone brought up the example of Andrew Jackson retiring the national debt in the 1830’s. I was thinking about this and am somewhat confused. Presumably there was still currency floating around after Jackson retired the national debt. How is this possible if government deficits equal private sector surpluses $-4-$? I assume it has to do with the fact that the U.S. was on a gold standard at the time, but still I am a little confused. Can someone clear this up for me?

NKlein1553,

The cumulative government deficit equals the net financial assets of non government. After consolidating the balance sheets of the government treasury and the central bank, total non government net financial assets equate to central bank reserves (liability), central bank currency (liability), plus the public float of government bonds.

The normal assets of the central bank are government bonds, and don’t affect the relationships in the equation above, because these bonds consolidate to zero when the central bank is consolidated with the government treasury.

If the cumulative government deficit is zero, then the contribution to non government NFA of reserves, currency, and bonds must be zero. Furthermore, if there is no outstanding public float of government bonds, then the contribution to NFA of reserves and currency must be zero. That can only occur if the central bank’s assets are liabilities of non government, rather than the usual Treasury bonds. That means that in the sectoral credit interface between government and non government, gross financial liabilities offset gross financial assets for a net position of zero.

You see some of this today, at the margin, in the sense that the Fed has acquired private sector assets in its credit easing balance sheet expansion.

(The current MBS portfolio is quasi government risk, but its original funding is not captured in the cumulative budget deficit, and so it is a non government item for purposes here. Some of the other Fed programs are unambiguously private sector oriented.)

(Unfortunately, there is some unrelated budget accounting ambiguity on Treasury’s books, because TARP should never have been treated as a deficit expenditure item. It’s a financial investment in the private sector, offset by government bond liabilities.)

“Markets create jobs.”

Really? Seems like the markets have been falling down on the job for the past ten years or so:

http://www.businessweek.com/the_thread/economicsunbound/archives/2009/06/a_lost_decade_f.html

“Governments don’t create jobs – at least not PRODUCTIVE ones.”

Whose making qualitative arguments now? Like Greg said, is working at Walmart more productive than this?:

http://livingnewdeal.berkeley.edu/

“they (deficits) certainly are the problem AT SOME POINT – right? What is that point? that’s the money question. Again, the concern is that we’re much nearer to that point than we’ve ever been (we = USA).”

The point at which deficits become a problem is when the economy has little to no under utilization of resources. That is certainly not the case at present. I am reminded of the quote by the British Secretary of the Treasury during the Great Depression, Ralph M. Hawtrey:

“Fantastic fears of inflation were expressed. That was to cry, Fire, Fire in Noah’s Flood … It is after depression and unemployment have subsided that inflation becomes dangerous.”

Modern Money Theorists actually write quite a bit about the threat of inflation. If you’re interested in some of their academic work you could try looking through the publications section of the Centre of Full Employment and Equity website:

http://e1.newcastle.edu.au/coffee/

I’m just beginning to look through some of these resources myself. For a less semantic version of these same arguments I suggest starting with Professor Mitchell’s three blogs, Fiscal Sustainability 101.

I’ll just add that if the cumulative government position is actually in surplus, then the balance sheet structure described above is extended to the stage where the government treasury (and the consolidated government sector) has a net financial asset position in the liabilities of the non government sector.

Thanks for the explanation JHK. I’m pretty sure I understand your explanation here of how the central bank’s liabilities (reserves + currency) and treasury bonds equals the non-government sector’s financial assets. You haven’t mentioned any money the central bank uses to pay its own expenses, but I assume that money also counts toward the liability side (or maybe it’s part of currency, I’m not sure). I’m still a little shaky on the history part though. Are you saying that at the time Jackson retired the public debt the assets of the central bank ceased to be part of the liabilities of the private sector? I’m unsure about the exact dates, but at the time didn’t Jackson also abolish the central bank. My question is if assets and liabilities net to zero what were private citizens using as money at that point?

NKlein1553

Sorry, I’m no good on that sort of history. Only describing how it works today.

When the central bank receives revenue, it debits commercial banks reserves and credits its own profit/capital account. When it pays expenses, it credits commercial bank reserves and debits its profit/capital account. (The commercial bank of the payer or payee makes a corresponding entry to the customer account.)

The central bank remits most profit annually to the Treasury.

Alright Kid

Let me ask you this. If we were to have some amazing technological breakthrough and every job currently done by man was done by robots where would we be? You seem to think that would be horrible because NOW no one could do anything productive anymore. We’d just sit around reading, playing golf, playing tennis, screwing, arguing….. you get the picture. IOW all the things we want to do NOW when we dont have to work. The only question at that time would be; How do we distribute the leisure activities? Does the guy who lives closest to the tennis court ALWAYS get it first, and if he wishes does he get to keep it all day?

Back to the real world now. Are only those who farm, mine or manufacture productive? As an anesthetist I am a service provider, I am totally unproductive, I only consume and destroy resources while aiming to keep people pain free during surgery. What about restaurants? They just distribute a transformed agricultural product, thats not productive. Wal Mart productive??? Give me a frikken break! See I can define productive my way and demean a large portion of the private sector as well, but I dont find any of those endeavors as unnecessary or worthless. Maybe I’m more interested in a citizen being “useful” or “helpful” rather than productive. A person can “add value” while not being technically productive.

Note….. I’m not advocating that the govt should employ everyone in any way shape or form nor that they are equivalent to the private sector as a productivity engine. I DO think that the private sector is where most of our imaginative people want to, should and WILL work in a healthy society but a healthy society requires a smart govt, cognizant of what it means and how to be responsible as a currency issuer.

You are just WRONG when you say MMTers (if you mean Bill, Warren, Randall, Marshall, Scott or Winterspeak) claim that deficits dont matter. That is plainly false. What they do say (I believe, they will correct me if I’m wrong) is that the deficit is only relevant as it relates to private savings desires, trade gaps and employment levels. Whatever the deficit needs to be to provide the savings desire of the private sector (including foreigners) and keep employment at the full level is the “right” level. Going above that is inflationary. So the focus on deficit levels them selves while ignoring those other metrics is bad policy. Which is what we have now. In fact when you hear people say they want ” A stronger currency, more exports (as an engine for American jobs), low taxes, a balanced budget, a reduced debt and increased private savings and low unemployment” That is an IMPOSSIBLE combination of wishes if you understand how the monetary system ACTUALLY functions. You might as well wish for robots to do every job currently done by humans or wish for a trillion dollar helicopter drop at your house.

NKlein1553,

If that wasn’t clear on the expense side, the central bank just creates the money by writing a cheque, etc. It’s similar to the case of a commercial bank. Both types of bank create money “from nothing”. The commercial bank creates new deposits in doing so. The central bank creates new reserves (and commercial bank deposits).

What some people don’t realize, in addition to the fact that the process is analogous for the two types of bank, is that it works not only in the case of new loans (balance sheet transactions), but also in the case of new expenditures (income statement transactions).

Both types of money creation are reversible. Commercial bank loan pay downs destroy deposits. Central bank loan pay downs destroy reserves and deposits. Commercial bank revenues destroy deposits. Central bank revenues destroy reserves and deposits.

greg, just for the record – you wrote; “You are just WRONG when you say MMTers (if you mean Bill, Warren, Randall, Marshall, Scott or Winterspeak) claim that deficits dont matter.”