I have received several E-mails over the last few weeks that suggest that the economics…

Extending unemployment benefits … an omen

As the danger of a global depression recedes, the themes I am picking up regularly now from commentators, politicians etc are all pointing back to the mainstream status quo version of the way the economy works, in particular, for the purposes of this blog the labour market. I expect to increasingly hear and read the rhetoric that dominated the public debates prior to the crisis – that unemployment is essentially a supply-side phenomenon reflecting choices made by individuals in the context of government welfare policy that distorts these choices in favour of not working. In this context, the simple act of extending unemployment benefits in the US has been controversial. This takes us back to the dominant debates over the last 20 years which saw governments all around the World pursuing policies that were antithetical to full employment and pernicious in their impact on the victims of their policy failures. Stay tuned – 2011 – the mainstream will be in full attack mode again – conveniently forgetting where we have been over the last 3 or so years.

In recent days, there has been a kerfuffle about statements made by Republican senator for Arizona John Kyl last week (March 1, 2010) which can be read from the Congressional Record for the Senate debate about the request to extend unemployment benefits in the US.

I have to say that in one sense I agree with Kyl rather than the so-called progressive response to him. Which makes for an interesting tension I would suggest. More about which later.

Here is some of what he said (you can read the full account by going to the link I provided above to the Congressional Record):

I wish to address the bill that is on the floor. The bill has been denominated by my colleagues on the Democratic side as a jobs bill, but it will not create any new jobs and when considered in conjunction with the health care legislation the President has proposed will actually cost jobs and I wish to address that …

What of the subject of unemployment coverage extension which we have just been debating? That doesn’t create new jobs. In fact, if anything, continuing to pay people unemployment compensation is a disincentive for them to seek new work. I am sure most of them would like work and probably have tried to seek it, but you can’t argue it is a job enhancer. If anything, as I said, it is a disincentive …

So it is not a jobs bill, and it is beyond me how it could be denominated as such.

He was then attacked by a Senator from Montana who said that with the Unemployment to vacancy ratio above 5 it was “ridiculuous” to claim that “unemployment insurance is a disincentive to jobs”.

Kyl then responded:

… I said it is not a job creator. If anything, it could be argued it is a disincentive for work because people are being paid even though they are not working. I certainly did not say, and would never imply, that the reason people don’t have jobs is because they are not looking for them. It is true that a lot of Americans have gotten so tired of looking for jobs or believe they are not going to find them that they have stopped looking and, as a result, the unemployment numbers are probably higher than the roughly 10 percent that is quoted now. Some people believe it could be as much as 17 percent. This is why I have supported every extension of unemployment benefits. I have voted for them. As my colleague says, there are five people looking for every job that exists. If they cannot get the jobs, they needed support.

But what I said is true, and if my colleague can find a source that says it is not true, show me. But providing unemployment benefits doesn’t create jobs. The bill we have before us is denominated around here as a jobs bill. That is the biggest single expenditure in the bill, and it doesn’t create jobs.

In between these exchanges there were other statements from Kyl.

He spoke at length about what he considered to be Democratic chicanery that they were trying to exempt the bill from the “pay-go” rules which require that if the US Government intends to spend money they have to “find an offset in the form of a spending deduction or revenue enhancement that covers the cost of that new spending.”

All Kyl demonstrated in that exchange is that he doesn’t understand that the US government faces no intrinsic financial barrier in being able to pay the unemployment benefits without any offset and that the pay-go legislation is always likely to be counter-productive in the sense that such fiscal rules do not allow governments to react fully to a crisis that requires counter-stabilising net spending.

He also claimed that because Obama had said they would have to put up taxes to pay for the new spending that it would reduce jobs. All revealing a failure to understand macroeconomics.

On March 4, 2010, Paul Krugman attacked Kyl in his column Senator Bunning’s Universe.

For non-US readers who haven’t been following this debate – Bunning is Republican Senator Jim Bunning of Kentucky – who stalled the debate on the extension bill and generally showed contempt for the unemployed throughout the proceedings.

Krugman claims that the debate showed the:

… incredible gap that has opened up between the parties. Today, Democrats and Republicans live in different universes, both intellectually and morally … What Democrats believe is what textbook economics says: that when the economy is deeply depressed, extending unemployment benefits not only helps those in need, it also reduces unemployment. That’s because the economy’s problem right now is lack of sufficient demand, and cash-strapped unemployed workers are likely to spend their benefits. In fact, the Congressional Budget Office says that aid to the unemployed is one of the most effective forms of economic stimulus, as measured by jobs created per dollar of outlay …

In Mr. Kyl’s view, then, what we really need to worry about right now – with more than five unemployed workers for every job opening, and long-term unemployment at its highest level since the Great Depression – is whether we’re reducing the incentive of the unemployed to find jobs. To me, that’s a bizarre point of view – but then, I don’t live in Mr. Kyl’s universe.

First, Kyl supported the bill and in his statement above he clearly indicates that he thinks that if the unemployed “cannot get the jobs, they needed support”. So I think Krugman is fitting the wrong criminal.

Second, Kyl is both correct and incorrect about the extension of unemployment benefits not creating any jobs. Where he is correct is that the measure proposed by the Democrats is definitely not a “Jobs Bill” (to quote Kyl).

To see this, you should understand that he is wrong (as per Krugman’s intervention) because he doesn’t understand automatic stabilisers. The provision of income support works automatically to stop aggregate demand falling as far as it would in their absence. It is the opposite of the tax system – revenue collapses which increases the budget deficit which is expansionary in itself.

But to claim that income support that ekes out via the automatic stabilisers is a strategy for job creation – which is what the Democrats have been suggesting and which is implied by Krugman – is to deprecate the concept of a job creation program beyond recognition.

Third, this bears on Krugman’s claim that the Republicans are heartless while the Democrats are moral types. The fact that the US Government – currently controlled by the Democrats has allowed unemployment to rise to 10 per cent (17 per cent if you include those who have given up looking) and are only responding by extending the pitiful income support available to the victims of the aggregate demand collapse tells me that there isn’t all that much difference between the two parties.

Both parties’ actions are being driven by a fundamentalism about deficits and debt – which reflects the common misunderstanding about the way the modern monetary system operates and the opportunities the fiat currency system provides to a currency-issuing government, such as in the US.

It is this basic error in reasoning that is common across both parties and really dominates the more superficial differences that one might observe in demeanour and policies.

Not to put too finer point on it – statements from the Obama Administration over the last year – “the US has run out of money” etc – have exemplified the best rhetoric that the deficit terrorists can muster.

To see how restricted the US government’s stimulus response has been you might like to read this article in yesterday’s (March 7, 2010) Financial Times – Good for America, as far as it went by Clive Crook who says that “Three-quarters of the electorate thinks the stimulus was mismanaged. The country’s children are being strung with debt, voters reckon, for no good reason.”

Crook however concludes that:

The public is wrong about the stimulus, but the error is understandable. As with healthcare reform, the machinations that produced it were gruesome. As with healthcare reform, the administration had no clear olicy of its own, and relied on a dysfunctional Congress that the country does not trust.

Two other factors intervened. First, the downturn was deeper and more tenacious than expected. Second, not so well understood, the stimulus was smaller than it looked.

It is clear that the early responses were inadequate and reflected the neo-liberal ideology running throughout the Obama Administration. The fact they thought monetary policy would be effective as a first reaction demonstrates their failure to appreciate both what was happening and what tools were appropriate.

As an aside, Australia’s fiscal response was early and significantly larger than the US government’s response and that helps explain why we largely avoided the major meltdown that other nations are still struggling through.

Crook summarises the Congressional Budget Office data which shows that:

… the stimulus boosted output in the fourth quarter of 2009 by between 1.5 per cent and 3.5 per cent, and reduced the unemployment rate by between 0.5 percentage points and 1.1 percentage points – unspectacular gains, given the scale of the commitment, but valuable nonetheless.

Crook also cans Barro’s claims which I addressed in this blog – Pushing the fantasy barrow.

But his most interesting observation (quoting an NBER study) which helps explain the extreme lassitude that the US economy is wallowing in at present was that:

… the aggregate fiscal expenditure stimulus in the US, properly adjusted for the declining fiscal expenditure of the 50 states, was close to zero in 2009.

Would the situation have been worse under the Republicans? I doubt it. So the claim that the Democrats are the nice ones who care about the unemployed and are actively seeking stimulus measures turns out to be false – at least in 2009.

However, Kyl is also misguided about the role of unemployment benefits. Here is some ways of thinking about that question.

UV Curve for the US

Economists have long used the unemployment-vacancy (UV) relationship, the so-called Beveridge curve, which plots the unemployment rate on the horizontal axis and the vacancy rate on the vertical axis to investigate these sorts of questions.

The logic is that movements along the curve are cyclical events and shifts in the curve are alleged to be structural events. So for many countries the UV relationship has shifted several times over the last 40 years or so.

However, the notion that there is a neat decomposition between shifts in and movements along the curve is highly contested and has not been reliably established in the empirical or theoretical literature.

One of my earliest papers, which came from my PhD work was published in 1987 – ‘The NAIRU, Structural Imbalance and the Macroequilibrium Unemployment Rate’, Australian Economic Papers, 26(48), pages 101-118 – showed that structural imbalances (supply constraints) can be the result of cyclical variations and can be resolved, in part, by attenuating the amplitude of the downturns using fiscal policy.

In other words, there is no decomposition as the mainstream would like us believe.

This is reinforced by work I did a decade ago where it is clearly shown that where the U-V curve shifts, almost always the shifts were associated with major recessions which generated structural-like changes in the labour market. In other words, the shifts are driven by cyclical downturns (aggregate demand failures) rather than any changes in autonomous supply side behaviour (like worker attitudes changing, or welfare policy introducing distortions to incentives, etc).

However, the mainstream interpretation which Senator Kyl is just rehearsing is that the shifts are due to a failure of the unemployed to seek work as effectively as before.

This is the classic line taken by Layard, Nickell and Jackman in their 1991 book which was extremely influential at the time and basically provided the theoretical case for the OECD Jobs Study (1994) which served as the blueprint for labour market deregulation since the early 1990s and underpinned the pernicious welfare-to-work policies that many governments introduced in the last 15 years.

Layard and Co claimed that outward in the European Beveridge curve, for example, represented a “a fall in the search effectiveness among the unemployed”. They repeatedly have claimed that the persistent unemployment over the last 20 years is the result of workers becoming “too choosy”.

Since that time, the OECD has been constantly pressuring governments to abandon the hard-won labour protections which provide job security and fair pay and working conditions for citizens. They also deemed welfare payments including unemployment benefits to be disincentives to work.

Please read my blog – The OECD is at it again! – for more discussion on this point.

An examination of the empirical evidence over the period would suggest that the major claims made by Layard and Co (and the myriad of hangers-on that have followed them) do not bear scrutiny.

While they claimed declining search effectiveness distorted by excessive generous welfare payments caused the rising unemployment rates prior to this recession, it is highly probable that both are caused by insufficient demand for labour. The policy response then is – of-course – entirely different and would emphasis fiscal policy expansion underpinning job creation.

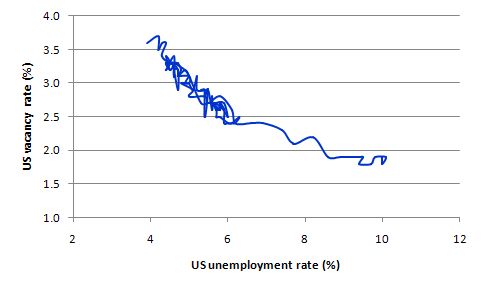

But this argument cannot even be made in the current downturn. The following graph shows the US Beveridge curve since December 2000. The vacancy rate is from the US Bureau of Labour Statistics JOLTS data for job offerings which only begins in December 2000. The unemployment rate is also taken from official BLS data.

Even the mainstream “text book” case would tell you that the data is recording a cyclical event with the sharp movement down a static U-V relationship – this sort of movement indicates a fall in job vacancies and a corresponding rise in unemployment – both being the manifestations of a collapse in aggregate demand and a failure of government policy interventions to redress it.

Phase diagrams

To examine this further, I had a look at some phase diagrams.

I first started using phase analysis in this 2001 paper – Exploring labour market shocks in Australia, Japan and the USA, which has since been published but you can get the free working paper version at the link provided. You will find reference in that paper to other relevant material if you are interested.

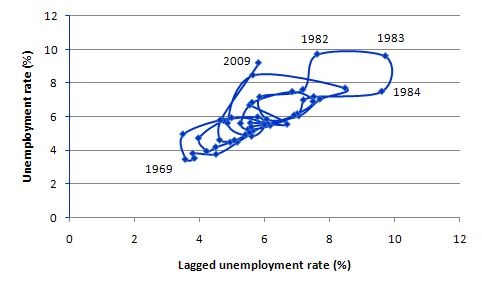

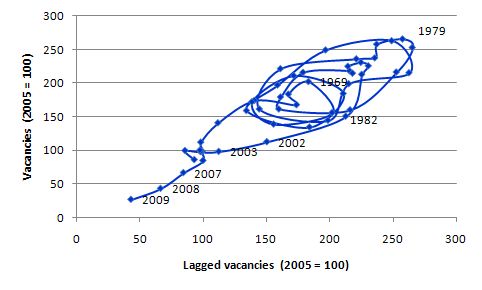

The following two phase diagrams show the current values of the respective time series plotted on the y-axis against the lagged value of the same series on the x-axis. The annual data is from 1960 to 2009 (so the graphs are for 1961 to 2009 given the lagged values).

The first graph shows the phase diagram for the US unemployment rate while the following graph shows the phase diagram for vacancies.

The vacancy data is derived from the Help wanted advertising index (2005=100), compiled by The Conference Board and published as part of the OECD Main Economic Indicators. I could have used the US Bureau of Labour Statistics JOLTS data for job offerings to generate a similar diagram but as noted above the dataset only begins in December 2000 and so doesn’t show you the past cycles.

These scatter plots are helpful in four distinct ways. First, the charts provide information on whether cycles are present in the data.

Second, the presence of “attractor points” can be determined. The points might loosely be construed as the middle of each of the traced-out ellipses.

Third, the magnitude of the cycles can be inferred by the size of the cyclical ellipses around the attractor points.

Fourth, the persistence (strength) of the attractor point can be determined by examining the extent to which it disciplines the cyclical observations following a shock. Weak attractors will not dominate a shock and the relationship will shift until a new attractor point exerts itself.

So if you examine the unemployment phase diagram first, you can see that US labour market has fluctuated around an attractor unemployment rate of around 5 to 5.5 per cent although the magnitude of the cycles around it has been variable. The early 1990s recession, while significant, did not promote a new attractor nor has the current recession.

This is quite different to say Australia where the attractor shifted in the 1974-76 period outwards (during the major recession), and the two subsequent recessions (1982 and 1991) oscillated around the higher point with varying cyclical magnitude. The recent downturn has not caused a shift in the current attractor in Australia – probably because it was a relatively mild recession.

It is clear in the US case that the economy takes several years to recover from a large negative shock even if the attractor remains constant.

But it is clear that the direction of the dynamics during a recession is to generate loops that head in the North-East direction then resolve slowly via a south-west adjustment.

While the vacancy rate attractor for the US has not exhibited any notable shifts over the period examined (since 1960) the cycles have been of different magnitudes.

The current downturn however suggests that a new attractor might be forming such is the collapse in the demand-side of the US labour market. So if anything there is a movement downwards in the relationship.

The mainstream text-book supply-side analysis would interpret any upward movement the unemployment relationship as a decline in labour market efficiency.

But equally, they would interpret the downward shift (or tendency) in vacancy relationship as increasing matching efficiency. Clearly, both states cannot hold.

The only consistent interpretation for the dynamics shown is provided by the view that the US economy is now severely demand constrained as a result of the collapse in private spending and the failure of the government response to adequately stimulate demand.

Any endogenous supply effects that may have occurred in skill atrophy and work attitudes – for example, workers giving up looking for work and instead trying to tide themselves over with the receipt of unemployment benefits – are not causal but reactive.

Conclusion

There has been a huge number of research articles published in the self-serving mainstream journals supposedly proving that unemployment support reduces employment by undermining the incentives of the jobless to search for work.

If you read this literature you will realise it proves nothing of the sort. The literature is replete with fudged datasets, spurious techniques and other niceties that the mainstream researchers use to cheat on their findings or mislead the reader as to what is actually being demonstrated.

The most sustainable argument that can be maintained however is quite different. It is summarised by this nice quite from Michael Piore (1979: 10):

Presumably, there is an irreducible residual level of unemployment composed of people who don’t want to work, who are moving between jobs, or who are unqualified. If there is in fact some such residual level of unemployment, it is not one we have encountered in the United States. Never in the post war period has the government been unsuccessful when it has made a sustained effort to reduce unemployment. (emphasis in original) [Unemployment and Inflation, Institutionalist and Structuralist Views, M.E. Sharpe, Inc., White Plains]

Despite all the labour market and related supply-side reforms that have been introduced across the OECD countries over the last 15 or so years, the unemployment rate persists at high levels due to demand deficiency.

The conventional NAIRU approach tends to neglect the role of aggregate demand and focuses on the supply side. The empirical foundation of the NAIRU is without credibility – Please read my blog – The dreaded NAIRU is still about! – for more discussion on this point.

And if the government isn’t willing to provide jobs for the unemployed, which is the best option when private demand collapses, then the only moral thing to do is provide indefinite income support at a level sufficient for the unemployment worker to avoid falling into poverty.

“As the danger of a global recession recedes”

I thought you were forecasting a high likelyhood of a double-dip less than a week ago Bill?

Dear Lefty

Thanks for picking that up – I meant to write global depression but in haste obviously wrote recession.

So on those grounds both points are not inconsistent. Europe is already probably double-dipping (recession) while the rest of the world will depend on whether governments continue to provide fiscal support this year.

Further, the unknown is the US financial system which is largely being propped up with public money. The commercial real estate market over there is probably in as bad a shape as the residential market was in 2007 and could collapse in the same way any time.

But Australia is likely to escape any decline unless the May budget is particularly austere.

best wishes

bill

I wonder if someone might address a question I have regarding stock-flow consistent modeling.

A critique I often read on MMT blogs is that mainstream macroeconomic models are not ‘stock-flow consistent’. I am not exactly sure what is meant by this. My guess here is that a stock-flow ‘inconsistent’ macroeconomic model could generate a set of results which are logically incompatible with one another. So, for example, plugging in certain parameters into an inconsistent model might generate surplus income flows across all sectors — i.e. government budget surplus, trade deficit, and net private savings. Is this what is meant by the ‘not stock-flow consistent’ critique?

I want to understand the meaning of the term ‘model’ itself in this context. Are we talking about basic, theoretical macroecnomic constructs such as IS-LM, Solow, etc., or are we talking about the major DSGE models which today’s mainstream economists ultimately use to generate inflation/growth forecasts? In what way specifically could some of these mainstream models generate results that are not ‘stock-flow consistent’?

I am also wondering what the MMT crowd thinks of the DSGE models which are based on ‘micro-foundations’ and thus fitted, versus the old-school econometric time-series models which used national accounts data. From some of the articles I have read on the levy economics site, the ‘stock-flow consistent’ models seem to favor the traditional national accounts approach.

Thanks a lot for the help and for the great blog — its really a great service to those looking for a clear and consistent view of the economic issues of the day.

Hi Bill,

In the section above regarding phase diagrams, there is no link to your 2001 paper.

Morgan Stanley’s Stephen Roach, speaking on CNBC, puts unemployment at not 9.7. but 11.5, given the 3 million not seeking work that will enter the labor force when things turn around a bit. Plus, most of the new hires are temps. He cautions against premature optimism based on a few reports, saying that the data is still to noisy to discern any emerging pattern. Risk of double-dip ~ 40%.

Paul Volcker is saying that the global economy is still on government life-support. Moreover, the financial crisis is still unfolding in the US, with CRE set to tank next, threatening regional banks. Banks are rebuilding capital rather than lending, and consumers are rebuilding their balance sheets, too. Without expanding credit, the US economy is not going up anytime soon, and the consumer is saving, not going further in debt.

The bright side is that the US government has signaled that it will but a floor under the economy. The dark side is that the US government will not do what it takes to close the output gap with consumers retrenching and exports unable to make up the shortfall in NAD. Moreover, the price of oil is signaling that it will rise at any sign of recovery, threatening to stall growth and generate cost-push stagflation during any recovery.

The really dark side is that it has become clear that the US is not in the mood for financial reform, which leaves more financial consolidation, greater moral hazard, and increasing systemic risk that will just about everyone agrees will implode at some point in the future, sooner or later. That leaves the specter of global depression still in play.

ds, I don’t know enough about the details of economics and MMT to parse this specifically, but scientific theories are expressed using models that relate the theory to facts. The criteria of modeling are consistency, correspondence, and elegance (parsimony). That means that models must be logically consistent, correspond to the fact through operational definitions susceptible to data, and be neither simpler nor more complex than they need to be in order to accomplish the purpose for which they are constructed. The standard critique of economic models is that many of them fail on all criteria.

Stock-flow consistency relates to logical consistency, e.g., taking GNP as a stock rather than a flow, GNP being an accounting identity of national income and expenditure, both of which are flows. Stock-flow consistency basically means that you can’t add apples and oranges and be correct.

Stock-flow consistency also has implications for correspondence. If a model is not internally consistent in its construction, then creating operational definitions susceptible to the data needed to make the model conform to fact becomes problematic.

Stock-flow consistency also relates to elegance, since it means that the model has to conform to accepted accounting identities, which have been constructed to express the data operationally. That is to say, income statements and balance sheets derive from the general ledger, and the general ledger can be deconstructed from the journal into individual transactions. The gives an operational picture of the facts, i.e., what actually happened. Accounting is neither simpler nor more complex than it needs to be to express this in terms of accurate records of actual operations.

Mainstream economic models are criticized for being based on assumptions that do not fit the facts. They are constructed to fit the model, that is, to make a complex model work. Moreover, the standard models are also criticized for being overly simplistic, which is necessary based on their construction in order to make them intelligible. MMT adds that they are also inconsistent to the degree that they violate standard accounting practice. This failure also affects both correspondence through operational definitions, and elegance though over-simplification.

Beginnings of a new global architecture? Former IMF chief economist and now MIT professor Simon Johnson thinks so.

European Monetary Fund, Arriving Soon

Dear SCC (1.20am)

The link is now fixed. Sorry for the trouble.

best wishes

bill

Bill–at some point, is there any chance that you could do a post showing the macro level balance sheet effects of paying down the national debt in its entirety? I mean, pretending that it didn’t cause a depression and more deficit–what are the implications in terms of the financial balances of the private sector, what would happen to “money” in the sense that most people think of, i.e. the ten pound note in my wallet, etc.

Vimothy: you pose an interesting question – i.e. what are the “balance sheet effects of paying down the national debt in its entirety.”

First, as long as the monetary base is counted as part of the national debt (and it’s a sizeable chunk of the national debt) the national debt cannot be disposed of entirely. However it is very debatable as to whether the monetary base is a debt in the normal sense of the word, and hence whether it SHOULD be counted as part of the national debt. I give some reasons for thinking this here: http://ralphanomics.blogspot.com/2010/03/monetary-base-part-of-national-debt.html

Anyway, let’s assume the monetary base is NOT counted as part of the national debt. As regards the rest of the national debt (Treasuries in the US, gilts in the UK, etc), proceed as follows. Buy back the whole lot partially with newly printed money (which means more monetary base) and partially with money collected via extra tax. The former would be reflationary and the latter deflationary. Get the proportions right, and the effect of the exercise would be neutral. Hey presto: the national debt has gone.

One of the many advantages of this: no need to pay interest to those pesky foreigners holding national debt. One of the disadvantages: the much enlarged monetary base could make for instability (though that could presumably be countered by requiring banks to hold much larger reserves, something the Chinese have just done). Also a small amount of national debt means central banks can influence interest rates, so a small national debt is probably desirable.

As I understand MMT, there is no national “debt” in the same sense that households, firms have “debts.” All debts are liabilities, but not all liabilities are debts in the sense of credit obligations. The currency that the government issues is a liability of the Treasury, but that doesn’t mean that the Treasury owes the holder of dollars anything but an other dollar in exchange. The liabilities of the Treasury are accepted by the Treasury in payment of financial obligations to the government, e.g., taxes, fees and fines. One liability extinguishes another.

Treasury securities are also liabilities of the Treasury that pay interest and therefore look like loans. However, they are not credit obligations in the any normal sense, in that they are funded by government currency issuance. Non-government net financial assets created by currency issuance through disbursements are equal to the debt, as required by law. That is, the government is required to issue debt (Tsy’s) $ for $ in the case of budgetary deficits. The reserves created by the disbursements are simply transferred to interest-bearing securities, just as demand deposits are switched to time deposits and back. There is no loan obligation involved. When Tsy’s are redeemed, they are just converted back into reserves again and the funds show up on the seller’s deposit account.

Including base money in the national debt demonstrates this accounting truism. There is an accounting fiction set up between the Treasury and Fed that makes it look like the Treasury is borrowing reserves from the Fed and obligating itself to the Fed. But both are agencies of the government, and it makes no sense to say that the government is “indebted” to itself (and it is erroneously claimed that the government is indebted to the bankers in money creation). This asset-liability relationship just keeps the double-entry bookkeeping straight.

Tom & Ralph: I agree that when the govt repays its debt, it simply issues another liability (currency). In fact the tenner in my wallet says on it “promise to pay the bearer ten pounds”. It’s just another IOU! So my question might have been a bit incoherent, since there doesn’t seem to be a way to pay back the national debt without replacing it with other government liabilities. I was wondering what would happen if the government just destroyed all of the NFA it had created (constituting the “national debt”)–could a banking system function without any high powered money, could there be deposit money, would there be any paper cash, etc. I guess that it’s ultimately impossible, since, as you both point out, the debt is paid for with govt liabilities, so that although the national debt would be gone, govt liabilities would be the same. In the modern monetary system, then, there has to be some kind of “national debt” (in the sense of govt liabilities qua fiat currency)…?

Dear DS

Here is a partial answer for you.

Please read my blog – Stock-flow consistent macro models – for more discussion on this point.

Most macroeconomic models fail to integrate financial stocks and flows into the standard income-expenditure-output model. In the text books that students learn from you do not have any attention to these matters. The only possible exception is when fiscal policy is presented and then the government budget constraint is presented as some sort of a priori financial constraint because it is alleged (erroneously) that the government is like a household which faces a financing constraint.

Further they do not provide a reconciliation between the different macroeconomic sectors – who act independently but are linked

by the flows between each.

What are the institutional mechanisms that reconcile the behaviour of the sectors? What role does government play? The banks?

In a stock-flow consistent model every individal flow or stock variable is (in an accounting) sense implied by the sum of all the others.

Further, in the standard income-expenditure models (which mimic the National Accounts) you are not given the precise implications of the flow of funds that underly the transactions and the resulting balances between the sectors is usually hidden from you.

So the transaction flows (income and spending) create financial balances at the end of the period which sum to zero (because one sector’s income is another sector’s spending)

At this stage (around week 3 of a macroeconomics course), most students would not understand that if the government is in surplus then the non-government is in deficit and if the non-government external component is in deficit then the domestic household and firms (taken together) are in deficit.

This means, in turn, that the private sector must be maintaining spending by increasing indebtedness.

So the real transactions that generate incomes and output have financial implications that you must integrate and understand as a whole.

But it doesn’t stop there. It is one thing to be able to derive the sectoral balances arising from the reconciliation of the sectoral transactions – spending and incomes.

But the next question you have to ask is the manifestation of these balances in terms of assets and liabilities.

Then you have to integrate the flow of funds between the sectors in to the analysis in a consistent manner.

So households accumulate financial assets (for example, bank deposits; superannuation funds etc) and these transactions have to be matched by their impact on other sectors. So for example, the household might hold cash which has to ultimately be sourced from high powered money injected into the system via government (some of which might also be held by banks).

Firms also borrow from banks and use retained earnings for working capital and investment. You have to understand then the linkages between the flow of funds and the spending in the national accounts.

Finally, governments net spend (positive or negative) and these decisions have implications for the financial assets that accompany the spending (which the mainstream erroneously call “financing” transactions). So there has to be a change in the stock of cash and bonds (for example) in the non-government sector at the end of each period as a consequence of the way the government has conducted its fiscal and monetary policy affairs.

So each of these spending-income transactions creates a flow of funds which manifest as changes to sectoral balance sheets.

All these things have to be consistently accounted for to make sense of the implications for example of a policy change.

Any change in the spending-income transactions must impact on the flow of funds and hence the balance sheets.

As an example, imagine you go into a shop and purchase a book. Your consumption spending creates income for the firm but also your stock of cash falls which reduces the bank’s liabilities toward you.

Firm’s increase their sales and profits and you then have to account for this in terms of how these profits are distributed and the impact on inventories.

Firms are able to reduce bank loans – so adjustments have to be made to those accounts (both reduction in liabilities and assets).

Then you have to deal with the multiplier effects arising from the initial spending impulse.

Finally, in terms of the DSGE models – I don’t like models that are calibrated and do not reflect the underlying data. GIGO after all. In terms of rendering the conceptual macroeconomics structure empirically tractable I favour the old Cowles Commission approaches (which you call national income approaches) notwithstanding the enormous difficulties involved in the estimation and the avoidance of arbitrary identifying restrictions.

I also think the New Keynesian claim to purity based on so-called rigorous attention to the micro foundations is a nonsense. As soon as they want to say anything about the real world they have to introduce ad hoc additions to their models which violate the theoretical results they hold out as their strength.

best wishes

bill

Dear Tom (at 2.17)

Thanks for helping to answer DS’s query about stock-flow consistency. However, there is one point on which you are mistaken.

GNP or GDP is always a flow – it can never be a stock.

You might like to read my extended reply to DS to see what stock-flow consistency it is all about. In a nutshell – in the context of your error – it means the spending flows that generate the flow of output-income which we call GDP all have financial implications which change stocks and balance sheets. Stock-flow consistency is about integrating these implications into your broader macroeconomic model and not analysing them as some stand-alone self-contained set of accounts.

Thanks for your on-going help in providing commentary.

best wishes

bill

Thanks, Bill. Actually I was quite aware of GNP as a flow not a stock (which you had just pointed out in the answers to the quiz). “Slip of the keyboard.” I just wrote it wrong and didn’t catch it in the preview. Sorry for the confusion.

Vimothy, the government doesn’t need to issue debt (Tsy’s) to finance its deficits. That’s a legislated requirement that could be repealed, leaving the government free not to issue debt at all. Then the NFA created by currency issuance would not be saved at interest as Tsy’s and would remain as excess reserves. This would drive the overnight interbank rate to zero, unless the Fed wished to control the overnight market and took other measures to neutralize the downward pressure of excess reserves, such as offering a support rate on excess reserves equal to the target rate.

The government creates three forms of liability under the current system – physical currency (coin and Federal Reserve notes), reserves, and Tsy’s. Reserves only exist in the interbank market. Banks exchange reserves for physical currency as demanded by customers. Tsy’s are held as assets both by the Fed and non-government. i.e., US entities and foreign entities.

The system could function without either Tsy’s or physical currency (as in the case of a purely electronic system that some foresee coming). However, reserves are necessary for interbank settlement, which occurs within the Federal Reserve System in the US, all commercial banks being in association with a regional FRS bank for this purpose.

It is conceivable that a government might leave money creation entirely to the banking sector, but it really is not plausible under the present international monetary regime.

Thank you, tom and bill, for your responses to my question. You all are very helpful and it is much appreciated.

Good comments by Tom and Vimothy above. One sentence of Vimothy’s wasn’t quite right: “so that although the national debt would be gone, govt liabilities would be the same.”

Total government liabilities would actually decline and for a reason I alluded to above. This is that a motive for holding interest paying government debt (e.g. Treasuries in the US) is the fact that interest is paid. I.e. remove the interest, and a significant proportion of debt holders would no longer want this chunk of net financial asset. This is the equivalent in the Warren Mosler “parent, child and business card” economy of parents ceasing to offer interest on business cards.

Re Tom’s point that the Treasury owes nothing to anyone other than more bits of paper or book keeping entries, that is true; but it rather implies that none of the national debt is “debt” in any real sense of the word. I suggest that US Treasuries and US monetary base held by the Chinese are debts in the normal sense of the word, owed by the US to China. This is because China can use their “bits of paper” at any time purchase goods in the US and ship them to China: that involves US citizens in a lot of hard work and for the benefit of Chinese citizens. That seems to me to be “debt repayment” in a very real sense of the phrase.

So how much of the monetary base is “national debt” in any meaningful sense of the phrase? My preference (in the case of the US) is to count Treasuries and monetary base held by foreign governments as national debt, but not monetary base held by US citizens.

Ralph,

That is not correct. If the Chinese start spending on real goods, firms in the US will demand more labor for increasing production and this will be beneficial for the US private sector. Capitalists will make higher profits and more workers will be employed. Of course real resources are leaving the United States, but ceteris paribus, exports increase employment and imports decrease it.

This is not inconsistent with Exports are a cost …

Ramanan–that is an excellent point.

Keynes via Wray:

“As Kregel (2007) explains, Hayek had argued that the market would automatically operate to ensure a quick return to the full-employment level of production because labor would be diverted to produce gold to satisfy the preference for accumulation of money over production of other commodities. Keynes’s response was that gold is not money, rather, money is an asset with “special properties”: nearly zero carrying costs, elasticity of substitution, and elasticity of production. The last characteristic means that when the demand for money rises, labor is not diverted to its production. So long as there is at least one asset that is not produced by labor, it can become a bottomless sink of purchasing power, overturning Say’s Law and subverting any market forces to return the system to full employment.”

Stiglitz:

” … the export of T-bills is different from the export of cars or computers or almost anything else: it does not create jobs. That is why countries whose currency is being used as a reserve, and exporting T-bills rather than goods, often face an insufficiency of aggregate demand.”

Ralph:

Can you help me to understand something? You said, “Total government liabilities would actually decline and for a reason I alluded to above.” I understand that interest income from outstanding gilts or bills adds to NFA in any given period. Are you saying that future interest payments are also a current government liability (I guess appearing on the balance sheet as discounted PV of future cash flows), and so replacing the interest bearing bill with the non-interest bearing cash or reserve principal would reduce govt liabilities by subtracting future coupon payments?

Tom:

Agree with much of what you say. What I am trying to get at is when, for example, people say “we must pay down the national debt”, what would it actually mean for the monetary system if someone took them seriously and paid the whole thing down? I appreciate that the resultant fiscal drag would almost certainly throw the economy into recession. I was thinking that this might be a useful “last mile” heuristic or gedankenexperiment when trying to explain the role of govt spending (qua currency issuance) in the monetary system. If govt destroys whole stock of NFA, what are the implications? Could bank money still circulate without HPM to leverage, etc? I was thinking that the monetary base was part of the national debt, but perhaps am wrong to do so. Need to read Ralph’s link when I have a spare moment. And again, perhaps my question is incoherent because the govt can only settle its obligations by issuing more liabilities.

Bill said: “This means, in turn, that the private sector must be maintaining spending by increasing indebtedness.”

I would disagree with this. In the real world, in this country, there is one main thing which has increased the indebtedness of the household sector…..and that is an ever increasing amount of mortgage debt, relative to real and nominal incomes.

The household sector is not going into debt because they have inadequate income to support consumption, they are going into debt in order to purchase houses.

The cause of the process has not been a shortage of government spending, it has been an ever-increasing propensity of home-buyers to pay more and more for houses. There is momentum in the market, as rising prices support higher LTV ratios, easier credit standards, more lending, which in turn continues to push prices higher.

The ultimate causes of this situation probably does lie with faulty government policies: favourable tax treatments toward housing investment, grant incentives to first homebuyers, slow and inefficient release of residential land, little incentive for increasing the housing stock rather than simply bidding up prices of existing homes.

What should the government do in this scenario? Increase spending in order to match the asset price inflation (hence increasing spending relative to actual real output? Or perhaps address the underlying problems contributing to the increasing indebtedness.

Dear Gamma

Please take some time to think about the basic macroeconomic aggregates that govern all the other individual behaviour.

My statement is true by definition no matter what else is happening.

The increasing fiscal drag over that 10 year period in Australia could only have been possible by the increased indebtedness of the private domestic sector. Otherwise growth would have ground to a halt much earlier.

best wishes

bill

Ramanan: If the US economy was at or near full employment (which is where it should be), the US would need to cut back on producing stuff for domestic consumption, so as to release resources to meet demand coming from China. If the above cut back did not take place, inflation would ensue. Thus the order from China results in US citizens temporarily consuming less.

Alternatively (second scenario) if the US economy is nowhere near capacity, the INITIAL effect of the orders would be for US citizens to work more for no increased standard of living, because the goods they make go to China rather than being consumed in the US. However, there is the multiplier effect; that that WOULD bring benefits for US citizens.

But the second scenario is very much second best, given that the US could have perfectly well have boosted demand on its own (e.g. by doing what modern monetary theorists advocate: expanding the deficit).

Vimothy: I don’t fully understand your question. I’m certainly not suggesting that “that future interest payments are also a current government liability”. As I said above, the point I’m making is nicely illustrated by a Warren Mosler article. See his “Soft Currency Economics” article: https://billmitchell.org/blog/?p=8555 and scroll down to the para starting “The concept of fiat money….”.

But to put it in my own words, people want to hold currency (even when it pays no interest) partially for the well known precautionary and transaction motives. But offer them interest and the total amount (cash plus Tresuries) they’ll want to hold will rise. Remove the interest, and they’ll revert to holding less.

vimothy, all paying down the national debt means is transferring Tsy’s to reserves, whence they came in the first place. The Tsy’s just remove the excess reserves introduced by deficit spending to securities, and extinguishing the government liability that the securities represent is accomplished by substituting another government liability, reserves. It’s just a transfer of one asset form to another. It’s a wash – like switching a deposit account to a CD and back in the same bank.

Ralph, I don’t see your point. Debt payment is in terms of exchange of one financial liability for another, not goods for an obligation, that’s a transaction involving purchase and sale. What if the Chinese had just kept the funds they earned from exports in reserves and then they bought US goods or assets later? The Tsy’s are just a way of introducing an interest-bearing savings stage in between. The US doesn’t borrow anything from China to buy its goods. The goods are paid for by the companies that import the goods, and the Chinese just keep the funds in either reserves or Tsy’s to do what they decide later. “Debt” is just a mistaken concept here that is confusing people. The US is not in debt to China. The goods were already paid for when they were imported, or if there was borrowing involved, it was by the US companies in the commercial banking system. I have friends who are importers. This is actually the way it works. They have contractual agreements to pay those from whom they import. The foreign companies make up the stuff to order. It’s a straight purchase and sale, generally requiring payment before the goods are shipped unless credit is extended, just like any domestic transaction. If they need funds, they draw on their line of credit at their bank. The same thing happens the other way. The transactions are then settled through the banks, since they obviously don’t send cash in an envelope. Those funds go into reserves at settlement and can be switched to Tsy’s for storage, and then back again. I really don’t see anything resembling what we call a “loan” or a “debt” involved in this process. This just arises because we call government securities “government debt.” That’s just misleading.

Er, yeah. I know that. I’m obviously phrasing the question badly. Or perhaps it just doesn’t make any sense (Occam’s Razor in action!). Let me try another tack: Paying down the national debt just means replacing one govt liability with another. Okay. But what would happen if the government destroyed the total stock of net financial assets held by the private sector? What if it issued no liabilities at all? Obviously, there would be a huge recession, but setting that to one side, what are the implications for the monetary system? Could it survive? Most people do not think of the cash money in their wallets as a liability of the government.

It the government issued no liabilities at all, there would be no NFA and that’s what’s used to pay taxes, fees, and fines. The government creates liabilities in order to exchange for goods and services for public use. It gives those liabilities value through accepting its own liabilities in satisfaction for liabilities to it, e.g., taxes, fees and fines. Taxes don’t fund government in a fiat system. But they do give government liabilities value, in addition to withdrawing non-government NFA.

If the government doesn’t create liabilities/NFA, then you have a monetary system that is entirely in private hands, and the government has to borrow from it in order to fund itself. The government then has to get revenue through taxation by force. Since military expenditure is high, that means that the government has to also have a strong internal security forces to collect taxes, and that force has to be funded too. But wars are expensive and governments have a hard time extracting enough taxes to pay for them, so they must borrow from the bankers’ too, and tax later. This is a feudal model. It’s been tried, and it didn’t work so well.

Vimothy

Just a few thoughts;

In order to destroy the entire stock of non-govt NFA, the govt would have to run cumulative surpluses equal to its cumulative deficits to date. The result wouldn’t be pretty, if you accept the MMT interpretation of the recessionary impact of surpluses. But, supposing you wanted to set up a banking system without any HPM.

Banks would presumably have to settle accounts with each other by accepting other banks’ deposit liabilities as assets when customers of other banks made payments to their own depositors. But why would banks do this (accept another banks liability)? I could imagine all sorts of settlement problems and instability arising in that sort of system.

In order to destroy the entire stock of non-govt NFA, the govt would have to run cumulative surpluses equal to its cumulative deficits to date. The result wouldn’t be pretty, if you accept the MMT interpretation of the recessionary impact of surpluses.

The cumulative deficits to date equal the national debt, i.e., Tsy’s outstanding, which store NFA as savings. Unless the US would become a huge net exporter, which is unlikely, running surpluses on this order would result in a precipitous drop in aggregate demand through raising taxes and/or slashing spending.

This is what the über-financial scolds say they want, i.e., to “restore fiscal responsibility” and “get government out of our lives.” However, this disregards the immense contribution of government to aggregate demand. Without a corresponding increase in net exports, the private sector would have to make up the difference, financed by private banking. There is no way that consumers could take on that amount of debt to make up for the government contribution. It’s unrealistic and unsustainable. It’s virtually impossible for a reserve currency country to become a huge net exporter, too, because everyone want to export to it to get the reserves they need. And one advantage of being the issuer of the reserve currency in a fiat system is to exchange fiat currency for real stuff.

Moreover, fiscal terrorists think that this can be accomplished by slashing government spending and cutting taxes to the bone at the same time. This is an ultra-conservative pipe dream that only someone like Grover Norquist could think up. The MMT analysis shows that there would be a humongous depression instead as aggregate demand plunged, an output gap increasingly widened, putting more and more people out of work, and debt-deflation spiraled because people would not be able to service existing debt with rising unemployment and falling wages. It’s a recipe for disaster.

Money and financial (titles) assets are a store, an intermediary that facilitates the exchange (non-simultaneous arbitrage) of utility (security, value), not utility itself. Utility comes from real assets (labor, capital). The presence of money and financial assets or titles is required because simultaneous arbitrage does not exist and danger bounds decisions and scarcity bounds praxis. They can play this role because they employ practically no resources, so Say’s Law is violated. Depending on what cover they offer for these bounds they yield a liquidity, an innovation, an interest premium and an income.

Bill, thanks for your reply. I understand that the aggregates must add up. As you said, the double-entry accounting entries are true, because they are defined to be true – no argument there.

So this is just an identity, but says nothing about cause and effect.

By way of analogy, consider the quantity theory of money (MV = PQ). It is true in the sense that it is defined to be true (as an identity), but that does not mean that it is necessarily true in the sense that moneterists believe – that changes in some variables cause changes in others in a predictable manner.

So returning to my point. By definition, for the government sector to run a surplus, it follows trivially that the non-government sector must run a deficit (of government money). But….so what? This doesn’t tell us anything about what actually follows from the situation.

In some of your writings and also some of Professor Wray’s there is some suggestion that non-government sector deficits have “caused” recessions in the past, and if I am interpreting you correctly, here you are suggesting that the non-government sector deficit has “caused” or at least contributed to the build-up in household (not non-government sector) debt. Am I mis-understanding you here?

I cannot see how these certain accounting identities which are true because they are defined to be true, are actually telling us anything about causation in the economy.

Tom Hickey: “This is what the über-financial scolds say they want, i.e., to “restore fiscal responsibility” and “get government out of our lives.” However, this disregards the immense contribution of government to aggregate demand. Without a corresponding increase in net exports, the private sector would have to make up the difference, financed by private banking.”

And what most of them want is a reduction in debt. Shifting debt from the government to the people would not accomplish that purpose. They do not see that paying off the national debt by reducing the deficit would drain money from the economy. After all, they believe that the government needs *their* money to exist.

Gamma: “The household sector is not going into debt because they have inadequate income to support consumption, they are going into debt in order to purchase houses.

“The cause of the process has not been a shortage of government spending, it has been an ever-increasing propensity of home-buyers to pay more and more for houses. There is momentum in the market, as rising prices support higher LTV ratios, easier credit standards, more lending, which in turn continues to push prices higher.

“The ultimate causes of this situation probably does lie with faulty government policies: favourable tax treatments toward housing investment, grant incentives to first homebuyers, slow and inefficient release of residential land, little incentive for increasing the housing stock rather than simply bidding up prices of existing homes.

“What should the government do in this scenario? Increase spending in order to match the asset price inflation (hence increasing spending relative to actual real output? Or perhaps address the underlying problems contributing to the increasing indebtedness.”

Dear Gamma,

I have some thoughts about this. And there are plenty of people here who really understand this who con correct me where I am wrong.

IMO, the housing bubble should have been pricked years ago. But it wasn’t, and now prices have fallen and are falling. The government, at least in the U. S., is doing something to prop it up. Meanwhile, people are defaulting, going bankrupt, or deleveraging, and getting a loan to buy a house is not so easy.

Let’s look at the people, who may not be homeowners, but who may be worried about losing their jobs or otherwise want to save or reduce their debt. Where do they get the money? If they are saving or reducing their debt, then (ignoring imports and exports) somebody else has to be reducing their savings or increasing their debt, OR the government has to run a deficit large enough to allow them to save or pay down their debt. If the government does not do so, you are going to have a lot of frustrated people.

To the extent that this bails out people who acted unwisely and overextended themselves, it does reward bad behavior. That’s too bad, but if we did it for the big bankers, we can do it for ordinary people, too. At the same time, it helps to protect the victims of the people who got us into this mess.

What about all the pictures?

I thought the reason they plastered all those pictures on the bills was that even those who were illiterate could still understand that they were holding an asset whose value is provided by the government — i.e. a liability of the government.

Have we sunk so far that even simple images are too confusing? Perhaps we need a 3D animation to project out of the bill and explain the concept of paper currency, bills, and notes each time a sale is made. We don’t want anyone getting confused, thinking that the bill was their own liability, just as they think that government debt is their own debt.

We could make it folksy, like “I am Joe’s Kidney”. Hologram Hamilton would appear, and with placatory hand movements, explain what money is, and reassure the nervous seller that this bill could be used in the settlement of debts, was fully transferrable, and that it was the role of government — represented by the images of presidents and impressive official looking buildings — to give the bill value.

Gamma, what the accounting identity, Y=C+I+G+NX, says is that if a gap occurs in NAD relative to real output capacity, then either an output gap opens up, or consumers have to supplement income with private debt to make up the shortfall unless the government runs a deficit equal to the shortfall, presuming NX doesn’t fill the demand gap either.

That’s not imputing causality. It’s a necessary condition implied by the identity. Of course, the operational dynamics of this can take many forms depending on circumstances. But the implication holds regardless. One such situation arises is if the government runs a surplus that is not offset by NX. Another would be if consumers desire to save more than the deficit, and this is not offset otherwise.

The idea is that if expenditure (demand) is not equal to utilization of real out put capacity for any reason, then a deflationary environment will arise (and if expenditure (demand) exceeds real output capacity, then inflation will occur). Any of the sectors can “cause” this deflationary condition. But it is not necessary to appeal to causality. The accounting identity establishes the conditionality.

Then one has to examine the data for specific causes in any situation, and unless the data are sufficiently accurate and complete, that may difficult to establish. The US is going through this analysis now, and the debate over causes is heated, but Ponzi finance of consumer debt seems to be deeply implicated. As I understand it, Bill, Randy and others have posited that the Clinton surpluses got the debt cycle started that culminated in the financial crisis, since the surplus resulted in a shortfall in demand relative to capacity utilization. There was a minor recession, and consumers decided on aggregate to go into debt to maintain their lifestyle.

I think you are saying that this needs articulating in greater detail, and I would agree. This was obviously a complicated time, with a lot going on that hasn’t yet been sorted out.

Min, the über-financial scolds I am talking about there are libertarians. They want the government gone as much as possible. Libertarians are somewhat different from fiscal conservatives who emphasize fiscal and market discipline.

Here is Holographic Hamilton:

— First Report on the Public Credit, January 1790

Min: “Let’s look at the people, who may not be homeowners, but who may be worried about losing their jobs or otherwise want to save or reduce their debt. Where do they get the money? If they are saving or reducing their debt, then (ignoring imports and exports) somebody else has to be reducing their savings or increasing their debt, OR the government has to run a deficit large enough to allow them to save or pay down their debt. If the government does not do so, you are going to have a lot of frustrated people. ”

Thanks for your reply. When households save or pay down debt, the banking sector is effectively that “somebody else” that is reducing their savings (their loan portfolio) or increasing their debts (their deposit book).

That is where I think this “vertical analysis” is quite lacking. The banking sector and household sector are not just interchangeable parts of the”non-government” sector that can be simply aggregated together, they are fundamentally different.

Identities contain a “black box” that needs to be opened up and understood. It shows you ex post a situation (a moment) that does not explain things. The Monetarist Fisher identity is a good example. Sector discrepancies in the balance sheet do not tell you why. You need an explanation, a hypothesis and MMT has one based on fiscal policy as catalyst of stimulus. It neglects however, that the catalyst can also came from the private sector (for example, animal spirits, technical change, speculation) something that both Keynes, Marx, Minsky and other PostKeynesians have stressed.

Dear Gamma

I wish you would take the time to understand what the MMT concepts are about before you conclude on spurious grounds that they are “lacking”.

None of us ever said there were not important difference between components of the non-government sector. Clearly, understanding the dynamics of the horizontal transactions (that is, transactions between non-government components which in financial terms net to zero) is an important part of macroeconomic theory.

In your example, the “transactions” net to zero and have distributional consequences.

But you clearly don’t get the vertical distinction at all. It is special and you can understand it by considering only the government and non-government sectors in aggregate. Most people do not understand the special nature of these transactions and as such make claims that cannot stand scrutiny.

I wonder how much of my work you have really ever read – and I mean my academic work – and that of Randy, Scott and others? Your examples continually suggest you have read very little. And I would say that until you have read the key theoretical pieces and understood them – then you cannot really say that the “vertical analysis is quite lacking”.

best wishes

bill

Dear Panayotis

Thanks for your comment.

You said this about MMT:

This is patently not the case. We are continually stressing the endogeneity of the budget balance outcome – which in other words, stresses the importance of the non-government spending components.

We are continually also stressing the concept of “fiscal space” as dictated by the private spending growth in relation to real productive capacity.

Many of the behavioural underpinnings of MMT come from Marx, Kalecki, Keynes and Minsky to name just some of the sources of ideas.

The difference that MMT adds is that all the relationships are considered in a stock-flow consistent manner which generates insights that standard Post Keynesian economics often overlooks (or in some cases, fails to even identify).

best wishes

bill

Your statement about behavioral underpinnings of MMT in the private sector as catalysts of change satisfies my concerns. You must admitt, however, that your emphasis on fiscal policy considerations as reasons for demand shortfall can lead your followers to interprete your positions differently and lead to many extreme positions as it happened to monetarists who some I know and was taught first hand! Are you still using the Krugman Cross? If yes see a comment I put in your birthday blog.

Best Regards,

Takis

“That is where I think this “vertical analysis” is quite lacking. The banking sector and household sector are not just interchangeable parts of the”non-government” sector that can be simply aggregated together, they are fundamentally different.”

Even I know that this criticism is misplaced. Read Godley and Lavoie’s textbook. They are quite clear that this is an essential distinction!

Bill,

Firstly, apologies – I did not mean to suggest that all MMT concepts were lacking. What I was saying that an analysis which focuses almost exclusively on vertical transactions and has little consideration for the horizontal transactions is missing somthing.

“In your example, the “transactions” net to zero and have distributional consequences.”

I agree, but what if there are more than distributional consequences, what if there are also effects on real output, unemployment, inflation and so on?

Data starts near year 2000.

Vacancy with employment rate population ratio (instead of unemployment rate0

http://research.stlouisfed.org/fred2/graph/?g=sAN

Vacancy with unemployment rate:

http://research.stlouisfed.org/fred2/graph/?g=sAO