iWorry about the conservatives

I can now safely call my blog – ibilly blog or billy iblog thanks to a court ruling preventing Apple from monopolising the i construction. But then I would have to change the logo and I don’t have time to do that so I won’t take advantage of the court ruling just yet. But on more substantive matters, today I have been thinking about how much momentum the conservative lobby has at present and that history is being continually re-written to give these characters the oxygen they need to warp public opinion. We are now in danger of an even greater shift to the right in the coming years than was represented by the “neo-liberal” era. It is an ugly thought. But the macroeconomics is clear – if these ideas really take over the policy making process – then we will be facing a lengthy period of economic malaise.

There was an interesting article by Wall Street Journal writer Thomas Frank on Wednesday (March 10, 2010) entitled –

The Rise of the Reactionary Right Conservatism as a revolt against civilization itself.

The main argument is that:

Conservative philosophies of government have brought us to the brink of economic disaster. So how do conservatives respond? By pondering anew the imagined crimes of the progressive and New Deal eras. By rededicating themselves to an even purer version of their tainted faith. The halfhearted liberals in the White House dream of bringing health-care costs under control, and conservatives demand in response a more thorough antiliberalism than ever before. Tear out the welfare state root and branch, and abolish the Fed, too! That will show the meddlers of the past 120 years.

Frank uses the keynote speech by Glenn Beck’s speech at the Conservative Political Action Conference in Washington a few week’s ago to motivate his argument.

As an aside, I was sent the link to the Glen Beck speech at CPAC the day it was presented. Upon watching it I concluded that, given his popularity, there is a major failing in the US education system. Something went very wrong in his childhood and those of his followers. I note he is fixated on scrawling one line statements on his blackboard that make no sense at all and usually include Socialism = Government or something along those lines. Something happened to him in primary school and development stopped.

But the point Frank makes is that the popularism preached by Beck doesn’t even stack up with the facts. His nemesis Woodrow Wilson didn’t do what Beck claimed he did and Beck’s hero Coolidge did do what Beck claimed Wilson did! That sort of distortion and worse riddles the Beck rhetoric.

On this new conservatism, Frank notes that the “sort of people who watch Glenn Beck” express “more ‘visceral’ sentiments” than the Republican conservatives and are motivated by:

“Fear” and “Extreme negative feelings toward existing Administration.” These donors are, in the language of the presentation, “Reactionary.”

The presentation he is referring too came from the “Republican National Committee … presentation given to party fund-raisers in Florida last month”.

The reactionary nature of the conservatives according to Frank is a:

… romantic attachment to a vanished medieval hierarchy of the kind we never had in America. The great dream here has always been an economic state of nature, where humans live in harmony with an untainted market.

… the revolt against big government stripped down to its essentials. Civilization itself is the bunk, its taxes and regulations as artificial and as unhealthy as its diet of booze and candy. For today’s cavemen conservatives, the correct model is simplicity itself: It’s every man for himself. And if you want a piece of the mammoth, you’d better get to work.

I agree with the sentiment of Frank’s article. His case can be made more emphatically by showing that these conservatives actually would not be able to achieve their desired outcomes should they be put in charge.

They believe that they will be able to produce wealth without government fiscal support of their saving desire. As I explain below, if the private sector desires to save, then unless you are running large external surpluses, the plan will fail without on-going fiscal deficits. That understanding is lost on all the conservatives.

But the nuances of the monetary system are always going to be lost on the general public who seem to respond, as Frank says, in a visceral manner.

Further, I don’t see these arch-conservatives as being the entire problem. Even the progressives who want to play what they think of as clever politics are a major problem. That group concede validity in the public debate to the manic fringe perspective – and modify their ambitions and use terminology (like exit plans etc) to try to assuage the nutters (to get their votes). In this way the debate shifts further to the right and civilisation is further endangered.

You see this type of manic conservatism in the rantings of popular American conservative Doug Casey, who because he has made a few bucks in the financial markets thinks he knows everything about the way the monetary system operates.

I think if I was able to get a true dataset I would find a strongly statistically significant inverse relationship between those who had made money in the financial markets and those who demonstrated a correct understanding of how the monetary system operates.

But the problem is that the “big money success” seems to bestow authority on otherwise dullard level understanding of macroeconomics.

Anyway, Casey was interviewed by a financial publication recently. I will not link to the interview because you have to sign up for his newsletter to read it in full. Luckily someone sent me the full text.

Here is a sample of the stuff Casey in sending to his readers:

As the world political situation continues to deteriorate towards something I think will vaguely resemble World War III, the chances are excellent that a U.S. government at the end of its financial rope will default … This is big trouble. It’s not just another economic downturn when scores of millions find their life savings go “poof.” What we’re looking at is a cataclysm at some point soon. I hate to sound inflammatory, but I think the situation is much, much more explosive than it appears on the surface, much worse than you see on the TV news …

There’s a titanic battle right now between the forces of inflation and deflation … … [an apocalypse is inevitable because] … It is simply not a politically acceptable option to step back and let the market correct the gross misallocations and distortions the government has imposed on the economy. They must “do something” – even if they know full well it’s the wrong thing …

There are only two ways to pay for that. They can borrow, which they can only do if they raise interest rates enough to make their bonds attractive, and that, too, would pull the plug on what you so colorfully called the “iron lung economy.” And they can print money, which they can do with some impunity, hoping the bill won’t come due until some other poor fool is in office – but that destroys the dollar sooner or later … it’s very close to being totally out of control.

As I said big money success but an otherwise dullard level understanding of macroeconomics.

He knows the US economy is deflating but in the interview continually talks about Zimbabwe and 1920s Germany so he has to cast the situation as a “titanic battle between inflation and deflation”.

Anyway, to all my American readers – bad luck – your dollar is kaput, there are going to be invasions as all those “nice foreigners” (in his terminology) get angry for losing out (because they are funding your excesses) and everything will be pretty grim.

As a billy blog public service to my American readers – here is the WWW site for the Australian Department of Immigration and Citizenship. The weather is better here and we don’t have as many loonies. Further, the conservatives here rave on continually about skill shortages so you should all get lots of points on the entrance test. But then I did conclude there was something fundamentally wrong with the US education system didn’t I! (-:

Moving on, the softer conservatism noted by Franks is demonstrated by the following nonsense.

In today’s Wall Street Journal (March 12, 2010), a US Republican senator from Oklahoma suggests that the US government freezes its spending at 2008 levels. This crazy fellow, one Jim Inhofe, seriously understands macroeconomics that is for sure.

He says:

American families and state governments across the country are cutting spending and making hard decisions about their budgets. It is time the federal government did the same.

This is all very folksy and what you might expect from a conservative Okie but not very smart. There is no valid analogy between American families and state governments which use the US currency and the US federal government which is the monopoly issuer of that currency.

The former are always financially constrained (although the states have more revenue-raising capacity and a greater ability to borrow) and must manage their budgets to ensure they remain financially solvent.

The latter is never financially constrained and can purchase at any time whatever there is for sale in its own currency. The latter can never go bankrupt – unless for political reasons it chose to. But in financial terms the US federal government never has a solvency risk.

When a person begins by making these false comparisons you always know they have no understanding of the way the monetary system operates and that the rest of the argument will be deeply flawed as a consequence.

The fact that a representative of the people in a position of power and influence makes these erroneous statements indicates that the political system in the US is deeply flawed and rewards incompetence.

It is this tendency to reward incompetence that is the real danger for the American future rather than a few numbers on a piece of paper that someone has called the budget deficit (for example).

The senator continued:

I’ve introduced legislation called the Honest Expenditure Limitation Program (HELP) Act … my plan reduces nonsecurity discretionary spending over a five-year period. Once it reaches the 2008 spending level, my bill then freezes spending there for an additional five years.

Real fiscal restraint requires cutting budgets, not locking in an artificially high spending level and then allowing spending to explode again after three years as the president’s proposal does.

Can someone out there who lives near to the senator please go around and calm him down then direct him to the nearest HELP line?

Let’s imagine what would have happened if the senator had his way last year.

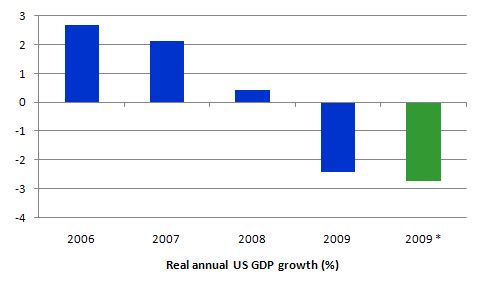

If we make the assumption that government spending in 2009 had no impact on private spending (when it probably boosted private spending somewhat) then the following graph shows annual growth in real GDP for the period 2006 to 2009 (blue columns) and then simulates the 2009 growth if US government spending had remained in real terms at its 2008 level (green column). You can get US National Accounts data from the US Bureau of Economic Analysis.

The point is that you cannot make fiscal rules like this in isolation from what is happening in the rest of the economy. We have been down this road before. A macroeconomic system is the interplay of government and non-government aggregates.

The private component of the economy is highly significant and influences real economy activity via its spending decisions. But even within the private sector – there are separable sectors (firms, households, banks etc) which make decisions that, presumably, best suit themselves – although the concept of herd behaviour suggests that ultimately irrationality rules rather than optimality.

The point is that there are a multitude of separate decision-making processes going on which aggregate into the major spending components we measure in the National Accounts.

The classical economists believed that free market movements in wage and prices (including interest rates) would ensure that all these decisions were coordinated to ensure that aggregate spending exactly coincides at each point in time with aggregate output (some of the more reasonable of this fold admitted that might be imbalances in certain markets which would quickly adjust to maintain macroequilibrium).

The conservatives of today also take this position without the same intellectual grounding. Either way, the Great Depression cast the Classical paradigm into the rubbish bin and any subsequent revivals share the same lack of credibility.

There is no guarantee that the private spending decisions will mesh to ensure that full-capacity output is demanded. Typically, that will not be the case and so there is a prima facie case for government net spending to fill the gap to ensure that the economy does not plummet into recession.

That understanding was reached categorically during the Great Depression after all the mad-cap mainstream remedies (wage cuts, public spending cuts etc) were tried and failed (they made the downturn deeper).

Nothing since has changed that understanding although in the last 35 years macroeconomics has been taken over by the conservatives again who rely on the discredited classical tool box (with some modern nuances) for their models and conclusions. The resurgence in the orthodox paradigm (around the mid-1970s) never was justifiable on the basis of evidence or logic.

It was just a power grab by the conservative elite who had been rendered less vocal and influential during the full employment era that followed the 1939-45 War. If you understand the literature you will see that during the 1950s and 1960s they were relentless in trying to regain the authority that was lost by there failings during the 1930s.

But whichever way you look at it, the mainstream macroeconomics that is now dominant has no credibility at all. In the current crisis, the policy makers ditched it and resorted to the prior dominant reliance on fiscal policy that had rescued the World (finally) from the Great Depression.

While the policy makers have demonstrated that they don’t really get it – as evidenced by all the talk about “freezes” and “exit plans” etc – the crisis has demonstrated that the mainstream approach to macroeconomics embodied in the senator’s argument is bereft of all credibility.

One of the basic understandings that you will gain from Modern Monetary Theory (MMT) is that the budget balance is endogenous – that is, dependent, ultimately on the spending decisions of the non-government sector.

There is clearly a discretionary component that has to be exercised when required but the deficit will fall when private spending recovers. Trying to engineer a reduction in the deficit via austerity programs (or freezes or whatever else you might like to call them) at a time when private spending is still not sufficient to maintain adequate real GDP growth is a recipe for disaster.

It is highly likely that if the senator was in charge (and thank the xxxx he is not) then the budget deficit would increase even further as the economy fell further into recession and tax revenue collapsed even more than it has.

The problem with the conservatives and so-called progressives who talk about the budget position as if it is a standalone entity is that they ignore the macroeconomic linkages which ensure the budget balance is endogenous.

What should the discretionary component be? At all times, the government should ensure that is net spending (independent of the cyclical components driven by the automatic stabilisers) should be sufficient to ensure full employment and sustainable real GDP growth. Nothing more nor less than that is the only viable and responsible behaviour of a government committed to pursuing public purpose.

To understand these points more fully I suggest you read the following blogs – Fiscal sustainability 101 – Part 1 – Fiscal sustainability 101 – Part 2 – Fiscal sustainability 101 – Part 3

Then you might like to read A modern monetary theory lullaby.

Attenzion! Goosestep in strict time! Repeat: No bailouts

Meanwhile in the EMU, the BuBa boss claims that the idea of an European Monetary Fund is:

counterproductive … [and any] … institution that provided aid to financially troubled eurozone states would penalise those with sound finances … [and] … was in conflict with the “no bail-out” principle that was at the heart of the EU framework … Greece has to concentrate on implementing its budget reform plans.

So Greece goes broke sooner or later and defaults … this spreads to Spain, Portugal … even Belgium is being mooted as a contender for the “market squeeze” on its spreads. What then for the Eurozone? The sort of budget reforms this guy has in mind will decimate living standards and, under current arrangements (that is, the EMU) will take several years to achieve – and it is not clear to me they are achievable without serious civil unrest and the most disadvantaged citizens dying from lack of nutrition, health care, heating whatever.

Further, the bond markets will not wait that long and the bureaucrats in Brussels and Frankfurt know that and will bail Greece out anyway.

Finally, as I have noted often, the arrangements are also totally unnecessary under alternative arrangements which would see Greece and the other nations walk across the EMU line out of penury and into sovereignty.

As an aside: I noted some veiled criticism on another WWW page of MMT in the context of not developing or not having demonstrated a thorough understanding of the financial and accounting arrangements underpinning the EMU given how important the region is now appearing in the crisis.

The monetary arrangements between the ECB and the national central banks and the treasuries in the member states are fairly straightforward in fact. I haven’t written about them because I didn’t see a need and I doubted anyone would be very interested anyway. But if there is a burning need for these arrangements to be explained and a groundswell of E-mails or comments identifies that need then I will devote a blog to the task of explaining how the accounting between the components of the EMU works and what opportunities and constraints exist. Over to you on that one!

Repo 105 aka lying through your teeth

Its very long – 2,200 pages in total – it has thousands of footnotes, each one of which (as far as I have read) leads to a trail of other documents and interesting issues – and it implicates the top management; the auditing firm (Ernst & Young); the New York Fed (which at the time was run by no other than current Obama Treasury Secretary, one Timothy Geithner); and it implicates – again – the slack financial regulation that exist in the UK.

The court-appointed US bankruptcy Lehman Brothers Holdings Inc. Chapter 11 Proceedings Examiner’s Report is now public and compelling reading for those interested in the detail.

It documents in detail how crooked the company was in using “accounting gimmicks” which are referred to as Repo 105 and Repo 108 – to hide their true leverage positions and maintain higher ratings that they deserved.

They were able to treat what were essentially repurchase agreements as sales rather than inventory changes to make their balance sheet look better by more than $US50 billion just before key reporting dates. They were then able to borrow more because their leverage ratio was wrongly represented to the markets.

The Report says that:

Unbeknownst to the investing public, rating agencies, government regulators, and Lehman’s board of directors, Lehman reverse engineered the firm’s net leverage ratio for public consumption …

Lehman employed off-balance sheet devices, known within Lehman as “Repo 105” and “Repo 108” transactions, to temporarily remove securities inventory from its balance sheet, usually for a period of seven to ten days, and to create a materially misleading picture of the firm’s financial condition in late 2007 and 2008.2847

Lehman regularly increased its use of Repo 105 transactions in the days prior to reporting periods to reduce its publicly reported net leverage and balance sheet.2850 Lehman’s periodic reports did not disclose the cash borrowing from the Repo 105 transaction – i.e., although Lehman had in effect borrowed tens of billions of dollars in these transactions, Lehman did not disclose the known obligation to repay the debt … Lehman used the cash from the Repo 105 transaction to pay down other liabilities, thereby reducing both the total liabilities and the total assets reported on its balance sheet and lowering its leverage ratios

The auditors (Ernst and Young) were warned that this was going on but the report says they “took virtually no action to investigate” and signed off on the books as being lawful.

Further, it seems that the New York Federal Reserve Bank (FRBNY) allowed Lehmans to trade when it was insolvent – a criminal act if true.

On the role played by the FRBNY, the Report said:

After March 2008 when the SEC and FRBNY began onsite daily monitoring of Lehman, the SEC deferred to the FRBNY to devise more rigorous stress-testing scenarios to test Lehman’s ability to withstand a run or potential run on the bank.5753 The FRBNY developed two new stress scenarios: “Bear Stearns” and “Bear Stearns Light” … Lehman failed both tests.5755 The FRBNY then developed a new set of assumptions for an additional round of stress tests, which Lehman also failed … However, Lehman ran stress tests of its own, modeled on similar assumptions, and passed.5757 It does not appear that any agency required any action of Lehman in response to the results of the stress testing.

See Yves Smith’s blog for more details on Geithner’s role. While she is calling for the unemployment queue to increase by one as a result, others are suggesting that the prison population should increase by one. As an aside, the US does not count the prison population as part of the Labour Force and so understate the true unemployment problem.

Finally, the UK is implicated because the Repo scheme relied on cooperation of British legal firms for its success. There is also evidence of high level political dealings after the crash which finally saw Barclays bank “taking assets it was not entitled to, including office equipment and client records belonging to a Lehman affiliate”.

This is another area where the swing to the right that is now occurring will prevent policy makers from making any substantive reforms.

Conclusion

So a ramble through the manic world of the conservatives who far from saving us are framing a policy agenda that will ensure high levels of unemployment, reductions in material standards of living on average, increased civil unrest and heightened international tensions.

Perhaps I better retire immediately, convert my superannuation into gold and start building a steel-reinforced bunker up the coast equipped with enough weapons to ward off the riff-raff. At least that is what the gold-bug who told me to delete my entire site (see below) recommended I do.

Digression – just ransack their offices and …

… put them out on the street. While the British people are now facing up to a non-choice in the May national election given the appalling state of both major parties in terms of their policy positions on how to deal with the current crisis … there is one choice that is very clear.

The ABC News reported today that the British expense scandal MPs invoke 320-year-old law.

Apparentely four Members of Parliament:

… have told a judge they will use a 320-year-old law as a defence against prosecution over allegations they dishonestly claimed parliamentary expenses.

In their first court appearance since being charged in a scandal that has rocked the British political establishment, the parliamentarians said they would argue that their cases should not be tried by a jury.

Instead, they will insist they should be dealt with by authorities in the House of Commons, arguing they are protected by parliamentary privilege.

They claim they are not seeking to be treated above the law because “(p)arliamentary privilege is part of the law, and it is for parliament to apply the law in their cases.” Yeh, right!

So the voting public should make sure these alleged criminals no longer enjoy the parliamentary privilege.

Admin Note:

I have received lots of requests for a FAQs page, a glossary, a key post page, and other things – including a request from an US gold bug to go to my server, select Ctrl-A on the blog directory and press delete. I particularly liked the ingenuity of that last request. The guy (it was a male) clearly knows his way around computer, which is about all I could conclude from his voluminous rant.

But I have been considering writing a blog which would become a dedicated page – which might be entitled a First-time readers guide to billy blog or something like that. So a travel guide through the pages.

You will also note I have been adding new categories (to ultimately replace the catch-all “economics” category) and I have been slowly re-organising specific blogs into the new sub-divisions to provide more ease of traverse.

I welcome any suggestions though and any help on the first-time reader’s guide.

Saturday Quiz

As usual – the deceptively easy Saturday Quiz will appear sometime tomorrow and answers and discussion will appear on Sunday.

That is enough for today!

Hi,

A great post.

Just one point – US conservatives like Ron Paul and other Austrian school libertarians want to re-introduce the gold standard, abolish the Fed, and establish free banking (with 100% reserve requirements in some cases).

Perhaps you could address this type of conservatism and what it would mean for modern economies?

Surely it would mean a return to frequent 19th-century-style deflationary depressions preceded by financial crises?

Regards,

Andrew

I have to say I love the reactionary Right’s myopic focus on “every man for himself” and “survival of the fittest”…….the complete opposite of their religious beliefs, and also a complete denial of their so-called religious teachings. Interesting. Well, not really. Both are about money and power, pure and simple, and the manic desire to maintain it any cost.

The really concerning thing to me is the fact that such “populism”works so well. The Right are exceptional at being loud and aggressive, but there ain’t a lot of meat on them moral bones. The more I think about it, Marx’s “opiate of the masses” quote seems less about religion, and more a comment on society in general. We get what we deserve. How else to explain the extraordinary success of these wingnuts, particulary when there is so little truth involved, and so much spin. Why would spin have become the industry it has without such a tacit acceptance?

More concerning is the lack of fight in liberals.

Dear Bill,

There are contradictions you must address.

1. Although there are states that have sovereign authority with their nonconvertible currency monetary systems and flexible exchange rates, they act with volition as revenue constrained public spending agencies. Other States like in a Federal system and in an EU arrangement are constrained because they do not have currency sovereign authority. Thus, the “reality” we must analyse is not an ideal world as MMT presents but as a situation where agencies behave as if and are voluntary and involuntary constrained.

2. Voluntary/involuntary agency cases of revenue constrained behave by using discretionary measures( public investment, payroll bill, certain social programs, etc.) to reduce spending, reacting to a real or imaginary leverage capacity. This can lead to to a deflation spiral as the stabilizers raise the deficit prompting tha authorities to cut discretionary spending even more.

3. The role of rating agencies and speculators come into play in these cases. Their mission is to calculate this “leverage capacity” even before the state authorities “realize” and believe it and impose their views with market plays that short public debt, raising interest cost prompting the governmnet to react with spending cuts conditional on the opinions of the rating agencies and the speculative funds.

4. These are real situations that are supported by conservative politicians and the media that have an impression effect upon the spending cut policies.

The fiscal drag scenarios are real and they all result in lower GDP that the endogenous budget deficit cannot avoid. These contradictions in a dialectical sense, and should be included, if they are not, in MMT analysis.

Thanks, Professor Mitchell. You are spot on regarding the non-choice in the upcoming UK elections. The main difference between the two parties seems to be “slash and burn now” versus “slash and burn next year”. Unfortunately the level of public debate here on these important issues is woeful.

With regard to the MPs, they are trying it on with the appeal to Parliamentary Privilege and I very much doubt it will succeed. Privilege is a long-established tradition but basically its role is to ensure complete free speech in parliamentary debates (so Privilege prevents MPs being sued for defamation) not to allow MPs to get away with fiddling their expenses.

“As an aside: I noted some veiled criticism on another WWW page of MMT in the context of not developing or having a thorough understanding of the financial and accounting arrangements underpinning the EMU given how important the region is now appearing in the crisis.”

Bill,

I can’t imagine who would make that sort of allegation, but this is an unveiled, single burning request for such an explanation. I think Ramanan at least would be quite interested as well, and perhaps one or two others at least – a tremor but not a groundswell. Maybe it can be done in a half-blog sometime?

Not completely on topic but a good example of fear mongering nonetheless. What kind of market power do people like this have to actually make their delusions become a self-fulfilling prophecy? Or to put it differently, to what extent does our market system rely on the understanding of its participants of how it functions or at least could function?

http://gordongekkosblog.blogspot.com/2010/03/its-going-to-implode-buy-physical-gold.html

and the same articel with more comment on zero hedge:

http://www.zerohedge.com/article/its-going-implode-buy-physical-gold-now

Dr. Bill,

Sorry to go there again, but because I share your fear of “what comes next” in a conservative nexus of reform, I offer the following.

To most of us, it is not only about functional finance and double-entry bookkeeping.

It is about the money POWER.

You, Warren, Marshall, Randall and others claim to have reached the shangri-la of monetary economics – noting that for SOME (you know who they are) all they need to do is to throw off their “voluntary restraints” of things like the PRIVATE MONEY CREATION POWER and raise the profile of unconstrained deficit spending as the solution to all that is wrong – and to do this because technically, from the back-side of the balance sheets, THIS is how it really works.

Now, from out here in la-la land on the other side of the curtain, it looks like what you say you fear.

Only one of these perspectives represent the reality of the street, where REAL people are getting more REAL hurt every day.

I find the best description of where the global insolvency presently is located in a paper titled How Debt Money Goes Broke.

Interest-charges EXCEED growth of NEW debt-money, things go bust at the edges, cascading cross-defaults work their way to the center, and the whole thing goes boom.

Now, while it’s going boom, it does little good to sit there smugly knowing that it was all a paper-based house of cards.

Further, that if politicians would only have listened to the chartalists who tried to explain what my Dad used to call the “crime” of double-entry bookkeeping, we could have kept the deficit spending up as long as we wanted, and outrun that interest conundrum somehow.

So, here’s the thing, Dr. Bill, what the above paper ends up with are two options:

A new monetary system, OR your basic fear realized, the government gets the hell out of the way, and private free money markets prevail.

I say monetary sovereignty prevails.

I say a public money system is the solution.

There is NO reason for privately creating the circulating medium of any national economy.

I think the Chicago Plan has been the best option for monetary and economic stability to come down the pike, only improved slightly by the works of Stephen Zarlenga at the American Monetary Institute.

We need a new debt-free money system, an equity-based money system.

Let the banks get back to banking.

The Money System Common.

Regarding my earlier comment in this blog, I post the following explanation.

Discretionary fiscal policy can be a) a victim of a partial/negative impression effect and b) an entropy of illusion regarding its posture.

1. When the message from a fiscal stimulus is partially disclosed, the impression effect that it produces can be either incomplete or negative, constraining the positive economic reaction (for example, causing rising interest rates). In this case, the fiscal policy multiplier can be measured to be less than if full disclosure was made.

2. During the impression process, communication and retrieval forces of information get entangled by the complexity of the situation. Impression is twisted by an illusion entropy so information release regarding the fiscal policy and its effects is delayed and disrupted. Conservative politicians and speculators find a window opening to exploit attacking fiscal policy in the media and in the markets respectively. All this leads to a fiscal policy discouraged with an operational shortfall and rationed with a behavioral exclusion of public spending/finance projects.

Notice that in this case, the MMT policy prescription subject to the reality of the situation is like buying a call option on deficit spending which in the short run is “out of the money” and in the long is “in the money”! The speculators instead sell a short put option and a long call option collecting premia and expecting austerity programs. My analysis comes and buys the short put and the long call options being “in the money” on both of them, based on the reality of the situation and the prevailing wisdom!

I hope you find my analogy funny! Thank you for sharing this with me!

“Whom the gods would destroy, they first make mad.”

Euripides (484 BC – 406 BC)

Since the end of WWII, American has become increasingly mad over wealth and power. Until recently, the barrel of the gun has been pointed at others, and unimaginable destruction has been the result of American hubris. But, “what goes around comes around.” Now, instead of being faced with an external foe capable of defeating it, America has risen to this challenge itself and is pointing the gun at its own head. The good news is that if this scenario takes the course it seems to be taking, the imperial war machine will be defunded, and the world will be a safer place. Some clouds have silver linings.

David Sloan Wilson on Elinor Ostroms’s Recipe for Success:

“Extensive research and analyses of real-world groups have shown that when these [eight] ingredients are met, groups manage their own affairs better than any other method, in part because only they are attuned to their local environmental conditions. When the ingredients are lacking, then either the tragedy of the commons results or inefficient centralized solutions must be imposed.

“If the ingredients strike you as obvious in retrospect, ask yourself how many public policies are based upon them. Lin and her colleagues document many examples in which public policies get in the way. Intriguingly, liberal and conservative policies are prone to fail in different ways. Lin’s recipe for success if a vigorous hybrid of liberal and conservative principles…”

Economics and Evolution as Different Paradigms VII: Lin Ostrom’s Recipe for Success

The recipe is pretty much the opposite of neoliberal principles based self-interest because they are based on self-organization as an evolutionary tool that is fundamental to economics and economic policy.

BTW, did you know that Ayn Rand modeled John Galt on a serial killer whose absolute disinterest for others and complete disregard for them in satisfying himself she admired? Figures.

Ayn Rand, Hugely Popular Author and Inspiration to Right-Wing Leaders, Was a Big Admirer of Serial Killer

The real problem isn’t the loud and shrill loony right. As Chomsky explained it, and got the liberal audience to choke their amusement, people see and live that there is something that is serious wrong in how things are run. The only ones who addresses their concerns and give what seems to be plausibly explanations that fit their reality is the Glen Becks and Rush Limbaughs and there is hardly no one else that address them with serious explanations of what’s going on. The real problem is that there is hardly anyone on the other side of the fence, all the presumed liberals is on the same side as the Becks and Limbaughs even if many still cling to the fence to distance them self from the Becks and Limbaughs who stay clear of the fence.

Similar in Europe, its the extreme right that is the grassroots movement and address and answer the concerns of common people, what used to be labor and social democrats have long gone abandoned the losers in the neo-liberal order. Their variants of progressive politics are in best case that they promise slightly more dole than the “evil” right. They are just as happy to avoid the real issues for full employment as the right and engage in lengthily debates on nonsense and pseudo issues about how to motivate the unemployed to not be unemployed.

Wake up little Doogies, why does ibilly and his lefty buds think the criminality of this administration is just fine and dandy….I thought Progs were oh so smart. Do you not even understand what the Lehman/Wall St deal is about? It is corrupted melding of Big Gov & Big Corps = Fascism = Collectivism = Progressives aka Useful Idiots, soon to be eliminated once power is consolidated.

“inverse relationship between those who had made money in the financial markets and those who demonstrated a correct understanding of how the monetary system operates”

If this is indeed true then you cannot be surprised that people don’t value education. 😉

On a more serious note, I was wondering whether the idea that governments should attempt to pad aggregate demand to match aggregate capacity was ever questioned on this blog. I am not asking whether we should run a big deficit to achieve this; that’s being questioned everywhere. I am curious why we seem to take it for granted that we should attempt this at all. To be blunt, Americans already consume a lot of crap as it is. I am not sure I want the government increasing consumption.

Of course “aggregate demand” could manifest itself in “useful” things not in “crap consumption”… but who decides what is “useful?” The government? That is an extremely hard sell no matter what one political orientation is. I believe this is why, as /L put it, “there is hardly anyone on the other side of the fence.”

JKH,

Just found this at the ECB website half-an-hour back.

GUIDELINE OF THE EUROPEAN CENTRAL BANK of 26 April 2001 on a Trans-European Automated Real-time Gross Settlement Express Transfer system (Target)

Article 4 Interlinking Provisions (b) 1 says:

2 says:

If I haven’t misinterpreted it, it would mean there is just one institution! What do you think ?

Article 3(f) says intraday credit is available to Treasury departments

Ramanan, It would seem that if settlement is to be seamless, then the institution(s), have to be seamless in their interrelationship. For example, the Treasury and Fed are different institutions, but institutionally they function as one overall. It’s not actually true that the Fed is the Treasury’s “banker,” as the relationship is sometime portrayed, since the Fed and Treasury work in tandem, and the Fed never says no. Not the same with commercial banks, because even through the Fed never says no until resolution, commercial banks are shut down by regulators. What’s the relationship between the ECB and the NCB’s?

There was a similar seamless arrangement in place under Bretton Woods for inter-government gold settlement. They actually transferred the gold daily in the underground vault at the NYFRB. A country short of gold had to obtain the deficit from someone who had an excess of it in order to settle, as I understand it. In the US, the Fed is the lender of last resort, but under gold convertibility, there was no lender of last resort inter-governmentally, to my knowledge.

I wonder how the ECB works with regard to the NCB’s. Is there an interbank market among the NCB’s? The EMU has to function institutionally one as some level for the monetary union to function. But how they work that out specifically with the ECB and different NCB’s, I don’t know and would like to. Does the ECB stand by as lender of last resort for the euro, or can the market fail? How do the ECB and NCB’s compare to the federal government and the states in the US? Etc.

Ramanan: Thanks for digging up that ECB document. I don’t have your “read the small print and understand it” skills. But my impression gleaned from elsewhere is also “one institution”.

Bill was wondering a few weeks ago if transactions by national central banks in the Euro area are vertical or horizontal. It strikes me they are all vertical, just as with the Fed.

Have I got anything right there?

joehed, while I would agree that something radical needs to be done along these lines, the idea that the US as a capitalist economy can eliminate the banking sector as the creator and allocator of capital and remain a capitalistic country is naive. This would amount to changing the entire system radically. Short of a revolution, it isn’t going to happen anytime soon.

/L, it’s not that the left is silent. Rather, it is effectively marginalized, just like heterodox economists are marginalized by the mainstream. But it’s not all just propaganda. The reactionary media is established, powerful and profitable because most people in the US are not to smart and not very well educated. They are easily demagogued.

Westright, no one gets elected in the US without corporate campaign cash. Both parties know this. Until the US gets the money out of politics and closes the revolving door, nothing will change. There’s an old Vietnamese proverb, “Flies come and go, but the dungheap remains the same.”

Ramanan,

Yes. I stumbled across that one myself earlier — great minds, etc. We proceeded from rat’s nest to near holy grail in one day.

It’s actually consistent with what I said at WM’s in a fumbling sort of way:

“So I’m guessing those long and short positions get converted into “structural” asset and liability claims that sit on balance sheets until they get reversed by “exogenous” cross border flows in the other direction. The balance sheets of both the ECB and the NCBs seem to show some sort of massive slush pool of intra-system claims in both directions which would support this idea.”

“Exogenous” reversal equates to:

“To effect a cross-border payment, the sending NCB/ECB shall credit the inter-NCB account of the receiving NCB/ECB held at the sending NCB/ECB; the receiving NCB/ECB shall debit the inter-NCB account of the sending NCB/ECB held at the receiving NCB/ECB”

As a wise man recently said, “It cannot be otherwise”.

Not sure of your single institution view. It looks to me more like a multilateral correspondent banking set up.

Requires more study, but we have much more to go on now.

Ramanan,

Actually the one I found is an update to yours.

Haven’t read either fully yet.

http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:2005:030:0021:0026:EN:PDF

JKH,

Yes great progress! Agree completely on the “single institution” part – just a matter of emphasis. Yes more study is required, OMOs etc. Maybe the NCBs and the ECB can be considered a bigger form of different desks at the open market desk of NY Fed ?

Just find it weird why they have so many different kinds of operations for interest rate targeting …

Tom,

The questions you have raised about analogies with the old fixed exchange rate setup bothered me as well – not now. There there cannot be a balance of payments crisis! Government budget constraints are the only ones which can create trouble. Of course, if the current account deficit is high, it affects the government’s deficits and debt, so the current account is problematic – not the balance of payments.

As I see it now, the governments have an account at their respective NCBs. Banks too have an account at their home NCBs. If I transfer €1m from my Spanish bank account to your Greek bank account, (no I am not rich!), my bank reduces my deposits by €1m and your bank increases it by €1m. The NCBs make sure that everything is correct and just write IOUs of each other in their books. They needn’t trade with each other – the law requires unlimited and uncollateralized credit for/between NCBs. Its just the banks who need to take care of their balances at their NCBs. So there is no “inter-central-bank” market (that point was worrying me and JKH yesterday).

The task is to see what the ECB does. Of course, it has the people in power, and takes the decisions and communicates policies but the ECB also enters the markets sometimes and makes some trades. I wonder why, though I can somehow see the point – can’t put it in words yet.

Ralph,

Couldn’t catch your point about your point about horizontal or vertical … but I guess – you can see it as the Fed’s operations.

There were more fine prints I read, though I lost the links. One FP said that the NCB cannot indirectly monetize the home Treasury’s debt. It can only purchase government bonds directly from the Treasury when they expire. The latter is true in almost all countries but the point about indirect monetization is not I guess. There is also an FP which says that banks cannot directly purchase the bonds directly or some such thing.

Indirect monetization would happen this way: Let us say some country X is being tortured by the market. Let us say that the Government X needs to spend $1b. The NCB, could then buy government bonds worth nearly $1b which are near expiry – from the markets. At expiry it is allowed to buy $1b from the government and replenish the government X by $1b. Such a thing is not allowed!

Direct purchase by banks is also not allowed because banks of a country X can keep buying government X bonds (directly) and this process can go on forever. The Maastrich Treaty has some rules but one can just get away by paying the “fines”. A country can have under-the-table deals between the government, banks and some financial institutions whereby the banks lend to the financial institution and the financial institution uses the endogenously created funds to purchase government debt.

Someone there knows how things work at the monetary level – if only they understood it at the macro level.

“America has risen to this challenge itself and is pointing the gun at its own head. The good news is that if this scenario takes the course it seems to be taking, the imperial war machine will be defunded, and the world will be a safer place. Some clouds have silver linings.”

Tom

I have thought the same thing regarding this “liquidation event” which seems destined to take place. I dont know how long it will take, but fairly soon we’ll hear more people decrying our war machine spending in the face of austerity for everyone else.

Tom,

I’m sorry if I find it a little ironic that the progressive-est monetary blog on the interweb is not capable of embracing the basic tenet of the sovereign national government’s right to CREATE the nation’s money, managing the quantity of it into existence.

Why do the bankers, besides the taxpayers, turn to the government to fix the problem of a fractured economy, and in fact demand that the government rein in the rampant manipulation of our money system we are presently witnessing – the increasing concentration of wealth into the hands of those with the money power.

When the Chicago Plan was proposed, it was done so to SAVE capitalism.

The predominance of favor by academic economists for this simple, yet essential, change to the money power, that of using a Federal Monetary Authority to determine the quantity of new money, and the public institution of government-budgeting to carry that out and determine the public betterments that are funded, is all well scribed.

The reason Milton Friedman supported it was because it was the best approach to eliminate the boom and bust cycle.

The basic concepts were included in his Program for Monetary Stability, but more importantly in his Fiscal and Monetary Framework for Economic Stability. All before his laissez-faire chapter of economics.

The American Monetary Institute’s proposals for reform are a copy of the Chicago Plan reforms.

There is nothing in there about the government’s ‘allocation’ of capital.

The instant money is created(same as with the MMT method of funded deficits) it is deposited into bank accounts, and it is thus available for lending and capital formation.

The amount of lending is determined by the demand for loans.

Bankers are doing banking.

Again, what I don’t get is how the chartalist’s foundation belief, that of monetary sovereignty – the PUBLIC power of money creation – can be cast aside because THAT would be a tough row to hoe.

What was it Henry Ford said about there would be a revolution in the morning if the people understood the money system?

We had one monetary revolution with the Declaration of Independence – needed a war to make it happen.

The second monetary (counter-) revolution was via the pen in passing the FRA.

Just want you to know that we are out here with a pen again.

Joebhed, I agree with you that there should be one system of money creation, and since money is a public utility, the creator should be the government, which is periodically responsible to the people through democratic election, instead of financial institutions responsible to their owners.

Moreover, the current crisis is the result of private finance, not public, as some on the right try to make it out. I don’t see how it is possible to effectively bridle this excess permanently through regulation as long as money creation and banking are a so-called public-private partnership. Some partnership. I’m for financial intermediation as a public service, and let the speculators take their own lumps. End the moral hazard and bring back market discipline through accountability.

I agree that it is positive politically that Friedman supported this, too, by connecting his name to it. There is support for change in this direction on the right as well as on the left and in the center. But libertarians are under no illusions of the early Friedman or the leftish nature of the Chicago School in the 20’s and 30’s. See Murray Rothbard’s criticism.

What I am saying is that unless the US gets the money out of politics and closes the revolving door, nothing like this will happen politically, no matter how good an idea it is. The big obstacle is that neither the financial oligarchy (FIRE), nor the military-industrial complex (defense industry), nor the energy industry that rule effectively rule America will countenance a change in the status quo other than on their terms. Their lobbies write the legislation and the politicians they rent pass it for them.

Unless comprehensive reform is forthcoming, and I see no positive signs of that at present, the wealth extractors will continue to bleed the American people dry, and the world will be oppressed by the agents of capitalistic imperialism seeking to secure resources in the name of spreading freedom and democracy. I suspect that most people involved in this scam are intellectually captured or complicit rather than deeply dishonest or evil. But under the law, ignorance is no excuse.

On the other hand, Chartalism has to do with monetary economics. It simply describes how different monetary systems operates and shows what this implies for various policies. It is policy-neutral. If the system were to change, Chartalism would describe that system and show the policy options possible with it.

What I would suggest to progressives is to work as hard as possible for campaign finance reform and closing the revolving door, and the all the other things that progressives aim for will be possible. Lacking that, not so much. Now that SCOTUS has opened the corporate money floodgate, the situation will be getting worse rather than better. It may take a constitutional amendment to fix things in the US.

I would also advise progressive to learn to work within the present system to maximum effect, and Chartalism has much to say about possible policy options that could be passed incrementally to relieve the burden. But lifting the burden will not be possible without changing the present system before it destroys itself through its own internal contradictions, as well as external confrontation by the oppressed.

From the Huffington Post:

http://www.huffingtonpost.com/2010/03/12/texas-education-board-app_n_497440.html

…A far-right faction of the Texas State Board of Education succeeded Friday in injecting conservative ideals into social studies, history and economics lessons that will be taught to millions of students for the next decade.

Teachers in Texas will be required to cover the Judeo-Christian influences of the nation’s Founding Fathers, but not highlight the philosophical rationale for the separation of church and state. Curriculum standards also will describe the U.S. government as a “constitutional republic,” rather than “democratic,” and students will be required to study the decline in value of the U.S. dollar, including the abandonment of the gold standard…

Seriously, what is that country coming to?

Dear Oliver and all

There was another related report about the state of US education today:

So at least the kids in KC school district (which is on the Missouri side) won’t have to listen to the rubbish that the Texas kids are going to have to put up with.

best wishes

bill

Well, poor kids in Texas might be forced to study the decline of the US$, due to the abandonment of the gold standard. Happy kids in South Carolina might soon be able to experience the benevolent effects of legal tender based on rock solid gold and silver. Provided State Senator Mike Pitts has his way. He introduced his bill: TO AMEND THE CODE OF LAWS OF SOUTH CAROLINA, 1976, BY ADDING ARTICLE 18 TO CHAPTER 1, TITLE 1 SO AS TO PROVIDE THAT SILVER AND GOLD COIN SHALL BE LEGAL TENDER IN PAYMENT OF CERTAIN DEBTS.

Section 1-1-1110. The South Carolina General Assembly finds and declares that the State is experiencing an economic crisis of severe magnitude caused in large part by the unconstitutional substitution of Federal Reserve Notes for silver and gold coin as legal tender in this State. The General Assembly also finds and declares that immediate exercise of the power of the State of South Carolina reserved under Article I, Section 10, Paragraph 1 of the United States Constitution and by the Tenth Amendment, is necessary to protect the safety, health and welfare of the people of this State, by guaranteeing to them a constitutional and economically sound monetary system.

Section 1-11-1130. On and after the effective date of this article, this State shall not recognize, employ, or compel any person or entity to recognize or employ anything other than silver and gold coin as a legal tender in payment of any debt arising out of:

(1) taxation by the State, where the applicable authority for the tax shall mandate the calculation and payment of it in silver and gold coin;

More here: http://bit.ly/bqmnFR

Dear Tom,

1. Regarding group organization it is important to set the taxonomy of such interaction in focus. A unit in relation to events( a group) has both a shelf and a civic part. The self part has a private orientation whose incentive is interest subject to competition in a market set formed by private interests. The civic part has a public orientation whose incentive is duty subject to solidarity in a community set (polis) formed by public duties. The shelf/civic part, as an operating system or as a market or a community system, attempts to shelf/civic reach a completion state but its entity fails and its identity errs because of conditions of imperfection and friction. This loss of system completion is more frequent for the self/ market set than the civic/community set basically because the complexity of shelfish parts that trade proprietary attributes is greater than the complexity of civic parts that share common attributes. (BY the way this can be proven by mathematical logic). The shelf/civic part as a behavior character or a market/community character, attempts to adjust and cover this loss manifested as danger of decision and scarcity of praxis. The cover against danger is a series of shelf/civic protection decisions and the cover against scarcity (and the diseconomies that it imposes) is a series of shelf/civic oganization practices. All this in context of your comment about groups, shelf interest and self organization. I bother to tell you all this because you seem to be somebody that explores other ideas.

2. Regarding your emphasis on the notion that MMT is “policy neutral” I would like to comment the following. MMT, as I understand it, has policy prescriptions that follow from the hypothesis it develops. Thus it is not neutral. My concern, as I mentioned in previous comments posted in the current blog, is that the reality of voluntary/involuntary restrictions upon fiscal policy and other prescriptions must be incorporated in the analysis because it leads to different results than the ones supposed and OUGHT to follow from the prescriptions. The problem is the absence of reaction processes in the analysis restricted by the static national accounts methodology which for point analysis is useful and correct and as a series is a practical approximation of national and sectoral balance. However, flow surprises and their reaction processes can lead to different levels of GNP which are all consistent to the national and sectoral balance. There is the potential for multiple equilibrium stasis points depending on these reactions and what we have modeled as assumptions for the hypothesis.

Bill

I can’t tell whether my eyes are still bleeding from all of this conservative hysteria or whether it’s the tears from not getting past the 2/5 mark (occasionally I manage 3/5) in your saturday quizzes. I need a rest at any rate.

Oliver

“The good news is that if this scenario takes the course it seems to be taking, the imperial war machine will be defunded, and the world will be a safer place. Some clouds have silver linings.”

Well it might be so but not necessarily. There is more than enough to criticize USA:s global imperial ambitions. But when No1 plunge as the only super power there will probably be bidders who want to fill the gap, it can easily develop to something very nasty. There was plenty of naive expectation of what Soviet implosion and end to the cold war should lead to.

One can speculate in how the world have lo0ked like if ardent mercantilists like Germany Japan or even China had been at the global rein. Germany as the local EU super power or the pompous EU mandarins in Brussels handling the present or earlier crisis e.g. like the melt down of Yugoslavia doesn’t impress neither the present or earlier international economic crisis. When it comes to economic crisis they usually sit on their hands and wait for the consumer of last resort to get the economy going

As I see it the overall failure in the bid to be the dominant power in former Soviet Asia and middle east is not a military failure it’s a neo-liberal ideological failure. Propping up crocks and the people getting it worse than they had under previous rulers won’t win hearts and minds.

I saw a lecture by Ha-Joon Chang – Kicking Away the Ladder- on internet he did see USA despite criticism US as a positive force, according to him USA previously have been the only imperial power that allowed others to rise with them. Albeit he is Korean and did definitely not want China to be at global rein. As a European I must say I do sympathize with him, I have hard time at the moment to see a better alternative. The problem isn’t per se USA its neo-liberal defunct ideology, the beast have to be killed.

As Churchill said: “We can always trust that the Americanes will do the right thing, after they tried everything else first“.

.

.

“The ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood. Indeed, the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influences, are usually the slaves of some defunct economist. Madmen in authority, who hear voices in the air, are distilling their frenzy from some academic scribbler of a few years back… soon or late, it is ideas, not vested interests, which are dangerous for good or evil.”

Baron Keynes of Tilton

Panayotis, thanks for sharing these ideas. Interestingly, this was all argued out in Greece in the days of Plato and Aristotle. Ironically, Aristotle the proponent of democracy, was the tutor of Alexander, who became the first world emperor.

Regarding #1, the US is facing several challenges with respect to the disconnect between private and public, or as you say, selfish and civic. This arises out of a prevalent but mistaken notion that society is an aggregation of independent individuals rather than a system of interconnected individuals in relationship to each other and the whole. The web of relationships is as significant as the individuals considered independently. The neoliberal economic doctrine of the so-called invisible hand operating on the basis of pursuit of self-interest reinforces this mistake about the selfish and the civic, the private and the public. The libertarian political doctrine that “freedom” means license to do as one wishes irrespective of the social consequences amplifies this mistake. This mistaken idea is further complicated by the deterioration of the idea of civic duty that occurs with a professional military that is heavily supplemented with mercenaries, giving the false impression that national defense is also a matter of economic self-interest rather than civic duty. Add to this crony capitalism based on neoliberal ideology and you have a recipe for disaster.

Conversely, research in evolutionary biology, anthropology, sociology, psychology, and political science reveals that societies are systems and to succeed (survive and progress) they need to behave as such. The force driving societal success, and therefore the success of the individuals that make up the society, is self-organization, not self-interest.

Thomas Paine, whom conservatives and libertarians love to quote, wrote in Common Sense, “Interested men, who are not to be trusted; weak men, who cannot see; prejudiced men, who will not see; and a certain set of moderate men, who think better of the European world than it deserves; and this last class, by an ill-judged deliberation, will be the cause of more calamities to this continent, than all the other three.” (source) The civic process is still being corrupted by vested interests, and foreign affairs are biased in favor of US and Western interests.

Regarding #2, while I agree that a proper appreciation of operations results in policy recommendations based on efficiency and effectiveness, I take this to be policy-neutral in the engineering sense. Engineering presents options based on operational analysis and shows what to expect from the various options. Even in mechanical systems the “best” policy may not be the optimum one, which may be ideal in the abstract, but cost-prohibitive in light of opportunity cost in terms of the larger system in which the system under consideration is a subset. Moreover, in social systems it is never easy to perfectly match efficiency with effectiveness. That’s when the political process takes over in decision-making for choosing among competing options, especially when there are disagreements over public purpose itself. In the US right now, the strident libertarian view is that there is no public public purpose at all, since freedom is exclusionary of all else, and freedom reduces to individual liberty. Some people are actually trying to secede from the US by declaring themselves to be “sovereign individuals.”

/L, killing the beast doesn’t mean that the US needs to lose its global leadership role. The US just needs to return to practicing what it preaches, like real freedom and democracy instead of using these slogans to mask a more sinister intent. This “soft power” of moral force is much more efficient and effective than military power subverted to imperial purposes in the interest of the ruling class. I don’t want America to fail due to hubris, and I don’t think that others of good will around the globe do either.

Stephan, I’m waiting to see how well that will work out for SC if it becomes law. Please explain why you think it will help the state, which is already one of the poorest in the US? I fail to see the logic here.

Tom.

Thanks for the reply.

I had read Rothbard’s “Fisherine” criticism of Friedman earlier.

It is proper to bring that up in the context of this discussion.

Rothbard’s was here casting out Friedman’s monetary policy views, mainly because of their ties to the progressives at the Chicago School in the 20’s and 30’s, naturally including Fisher. All of this was done to identify Friedman as a closet statist, freeing the libertarians to abandon Uncle Milton and proceed with their anti-government rants.

Here Dr. Bill is concerned with the advent of the ‘conservative’ fiscal-monetary policy view that we need to starve the baby(the working public) in order to preserve the bathwater(banksters of all kinds).

This usually reads as ‘the guv’mint has done all it can with monetary policy (ZPR) and it’s fiscal stimulus has gotten us nowhere(true, if you ignore the prevention of backsliding), so, folks it’s time to hunker down, and feed the debt-deflation spiral. Let ‘er rip!”

You have made the point in both comments that ‘lacking a financial upheaval of calamitous proportion’, we can’t have that public-money monetary revolution I am after. (my quote).

Those of us studying the global insolvency of both private and public institutions believe that the next tip over the edge will be exactly into that calamity. I fail to see any alternative, given the infallibility of debt-contracts.

And, AT THAT POINT, we believe we need to have a new monetary system in design, or we are going to lose ALL of our monetary sovereignty. As we type, Tom, the money-powered financial elitist are not sitting back and arguing over what might be possible. They are ready with their next order of financial and monetary globalism.

At a minimum, chartalists need to remove these supposedly “self-imposed monetary constraints” that drive governments into debt. Here’s a clue from a somewhat outsider: If we didn’t know that or how we were constraining ourselves, then they aren’t self-imposed. They are banker-imposed

Where are they spelled out exactly?

Where is the draft legislation for removing those constraints?

Who is working on the exit strategy?

Finally, you say that it is proper that we have one system of public-utility money creation by the government.

Dr. Bill, in discussing full-reserve banking, says he has no problem with the private creation of “credit”.

These are not trivial matters, and I say that every day we ignore them at our own peril.

Thanks.

joehbedThose of us studying the global insolvency of both private and public institutions believe that the next tip over the edge will be exactly into that calamity. I fail to see any alternative, given the infallibility of debt-contracts.

And, AT THAT POINT, we believe we need to have a new monetary system in design, or we are going to lose ALL of our monetary sovereignty. As we type, Tom, the money-powered financial elitist are not sitting back and arguing over what might be possible. They are ready with their next order of financial and monetary globalism.

Agreed.

Finally, you say that it is proper that we have one system of public-utility money creation by the government. Dr. Bill, in discussing full-reserve banking, says he has no problem with the private creation of “credit”. These are not trivial matters, and I say that every day we ignore them at our own peril.

Agreed.

I think that one disagreement among people discussing this, whether Chartalist or not, involves whether the present system can be reformed permanently. Some think so. Others, including me, think that reform that cannot eventually be subverted is not possible, entailing that the system must be radically altered because it is a lot more difficult to subvert an entire system.

I think that Fisher and Minsky’s analysis of debt-deflation and the financial cycle that leads to instability are the outcome of private creation of money. So I don’t think that the government should be giving private banks the prerogative of using the currency of issue as bank money. If private parties want to lend fine. But let it be in their own IOU’s, and let there be full accountability. Of course, there is still going to be a need for some public regulation of private credit extension to preserve a level playing field and to minimize cheating, just as there is in other areas of commerce.

There are probably a number of ways this could be structured, but the principle of the separation of private banking and state should be preserved. This public-private partnership thing isn’t working out. The rich uncle is getting stuck with the bills of the profligate nephews.

Stephan: “Happy kids in South Carolina might soon be able to experience the benevolent effects of legal tender based on rock solid gold and silver. Provided State Senator Mike Pitts has his way. . . .

“(1) taxation by the State, where the applicable authority for the tax shall mandate the calculation and payment of it in silver and gold coin;”

Even our current conservative Supreme Court would strike that law down. 😉

It is amusing, however, to contemplate paying taxes with sacks of dimes. 😉

“students will be required to study the decline in value of the U.S. dollar, including the abandonment of the gold standard…”

Oliver: “Seriously, what is that country coming to?”

Hey! Look at the bright side. At least they will learn that we are not on the gold standard anymore. 😉

Dear Tom,

All systems fail. Furthermore, every unit whether social or atomic incorporates a civic and shelf part that coexist. A society functioning more as a shelfish unit or as a market set of private interests is more unstable than if it functions with a public orientation as a civic unit or as a community of public duties. This I explain in my earlier comment. Policy is a public response to this private instability (excessive behavior) although as I have written in my work it can be “captured” by private interests! In this case a client interconnection influences agencies to act not for a public but a private purpose. In this sense we cannot talk about neutral policy as to counterbalance (neutralize) excessive behavior (for example, speculation).

The engineering sense you have mentioned does not apply for policy prescriptions that are endogeneously changing and they are not instruments of system management (control theory). They cannot be neutral because they shift not to stabilize but to promote outcomes. For example, discretionary fiscal policy is changed into an austerity program, a reaction as soon as a deficit situation emerges. It is not neutral because it does not behave as it OUGHT to behave but rather it follows a political agenda. The point is do we incorporate this reality into our model or do we continue to pretend that discretionary policy is an issue of voluntary but uncaptured public choice which we can change freely to bring full employment. Maybe a Marxist can appreciate what I am saying!

Tom,

Sorry, I’m not a native English speaker. Thus the irony of my post in regard to crazy ideas of US conservatives was maybe lost? It’s a little bit embarrassing but I don’t think it’s a good idea to have legal tender based on gold and silver in SC.

Stephan

Stephan, I thought you might be serious. It is a completely crazy idea, of course. In the first place, where would SC get the gold and silver to mint if taxes are paid in gold or silver coin. Sure looks like a vicious circle to me.

Panayotis, I see what you are saying and I agree. Perhaps I am not making myself clear. I certainly don’t think that there is an ideal system that can be arrived that would be a permanent solution.

My argument with capitalism in the sense of market fundamentalism is summed up by George Soros in The Crisis of Global Capitalism (LINK):

There is a widespread presumption that democracy and capitalism go hand in hand. In fact the relationship is much more complicated. Capitalism needs democracy as a counterweight because the capitalist system by itself shows no tendency toward equilibrium. The owners of capital seek to maximize their profits. Left to their own devices, they would continue to accumulate capital until the situation became unbalanced. Marx and Engels gave a very good analysis of the capitalist system 150 years ago, better in some ways, I must say, than the equilibrium theory of classical economics. The remedy they prescribed-communism-was worse than the disease. But the main reason why their dire predictions did not come true was because of countervailing political interventions in democratic countries.

Unfortunately we are once again in danger of drawing the wrong conclusions from the lessons of history. This time the danger comes not from communism but from market fundamentalism. Communism abolished the market mechanism and imposed collective control over all economic activities. Market fundamentalism seeks to abolish collective decision making and to impose the supremacy of market values over all political and social values. Both extremes are wrong. What we need is a correct balance between politics and markets, between rule making and playing by the rules.

The very name “capitalism” signals that capital is to be favored over other economic factors. In reality, capital comes to be publicly subsidized, as the current situation underscores, where a public bailout was engineered to protect capital. All imbalances end in failure eventually.

There are four functions of money: (1) medium of exchange (reducing friction in transactions of goods and services), (2) unit of account (pricing), (3), store of value (saving aka hoarding), and (4) medium for settlement of financial obligations (payment of taxes, servicing of interest and principle on debt). Under the current regime, #3 and #4 have precedence, and other economic factors are used to protect savers and creditors from economic harm arising, even harm arising from their own mistakes. As a result velocity decreases owing to inadequate demand, an output gap opens, and unemployment rises. The government is then prevented from intervening for fear of “inflationary expectations” that would undermine the value of money as the store of value, while a rescue package is designed to protect creditors from default. Deflation disproportionately benefits savers and creditors and harms workers and debtors. This involves serious imbalances.

But even if the dysfunctional system were to be changed, political decisions remain. Many of these decisions are based on preferences rather than facts. For example, the left and right have historically disagreed about the relative balance of public and private. Such decisions involve value judgments. Different cultures also have cognitive biases and will take different decisions based on their traditions and institutions. Asians are more likely to prefer a more cooperative and collective solution than Americans, for example, who prefer competition and individual liberty.

So I am not saying that there is, should, or could be a single optimal solution for all. Humanity has a long evolutionary trek in front of it for full integration of the species internally and externally with the environment. That is, if humanity doesn’t make any really serious evolutionary mistakes. If we continue on the present unsustainable course, there will either be a lot fewer humans on earth, if any at all.

What I am suggesting is an integral approach to economics that is (1) evolutionary in the sense of adaptive and applicable species-wide in relation to the global environment, not only socially but also ecologically, and (2) operational in that it is based on the engineering method (heuristics) instead of theory (static models based on assumptions). By “integral,” I mean taking all relevant factors into consideration in deliberation and decision-making.

What I am saying further is that the present system is hopeless compromised and needs to be re-engineered, not patched. Instead, the US and West are trying to impose capitalism/market fundamentalism = freedom/democracy on the process of globalization. Hegelians and Marxists would note that there is now a powerful bloc forming to circumvent this as a dialectical reaction to corruption and excess arising from unbridled self-interest. Taken to its extreme, this will result in conflict.