I have received several E-mails over the last few weeks that suggest that the economics…

Same old arguments = lack of leadership

You realise how misguided the economic debate is in the West when you read that the British Opposition has been telling the British people that governance is about to break down and the IMF are poised to take over the country – that is, unless they vote for their austerity plans – and on the same day the UK Office for National Statistics releases the latest unemployment data which shows that unemployment has risen to a 15-year high. And while the British election debate appears to be all about who can cut public net spending the most, the IMF releases its latest World Economic Outlook (WEO), which is far from optimistic about the future and is warning against withdrawing the fiscal support for the very fragile demand conditions around the world. Then you read the Financial Times and see that former Clinton deputy treasury secretary Roger Altman is predicting a debt explosion. The general conclusion: our education systems have failed – and have been pumping out a population that mindlessly believes all this stuff while the elites run us over in their rush to bank the wealth they are harvesting.

Leadership on display for all to see!

Leadership was on display in the UK yesterday when the former chancellor and now conservative shadow business secretary Kenneth Clarke claimed that (Source):

Bond markets won’t wait … Sterling will wobble. We have seen even minor flickers in the opinion polls causing problems with interest rates in the recent past … If the British don’t decide to put in a government with a working majority, and the markets think that we can’t tackle our debt and deficit problems, then the IMF will have to do it for us

The Opposition shadow chancellor, George Osborne was also demonstrating that he knew what was best for Britain. He said:

It is a statement of fact that the last time the IMF came in was when the governing party did not have a workable majority in parliament. I don’t think people should underestimate the economic consequences of political instability in this country at a time when we are running one of the largest budget deficits in the developed world, when people have questioned our credit rating and people can see there is a very serous problem with employment and business confidence. That is a very serious economic challenge. Political instability and a hung parliament – people need to be aware of the consequences of that.

You could never vote for this lot unless you wanted to inflict more damage that has already been caused by faulty policy.

Last time I knew the IMF were an unelected organisation and its personnel probably require entry permits to travel to London. What do these characters think is going to happen? The sterling will probably fall a bit – so what? That will stimulate exports and choke imports. There will be less sunburnt Brits lying around on Mediterranean Islands. Instead they will spend their money locally.

And bond markets acting on the spurious advice of the criminal credit rating agencies might baulk at the upcoming debt auctions and demand higher yields. Answer: the government tells them to F*** off and repeals its ridiculous fiscal responsibility act and forces the Bank of England to buy their debt. Or better still they wake up to fact that it is 2010 and not 1970 and that the Bretton Woods convertible currency monetary system is buried and they do not have to issue debt anyway.

That would be a show of leadership.

And leadership is what is required. Especially in the context of the April Labour Force Statistics, released yesterday by the Office for National Statistics. The following graph shows the sorry story of their labour market (taken from the official statistics).

Unemployment has risen above 2.5 million persons for the first time since 1997 with 43,000 extra unemployed being added to the jobless pool in the February 2010 quarter.

Question: how on earth would any politician advocating harsh cutbacks have any credibility under these circumstances? Answer: there is no credibility.

The fact is that both parties will further entrench disadvantage in Britain and the “bond markets” will then just scream louder as deficits rise further via the automatic stabilisers.

This is a very stark example of how our polity has to break out of this vicious circle and dispel these myths one by one. Otherwise, they are just getting themselves deeper into the circular mire of sluggish if not negative growth, rising deficits and debt, downgraded credit ratings, rising yields, fiscal austerity, worsening growth prospects.

This is the time when the paradigm break out is desperately indicated. The mainstream model has categorically failed to provide for sustainable growth and now a sustainable recovery. On both parts of the growth curve the policy advice forthcoming from mainstream economists has been detrimental.

On upswing it constrained growth and the chance to eliminate unemployment by introducing budget surplus fetishism and forcing the non-government sector to drive growth by ever increasing levels of indebtedness. That strategy was always going to crash and now it has their advice is preventing the economies around the world from staging a more rapid recovery.

At the bottom of all this pack of misperception, incompetence, lies and plain straight out criminality are the unemployed and the poor – getting trampled.

If we ever needed a change now is the time.

Even the IMF who still don’t get it think the fiscal support should stay

Then I read the April 2010 WEO from the IMF. On pages 5-6 we read that the “policy support has been essential in fostering recovery” and that:

Extraordinary policy intervention since the crisis has all but eliminated the risk of a second Great Depression, laying the foundation for recovery. The interventions were essential to prevent a downward debt-deflation spiral, in which increasingly severe difficulties would have fed back and forth between

the financial system and the rest of the economy.

They argue that in terms of the recovery process:

Economies that are off to a strong start are likely to remain in the lead, as growth in others is held back by lasting damage to financial sectors and household balance sheets. Activity remains dependent on highly accommodative macroeconomic policies and is subject to downside risks, as fiscal fragilities have come to the fore. In most advanced economies, fiscal and monetary policies should maintain a supportive thrust in 2010 to sustain growth and employment.

As a result, the IMF claim that many economies are still too weak to be contemplating tax rises, spending cuts or tightening of monetary policy.

So all the chapters in mainstream macroeconomics textbooks about the ineffectiveness of fiscal policy should be torn out and major apologies provided to the students who were forced to learn these lies at the expense of their intellectual development.

But in case you are wondering whether the IMF has really learned their lessons you then read this:

A key concern is that room for policy manoeuvres in many advanced economies has either been exhausted or become much more limited. Moreover, sovereign risks in advanced economies could undermine financial stability gains and extend the crisis. The rapid increase in public debt and deterioration of fiscal balance sheets could be transmitted back to banking systems or across borders.

This is not a valid concern. The only thing limiting the continued capacity of fiscal policy to stimulate economic growth and provide jobs for the unemployed is the ideological dead-end that the mainstream has forced us down.

Question: Are there idle labour resources in our economies? Answer: millions of persons and potential hours of work?

Question: Can the national government purchase those resources? Answer: by offering them a wage?

Question: Can the national government afford to offer them a wage? Answer: it would only involve a weekly electronic transfer from one bank account to another.

Question: Are there other resources lying idle that the government could purchase or lead to be employed by purchasing the outputs derived? Answer: massive excess supplies of productive resources are lying idle. The national government can always afford to purchase these resources. There is no question about that.

So what limitations are there on fiscal policy at present? Answer: none that are of any relevance.

Further, there are no sovereign risks in advanced economies other than those that have voluntary given up their currency sovereignty (such as the EMU nations). Say that again – there are no sovereign risks in advanced economies. The IMF bosses should be prosecuted for publishing misleading information which will cause other behaviours that will undermine the welfare of the disadvantaged.

Finally, use of the terminology “deterioration of fiscal balance sheets” evades meaning. There is no such things a deterioration in the fiscal situation. That implies that deficits are bad, larger deficits are worse and vice versa. That sort of imagery has no application in a modern fiat currency system.

To assess the state of the economy you do not look at the budget balance. A rising budget deficit might be a sign that growth is strong and unemployment low – which is unambiguously good (as long as growth is not endangering our natural environment and is being equitably distributed). Then again a rising budget deficit might be driven by automatic stabilisers reacting to a collapse in private spending and rising unemployment. That would be unambiguously bad.

So you see that statements like “fiscal deterioration” have no meaning as they are applied by the IMF and the mainstream economists.

Anyway, what I gleaned from the April WEO was that even the IMF considered it to early to be introducing fiscal austerity programs and tightening monetary policy.

Altman is back

But then I read the latest salvo (April 20, 2010) from Roger Altman in the Financial Times – America’s disastrous debt is Obama’s biggest test.

This is one of the worst pieces of analysis you will ever read. You might also be interested in the comments that my sometime co-author and good friend Warren Mosler had on this same piece – HERE. I will try to add to rather than repeat what he has said.

But to give you some clue as why this guy should be totally disregarded in the current debate consider what he said as the crisis was unfolding in late 2008.

Altman wrote about the The Great Crash 2008 which was published in the January/February 2009 edition of Foreign Affairs.

Indeed, rising economic powers are gaining new influence. No country will benefit economically from the financial crisis over the coming year, but a few states — most notably China — will achieve a stronger relative global position. China is experiencing its own real estate slowdown, its export markets are weak, and its overall growth rate is set to slow. But the country is still relatively insulated from the global crisis. Its foreign exchange reserves are approaching $2 trillion, making it the world’s strongest country in terms of liquidity. China’s financial system is not exposed, and the country’s growth, which is now driven by domestic activity, will continue at solid, if diminished, rates.

This relatively unscathed position gives China the opportunity to solidify its strategic advantages as the United States and Europe struggle to recover. Beijing will be in a position to assist other nations financially and make key investments in, for example, natural resources at a time when the West cannot.

At the time, when I read that I concluded that if Altman had any influence in US domestic policies (he was advisor most recently to Hilary Clinton) then it would only undermine the global dynamics further.

The fact that China escaped (so far) relatively unscathed from the global financial crisis had little to do with the fact that its financial system was “not exposed”. While clearly the financial crisis presented a major issue for the US economy given how bloated the US government had allowed the financial sector to become, the fact remains that as a sovereign government it could have followed the example of China and used fiscal policy more aggressively.

It is hard to be accurate but in the early stages of the crisis and before the Chinese government turned on its very significant fiscal expansion, millions lost their jobs in China. If they had have followed the very mean fiscal path adopted by the US government acting under the advice of the likes of Altman and Summers and their ilk, then they to would have experienced a much greater downturn.

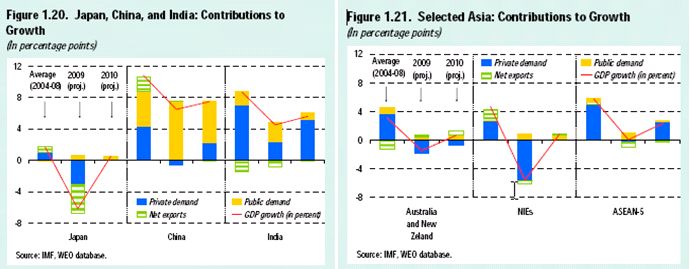

This graph was taken from the IMFs Regional Economic Outlook: Asia and Pacific Report which was published May 2009. It presents an interesting picture by splitting the contribution to growth of public demand (net government spending), private demand and net exports. China stands out. Most people think of China’s growth coming from its burgeoning export sector. But it has a very strong domestic economy and a large public spending program.

The Chinese clearly understand how to build a nation even if they have some way to go in creating free spaces for their citizens’ thoughts.

Nations need to be continually built and the comparison between China’s performance with Japan (with virtually no public sector) and the performance of Australia and New Zealand, which have only minuscule growth originated from public spending, is compelling.

The IMF Report notes in that:

In China, GDP growth will also slow down notably from the average pace of the recent past. Still, the aggressive policy response is expected to support domestic demand and maintain growth at rates close to the level authorities consider necessary to generate jobs consistent with social stability. In particular, the massive program of public investment initiated late last year is expected to compensate for the decline in private investment and absorb productive resources no longer utilized in the tradable sector.

The graph highlights, in my view, the importance of very large fiscal interventions. My Chinese friends tell me there is no discussion over there about the country drowning in debt and all of that nonsense. They know full well that they are sovereign in their own currency and can deficit spend to further their sense of public purpose.

While the Chinese government is an oppressive regime (in political terms) they clearly have a much more sophisticated understanding of the opportunities that they have as a monopoly supplier of their currency than Western government have. And they are taking those opportunities more than other nations around them that are caught in and are being choked by the neo-liberal web imposed on them by the advanced nations.

Further, while the west likes to think of itself as being democratic and free – the economic oppression that our governments have imposed on the citizenry in the form of persistently high unemployment as a result of their failure to act appropriately in the early stages of the crisis – exemplifies an abrogation of freedom.

Pointing the finger at China for their political oppression is somewhat hypocritical when the power elites in the so-called free world oppress the workers via unemployment and poverty.

Altman also disclosed his lack of understanding (or a willingness to lie) in this passage:

This recession also will be prolonged because the usual government tools for stimulating recovery are either unavailable or unlikely to work. The most basic way to revitalize an ailing economy is to ease monetary policy, as the U.S. Federal Reserve did in the fall. But interest rates in the United States and Europe are already extremely low, and central banks have already injected unprecedented amounts of liquidity into the credit markets. Thus, the impact of any further easing will probably be small.

Another tool, fiscal stimulus, will also likely be used in the United States, Europe, and Japan — but to modest effect. Even the $300 billion package of spending increases and tax rebates currently under discussion in the U.S. Congress would be small in relation to the United States’ $15 trillion economy. And judging from the past, another round of stimuli will be only partially effective: the $168 billion package enacted last February improved the United States’ GDP by only half that amount.

Many nations caught in the neo-liberal policy vice which had conditioned their policy makers over the recent decades to eschew fiscal policy and rely on monetary policy as the only counter-stabilisation tool clearly though monetary policy was the first port of call in response to the crisis. This ideological dislike for fiscal policy cost their nations billions of dollars (or equivalent currency) in lost output and millions of lost jobs.

Monetary policy is not the “most basic way to revitalize an ailing economy”. That is just an ideological statement. Monetary policy even when rates are above zero is a relatively indirect and blunt policy tool with no reliable impacts. It first of all has to rely on households and firms changing their spending patterns. But the changes are unpredictable because there are distributional complexities – creditors and those living on assets lose when rates fall while debtors gain. Net effect? Unclear and certainly not immediate. Further, monetary policy changes cannot be targeted across regional space. So areas that need stimulus more than others cannot be isolated.

Alternatively, fiscal policy is direct – $s can flow immediately and in a targeted fashion. While the Australian government policy reaction in late 2008 and early 2009 was far from optimal (for my tastes) it put $As into consumer’s pockets which were spent. The impact of that policy intervention on retail sales was stunning. Please read my blog – Robin Hood was a thief not a saviour – for more discussion on this point. The fiscal stimulus, in no small part, saved Australia from a recession. It was early, targeted and of a significant size.

The US problem was always too little – too late. And clearly, this was because of the likes of Summers and Altman and whoever else has influence in the economic policy making.

So that should warn you that Altman’s latest piece in the Financial Times (April 20, 2010) – America’s disastrous debt is Obama’s biggest test – will be fairly far off the mark.

This time he is trying to be convince us that there are sovereign debt risks and he claims that the current situation:

… evokes bad memories of defaults and near-defaults among emerging nations such as Argentina, Russia and Mexico. But the real issue is not whether Greece or another small country might fail. Instead, it is whether the credit standing and currency stability of the world’s biggest borrower, the US, will be jeopardised by its disastrous outlook on deficits and debt

Each of these defaults was necessitated by the unsustainable currency arrangements the nations had in place. Both Argentina and Mexico were operating with currency pegs (to the US) and built huge US-dollar debt exposures. A major loss of export income was all that was needed to force a default. Russia too was running a tight peg against the US dollar and has accumulated huge foreign-currency debt exposures. They lost billions in foreign reserves trying to defend the parity when energy markets collapsed.

The only exception to this pattern was the Russian default on its rouble-denominated debt which can be put down to an act of madness aided-and-abetted by terrible advice given to them by the IMF.

So these instances invoke nothing at all about the current debt situation in the US, the UK, Australia, Japan or anywhere else that the government is issuing its own currency and floating it freely on foreign exchange markets.

In these cases, there is absolutely no sovereign debt risk – by which we mean a risk of insolvency leading to default. Even entertaining the prospect in serious discussion is gratuitously irresponsible.

Further no meaningful comparison or lineage can be drawn between the fortunes and prospects of an EMU nation (which is not sovereign in its own currency and has no central bank under the control of its government) and the US or Japan or whatever.

He later uses the same false analogy when he notes that the US public debt ratio is “nearly equal to Italy’s”.

Altman then invokes some more distortion – this time of an historical nature:

Global capital markets are unlikely to accept that credit erosion. If they revolt, as in 1979, ugly changes in fiscal and monetary policy will be imposed on Washington. More than Afghanistan or unemployment, this is President Barack Obama’s greatest vulnerability.

I presume Altman is talking about the pressures that came onto the US dollar in 1979 during Jimmy Carter’s tenure although he might also be referring to the Latin American debt crisis which occurred around the same time. Remember the Iranian oil embargo, the continuing stagflation and the falling dollar value. The US government at that time accepted the demands of bond markets for deficit reduction and tighter monetary policy exactly because they listened to Altman-type hysteria arguments.

Just as they can now – they could have ignored the demands and continued to support aggregate demand and allowed the US dollar to fall if that was the will of the foreign exchange markets. That would have been a far better strategy than the one Carter took which prolonged the recession.

Further, those who are aware of the financial upheavals in the late 1970s will already know what I am about to say. The basis of the Latin American debt crisis in the late 1970s and early 1980s was the large stocks of foreign-currency denominated debt held by many Latin American countries. What followed was predictable.

The OPEC oil price hikes in the 1970s and early 1980s created a global recession and primary commodity export prices collapsed. The highly indebted nations – most running currency pegs – clearly lost the essential export income necessary to keep servicing these debts.

The debtor nation currencies devalued and this exacerbated their debt exposure to the US and European banks. The crunch came in 1982 when Mexico defaulted (announcing a 90-day stay of payment). Lending to Latin American nations ceased for a time and given that the first-world bankers had screwed these nations with mostly short-term debt exposures – refinancing became impossible.

Solution – enter the IMF who then raped the nations as national incomes plunged and unemployment soared. This document provides an interesting historical account of the debt crises in the late 1970s and early 1980s.

Has any of that anything to do with the US or Japanese or UK situation now? There is not a single common element. None of the major sovereign nations borrow in foreign currencies (or only in minuscule amounts). They all have their own currency which floats freely. They can always service their own currency debt.

Altman’s false analogy is scandalous but then he is a mate of Peter G. Peterson (having worked in the Blackstone Organisation) – so what more should we expect?

Further, like the UK leaders who are blithely ignoring the fact that unemployment is still rising as they argue about how far and when to cut the fiscal support being provided, Obama will eventually run out of friends among the unemployed.

As Warren notes, the greatest vulnerability or liability that Obama carries is not the rising public debt but the advice he is getting from economists within and outside of his inner circle.

The rising public debt is just a mirror image of the rise in government financial assets in the hands of the non-government sector. The real issue is the collapse in aggregate demand which has necessitated the budget deficits. The debt ratio or debt level is a side show of no particular import.

Altman then quotes some figures about the rise in public debt ratios that I am sure he has worked out with the PGPF as being frightening to the main-street punter (they are strikingly similar to those found in the citizen’s guide I talked about yesterday). And then the inevitable ominous question:

Why is this outlook dangerous? Because dollar interest rates would be so high as to choke private investment and global growth.

Really? Which interest rates? The terminology “dollar interest rates” is quaint but not helpful. He means the rates that the US government will be paying on its debt.

But these are conditioned (even under the current system) by the fact that the central bank in the US has total control over the setting of short-term interest rates.

Moreover, if the treasury insists on continuing the “gold standard” and totally unnecessary practice of issuing debt then it can just confine itself to issuing short-term bills in the maturity range controlled by the central bank. Problem solved.

Further, even if they continued to issue longer term debt, the central bank can easily control longer maturity rates if it was instructed to do so.

Finally, it is unclear that monetary policy has much impact on economic growth anyway – certainly it is a junior partner when compared to fiscal policy. The latter will always dominate the impacts on expenditure of monetary policy.

The article then gets into a tangle that only these deficit terrorists can create – they know damn well that “the economy is too weak to withstand the contractionary impact of deficit reduction” but then argue that the “the big elements of a solution” are to cut spending and increase taxes. The latter is their ideological slant dominating.

From a Modern Monetary Theory (MMT) perspective the facts are obvious. The “economy is too weak to withstand the contractionary impact of deficit reduction” because the deficit was too small in the first place and continues to lag below what is required. As discussed above, the Chinese were the ones who understood the fiscal imperative. The advanced world was too caught up by the neo-liberal mindset to take the required action when it was really needed.

Result: prolonged recession, sluggish growth and rising or static (but high) unemployment.

What the “big elements of a solution” constitute is simple. The complete excoriation of the failed neo-liberal mindset. Nothing short of that will allow fiscal policy to provide the necessary support for as long as it is needed. Nothing short of that will allow the policy makers to free themselves of the influence of the financial markets and introduce wide-ranging but essential banking reform. Nothing short of that will restore full employment.

Altman thinks that the future lies in the introduction of fiscal austerity driven by new budget rules to achieve “a truly balanced budget”. My comments yesterday about the failure of these commentators to understand the endogeneity of the budget outcome and its relationship to the other sectoral balances (external and private domestic) apply here.

He wants “America’s addiction to debt” to be cured but that concern only applies to the private debt. The public debt is not an addiction but an artefact of the anachronistic institutional arrangements that the US government inherited from the gold standard. They could ditch those institutions any time they liked.

But given these institutional arrangements which see the US government issue debt $-for-$ to match its net public spending all we can say from the rise in the public debt ratio is that GDP has gone south and deficits have risen via discretionary policy changes and the operation of the automatic stabiliser to support aggregate demand after the collapse in private spending.

That doesn’t sound like an addiction at all but a necessary correction after the private debt binges fuelled by financial firms of the likes that Altman has worked for and managed.

The Fiscal Sustainability Teach-In and Counter-Conference

The Fiscal Sustainability Teach-In and Counter-Conference will be staged in Washington D.C. next Wednesday (April 28, 2010) and details of venues and other relevant arrangements are available at the home page. All are welcome.

This is the first grass roots effort to promote MMT. The day has been chosen to rival the sham Peter G. Peterson Foundation conference exploring the same topic.

If you are near to Washington DC and have the means it would be great to meet you next week.

You will also note that I have included a fund raising widget on my right side-bar. Any help for the organisers will be very appreciated. Just click the image and open your bank accounts! The fund-raising home page is HERE.

At present they really need some financial support. It is a shoe-string, community-driven event being organised by committed volunteers who are motivated by the fact that they care and realise something is wrong with the dominance of conservative, free-market think tanks like the PGPF in the public debate.

Conclusion

My band is playing tonight so …

That is enough for today!

bill,

is my understanding from the webpage correct that as not a US citizen or resident I am not able to contribute?

Dear Bill,

I am an engineer have not much background knowledge on economical affairs. But, I always had the instinct that the real economic problems lies with the real resource allocation or lack of it, not finances or budget. Thanks for helping provide a theoretical background for me to solve the puzzle in my mind.

I, however, still have a question that I could not answer myself. I know that countries like US can actually produce all the goods and services it needs itself (except for, perhaps, oil). So, it can affort to dismiss bond markets’ “feelings”. (And, I am still not clear about the consequences on the US’s imperial aspirations as the dollar might loose its status as the world currency)

However, the case is not true for countries like mine: Turkey. We run a fiat currency system. But also we definitely do not have enough internal resources to produce all the goods and services ourselves. So, a declaration by the government that it will no longer issue debt would result in hyperinflation due to the fact the the value of our currency would go down starkly and we have to import many important goods like oil. The drop in the value of our currency might not make our exports more competitive either, as the exporters use lots of imported raw materials. Is this analysis correct? If so what is the correct policy action for countries that depend on imported goods for at least short to medium term?

Thanks again,

Kemal

Bill,

In the UK the inflation rate is also growing and house prices are on the rise again. Coupled with the increased unemployment rate, doesn’t this suggest (via MMT) that the UK is actually operating at capacity and that we have destroyed all our spare capacity with the policies run over the last few years?

How would you propose diggin the UK out of the mess it is in?

Neil

Dear Sergei at 8.22pm

You said:

To which I reply – I haven’t the slightest idea of what you are talking about? Which WWW page?

best wishes

bill

Sergei –

ActBlue, the website and “agent” for collecting contributions for counter-conference, is a website for progressive grassroots Democrats to collect political contributions for certain candidates. It looks like they used the template for political contributions (it could be that’s the only template they have). ActBlue system may not be able to accept non-US citizen contributions – I don’t know but I will try to find out.

But please don’t be offended by exclusion – it could be a matter of a system being used for what it was not intended to be used for such as funding a grassroots (non-political) counter-conference.

Related to Peterson, I recently found this Public broadcasting interview with Peter Peterson from early 2008. (54 mins; Pretty Long)

Link here.

He had just cashed out of Blackstone and endowed his Foundation, and again this was pre Lehman (he actually says that he thinks Lehman would be fine). Ive looked at this and I have to admit I cannot detect anything sinister on the surface. He is somewhat self effacing, self-deprecating. I think he sees himself as a form of a “savior”. His “public service” career has been one of repeated “coming in to save the day” type of things (Peterson Commision under Reagan, Concord Coalition, Peterson-Pew Commision under Bush2, now his $1B Foundation). His m.o. seems to be to inappropriately overlay his business principles/acumen onto government procedures/policy and here we are.

If you want to skip the bs and go to the end, he does sort of do a summary where he admits he often gets into things that he doesnt know much about initially, but within 6 mos. of study, he feels he gets to the point where he understands things well enough. (Also he went to U of Chicago under Friedman! oh no!) This is obviously the case today where he clearly does not understand all of the economic policy options available to Governments.

Resp,

bill, I would leave it a few days to see if the British electorate is actually swallowing the debt-mongering bilge being pumped out by the tories.

It is obvious to all, including their own supporters, that they are becoming increasingly desperate.

The reality on the ground is that immigration is for most voters a much bigger issue than the deficit, with few people really giving a stuff about the latter, but many voters remain very keen to keep the darkies out.

sad but true.

Matt, I think we have to distinguish between being ignorant and being disingenuous. Most people are probably ignorant of monetary economics, and some of these are even economics professors, even after it is explained to them clearly. Being ignorant doesn’t mean lacking intelligence. It just means not knowing, for whatever reasons. A lot of people are invested in not knowing certain things since knowledge would upset their apple cart. Others are intellectually capture by the prevailing ideology or conventional wisdom. In fact, I have found it is usually easier to explain MMT to people who haven’t studied orthodox economics than to those who have. Moreover, business people, bondholders, and people on fixed incomes are terrified of inflation, and they see inflation lurking under every rock. It is difficult to convince them that deficit spending is not inflationary in itself or that a growing debt ratio is not dangerous, even though there is no similarity between government that issues currency and nongovernment that uses it. It is as if they are wearing blinders and don’t realize it.

Pete Peterson is very likely in the group of the ignorant, and he and his conference is speaking from this platform. They are probably redeemable through knowledge. On the other hand, I suspect that others are not ignorant of MMT principles but being disingenuous about it to gain advantage. When Cheney says that deficits don’t matter, for example, my ears perk up. These people may be irredeemable and go down fighting.

Sergei –

Further clarification:

ActBlue is a political action committee (PAC) and a “political organization” as defined by IRS, but it’s not connected to any party, candidate or other entity. Because of its status it can only accept contributions from U.S. citizens.

Bill,

So was the recent chinese housing bubble an indication of advancing ‘public purpose’ ?

Were those phenomenal rises not driven at all by low interest rate policies and fiscal support which progressives such as yourselves advocate ?

Atleast the chinese govt. have had the sense to recognize what it is….and introduce policies to cool the bubble. But all too often, the ‘progressive economists’ are so absorbed by some of the topics you discuss [idle resources,ergo must spend, must lower IR’s,] which don’t seem to focus on real world consequences of loose monetary policy and aggressive stimulus…..ie one consequence is arguably soaring house prices.

care to respond to that ?

tricky, The land situation in China is not as simple as you picture. See Michael Pettis and Andy Xie on this. A lot of the problems arise because this a one off program to privatize previously state-owned property. A lot of parties are invested in this process, and there’s something of a tug of war among different interests.

So Pete Peterson is coming to save the day?

So are the Koch brothers. So is Howard Ahmanson, Jr. So are the rest of them. They all know what is best for us and want to be our heros.

Spare me. Everytime any one of these people enters the discussion, it is ALWAYS in the same fashion. They plop their great wealth on the table, and then use it to suck the air out of the room so that no other voices can be heard.

Save us? Hardly. They are choking us all to extinction. Peterson is just one more of a long line of them who want to play God before they go off to meet Him.

Dear Sergei and RebelCapitalist

If you go to http://www.fiscalsustainability.org/contact and ask Joe how to contribute I think non-US citizens should be able to help.

Otherwise, contact me personally and I will put you onto Joe Firestone who is a major organiser.

best wishes

bill

You are wrong about fewer sunburnt Brits hanging out on beaches in the Meditteranean. when Greece and Spain get kicked out of the Eurozone, their currencies will outrun Britain’s to the floor and the Brits will be able to travel there cheaply.

Dear Bill,

I hope that you’re feeling better after the surfig mishap.

I just want to mention that I planted 3rd post on AEP’s blog which is somehow inspired by MMT even if I may see certain things a bit different than MMT prescribes.

http://www.telegraph.co.uk/finance/financetopics/financialcrisis/7620444/Fitch-warns-of-debt-shock-for-Japan.html?state=target#postacomment&postingId=7621738

This is just an experiment as AEP may intuitively understand some of the the dynamics of the global financial system but he is clearly on the right side of the political spectrum in the UK (and the most of the people who comment on his blog have quite extreme views even for me).

I am not sure whether AEP subscribes to the Keynesian view that government spending may create financial and real wealth if there is gap in aggregate demand.

It is yet to be seen whether my post will be ignored completely (as the previous ones), whether it will generate flaming or a few more people will visit your site.

I just wanted to inspire the discussion…

@tom

i’ve googled one of the names you mentoned, and came across this article…

http://www.chinatranslated.com/?p=835

What is it the MMTs say ? The natural rate of interest is zero. Well, it maybe in china if you want a massive property bubble.

i know there’s more to it than that, but then everytime the modern monetary theory wants to use a nation as a case study for the

success of the things it advocates, it may be worth looking at the whole economic picture….as important as employment numbers and growth are, property prices are arguably the issue of the last decade globally.

KEMAL ERDOGAN, interesting question. I myself had similar in another thread and Bill answered this:

“An application of MMT principles to policy cannot resolve every problem there is. Properly applied MMT principles allow a government to maximise the utilisation of the available domestic real resources. It may increase the availability of resources (for example, high quality education leading to medical discoveries that keep people healthier etc) but in the short-run a real resource constraint is something that policy can do very little about.

For a country with zero resources other than people, then export income has to be earned. If that is impossible then such a country would be at the behest of the rest of the world for generosity. But even then MMT tells us that the government can ensure its own people are achieving their potential (should they want to).

best wishes

bill”

rmv,

There is a qualification that must be made regarding the use of fiscal policy to deal with structural inefficiencies/inadequacies. They cannot be dealt with endogenous (stabilizers) and automatic vertical income generation programs(insurance schemes, income support, job guarantee) but rather voluntatry(discretional) spending allocation programs that expand infrastructure, human capital, skills development and innovation with alternative technologies to deal with shortages of strategic materials. This is a development policy or long term fiscal policy. In this case, the real resource constraint can become variable beyond the cycle and over time. Furtermore, the so called structural fiscal balance can be shown to be variable and shifting over time, even if full employment of resources is accomplished. There is room for fiscal policy even at full employment, if there are social or public oriented inefficiencies/inadequacies to be corrected and inflation to be checked!

Panayotis: They cannot be dealt with endogenous (stabilizers) and automatic vertical income generation programs(insurance schemes, income support, job guarantee) but rather voluntatry(discretional) spending allocation programs that expand infrastructure, human capital, skills development and innovation with alternative technologies to deal with shortages of strategic materials.

Good point, Takis. I believe that Bill, Randy Wray, etc., have pointed out that relying on automatic stabilizers is like leaving the barn door open and then having to chase the horse when he gets away. Better to formulate an expansive policy to begin with in order to lock the door so the horse doesn’t get away. This involves an economic policy that provides for government funding matters like these that the private sector is unwilling or unable to undertake on it own, or providing the private sector with incentives to do so. This is often not emphasized in the discussion, and it could be missed. But it is an essential factor in formulating and implementing effective fiscal policy using MMT principles.

Dear Tom,

I agree that MMT theorists accept htis point. I emphasize it in case some my not realize that fiscal policy is more than cyclical response and incorporates development policy aspects. This leads to another point that fiscal policy of the discretionary kind, by reducing public inefficiencies/inadequacies (structural) or social negative externalities can lower inflation even if the economy is at full employment of resources.