I have received several E-mails over the last few weeks that suggest that the economics…

Understanding central bank operations

I have arrived in Washington now and it is late Monday. I am staying on local Newcastle time because for a short-trip it is easier to avoid jet lag that way. So I started work today at around 20:00 Washington time and will finish close to dawn. I think I will play Night Shift on You Tube to keep me company through the night … err day (Australian time). On the plane coming over, among other things, I read a paper written a couple of years ago by the Federal Reserve Bank of New York about the way in which monetary policy can be “divorced” from bank reserves. It is a useful paper at the operational level because it brings out a number of important points about bank reserves and the way central banks can manipulate them or ignore them. That is what this blog is about.

In the September 2008 edition of the Federal Reserve Bank of New York Economic Policy Review there was an interesting article published entitled – Divorcing Money from Monetary Policy.

It demonstrated why the account of monetary policy in mainstream macroeconomics textbooks (such as Mankiw etc) from which the overwhelming majority of economics students get their understandings about how the monetary system operates is totally flawed.

The FRBNY article begins by stating that:

Monetary policy has traditionally been viewed as the process by which a central bank uses its influence over the supply of money to promote its economic objectives. For example, Milton Friedman (1959, p. 24) defined the tools of

monetary policy to be those “powers that enable the [Federal Reserve] System to determine the total amount of money in existence or to alter that amount.” In fact, the very term monetary policy suggests a central bank’s policy toward the supply of money or the level of some monetary aggregate.

In his Principles of Economics (I have the first edition), Mankiw’s Chapter 27 is about “the monetary system”. In the latest edition it is Chapter 29. Either way, you won’t learn very much at all from reading it.

In the section of the Federal Reserve (the US central bank), Mankiw claims it has “two related jobs”. The first is to “regulate the banks and ensure the health of the financial system”. So I suppose on that front he would be calling for the sacking of all the senior Federal Reserve officials given the massive collapse that occurred under their watch.

The second “and more important job”:

… is to control the quantity of money that is made available to the economy, called the money supply. Decisions by policymakers concerning the money supply constitute monetary policy (emphasis in original).

And in case you haven’t guessed he then describes how the central bank goes about fulfilling this most important role. He says that the:

Fed’s primary tool is open-market operations – the purchase and sale of U.S government bonds … If the FOMC decides to increase the money supply, the Fed creates dollars and uses them buy government bonds from the public in the nation’s bond markets. After the purchase, these dollars are in the hands of the public. Thus an open market purchase of bonds by the Fed increases the money supply. Conversely, if the FOMC decides to decrease the money supply, the Fed sells government bonds from its portfolio to the public in the nation’s bond markets. After the sale, the dollars it receives for the bonds are out of the hands of the public. Thus an open market sale of bonds by the Fed decreases the money supply.

The very next paragraph gets to the message he wants students to take away “because changes in the money supply can profoundly affect the economy”. Why? That is easy, “(o)ne of the Ten Principles of Economics … is that prices rise when the government prints too much money”. Please read my blog – Do not learn economics from a newspaper – for more discussion on why these principles are just an ideological brainwashing exercising.

The upshot is that students who purport to learn economics from a course using this textbook will be ill-equipped to say anything sensible about how the actual monetary system operates.

The FRBNY state clearly that:

In recent decades, however, central banks have moved away from a direct focus on measures of the money supply. The primary focus of monetary policy has instead become the value of a short-term interest rate. In the United States, for example, the Federal Reserve’s Federal Open Market Committee (FOMC) announces a rate that it wishes to prevail in the federal funds market, where overnight loans are made among commercial banks. The tools of monetary policy are then used to guide the market interest rate toward the chosen target.

This is practice is not confined to the US. All central banks operate in this way and I have shown in other blogs that central banks cannot control the “money supply”.

However, the FRBNY try to build a bridge between the two viewpoints by claiming that “the quantity of money and monetary policy remain fundamentally linked”. How do they construct that argument?

They say that because commercial banks hold “reserve balances at the central bank” and demand “reserve balances … inversely … [to] … the short-term interest rate”, which is the “the opportunity cost of holding reserves” then the central bank can “manipulate the supply of reserve balances” by exchanging “reserve balances for bond” (open market operations) to ensure that the “marginal value of a unit of reserves to the banking sector equals the target interest rate”. This allows the interbank market (for overnight funds) to clear and maintain the policy rate.

The FRBNY say that “(i)n other words, the quantity of money (especially reserve balances) is chosen by the central bank in order to achieve its interest rate target”. This is, in fact, fairly loose language. It is clear that the level of reserve balances in the system are chosen by the central bank to maintain the policy rate as I will explain. But using terminology like the “quantity of money” is misleading and doesn’t match the concept of the “money supply” that the likes of Friedman and Mankiw were referring to. They were in fact referring to a close relationship between what is known as the monetary base and broad money. In mainstream economics, the link is provided by the money multiplier model.

However, that construction of banking dynamics is false. There is in fact no unique relationship of the sort characterised by the erroneous money multiplier model in mainstream economics textbooks between bank reserves and the “stock of money”.

You will note that in Modern Monetary Theory (MMT) there is very little spoken about the money supply. In an endogenous money world there is very little meaning in the aggregate concept of the “money supply”.

Central banks do still publish data on various measures of “money”. The RBA, for example, provides data for:

- Currency – Private non-bank sector’s holdings of notes and coins.

- Current deposits with banks (which exclude Australian and State Government and inter-bank deposits).

- The M1 measure – Currency plus bank current deposits of the private non-bank sector.

- The M3 measure – M1 plus all other ADI deposits of the private non-ADI sector. So a broader measure than M1.

- Broad money – M3 plus non-deposit borrowings from the private sector by AFIs, less the holdings of currency and bank deposits by RFCs and cash management trusts.

- Money base – Holdings of notes and coins by the private sector, plus central bank reserves (deposits of banks with the Reserve Bank and other Reserve Bank liabilities to the private non-bank sector.

Note that ADI are Australian deposit-taking institutions; AFI are Australian financial intermediaries; and the RFCs are Registered Financial Corporations. Here is the RBA’s excellent glossary for future reference.

The mainstream theory of money and monetary policy asserts that the money supply (volume) is determined exogenously by the central bank. That is, they have the capacity to set this volume independent of the market. The monetarist portfolio approach claims that the money supply will reflect the central bank injection of high-powered (base) money and the preferences of private agents to hold that money. This is the so-called money multiplier.

So the central bank is alleged to exploit this multiplier (based on private portfolio preferences for cash and the reserve ratio of banks) and manipulate its control over base money to control the money supply.

To some extent these ideas were a residual of the commodity money systems where the central bank could clearly control the stock of gold, for example. But in a credit money system, this ability to control the stock of “money” is undermined by the demand for credit.

The theory of endogenous money is central to the horizontal analysis in MMT. When we talk about endogenous money we are referring to the outcomes that are arrived at after market participants respond to their own market prospects and central bank policy settings and make decisions about the liquid assets they will hold (deposits) and new liquid assets they will seek (loans).

A leading contributor to the endogeneous money literature is Canadian Marc Lavoie. In his 1984 article (‘The endogeneous flow of credit and the Post Keynesian theory of money’, Journal of Economic Issues, 18, 771-797) he wrote(page 774):

When entrepreneurs determine the effective demand, they must plan the level of production, prices, distributed dividends, and the average wage rate. Any production in a modern or in an “entrepreneur” economy is of a monetary nature and must involve some monetary outlays. When production is at a stationary level, it can be assumed that firms have at their disposal sufficient cash to finance their outlays. This working capital, in the aggregate, constitutes credits that have never been repaid. When firms want to increase their outlays, however, they clearly have to obtain extended credit lines or else additional loans from the banks. These flows of credit then reappear as deposits on the liability side of the balance sheets of banks when firms use these loans to remunerate their factors of production.

The essential idea is that the “money supply” in an “entrepreneurial economy” is demand-determined – as the demand for credit expands so does the money supply. As credit is repaid the money supply shrinks. These flows are going on all the time and the stock measure we choose to call the money supply, say M3 is just an arbitrary reflection of the credit circuit.

So the supply of money is determined endogenously by the level of GDP, which means it is a dynamic (rather than a static) concept.

Central banks clearly do not determine the volume of deposits held each day. These arise from decisions by commercial banks to make loans. The central bank can determine the price of “money” by setting the interest rate on bank reserves. Further expanding the monetary base (bank reserves) as we have argued in recent blogs – Building bank reserves will not expand credit and Building bank reserves is not inflationary – does not lead to an expansion of credit.

So what the FRBNY is talking about is the relationship between bank reserves (used to satisfy any imposed reserve requirements and facilitate the payments system) and the policy interest rate setting. They recognise that this relationship – between reserves and monetary policy – “can generate tension with central banks’ other objectives because bank reserves play other important roles in the economy”.

They specify these roles in this way:

… reserve balances are used to make interbank payments; thus, they serve as the final form of settlement for a vast array of transactions. The quantity of reserves needed for payment purposes typically far exceeds the quantity consistent with the central bank’s desired interest rate. As a result, central banks must perform a balancing act, drastically increasing the supply of reserves during the day for payment purposes through the provision of daylight reserves (also called daylight credit) and then shrinking the supply back at the end of the day to be consistent with the desired market interest rate.

This statement allows you to gain some appreciation of we mean by the liquidity management operations of the central bank. It must ensure that all private cheques (that are funded) clear and other interbank transactions occur smoothly as part of its role of maintaining financial stability. But, equally, it must also maintain the bank reserves in aggregate at a level that is consistent with its target policy setting given the relationship between the two.

The FRBNY say that the central bank’s role as lender of last resort (standing ready to lend reserves on demand to facilitate the payments system) exposes them to credit risk (bank failure) and “may also generate moral hazard problems and exacerbate the too-big-to-fail problem, whereby regulators would be reluctant to close a financially troubled bank”. These exposures have clearly been topical over the course of the recent crisis.

How might this compromise monetary policy? To answer that we need to understand the relationship between bank reserves nad the monetary policy target.

During a crisis central banks increased bank reserves to keep the system “liquid”. As I explain in this blog – Quantitative Easing 101 – many commentators thought the injection of reserves was about easing credit. But banks don’t lend reserves anyway (except among themselves in the interbank market).

But the consequence of “increasing the supply of the most liquid asset in the economy – bank reserves” was to drive the “market interest rate below the FOMC’s target rate and thus interfered with monetary policy objectives”. This arises because banks with excess reserves (and some have to have excesses if there is an overall system excess) will try to lend them out to other banks in the interbank market if there is no return provided by the central bank on those reserves. The competition within the interbank market drives the “market interest rate” down and so a dislocation occurs between the interbank rate and the policy rate.

You will sometimes read in MMT literature that budget deficits drive interest rates down. The logic is that the deficits add reserves to the cash system which are in excess of the levels desired by the banks and so they try to rid them via interbank market competition. That statement however should not be taken as a reflection of what actually happens in reality. It is clear that the central bank sets the short-term interest rate according to its current policy aims and its excpectations of likely movements in variables that influence its monetary policy formation. Some call this the “central bank reaction function”, although concept is tainted by its association with deficit terrorist John B. Taylor.

But the conduct of fiscal policy is executed within institutional structures that do not allow these reserve excesses to occur to any degree. So governments have volunatarily introduced legislation or regulations that force it to issue debt to match their net spending – in some cases the former has to come before the latter. Under these institutional constraints, it is not accurate to say that budget deficits drive down or put downward pressure on interest rates. If the governments abandoned these gold standard/convertible currency artefacts, which are totally unnecessary in a fiat currency system, then budget deficits would force the central bank to issue debt to maintain a positive interest rate target (that is, to drain the excess reserves).

Anyway, that was an aside.

The point is that operating factors link the level of reserves to the monetary policy setting under certain circumstances. These circumstances require that the return on “excess” reserves held by the banks is below the monetary policy target rate. In addition to setting a lending rate (discount rate), the central bank also sets a support rate which is paid on commercial bank reserves held by the central bank.

Many countries (such as Australia and Canada) maintain a default return on surplus reserve accounts (for example, the Reserve Bank of Australia pays a default return equal to 25 basis points less than the overnight rate on surplus Exchange Settlement accounts). Other countries like the US and Japan have historically offered a zero return on reserves which means persistent excess liquidity would drive the short-term interest rate to zero.

The support rate effectively becomes the interest-rate floor for the economy. If the short-run or operational target interest rate, which represents the current monetary policy stance, is set by the central bank between the discount and support rate. This effectively creates a corridor or a spread within which the short-term interest rates can fluctuate with liquidity variability. It is this spread that the central bank manages in its daily operations.

During the current crisis the US Federal Reserve started paying a positive return on bank reserves. The FRBNY says that:

Recently, attention has turned to an alternative approach to monetary policy implementation that has the potential to eliminate the basic tension between money and monetary policy by effectively “divorcing” the quantity of reserves from

the interest rate target. The basic idea behind this approach is to remove the opportunity cost to commercial banks of holding reserve balances by paying interest on these balances at the prevailing target rate. Under this system, the interest rate paid on reserves forms a floor below which the market rate cannot fall. The supply of reserves could therefore be increased substantially without moving the short-term interest rate away from its target. Such an increase could be used to provide liquidity during times of stress or to reduce the need for daylight credit on a regular basis.

So the US is catching up with the other nations in this regard.

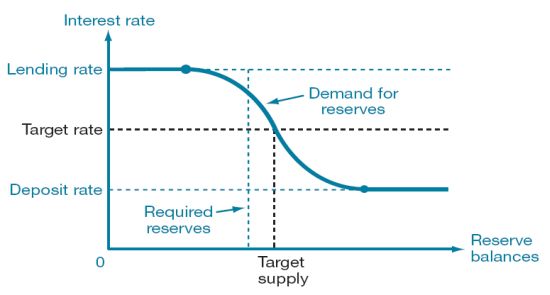

To see how this works the FRBNY provide the following diagram (Exhibit 1) which outlines a simple model of the way in which reserves are manipulated by the central bank as part of its liquidity management operations designed to implement a specific monetary policy target (policy interest rate setting).

Note they ignore “vault cash” which means that reserve balances and reserves can be used “interchangeably”.

While the article is about monetary policy implementation in the US, the general principles apply to all central banking operations.

The demand for central bank reserves by banks arises for two reasons. First, in the US, banks face reserve requirements which means that if a specific bank experiences a shortfall in its reserves it has to pay a penalty (“proportional to the shortfall”). In other nations, such as Australia and Canada the only “requirement” is that the banks keep there reserves in the black on a daily basis. But the imposition of reserve requirements is a hangover from the gold standard days and is totally unnecessary in today’s banking environment. Please read my blog – Lending is capital- not reserve-constrained – for more discussion on this point.

The second factor determining the demand for reserves arisise because:

… banks experience unanticipated late-day payment flows into and out of their reserve account after the interbank market has closed. A bank’s final reserve balance, therefore, may be either higher or lower than the quantity of reserves it chooses to hold in the interbank market. This uncertainty makes it difficult for a bank to satisfy its requirement exactly and generates a “precautionary” demand for reserves.

Thus central bank reserves are intrinsic to the payments system (or clearing house system) where a mass of interbank claims are resolved by manipulating the reserve balances that the banks hold at the central bank. This process has some expectational regularity on a day-to-day basis but stochastic (uncertain) demands for payments also occur which means that banks will hold surplus reserves to avoid paying any penalty arising from having reserve deficiencies at the end of the day (or accounting period – which in the US is a moving two-week average).

To understand what is going on not that the diagram is representing the system-wide demand for bank reserves where the “horizontal axis measures the total quantity of reserve balances held by banks while the vertical axis measures

the market interest rate for overnight loans of these balances”.

On the horizontal axis the required reserves are regulated and are the absolute minimum that the system has to hold overall.

On the vertical axis, the penalty rate is the rate the central bank imposes on banks if they access the “primary credit facility” (which is sometimes known as the discount window). You might like to read the FRBNY article to understand some of the nuances associated with the use of the discount window, in particular, the fact that banks will sometimes borrow above the discount rate to avoid the stigma associated with signalling that they need help.

But the feature the FRBNY highlight is that “penalty rate … lies above the FOMC’s target interest rate”.

Why should the demand for reserves take this particular shape? The question the FRBNY ask is:

… given a particular value for the interest rate, what quantity of reserve balances would banks demand to hold if that rate prevailed in the interbank market?

Note that it would not make sense to set the penalty rate below the likely market (interbank) rate. If the market rate equals the penalty rate then banks will be indifferent as to where they access reserves from so the demand curve is horizontal.

Once the price of reserves falls below the penalty rate, banks will then demand reserves according to their requirments (the legal and the perceived). So “aggregate reserve demand will be close to the total level of required reserves”. The higher the market rate of interest, the higher is the opportunity cost of holding reserves and hence the lower will be the demand. As rates fall, the opportunity costs fall and the demand for reserves increases. But in all cases, banks will only seek to hold (in aggregate) the levels consistent with their requirements.

At low interest rates (say zero) banks will hold the legally-required reserves plus a buffer that ensures there is no risk of falling short during the operation of the payments system. So the FRBNY say:

If the market interest rate were exactly zero, however, there would be no opportunity cost of holding reserves. In this limiting case, there is no cost at all to a bank of holding additional reserves above the fully insured amount. The demand curve is therefore flat along the horizontal axis after this point; banks are indifferent between any quantities of reserves above the fully insured amount when the market interest rate is exactly zero.

Bear in mind this is a very simple model. Its value is that it demonstrates that the market rate of interest will be determined by the central bank supply of reserves. “If the supply is smaller than the total amount of required reserves, for example, the equilibrium interest rate would be near the penalty rate. If, however, the supply of reserves were very large, the equilibrium interest rate would be zero. Between these two extremes, on the downward-sloping portion of the demand curve, there is a liquidity effect of reserve balances on the market interest”.

At the supply level the FRBNY call the “target supply”, the central bank can hit is monetary policy target rate of interest given the banks’ demand for aggregate reserves. This allows you to understand how monetary operations work. Monetary policy involves the announcement of a policy rate and then the liquidity management operations require the central bank to set “the supply of reserves to this target level”. In practice, the situation is a little more complicated and the central bank actually works to “flatten the demand curve” to take out the volatility in short-period fluctuations around the target rate.

So contrary to what Mankiw’s textbook tells students the reality is that:

… monetary policy is implemented … by changing the supply of reserves in such a way that the … [interbank market] … will clear at the desired rate.

The FRBNY say that “(i)n other words, the stock of “money” is set in order to achieve a monetary policy objective” but we know the more accurate statement is the level of reserves is set in order to achieve the monetary policy target in the absence of the payment of a support rate.

The next diagram (Exhibit 2 in the FRBNY paper) adds the payment of a support rate, which they term the deposit rate. The major impact is to lift the rate at which the demand curve becomes horizontal or which “allows banks to earn overnight interest on their excess reserve holdings at a rate that is the same number of basis points below the target”. The support rate becomes the minimum market interest rate (arbitrage will ensure that is so) and it defines the lower bound of the corridor within which the market rate can fluctuate without central bank intervention.

So in this diagram, the market interest rate is still set by the supply of reserves (given the demand for reserves) and so the central bank still has to manage reserves appropriately to ensure it can hit its policy target.

It is then clear how the central bank can “divorce” its monetary policy target from the level of bank reserves and allow the central bank to provide whatever reserves it thinks are needed beyond the essential equilibrium target supply shown in the first graph. This can be accomplished by paying the target rate as the support rate.

In addition, such a policy reduces the activity in the interbank market because “banks would have less need to target their reserve balance precisely on a daily basis. In particular, since banks with excess funds can earn the target rate by simply depositing them with the central bank, the incentive to lend these funds is lower than it is under the other approaches to implementation discussed above”.

However, the FRBNY says:

It is important to bear in mind, however, that the market for overnight loans of reserves differs from other markets in fundamental ways. As we discussed, reserves are not a commodity that is physically scarce; they can be costlessly produced by the central bank from other risk-free assets. Moreover, there is no role for socially useful price discovery in this market, because the central bank’s objective is to set a particular price.

While the FRBNY do provide some reasons why an active interbank market is a good thing, the balance lies in the view that it is not. Setting a support rate at the target rate allows the central bank to maintain its policy rate without the uncertainty associated with guessing what level of reserves to supply on a daily basis.

The Fiscal Sustainability Teach-In and Counter-Conference

The Fiscal Sustainability Teach-In and Counter-Conference will be staged in Washington D.C. next Wednesday (April 28, 2010) and details of venues and other relevant arrangements are available at the home page. All are welcome.

This is the first grass roots effort to promote MMT. The day has been chosen to rival the sham Peter G. Peterson Foundation conference exploring the same topic.

If you are near to Washington DC and have the means it would be great to meet you next week.

You will also note that I have included a fund raising widget on my right side-bar at present. Any help for the organisers will be very appreciated. Just click the image and open your bank accounts! Apparently this will only accept funds if you are in the US. The alternative strategy is to use the contact page that the organisers have set up and pursue your enquiry that way.

At present they really need some financial support. It is a shoe-string, community-driven event being organised by committed volunteers who are motivated by the fact that they care and realise something is wrong with the dominance of conservative, free-market think tanks like the PGPF in the public debate.

That is enough for today … I mean tonight! Where am I?

Long flight, huh.

Thought you might be interested (after you rest up, of course) in this hack job by Joel Achenbach from Sunday’s Washington Post: The national debt and Washington’s deficit of will (Will the debt break Washington?) http://www.washingtonpost.com/wp-dyn/content/article/2010/04/23/AR2010042302222.html …. Peter Orszag, a headliner at the Peterson gig, shows his Chicago breeding, and the generally rational Bill Gross from PIMCO is apparently also caught up in the deficit hysteria. Bad news, that last one. He’s got money that moves markets.

Benedict@Large,

Bill Gross uses the “ring of fire” diagram (essentially debt/gdp & deficit) to assess a country’s credit worthiness and gives absolutely no consideration to their monetary systems. As even Bernanke knows, the US federal gov cannot default. Greece and even Germany can. I would have thought that Bill Gross would know the difference. How much of this is simply marketing aimed at perpetuating some myths so as the create deflation to increases the real return on their bond holdings?

MMTer Marshall Auerback consults to PIMCO. I guess Bill Gross doesn’t listen to what he has to say. Another explanation is that Gross has concluded from experience that markets move based on perception, not reality, and he is ignoring the challenge to bring perception in line with reality.

Dear Bill,

Welcome to US!

Take some rest now – we need one fresh Prof. Mitchell on Wednesday. 🙂

Your contraindications depend upon “binding” reserve requirements & reserve requirments haven’t been “binding” for years.

When central banks operated under the gold standard, and had gold inflows which they purchased, how did they prevent short rates from going to zero?

Yes: we need a monetary blitz – or “shock and awe” on the bonds markets. Jacques Cailloux, Chief Europe economist at the Royal Bank of Scotland, said the ECB should resort to its “nuclear option” of intervening directly in the markets to purchase government bonds. I hope Jean-Claude finds the trigger. Nuke them!

It would be much more sensible for the ECB to use newly minted Euros to buy up all the Greek Euro debt that is floating around the place.

Neil, that is the “nuclear option”. According to my knowledge the ECB can in times of systemic crisis buy a wide range of assets from whoever it chooses, theoretically in unlimited quantity. Bumm …

Guys like Gross know what’s up, they just are self-serving. Of course he knows how things work. But he benefits financially from the hysteria so he helps fuel it. So don’t write the same tiresome “oh this guy doesn’t get it when he ought to stuff.” Think a little deeper than that, please. Eliminate the fiction of UST bonds and there goes most of Pimco’s business, ok?

Earl, prove it.

Afterthought : I guess this post answers my earlier question

[“Monetizing public debt” (a misnomer as per Bill) means buying bonds at issuance, right? This creates a supply of reserves (although this is less clear to me as when the CB buys treasury bonds from the secondary market) and should therefore bring the interbank rate down. This may or may not be compatible with maintaining a target rate : it cannot be discretionary. I actually raised a related concern here :

bilbo.economicoutlook.net/blog/?p=9183&cpage=1#comment-5622]

At the very least, the CB can set deposit rate = target rate, so that the level of reserves becomes irrelevant to short term rate targeting, and can pursue any secondary objective such as setting long term sovereign bond rates. That’s fairly clear from a paper by BIS on unconventional monetary operations.

What is less clear and was the dilemma underlying my initial question is whether there exists a ‘sterilization’ channel to achieve the 2nd objective, while also maintaining interbank rate at target, but deposit rate < target rate.

Finally, a question whose answer should be obvious to most : what exactly is the arbitrage argument such that the rate at which banks lend to the non-bank sector is at least the interbank rate?

Thanks.