It's Wednesday, and as usual I scout around various issues that I have been thinking…

I wonder what they will do with the new building

The ECB is embarking on a major construction project to erect new building at the east end of Frankfurt, which will be completed on current plans by the end of 2013. It will replace the old wholesale market which supplied fruit and vegetables to Frankfurt and surrounds. One suspects the health of the citizens was better served in this former land use. I wonder what they will do with the new building when the Eurozone collapses. Perhaps it could be a nice retirement village for the executives who will be looking for something to do.

First, before we go back to Europe, the news today from Japan is good and its economy is now experiencing relatively rapid economic growth. The data released today show that it has now posted 4 consecutive quarters of growth – the latest quarter recording an annualised growth 4.9 per cent to March 2010 (Source).

Private investment grew by 4.6 per cent annually in the March quarter on the back of a very sizeable recovery in net exports grew by about 21 per cent annually in the first quarter (exports up 30.5 per cent annually and 6.9 per cent for the quarter) despite having an overvalued currency courtesy of the ensuing flight from the euro. Public demand continues to support domestic demand and private saving.

The consumer price index fell by 1.1 per cent in the most recent period, so deflation is still dogging them. But that just means private spending will remain weaker than otherwise and they will have to maintain the fiscal support. But it is clear that the private investment is recovering modestly helped by the strong fiscal stimulus from the national government.

Japan also just recorded a steady unemployment rate at 5 per cent (Source), which demonstrates that with appropriate social policies and collective sensibilities a production meltdown does not necessarily have to devastate the labour market. 5 per cent is clearly too high but better than 20 per cent in Estonia and Spain.

The Japanese have a nice turn of phrase. Apparently they described the recent (second) bailout offered to struggling EMU governments as as being (Source):

… like a “picture of a rice cake” – attractive, but without nourishment.

I think they overstated things. The 750 billion euro fund was not even attractive given what they were up against. What has slowed the massacre in recent days (marginally on sovereign debt markets) has been the ECB compromise on what debt it will buy from member governments.

But the sovereign debt tensions in the EMU are now playing out in foreign exchange markets as portfolio adjustments are leading to the dumping of the Euro.

Last week the financial markets were publishing CDS spreads for the EMU nations all heading up against the German benchmark bond. Today the story is Will the Euro Survive?. The Euro, their cherished darling which the European bosses always hoped would displace the USD as the principal reserve currency, is showing the strain of the current crisis.

Here is the first picture today. It shows the USD-Euro parity as at May 14 (last observation).

It is true that the volatility is being driven by large portfolio adjustments which are not necessarily a guide to the future direction of the currency. The Australian dollar is also suffering from these adjustments today and our economy is in terms of the “fundamentals” in much better shape than the EMU economies. I noted earlier this morning that the AUD had plunged against all currencies other than the Euro but as I write this in the late afternoon we are even down against it as well.

No problem, that is what a floating exchange rate is about – it is already improving the competitiveness of our export sector as is the plunge in the Euro helping exporters in that region.

But the real worry in Europe is that they are still running deflationary monetary policies (interest rates are too high) given the state of the real economies. Their policy stance is continually pushing the currency up rather than allowing it to adjust downward to give its export sector the boost it needs.

The smart governments (for example, China) are not only providing massive fiscal stimulus to their domestic economy but are buying up USD to keep their own currency at the “competitive” levels they desire. Japan’s export-growth strategy also saw the Bank of Japan adopting this practice. Only in recent years has the BOJ stopped this practice which immediately saw the Yen appreciate and this exacerbated their export collapse.

The problem for the citizens of Europe (EMU land and those foolish nations that peg to the Euro) is that the mindset of the ECB is totally against adopting a sensible strategy like this. They prefer to keep the Euro as strong as they can even if that damages exports which just compound the fiscal contraction that they imposing on the region as a result of their moronic adherence to the sanctity of the Stability and Growth Pact rules. These rules were never capable of delivering optimal fiscal policy outcomes when confronted with a crisis of the magnitude of that they are now experiencing.

This policy madness (which just compounds the inherent design faults of their monetary system) reflects the European obsession that the Euro should be a “reserve currency” alongside the USD. This has led them to adopt a high Euro policy stance at the expense of almost everything else that matters.

I wrote the following in an earlier (less organised) incarnation of billy blog on December 26, 2004 well before the crisis. It was in relation to a fall in the USD against the Euro during the xmas period in 2004 and all sorts of deficit hysteria articles were appearing in the financial press. The title of the specific blog was Euro zone madness continues, so you can see that I had it in for them long ago:

… The reality is that the US deficit is currently too small relative to GDP as evidenced by the rising unemployment in that country. The current account deficit is just a sign that there are foreign interests who wish to accumulate (save) in USD-denominated financial assets. This is allowing the US economy (and consumers) to enjoy imports with less exports! A correction will come when the rest of the world desires less saving in USD-denominated financial assets. At that point, the gains from the favourable terms of trade will diminish. But this is unrelated to the need for the US government to increase net spending to ensure job creation is sufficient to fully employ their willing labour force. The risk in the US is deflation (following the Japanese route) not inflation.

The problem is compounded by the incompetent monetary policy stance of the ECB. They refuse to purchase USD in the currency markets (for fear of using the USD as a support currency) but in doing so they prevent essential Euro liquidity injections into the world economy. The squeeze on their export sector is a result. They should follow the example of the German Bundesbank in the 1970s which kept their industrial sector competitive on world markets by ensuring they bought USDs to keep the Mark from appreciating. Euro-zone countries should abandon the fiscal discipline of the Stability and Growth Pact and increase net government spending (deficits) and further allow the ECB to use all the monetary policy instruments and move away from a singular reliance on interest rate setting to stimulate their economies. However, if the Stability and Growth Pact is going to remain with its destructive fiscal policy implications, then at the very least the ECB should be “net spending” through forex strategies. For the Euro countries, the failure of the ECB to act once again signals the failure of the “Brussels-Frankfurt consensus” to tackle the chronic unemployment in Europe which is over 10 per cent in many countries.

The European failure to understand the correct macroeconomic policy approach to their low growth, high unemployment malaise is captured by the comments of the Dutch finance minister Gerrit Zalm who said that the “euro is moving within a range which is still acceptable.” … Zalm went on to say that he “hoped the European Central Bank would increase its key interest rates soon from 2 per cent” to prevent any inflation from arising as European growth began. Spare the thought that he might become unemployed as a result!

Even with their system now failing terminally, there are calls for a strong Euro. Consider the socio-economic state of Europe at present and then consider this Editorial from a leading English-language Baltic news service, which (truly you can check it up) carried the title – At times of despair a strong euro is wanted.

The editorial said that the “€750 bln bailout” is threatening “the euro’s status as a global reserve currency”. It said that in approving the bailout:

… the euro-zone’s finance ministers … [signalled that] … their main intention was to save national bond markets. If the ministers wanted to “save” the euro, they would have tightened monetary conditions; they have been loosened, in fact.

So forget the fact that the whole region is a basket case – what Europe needs is a strong currency. Given its only source of growth is really exports as a result of the Stability and Growth Pact and its fairly sluggish domestic spending propensities, this “reserve currency mania” is so destructive and syptomatic of how the European leaders have completely lost the plot.

Incidently, the same news service has also reported today that Latvia records EU’s sharpest fall in construction output volume in Q1. Given that the “Construction output volume of the entire EU decreased 6.5%, including a 9.6% fall in eurozone countries”, any guesses up front on what the annual loss of construction in Latvia was in the March 2010 quarter. Try 43.4 per cent.

This is a nation that like Estonia pegs its currency against the Euro, has allowed massive deregulation of its banking sectors, which has enslaved its citizens with home mortgages mostly denominated in foreign currencies, and is doing every it can to get into the EMU cauldron. It is certainly looking like a contender at present – it is heading south at a rate of knots.

All of which brings me to the Jean-Claude Trichet interview that the German publication Der Spiegel published on May 15, 2010 (and made available to their English edition which saved me wading through the German version).

It was a long interview but contained some gems of arrogance and not remotely in sympathy with the realities facing citizens in Europe.

His response to the question that the latest rescue package and decision “to purchase even poorly rated government bonds” was a reversal on the ECB’s “firmest principles”, Trichet said:

No, we have not relented on our principles. Price stability is our primary mandate and compass. That being said, it is clear that since September 2008 we have been facing the most difficult situation since the Second World War — perhaps even since the First World War. We have experienced — and are experiencing — truly dramatic times.

Of-course, they have relented and current EMU policy is a “dog’s breakfast”. Moreover, it is true that the socio-economic circumstances are dramatic but they have been created, in part, by the conduct of the ECB and its obsession with its “primary mandate”.

He was then asked what the current danger is (“the banks?” “the euro?” the EU?) and said:

We are now experiencing severe tensions, which are coming after the events of 2007-2008. At that time, private institutions and markets were about to collapse completely. That triggered a very bold and comprehensive financial support by governments. And now we see the signature of some governments put into question. This is a problem for almost all industrialized countries. In the G-7, the major economies have a yearly deficit of around 10 percent of gross domestic product (GDP). In the euro area as a whole it averages 7 percent of GDP. In this situation with extremely elevated deficits across the globe, the markets have singled out a weak link: Greece. Also taking into account the fact that its statistics were incorrect at one time, market pressure was concentrated there and a drastic adjustment program was necessary

There is no sovereign debt crisis in anywhere other than the EMU. The “signature of some governments” in the EMU is not worth the paper it is written on when events are as they are … no EMU government can ultimately save their banking system using its own capacities. But the “signature” of all sovereign governments which issues its own currency and floats it on foreign exchange markets is a powerful force.

The reason they singled out Greece rather than Portugal or Spain is not the issue. The bond markets would have tested one or more of the weaker EMU nations as a matter of course. The design of the Eurozone monetary system guaranteed that.

Trichet was then asked about the current selling of the Euro by Asian central banks and he replied (extraordinarily):

A currency which keeps its value fully in line with its definition of price stability — with annual inflation rate of less than 2 percent, close to 2 percent — over almost 12 years is a currency which inspires confidence.

So hold the line and keep the currency strong with tight monetary policy! The ECB has their deflationary foot as hard on the accelerator as they can and what they don’t seem to get is that in not arresting the real economic crisis (the collapse of spending and rising unemployment) they are creating the sovereign debt crisis which is now manifesting (for the time being) as the falling Euro.

Trichet’s interpretation of the falling Euro seems to accord with this assessment. He was asked about the “attack on the euro” and he said:

It is not an attack on the euro. It is an issue for the states’ signatures and, as a consequence, of the financial stability of the euro area. It is clear that it is the primary responsibility of the Europeans to take the appropriate measures in order to counter the present severe tensions which have erupted in Europe.

He is sheeting home blame to the fiscal conduct of the member governments. But the automatic stabilisers would have driven the deficits into a situation that the debt concerns would have been played out anyway. As you will see, later he advocated harsh discretionary fiscal cutbacks. So he would have run very contractionary fiscal policy to offset the automatic stabiliser effect in order to keep the fiscal ratios within the Stability and Growth Pact rules.

The next part of the interview was amazing. He was asked about the decision of the ECB “to buy the government bonds of troubled EU countries — thus breaking a taboo”. He said they were not going to leave any “additional liquidity” in the system for long.

He was pushed on this issue and was asked “The general public has gained the impression that the governments pressured the ECB to take this decision. That would be an appalling signal in terms of its independence and credibility”. He replied (somewhat angrily):

That is ridiculous! We take our decisions completely independently and have a track record of taking positions contrary to those of the heads of state and government — in 2004 in refusing to decrease rates, in 2005 in increasing rates against their wishes, and throughout this period in fiercely defending the Stability and Growth Pact including defending it against the German chancellor of the time. Just who has been weak over the past few months? It was not the ECB. The governments with their high debts were weak …

I was amazed anyway by the breathtaking arrogance of the reply. The clear impression he presents is that weakness is a government that tries to halt the meltdown of its output and labour markets and strength is an institution that wants to worsen the real crisis (as long as inflation doesn’t accelerate).

The next interchange was also interesting. Der Spiegel said that “Thus far, the ECB has been strong and independent because it had repeatedly rejected demands from the political domain for lower interest rates or too expansionary a monetary policy. You have now consented for the first time”. Trichet said:

We have consented nothing to the heads of state and government. We always take our decisions taking into account only our own assessment of the situation and not the “recommendations” of governments, markets or social partners … those who took very significant responsibilities were those not applying the spirit and the letter of the Stability and Growth Pact. And neither were those who did not carry out their surveillance as they should have, and as we constantly asked them to do.

Again an attack on the use of fiscal policy by member governments which was followed by a discussion about how the same governments were risking an inflation outbreak. He replied:

Those who believe — or, even worse, are suggesting — that we will tolerate inflation in the future are making a grave error. The governing council of the ECB did not hesitate to increase rates in July 2008 in a period of financial turbulence in order to ensure price stability. We were criticized at the time by the markets. This is a measure of our inflexible determination.

Note: “inflexible determination”. The words of a blind ideologue.

Trichet also said the ECB now demands “extensive adjustment programs from the governments” which will certainly see inflation heading south but nothing good heading north, except population shifts leaving for Scandinavia (or somewhere).

Trichet said that Greece was excluded from leaving the Eurozone and that:

There is a need for a quantum leap in the governance of the euro area. There need to be major improvements to prevent bad behavior, to ensure effective implementation of the recommendations made by “peers” and to ensure real and effective sanctions in case of breaches (of the Stability and Growth Pact). The ECB is calling for major changes …

A reasonable response to their on-going crisis, which is now challenging the very viability of the whole monetary union, would have been to question the design of their monetary system and the fiscal rules they have imposed on that system. But that is not the way the debate is heading in Europe. Trichet is among many leaders who are calling for more rigid rules, which will only make matters worse.

They are blind ideologues and do not serve public purpose at all.

Those lazy and spendthrift southern Europeans

Everyday you read about the lazy and/or profligate southern Europeans. For example, today in the UK Times I read:

Portugal, also heavily indebted, is in an only slightly better position. Germany is in a different predicament. Taxpayers are furious that their money – €123 billion of it, within this month’s giant €750 billion bailout – has gone to rescue profligate southerners. The mass-market newspaper Bild, declared: “We are the schmucks of Europe yet again!”

You also get the flavour from a recent piece in the Australian press from rabid Sydney Morning Herald political correspondent Paul Sheehan (who knows nothing about economics):

This is the depravity of modern Greece, where political street intimidation is routine and public debt is larger than the nation’s gross national product. This debt has been used to pay the bribes demanded by the militants, to pay for a giant public sector that Greece cannot afford, and whose workers expect a generous pension from the age of 58.

So this is a daily onslaught. The problem with it is that evidence keeps getting in the way.

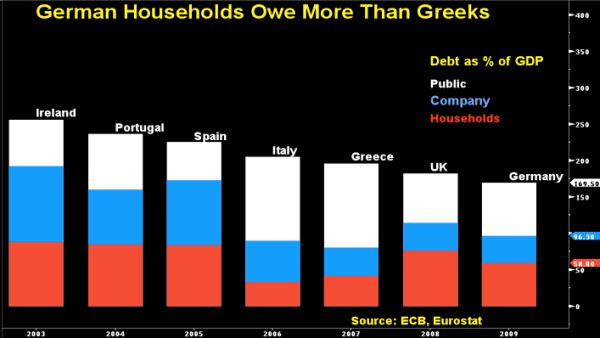

There was a Bloomberg report on May 17, 2010 (the link appears to have disappeared but you can read the story HERE) that produced the following graph. It shows that Germans are more indebted than Greeks.

The Report said:

… while Greece has the highest level of government debt as a percentage of gross domestic product, shown in white, its household debt, shown in

red, is less than Germany’s. Overall, Greece has 26 percent more debt as a percentage of GDP than Germany, according to data from Luxembourg-based Eurostat and the European Central Bank.

So the Greeks are not profligate when compared to the Germans and the higher budget deficits in Greece as a percentage of GDP are also supporting the ability of the Greek private sector to save in the Euro.

But the Greeks must be lazy! We have heard this over and over again in recent weeks.

Well the OECD produces data on working hours that can resolve this question. The following graph from the OECD tells us that the Greek workers worked 2120 hours in 2008 while the German worker on average worked 1430 hours. The OECD average was 1764 hours.

So they are not that lazy (at least in relative terms). Portugal’s workers also work harder than Australia and a lot harder than the Germans. And spare the thought … even those lazy latino Spaniards work harder than the Germans!

Time for a new narrative on why the Greeks are to blame for the crisis that they find themselves in! We might start from the flawed design of the EMU monetary system and that would get us further towards a solution.

Quote of the day

This came from the Shadow Treasurer (who would be the Treasurer if the government loses the election later this year). He was asked on national TV last night what he thought of the current state of fiscal policy (the reference to the xmas bonus is the new mining resource rent tax the government will collect from 2012) (Source):

From my perspective the Government is building a structural challenge because the mining revenue that they’re banking on is based on the best terms of trade in 60 years. They’re banking that there’s going to be growth following a massive new tax and what they’re doing is they’re increasing the family mortgage on the basis of a good Christmas bonus.

It doesn’t get much worse than that. The problem is that people believe analogies like this. Family = Government; Taxes fund spending; solvency worries.

Conclusion

That is enough for today!

Well, at least ECB is providing a close to 1bn euro fiscal stimulus. And Frankfurt will get a nice looking building attracting tourists. Keep on, Jean-Claude! We believe in you!

I read today France is willing to reform its Constitution in the same way as Germany did, that is, transform the 0-deficit policy into a Constitutional mandate. How blind can we Europeans be is simply amazing.

The OECD numbers on working hours only tell that there are more part-time jobs in the Netherlands than in Korea. That is not laziness in the usual sense.

Hey all,

I just had a thought that I wanted to run by the MMT community to get your take if you would be so humble as to indulge me…..

It just occurred to me that in the mv=pq model, doesn’t taxation HAVE to be based entirely on m and not v in order for surplus taxation (taxes greater than spending) not to be contractionary by definition? But we calculate taxes based on people’/business’ income, which could theoretically be composed entirely of v-related events where m is relatively fixed. In other words, if the nature of the economy in a given period of time consists of people spending the same quantity of dollars back and forth–basically, aggregate income=spending, aggregate savings=borrowing–then wouldn’t surplus taxation of any significance based on reported income only be contractionary in terms of m?

If that’s the case and m shrinks during budget surpluses, the only way for prices to remain stable during sustained surpluses would be for v to keep increasing, or for some other source of m to take its place. If that didn’t happen in sufficient quantity to offset the m drain from the surpluses then we’d have a shrinking economy. Regardless, if v stays relatively constant then the non-contractionary surplus the government could run would be limited to the amount of offsetting m that could be injected. But where would that m come from and what would determine its volume?

It gets weird too, since m and v are interrelated. In other words, if there’s less m in circulation then there is probably gonna be less v. If there’s less v, then reported incomes go down and thus tax revenues go down, thwarting the ability to run the surpluses in the first place. I guess I’m saying I don’t see how even using the simple mv=pq equation the economy won’t resist the gov’t running sustained surpluses by nature.

If those assumptions are generally correct, then wouldn’t it be ideal to devise a taxation system based solely on m and not v?

At the very least, does what I’m saying bolster MMT arguments, in that it seems to me to make the notion of separating gov’t fiscal policy from central banking and banking in general seem bunk and dumb.

If I’m restating things that have been said here before already I apologize, but I was curious as to what your thoughts were on defending MMT in terms of the mv=pq paradigm.

Thanks, Kent

I forgot to apologize for the above post being off topic a bit 🙂

Once again the Greek workers demonstrated and striked massively. It is no coincidence that markets had another major fall (the correlation is happening too often!). Revolt against austerity will continue driving fear into the heart of the market that knows that when the community wakes up (these defiant Greeks!) the resulting crisis will lead to a regime switch! Markets Beware!

To Kent

Yeah it’s an important and off-topic discussion that needs having.

I don’t completely understand the importance of the taxation basis related to monetary valuations, except what appears to be efficiency.

But the relationships you describe between quantity and velocity seem spot on, and after playing themselves out we are left with the question of from where does the supply of new money come, and how do we decide how much.

And I agree that while we’re trying to figure out the answers to those two questions, we need to recognize the very real role of government in deciding these monetary policy questions.

But I have no idea at all about how this off-topic remark might relate to MMT.

So,I’ll leave it there and hope it’s a good discussion, MMT or not.

And leave a suggestion that the money come from direct government issue, debt-free, with the amount determined regularly by a body that has nothing else to do.

And we fire them if they’re wrong.

Bill,

I’d be interested in hearing your views on the effectiveness of the LDP. They are advocating for a 50% household income increase and 4% NGDP growth. But also simultaneously advocating a consumption tax increase and corporate income tax decrease, leaving me completely confused. Is any of this happening?

@ joebhed

“And leave a suggestion that the money come from direct government issue, debt-free, with the amount determined regularly by a body that has nothing else to do. And we fire them if they’re wrong”

Lol!!! Word!