I have received several E-mails over the last few weeks that suggest that the economics…

Fiscal policy worked – evidence

At the end of 2008 and into 2009, as the real sectors in our economies were starting to experience the aggregate demand collapses instigated by the banking crisis, most governments took steps to stop the meltdown from becoming the next Depression. At times, the unwinding private spending looked to be pushing the world to those depths. So after years of eschewing active fiscal policies, governments suddenly rediscovered the fiscal keyboard key and in varying magnitudes pushed fairly large expenditure injections into their economies. Most of the mainstream economists who had been teaching their students for years that this would be futile were silent because they had to hide out in shame given their textbook models could neither explain how we got into the mess nor how to get out of it. But there were some notable exceptions from Harvard and Chicago who came out attacking governments for being profligate. They claimed their models would demonstrate that the fiscal interventions would come to nothing (Barro, Becker, Taylor all were leading this charge). Lesser lights, then emboldened, joined the throng screaming that proponents of the stimulus strategy should provide evidence. Well the evidence has been mounting and the conservatives should just lock their office doors and go home to their families in shame.

On January 23, 2009 the conservative George Mason University economist Tyler Cowen wrote on his Marginal Revolution blog that:

… the pro-stimulus proponents … are not putting up comparable empirical evidence of their own for the efficacy of fiscal policy and there is a reason for that, namely that the evidence isn’t really there.

He was attacking several economists who around that time were calling for a significant fiscal stimulus to be implemented by the US government while Chicago and Harvard economists, among others in the mainstream were arguing against any relaxation of the tight fiscal positions they have advocated for years.

Of-course the fiscal positions were loosening anyway courtesy of the automatic stabilisers as private spending and tax revenue collapsed and that was providing some constraint against the free fall in demand that was occurring.

Extreme elements within the mainstream profession actually advocated tightening discretionary policy settings to offset the cyclical effects coming via the stabilisers. Which is exactly what is being forced on EMU nations at present by the austerity measures.

Cowen went onto attack pro-stimulus economists:

Writing polemics against market-oriented economists, no matter what the failings of such economists (and I am one of them, and I have failings), doesn’t get us out of that box. I’ll say it again to the pro-stimulus forces: a stimulus is going to happen, so I’d love to be cheered up by your evidence. Put it on the table.

Well I wonder what Cowen calls the Post World War II period up until the mid-1970s?

The Great Depression taught us that, without government intervention, capitalist economies are prone to lengthy periods of unemployment. The emphasis of macroeconomic policy in the period immediately following the Second World War was to promote full employment. Inflation control was not considered a major issue even though it was one of the stated policy targets of most governments.

In this period, the memories of the Great Depression still exerted an influence on the constituencies that elected the politicians. The experience of the Second World War showed governments that full employment could be maintained with appropriate use of budget deficits. The employment growth following the Great Depression was in direct response to the spending needs that accompanied the onset of the War rather than the failed Neoclassical remedies that had been tried during the 1930s.

The problem that had to be addressed by governments at War’s end was to find a way to translate the fully employed War economy with extensive civil controls and loss of liberty into a fully employed peacetime model.

From 1945 until 1975, governments manipulated fiscal and monetary policy to maintain levels of overall spending sufficient to generate employment growth in line with labour force growth. This was consistent with the view that mass unemployment reflected deficient aggregate demand which could be resolved through positive net government spending (budget deficits). Governments used a range of fiscal and monetary measures to stabilise the economy in the face of fluctuations in private sector spending and were typically in deficit.

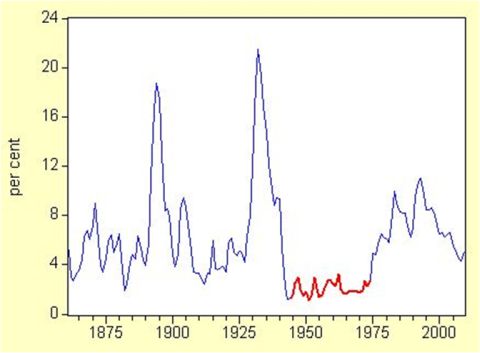

As a consequence, in the period between 1945 through to the mid 1970s, most advanced Western nations maintained very low levels of unemployment, typically below 2 per cent. Here is a graph that charts the history of the unemployment rate since 1861 for Australia. The experience was common in most other countries. The red segment is the “full employment period” and it stands out in stark contrast to the periods before it and since.

While both private and public employment growth in Australia was relatively strong during the Post War period up until the mid 1970s, the major reason that the economy was able to sustain full employment was that it maintained a buffer of jobs that were always available, and which provided easy employment access to the least skilled workers in the labour force.

Some of these jobs, such as process work in factories, were available in the private sector. However, the public sector also offered many buffer jobs that sustained workers with a range of skills through hard times. In some cases, these jobs provided permanent work for the low skilled and otherwise disadvantaged workers.

Anyway, that historical evidence is incontrovertible.

A few weeks after Cowan set the challenge, this article appeared in the US Magazine Business Week (January 29, 2009) – To Spend or Not to Spend? – written by Michael Mandel.

He also took up the theme of whether fiscal policy is effective:

As the House of Representatives prepares for a Jan. 28 vote on the $825 billion Obama fiscal stimulus bill, politicians want to know: How much does boosting government spending or cutting taxes help the private sector? Can massive fiscal stimulus, as Obama is calling for, create jobs and increase economic output?

He then described what he called an “(i)ntellectual War” between macroeconomists about the size of spending multipliers (the extra induced consumption spending per dollar of injected net public spending) and the related monetary effects that arguably accompany public spending (so-called crowding out and Ricardian equivalence effects).

Mandel correctly placed the current debate about fiscal effectiveness into a historical context and tells us that:

It’s important to understand that the vehemence of this debate reflects the resumption of an intellectual conflict that dates to the Great Depression and the famous economist John Maynard Keynes. The question then was whether the New Deal helped shorten or soften the Depression, as Keynes argued, or whether government intervention actually hurt the economy.

He claimed the evidence is “ambiguous” but that is a very partisan interpretation of the data. The 1937 relapse in the US was a clear result of tightening fiscal policy. All through the 1930s the attacks on fiscal intervention were fierce and prevented the governments from expanding sufficiently. Earlier in the 1930s, the neo-classical remedies had been tried and things got worse as Modern Monetary Theory (MMT) would predict. For example, cutting wages may have reduced costs but it also reduced demand.

However, Mandel agreed that (world) “economy did not conclusively recover until 1939, when military spending started to ramp up before World War II” but fails to draw the logical conclusion. This was a period when the deficit terrorists became patriotic and governments could spend what they wanted to to prosecute their military ambitions.

At that point the fiscal stimulus was sufficient to create full employment (and labour scarcity) whereas during the 1930s, fiscal policy exerted clear positive impacts but not sufficient to really wipe out the aggregate demand failure that allowed the bank collapse to spill into the real sector in the first place.

Mandel was aware of this argument. He says:

But economists who believed in fiscal stimulus as appropriate medicine for deep recessions – many of whom identified themselves as Keynesians – argued that the New Deal simply wasn’t big enough.

Clearly that is the case. The onset of war in 1939 showed that there isn’t a crisis big enough that fiscal policy cannot solve.

As an aside, there are two occasions when the deficit terrorists will advocate unlimited spending: (a) to fight a war; and (b) when they are pocketing the largesse directly themselves.

Mandel concluded by saying:

In the end, this near-depression is likely to be a transformative event for macroeconomics. We are going to have a mammoth fiscal stimulus package this year – and in all likelihood, more in the near future. And when we see what happens, we may finally settle some of the disputes that have bedeviled economics for 80 years. And who knows – we may get the next Keynes as well.

So you always have to have some patience in these matters as the evidence accumulates. And it has been steadily accumulating throughout last year.

I was steadily tracking them throughout 2009 and while most of the empirical work concentrates on Australia, the evidence was mounting that the fiscal interventions were having an impact.

Some of the blogs where I published this accumulating evidence include – How fiscal policy saved the world – What else but a fiscal stimulus? – More fiscal stimulus – what shape recovery?.

In this blog – Why we need more fiscal stimulus – (September 7, 2009) I provided emerging IMF and OECD evidence that the fiscal stimulus packages were helping maintain demand and putting a floor under the output losses.

In this blog – Lesson for today: the public sector saved us – (December 21, 2009) I discussed an Australian Treasury presentation they made on December 8, 2009 entitled The Return of Fiscal Policy. It was presented at the Australian Business Economists Annual Forecasting Conference 2009.

The presentation contained some interesting graphs. My theoretical qualms about some of the underlying assumptions in the modelling that produced some of the estimates would lead to the conclusion that the estimated impacts would be understated rather than biased upwards.

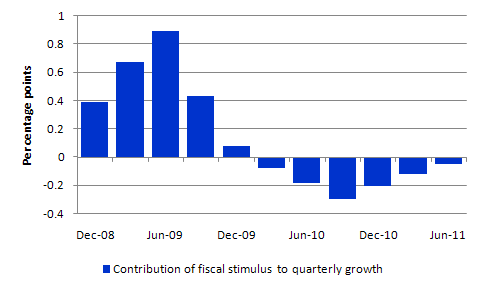

The following graph is reproduced from Graph 10 in the Treasury presentation:

The accompanying text said:

Chart 10 shows Treasury’s estimates … of the effect of the discretionary fiscal stimulus packages on quarterly GDP growth. These estimates suggest that discretionary fiscal action provided substantial support to domestic economic growth in each quarter over the year to the September quarter 2009 – with its maximal effect in the June quarter – but that it will subtract from economic growth from the beginning of 2010.

The estimates imply that, absent the discretionary fiscal packages, real GDP would have contracted not only in the December quarter 2008 (which it did), but also in the March and June quarters of 2009, and therefore that the economy would have contracted significantly over the year to June 2009, rather than expanding by an estimated 0.6 per cent.

So for all the conservatives who wanted no fiscal response – the message is clear – Australia would have been in a 3-quarter recession if the intervention had not have occurred. Note this is the discretionary action only.

The automatic stabilisers also add to aggregate demand as the business cycle nose-dives. The Treasury do not estimate this impact but I suspect it will significant given the collapse in tax revenue.

They also estimated the impact of the rapid reduction in interest rates by the Reserve Bank on GDP growth rates and concluded that:

…this fall in real borrowing rates would have contributed less than 1 per cent to GDP growth over the year to the September quarter 2009, compared with the estimated contribution from the discretionary fiscal packages of about 2.4 per cent over the same period.

So discretionary fiscal policy changes are estimated to be around 2.4 times more effective than monetary policy changes (which were of record proportions).

Fast track to May 2010

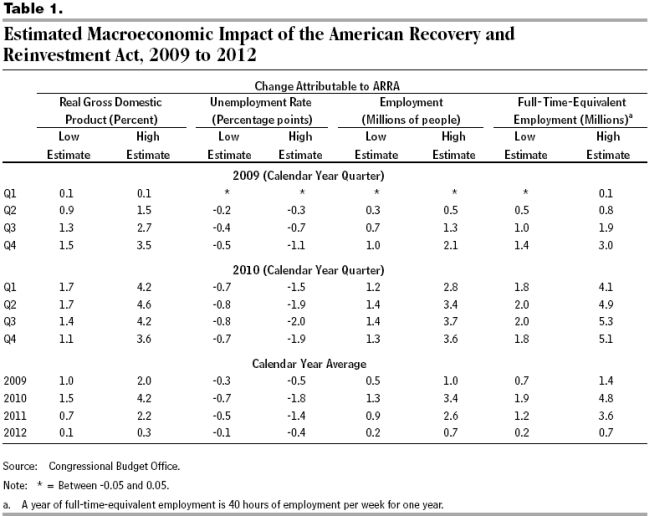

On May 25, 2010, the US Congressional Budget Office released a detailed study – Estimated Impact of the American Recovery and Reinvestment Act on Employment and Economic Output from January 2010 Through March 2010 – PDF document.

The CBO present information that recipients of the stimulus funds under ARRA have provided estimating the “the number of jobs they created or retained with ARRA funding”. This information suggests that “nearly 700,000 FTE jobs during the first quarter of 2010” were created by the fiscal stimulus.

However, they note that there are several problems encountered when using this data which bias the impact. First, the jobs might have already been created without the stimulus (therefore overestimate impact).

Second, the reports don’t consider jobs created by “lower-level subcontractors” (therefore underestimate impact).

Third, “reports do not attempt to measure the number of jobs that may have been created or retained indirectly as greater income for recipients and their employees boosted demand for products and services” – the multiplier effects (therefore underestimate impact).

Fourth, reports only cover a fraction of the stimulus capacity (therefore underestimate impact).

The alternative method was to use their modelling capacity and historical evidence. They conclude that the impact of ARRA for the first quarter of 2010 were:

- Raised the level of real (inflation-adjusted) gross domestic product (GDP) by between 1.7 percent and 4.2 percent.

- Lowered the unemployment rate by between 0.7 percentage points and 1.5 percentage points.

- Increased the number of people employed by between 1.2 million and 2.8 million.

- Increased the number of full-time-equivalent (FTE) jobs by 1.8 million to 4.1 million compared with what those amounts would have been otherwise. (Increases in FTE jobs include shifts from part-time to full-time work or overtime and are thus generally larger than increases in the number of employed workers).

They also said that these impacts “on output and employment are expected to increase further during calendar year 2010 but then diminish in 2011 and fade away by the end of 2012”.

This Table reproduces Table 1 in the CBO report.

The more detailed sections of the Report outline the methodology used which is interesting and there is an appendix showing the range of multipliers used.

And recall, just yesterday the justification for tightening fiscal rules presented by the Adam Smith Institute Director Eamonn Butler was this:

Forget the Keynesian argument that a shrinking economy needs the “stimulus” of public spending. That’s like taking blood from one arm of a dying patient and putting it in the other. For every job saved, at least another is lost. And spending caps would prevent politicians setting off boom and bust cycles in the first place.

I noted in the blog that Butler believes as a religious article of faith that there is complete crowding out in the labour market and therefore a multiplier of zero. No empirical research worth anything has found that result.

In the ARRA Report, that the multipliers used in the CBO modelling were “chosen judgmentally to encompass most economists’ views about the direct and indirect effects of different policies”. The ranges they present are all well over zero. The CBO give an example:

CBO estimates that a one-time increase of $1 in federal purchases of goods and services in one calendar quarter last year would raise GDP above what it would otherwise be by a total of $1 to $2.50 over several quarters. That cumulative multiplier of $2.50 on federal purchases comprises increases in GDP of roughly $1.45 in the quarter when the spending occurs, roughly 60 cents in the following quarter, and roughly 45 cents in later quarters combined.

Anyway, as time goes by more data and more analysis will be possible of the fiscal impacts. I will close my blog and go and swear an oath of allegiance to the Austrian School catechism if one of them convincingly shows that there has been no (or even a negative) impact.

The problem now is that even more stimulus is required in most countries. In that context, I thought Paul Krugman’s blog yesterday (May 26, 2010) was very apt.

He said that:

Here’s where we are: growing GDP, but mass unemployment still the law of the land, with only tiny progress so far. What can be done?

Well, we could have more fiscal stimulus – but Congress is baulking even at the idea of extending aid for the ever-growing ranks of the long-term unemployed. Fiscal responsibility, you see – hey, and let’s make sure estate taxes stay low!

That is the case everywhere (almost) in the advanced world. Only two OECD nations officially avoided the recession – Australia and Poland. The former did it on the back of two major fiscal interventions: (a) our own; and (b) the massive stimulus from the Chinese government.

Krugman is correct in saying that “(i)t’s depressing: shibboleths and conventional wisdom are blocking all routes out of this slump”.

The neo-liberal paradigm maintains such a strong grip on the policy setting process that it is hard to see progress now on the fiscal front. It amazes me that their ideas promoted policies that caused the meltdown yet those same ideas are now preventing the recovery from being as fulsome as it should be.

Blind ideology harming people, families, children, and communities. Evil at best!

Meanwhile: Australian investment expenditure is hardly rocking

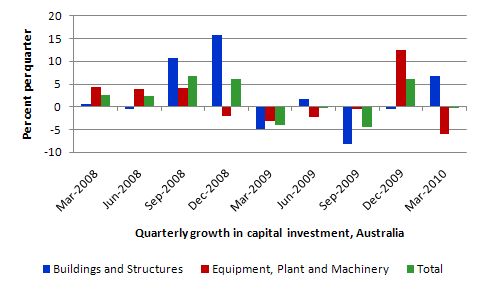

The Australian Bureau of Statistics released the March quarter Private New Capital Expenditure and Expected Expenditure data today and showed that capital spending has fallen in that time.

This is another piece of evidence that I am adding to my portfolio of data releases in recent weeks that indicates that the “GDP growth is nearly back on trend” mantra that the business economists are continually pushing is not evidence-based.

As the fiscal stimulus unwinds, GDP growth strong enough to start eating into the unemployment and underemployment queues will have to rely on investment, given that consumers are still trying to increase their saving ratios to reduce the exposure they have had to the record household debt levels.

Today’s data suggests that to the end of March, at least, such a pick up in private capital formation is not happening.

The following graph shows the quarterly growth rates of the investment components and the total since March 2008. The crisis really started to impact in early 2009 and that point the Federal government announced its second and larger fiscal stimulus. By the end of 2009, as the spending impacts of the fiscal stimulus were in full swing, investment started to recover. started to have real effects. You can see that the impacts of the fiscal stimulus were probably supportive by the recovery in the December 2009 quarter.

Now the fiscal support is unwinding, private investment has slumped again.

Some will claim this recovery was in mining given the public (mis)perception that the mining sector is saving us at present. The facts disclosed in the printed ABS publication accompanying this data are different. Mining investment growth rates peaked in December 2008 and have trended down until the March quarter 2010 where a modest 0.9 per cent growth was recorded. Hardly setting the world on fire!

The ABS also published expected investment which is a reflection of forward-looking behaviour. I might write a separate blog about these estimates one day because they are very interesting and provide evidence of the large discrepancies between what firms were going to do some months earlier and what they end up doing. That gap is worthy of study.

But in the current data release investment is expected to fall in the last quarter of 2009-10 but rise strongly in 2010-11 (driven by strong growth in mining).

Meanwhile, the Australian government is polishing up its neo-liberal medals with the announcement that – Government to get tough with jobless.

The Federal Human Service Minister announced today that:

More than 350,000 job seekers will be targeted as the Federal Government toughens the rules for obtaining unemployment benefits. From July, those that do not turn up for regular interviews with Centrelink will risk losing the dole. The focus will be on the newly unemployed, the long-term unemployed, job seekers under the age of 25, early school leavers, and those with a record of “poor compliance”.

Now remember we are talking about an economy which has GDP growth well below the rate that is required to provide enough jobs to eat into the pool of underutilised labour.

That pool currently sits at 12.5 per cent of the labour force (comprising 5.3 per cent unemployment and 7.2 per cent underemployment). All the recent indicators of spending are relatively flat.

Human Service Minister said specifically that:

This is about making sure that they are … doing their bit to get a job and that we are doing everything we can do to assist them get a job … It’s about mutual obligation. It’s about them doing their bit and us doing our bit … These will be interviews that are five times as long and with a very substantial proportion devoted to compliance measures and making sure that the person is looking for work and actively seeking work and checking to ensure that what they’ve told us is correct.”

So mutuality involves responsibilities for two parties. I don’t interpret mutuality to be consistent with the government thinking its part in the deal is to wield a stick when it quite obvious there are not enough jobs to go around.

The Minister proceeded to mimic the nonsense that came out in the May Budget speech that:

We do have low unemployment in Australia and what is historically regarded as being close to full unemployment, but that does not mean you let people fall through the cracks

It depends on which historical period one is talking about. In the 35 year period after World War II we had true full employment which comprised official unemployment below 2 per cent and zero underemployment and zero hidden unemployment. Governments risk losing office if unemployment went above 2 per cent.

In this period the Australian government used fiscal and monetary policy to ensure there were enough jobs made available. If the private sector didn’t provide enough then the public sector filled the gap.

In the next 35 year period until now, which is marked by the resurgence of the neo-liberals, we have never got below 3.9 per cent unemployment and then only for a quarter and the average unemployment rate has been 7.1 per cent.

During this period, the Australian government eschewed the use of fiscal and monetary policy to provide enough work and abandoned their responsibilities for maintaining full employment. Instead, they carved out a new (supply-side) responsibility – full employability – which is to push the unemployed around allegedly training and re-educating their work attitudes in case a job happens to come along.

We are no where near full employment now because you have to also consider the 7.2 per cent of underemployed as well as the unemployed.

Conclusion

As I noted the other day in this blog – What is it really about? – we spend a lot of time discussing and analysing growth rates and ratios and all sorts of things and sometimes lose track that what really matters are the people underneath the mass of statistics.

So that requires constant attention to labour underutilisation rates etc so that the “we are at full employment” mantra (when 12.5 per cent of willing labour resources are idle) does get too much traction.

But deeper down is the concern that unemployment and the economic hardship it brings impacts on our personal relationships within our families and beyond. And the more I think about it the only thing that matters is how “well” we fare at that level. And at that level, all the financial ratios and growth rates pale into insignificance and you are confronted with other realities that are much more important.

On this theme, I have been reading some poetry this week. I have always believed that economics students should take liberal arts courses to pre-dispose them to more gentle feelings about humanity before they launch into providing policy advice that harms their fellow humans.

My favourite so far this week is Shakespeare’s Sonnet 45 (which should be read in tandem with Sonnet 44) (Source):

The other two, slight air and purging fire,

Are both with thee, wherever I abide;

The first my thought, the other my desire,

These present-absent with swift motion slide.

For when these quicker elements are gone

In tender embassy of love to thee,

My life, being made of four, with two alone

Sinks down to death, oppress’d with melancholy;

Until life’s composition be recured

By those swift messengers return’d from thee,

Who even but now come back again, assured

Of thy fair health, recounting it to me:

This told, I joy; but then no longer glad,

I send them back again and straight grow sad.

Anyway, now we know fiscal policy works, we should set up camps to study literature and sociology and philosophy and break this neo-liberal obsession.

That is enough for today!

I’m more a Charles Bukowski man myself, but I definitely agree- Economics students (of whom I am one) should get a more liberal education. Economics is so full of maths and science boffins they could really gain from some exposure to the humanities.

Even teaching some more economic history courses at universities would be a good start rather than micro, macro, econometrics repeat like most courses.

Formulating successful economic policy is all about what will work in the real world, not within the narrow confines of restrictive mathematical models based on absurdly narrow assumptions.

Economics, despite claiming to be a behavioural science needs to recapture its moral and human dimension.

I’d run into Tyler Cowan’s writing a while back, and got a laugh when I checked to see who he was and saw the Mercatus Center (George Mason U.). It wasn’t the first time I’d run into Mercatus; they actually follow me on Twitter (!!!!) and I’m pretty much a nobody. The back story …

Everyone thinks that Phil Gramm is the evil man who deregulated derivatives, but this is not true. All Dr. Phil did was encode that deregulation into law. The person who actually deregulated derivatives was Phil’s wife, Dr, Wendy Gramm, who headed the Commodity Futures Exchange Commission through the end of the Bush (Sr.) presidency. As her last act there (and against the will of two of the other four board members there (one of the anti’s was Sheila Bair)), Wendy horsed thru an administrative ruling preventing her commission from regulating derivatives. It was Wendy’s ruling that Phil would change to a law eight years later.

Anyways, Wendy was out of work, and when you’ve been a good little Republican operative and served the ideology well, there is always another (good) job waiting for you. And so it was with Wendy, who promptly accepted an appointment to the Board of Directors of Enron. In fact, she was placed on the Audit Committee of the Board, where she was responsible for approving Enron’s accounting practices for the next nine or so years until Enron imploded because of (you guessed it!) derivatives. (Phil of course by this time had move on to a Vice Chairmanship at UBS, something that UBS no long makes any noise about since they were caught pilfering US taxes for 3,000 of their clients.)

By this time, Wendy’s paycheck from Enron had totaled up nicely. Estimates vary, but $12 million is probably real close. Trouble was, Wendy had now been named in a shareholder lawsuit seeking damages for Enron’s implosion. The specific details of the subsequent settlement are sketchy, but 16 board members actually paid into a damage pool, and their average payments were $12 million each. So it’s quite possible that Wendy worked for Enron all of those years for absolutely nothing. Which is probably what she deserved.

But poor Wendy. She was now out of a job again. Not a problem. She was quickly snapped up by (here’s the punch line) the Mercatus Center at George Masom U., where she would be responsible for teaching a whole new generation — I don’t know, what? — how to deregulate derivatives?

Anyways, I’ve written this story a few times, and I guess after one of them, someone from Mercatus picked up on it and decided they’d better follow me on Twitter. I guess I’m sort of an enemy agent to them.

More along the lines of what you’ve got here, Bill, I just ran into this story over at the Telegraph/UK, and it left me speechless. “Austerity is the new cool as Europe turns its back on Keynes” (

http://www.telegraph.co.uk/finance/comment/jeremy-warner/7760876/Austerity-is-the-new-cool-as-Europe-turns-its-back-on-Keynes.html ) Neoliberal (no doubt) author Jeremy Warner is actually gloating about Great Britain leading the rest of Europe into a depression now that their elections are done and the new Parliament has been set. No wonder they lost the Empire.

Just a short note before continuing reading your blog post: it’s Tyler Cowen.

Thanks Stephan

best wishes

bill

Food for thought.

One must realize that in order to understand policy debate, the conflict between public and private purpose must be brought into focus. Public policy “captured” by private interests trading with market competition is different from public policy pursuing civic duty sharing with community solidarity. Private interests using market forces respond to reasoning criteria of behavior while civic duties using community (political) forces respond to ethical criteria of behavior. The private criteria of reasoning are rationality for decisions and rules for practices. The public criteria of ethical behavior is fairness for decisions (such as the wage rate aspired) and equity for practices (such as labor utilized). Unless we understand this difference in behavior, we are talking across purposes!

In an email somebody asked me to give examples of the other sources of imperfection( beyond asymmetry) and I plan to share this with you in the future.

Bill

How do (you explain that) they come up with the fact that the stimulus will subtract from GDP growth in 2010?

Oliver

Dear Oliver

Because it is being withdrawn steadily so discretionary fiscal policy is actually contracting.

best wishes

bill

I still can’t see how any amount of stimulus will actually ‘subtract’ from growth? Isn’t it just other drag factors that have a stronger negative influence than what’s left of the positive stimuli? It seems to me their language is a bit muddled and one can easily think they are saying that injecting (net) money will influence GDP negatively.

Thanks for correcting my quote, btw. I’m illiterate when it comes to html and the likes. It’s too similar to math, I guess :-). Is there an explanation for dummies like myself anywhere?

Oliver

Great post today!

I posted a comment on Cowans site last week noting that we are now actually running a double blind experiment on monetary theory with the ECB taking the Ricardian stance and the Fed a Keynsian “lite” position. Of course Jean-Claude and Ben are the double blind.

Oliver, GDP growth is about changes. Stimulus withdrawal is a negative change vis-a-vis previous period and so it has contracting effects. But I agree it seems counter-intuitive at first

Thanks Sergei, I see what you mean. Reference growth in previous periods is total growth including the effects of previous stimuli, so contracting will slow with respect to what might have been had stimulus (per head? as % of GDP? nominal?) been kept up. As I said: maths, not my forte…

actually, forget that last sentence. what might have been is irrelevant.

Also worth pointing out again (in regard to the Great Depression) that fiscal policy was highly effective IF YOU CALCULATED THE BLS STATISTICS FOR UNEMPLOYMENT CORRECTLY! In particular, the key to evaluating Roosevelt’s performance in combating the Depression is the statistical treatment of many millions of unemployed engaged in his massive workfare programs. Including such ‘workfare’ recipients as employed presents a radically different picture for the New Deal, showing unemployment dropping by almost two-thirds from a high of 25%. Treating these men and women as unemployed while soldiers in Germany and France were treated as having jobs has made the Roosevelt administration’s economic performance appear uncompetitive, but it is fairer to argue that the people employed in government public works and conservation programs were just as authentically (and much more usefully) employed as draftees in what became garrison states. Meanwhile Roosevelt was rebuilding America at a historic bargain cost. If you incorporate the workfare employees (whom the BLS classified as unemployed until 1940, largely because there had never been government based employment of this extent before in American history), FDR’s record on unemployment is most impressive. The rate falls from 25% in 1932 to 9.6% by 1936. Obama’s approval ratings would be at 80% if he was able to reduce unemployment by two-thirds by the end of his first term in office. Of course, that will never happen because Obama believes the crap fed to him by the likes of Pete Peterson and his odious fellow deficit terrorists.

Bill, in the past you talked about the Hartz IV regime for unemployed people in Germany. Well apparently it makes people ill, the psychological pressure of being forced into poverty after 1 year unemployed ( Hartz IV kicks in after 1 year) is getting to people and making them ill. This is just another illustration of the REAL cost of all this NeoLib rubbish. See link in German

http://www.rp-online.de/wirtschaft/news/Arbeitslose-immer-haeufiger-krank_aid_862059.html

Regards,

p

@Marshall

Thanks! I was not aware about this statistical misstatement. But I’m also no expert in The Great Depression. I’ve read some books among them “Freedom From Fear” from Kennedy, but also there as far as I can remember the track record of the New Deal in regard to unemployment was at least mixed. How comes even Pulitzer Prize Winners miss such an important detail?

The usual long and interesting post. How does Bill do it? Anyway, just one criticism.

When attacking Butler and the “crowding out is 100%” idea, it is worth mentioning a fundamental argument which MMT has up its sleeve when renders the whole crowding out argument irrelevant. This is that MMT advocates an abolition or near abolition of government borrowing. (I don’t think Bill mentioned this.)

I.e.MMT claims that if stimulus is required via more net govt spending, then print and spend. As to borrowing or tax to fund the spending, this is raving bonkers, because the effect of borrowing or tax is deflationary and the whole object of the exercise is reflation.

If you don’t include the above point, you sort of offer a hostage to fortune. That is, the Butlerists might just come back at you with evidence that crowding out really is 100% or at least a serious problem. And you don’t then want to make it look as though you’re scratching around for alternative defence. Put another way “shock and awe” is best: throw everything at them INITIALLY.

For a similar reason I am not even happy with MMTers using the phrase “fiscal policy” without making it clear they think traditional fiscal policy (i.e. taxing or borrowing in order to effect stimulus) is nonsense.

And, to boot, CBO is run by Douglas Holtz-Eakin, a Republican and former advisor to the McCain campaign, so this report can’t reasonably be ignored as liberal/Democratic Party bias.

Bill,

I don’t think you have to go all the way back to WWII to show fiscal stimulus works. In the US, a tax rebate was sent out the second qtr of 2008 (the amount was close to the payroll tax break that Warren is advocating). That was the only good qtr of GDP growth since the slide started. Also proves tax cuts can be just as effective as increased spending.

This “bastard Keynesianism” at work is going to give neoliberals ammunition. Fiscal policy did work and could have worked more if Obama had the courage to lead (and not listen to Larry Summers). Christina Romer is now begging congress for more stimulus and the sausage grinder is weakening the already timid attempt at second stimulus.

We are doomed & our enemies can’t wait to say ‘we told you so’. Thanks ‘bastards’.

@RebelCapitalist

I don’t think the US is doomed. Too much drama. At the end of the day wisdom can at least still prevail. What shall we Europeans say? We’re not doomed but crucified on the cross commonly known as Euro. You can send letters to your elected representatives, we need to storm and hijack the ECB. Once I’m there I will explain to Jean-Claude how to work with a modern PC keyboard. First buy some Greek Bonds and then (very important!) here’s the DEL key.

Stephan –

I try to be optimistic but just today the House of Rep. couldn’t come to grips with deficit hysteria and has made a second stimulus incredibly weak. They don’t understand the one of the objectives of fiscal policy should be full employment. Instead we get this “priming the pump” crap that in the end can potentially discredit any future use of real fiscal policy.

But you are right, Europeans are in worse shape than U.S. Good luck.

Let me suggest one other piece of evidence for the effectiveness of fiscal policy in the current period, in one word: China.

markg – I’ve come around to the thinking that tax cuts can be very stimulative, but I don’t believe they are “just as effective” as increased spending – depends on what the spending is directed towards.

But I do wish all the “Social Security is bankrupt” commentators would start calling for an immediate halt in payroll tax payments, if for no other reason than to be consistent. If they were serious about ending SS, they could get the public behind a significant tax cut very rapidly. But for some odd reason, I have the impression they want to end SS, but keep the payroll tax.

Hey Bill, if you have any bright PhD students who can present MMT to a mainstream audience you might want to turn them loose on this offer from Core Economics: http://economics.com.au/?p=5638

@ Marshall at 1:08. Important point. Conservatives still hold that work not created by the private sector (investment) constitutes “job creation” – excepting the military, of course. Everything else is “hand-outs.” And this is coming from the GOP congressional leadership.

Does anyone have a link to an interview where a U.S. politician is challenged on their deficit crisis theories and asked to explain how they came to their conclusions? Sec. Clinton mentioned the threat posed by the U.S. deficit in her recent security strategy talk. Just curious. Thanks.

Ray, I don’t recall a Democratic leader explaining this but the GOP leadership regularly cites the household-government finance analogy, and most people accept it as factual because to them it is a matter of common sense. It’s something that doesn’t seem to require further explanation because “it’s something that everyone knows.”

Logically, this means that it functions as a norm in the prevailing universe of discourse, that is, a standard against which knowledge claims are measured. As a result, the MMT position is not just factually wrong from this vantage, it is ridiculous because it contradicts an established norm. This recalls Galileo’s problem convincing the pope that the earth moves and not the sun. The pope considered it unnecessary even to bother looking through the telescope since holy scripture was clear on this point, and even the pagan philosopher Aristotle (who was considered an “independent expert” at the time) was in agreement with this position. Therefore, Galileo could not possibly be correct.

Hi. Good post, well argued. And my favourite part: when the Minister says things are close to Full Unemployment!

“Anyway, as time goes by more data and more analysis will be possible of the fiscal impacts. I will close my blog and go and swear an oath of allegiance to the Austrian School catechism if one of them convincingly shows that there has been no (or even a negative) impact.”

Too funny, Bill! You know the Austrians never test their theories with empirical evidence!

Still sifting through the treasure trove of materials here . . .