It's Wednesday, and as usual I scout around various issues that I have been thinking…

The RBA has lost the plot – monetary policy is now incomprehensible in Australia

It’s Wednesday and I have some comments to make about yesterday’s RBA decision (July 5, 2022) to continue increasing its interest rate – this time by 50 points – the third increase in as many months. If the rhetoric is accurate it will not the last rise by any means. In its – Statement by Philip Lowe, Governor: Monetary Policy Decision – the RBA noted that global factors were driving “much of the increase in inflation in Australia” but there were some domestic influences – like “strong demand, a tight labour market and capacity constraints” and “floods are also affecting some prices”. It is hard to make sense of their reasoning as I have explained in the past. Most of the factors ‘driving inflation’ will not be sensitive to increase borrowing costs. The banks are laughing because while they have increased borrowing rates immediately, deposit rates remain low – result: massive gains in profits to an already profit-bloated sector. But the curious part of the RBA’s stance is that they are defending themselves from the obvious criticism that they are going to drive the economy into the ground and cause a rise in unemployment by claiming that “many households have built up large financial buffers and are benefiting from stronger income growth” – so the increased mortgage and other credit costs will be absorbed by those savings (wealth destruction) allowing households to continue spending. You should be able to see the logic gap – if “strong demand” is driving inflation and that needs to come off for inflation to fall but the buildup of savings will protect demand – go figure. Monetary policy is in total chaos and being driven by ideology. And to calm down after that we have some great music as is the norm on a Wednesday.

The RBA’s irresponsible interest rate rises

The RBA claims that it is increasing interest rates in order to stifle inflationary pressures.

They itemise the factors driving those pressures:

1. “COVID-related disruptions to supply chains” – not sensitive to interest rate changes.

2. “the war in Ukraine” – not sensitive to interest rate changes.

3. High energy prices as a result of the uncompetitive OPEC cartel exercising monopoly power – not sensitive to interest rate changes.

4. “Floods are also affecting some prices” – not sensitive to interest rate changes.

So they are obviously wanting to target:

5. Strong demand – which means they want to bring spending growth down to align with the temporary disruptions in supply.

That isn’t a very sensible strategy because when those temporary disruptions ease what we will be left with is excess productive capacity, unsold inventories, and elevated unemployment.

Then what?

6. “a tight labour market” – it is tighter than it has been but that isn’t really saying anything.

The broad labour underutilisation rate is currently at 9.6 per cent with underemployment at 5.7 per cent.

The underemployed (all 807.3 thousand of them as at May 2022) want to work around 15 hours extra a week.

That is about 345 thousand Full-time equivalent jobs that are needed before that source of labour wastage is eliminated.

Further, the unemployment rate is artificially low at present given the state of overall spending because the external borders have not yet recovered from the closures in 2020-21.

Once the working age population growth recovers with new workers coming in (especially now the Federal government has made the poor decision to allow everyone in without restriction in relation to Covid status) then the labour underutilisation rate will rise given the current state of overall spending growth.

The other point is that wages growth remains low despite the continual claims by business that they cannot attract staff.

I have a solution for them that would give them immediate access to more labour – offer higher wages!

Business tells the RBA that wages growth is accelerating but there is scant evidence of that.

If they really wanted to hire more workers there are 807 thousand underemployed who are desperate for more work.

7. “capacity constraints in some sectors”.

The latest – Monthly Business Survey: May 2022 – from the NAB (published June 14, 2022) – indicates that “Business confidence and conditions both eased in May”.

It also notes that:

Capacity utilisation is now around the record high levels seen just before the Delta outbreak in 2021, which should support investment and hiring over coming months.

Three points:

(a) Capacity utilisation rose from 84.2 per cent to 85 per cent in the month to May 2022. So business still has spare productive capacity.

(b) The record highs previously did not drive inflation (pre Delta).

(c) The signal for business as capacity utilisation tightens is to invest more as the report notes.

Investment has a dual characteristic – it adds to current demand and builds future productive capacity which allows the economy to absorb the growth in nominal spending without creating inflationary pressures.

So the RBA logic seems to be that it wants to choke off business investment because capacity utilisation is rising, which will not only undermine current economic activity but reduce the growth in potential GDP (and makes it harder to grow and reach full employment in the coming period).

Stupid logic.

The bit about household saving

What I found interesting in the statement issued yesterday by the RBA, which just repeated things the Governor has been wheeling out to justify the unjustifiable was the reference to household saving.

The RBA stated yesterday:

One source of ongoing uncertainty about the economic outlook is the behaviour of household spending. The recent spending data have been positive, although household budgets are under pressure from higher prices and higher interest rates. Housing prices have also declined in some markets over recent months after the large increases of recent years. The household saving rate remains higher than it was before the pandemic and many households have built up large financial buffers and are benefiting from stronger income growth.

First, holding out pre-pandemic household saving ratios as some sort of norm is misleading.

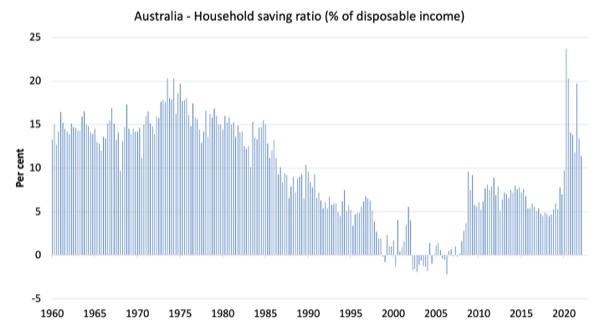

The next graph shows the household saving ratio (% of disposable income) from the March-quarter 1960 to the current period.<

Back in the full employment days, when governments supported the economy and jobs with continuous fiscal deficits (mostly), households saved significant proportions of their income.

In the neoliberal period, as credit has been rammed down their throats, the saving rate dropped (to negative levels in the lead-up to the GFC).

Hopefully, households are paying off the record levels of debt they are now carrying and improving their financial viability.

The following table shows moves in the saving ratio by decades.

| Decade | Average Household Saving Ratio (% of disposable income) |

| 1960s | 14.4 |

| 1970s | 16.2 |

| 1980s | 12.0 |

| 1990s | 5.1 |

| 2000s | 1.4 |

| 2010s | 6.4 |

| 2020- | 15.3 |

One should also remember that households now have record levels of debt. Nearly 200 per cent of disposable income when in the 1980s the ratio was more like 60 per cent.

So, thinking the current saving ratio is too high and offers households a spending buffer is not responsible in my view.

Second, it is clear the RBA thinks that the buildup of saving by households while spending opportunities were limited during the lockdowns is a spending buffer.

But think about that.

They claim they are raising interest rates to address strong domestic demand (spending).

They obviously know the interest rate rises will do nothing to attenuate the global factors mentioned above.

So it is all about reducing domestic spending.

But then they are open to the criticism that they are deliberately going to create unemployment – and the use the unemployed as pawns in a very inefficient fight against temporary inflationary pressures.

More crudely, they are going to destroy the material prosperity of workers in some hope that will kill demand and force business to narrow profit margins and … whatever else they think will happen.

So to address that criticism they claim – no, wait, households might be squeezed by higher interest rates and rising cost-of-living, but they have a wealth buffer they can run down to fill the gap and maintain spending.

If they maintain nominal spending growth (which isn’t particularly strong anyway) then the interest rate rises will only succeed in destroying household wealth (running down savings) and the so-called domestic inflationary pressures remain.

I could go on teasing out this twisted logic – but I think you will get the picture.

Surgeons attain meaning and function by cutting people up. That is their skill but in most cases is unnecessary and other non-invasive techniques (physio etc) are better options.

Monetary policy functions to push interest rates around. Usually there are better options.

But then what does the central bank do to retain its place in the hierarchy?

That is the problem.

Retail sales growth

Here is a measure of demand – retail sales.

The most recent data was published last week (June 29. 2022) by the Australian Bureau of Statistics – Retail Trade, Australia (May 2022).

The graph shows monthly growth in turnover and as you can see has been declining since the beginning of the year – before the RBA started its current hiking phase.

There were some sectoral differences (Department stores and Cafes, restaurants and takeaway services were both above the aggregate) but total spending on retail goods and services has been in decline.

Growth in credit aggregates

This graph shows the monthly growth in the major credit aggregates since January 2020.

These are the interest-rate sensitive aggregates that the RBA might influence through interest rate rises.

Apart from the on-going speculative binge on investment properties the other aggregates are not accelerating and growth in owner-occupied housing credit has been in decline since May 2021, long before the RBA moved.

The investment housing binge is due to distortions in the tax system that rewards high income earners with massive tax breaks for accumulating multiple properties.

It should be addressed through tax reform.

It is also true that while the rate of change might be levelling off in most categories, the absolute level might be excessive. There is some evidence that the current growth in overall credit is higher than the pre-pandemic.

Dampening housing credit will do little to address the overall inflation rate which is being driven by energy and food prices mostly.

And if one nets out housing then the credit growth picture is more subdued.

If the RBA further dampens non-housing credit growth that will impact on the already weakening retail sales and push Australia towards recession.

My new blog header photo

The photo is from Cape Paterson, Victoria.

I am part of Australia’s most sustainable community development there called – The Cape.

I wrote about it in this blog post – Biodiversity Sensitive Urban Design and the silence of our political parties (May 16, 2022).

This magnificent beach is a short walk through the dunes.

I am planning in 2023 (once buildings are completed) to run Modern Monetary Theory (MMT) workshops through – MMTed – down at the coast, which will also provide training in sustainable living etc.

More details as progress is made on that.

Music – Ryo Fukui

This is what I have been listening to while working this morning.

Last week, I featured one of the great Japanese tenor players – Jiro Inagaki – and I noted a commentator suggested we listen to Ryo Fukui.

I first acquired the album – Scenery – by Japanese jazz pianist – Ryo Fukui – soon after it was released in 1976.

One could get all sorts of albums from the import shop in Melbourne that would not usually come to Australia.

This album was his first release and went largely unnoticed outside the cogniscent jazz circles, which meant, at the time, it was ignored in the US, which was knee deep in disco.

This is the title track – Scenery – and features:

1. Ryo Fukui – piano.

2. Yoshinori Fukui – drums.

3. Satoshi Denpo – Double bass.

Ryo Fukui died in 2016 at the age of 67 and was a great loss.

Here is an interesting account (written just after his death) of how America realised that not everything happens within its own borders – Lost In Time: A retrospective on Ryo Fukui’s ‘Scenery’ (March 24, 2016).

And, if you read Japanese, here is a – Bio.

He was self-taught and didn’t move to the piano until he was 22 years of age and then produced amazing music with his bands.

Next week we might listen to another giant in the Japanese jazz scene, tenor player – Hidehiko Matsumoto. I have one

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

Seriously Bill, you should be RBA governor.

“Monetary policy is in total chaos and being driven by ideology. ”

It all becomes clear once you see the central bank regime not as ‘controlling inflation’ but as ‘protecting our members from inflation’.

Those being those who do the lending and who own the banks. Transferring household savings buffers to them then makes perfect sense.

The central bank is the trade union for rentiers.

all well and good until you get to the part about how good this will be for the big 4 banks.

of course their share prices have been smashed since interest rates went up – Bill must be the only person who thinks interest rate rises will help their profit margins.

yes it might help one part of the business but hurt other parts, So much time discussing distributional effects of interest rate rises on the economy and then such a basic analysis on the effects on Banks – but then again apart from Keynes, economists make very poor financial advisors.

I was around when interest rates went to 16% – hardly a great time for Banks – Kerry Packer nearly bought one for himself.

5. Strong demand – which means they want to bring spending growth down to align with the temporary disruptions in supply.

Yet, every right winger in the UK are screaming for- “A Raise Universal credit, cancel the National insurance rise, suspend VAT on fuel, end the threat of higher business taxes, cut Council tax. These are necessary to ease the squeeze and to stop future job losses.”

They want to slash government spending to align with the disruptions in supply. Then slash taxes across the board which won’t help with the disruptions in supply. As they think by slashing taxes it is not inflationary.

Which shows it is all ideological depending on your politics. None of them understand how to fix it. They are are all waiting around for the free market to fix it. For the private sector to solve the disruptions in supply. Just look.at how slow the free market is at trying to sort it out. The private sector will go on an investment strike if profits fall and costs rise.

Nobody in any globalist, neoliberal government is saying that much more targeted government spending is needed to ease the disruptions in supply. Instead, all They talk about are the size of the deficit and debt and the increased tax revenue that tax cuts would give to the treasuries.

The debate is all ideological drivel from both sides that has never worked for decades. Highlights even more how divided society is regarding government spending and taxes. It has been embedded in voters minds and neither side will move away from these ideological trenches they have created. MMT find ourselves stuck in the middle it all in no man’s land.

For years there has been a consensus that interest rate policy and financial asset sale/ purchase policy should be used to stabilise the economy. Which has caused rising inequality, weak nominal wage growth and ecological destruction. All based on the failure of fiscal policy or that interest rate policy would simply ” react” and eliminate any positive effects from increased government spending.

The need for expansionary fiscal policy was always framed around ” when interest rates are low” and ” when central banks can’t respond”. Which has led to progressives arguing for expansionary fiscal policy but without changing the monetary policy framework at all. Which has effectively kept the central banks in charge of macro policy. Allowing the blob to absorb many different view points and preventing any real change.

It won’t change. Those faces put in front of us who win elections are put there to defend the status quo. Hand picked to ensure the economics of Colonial rent extraction stays in place. Hand picked central bankers might as well have a seat on NATO. As the bond holders and the banks are their infantry, sailors and airforce. Who’s task it is to steal other countries real resources.

Owning and controlling the world’s real resources is by far more important to these psychopaths than a bunch of job losses back home. Since March of this year they have never been more open about it. What used to be said behind closed doors is now plastered across the media as official Western government policy. Everyone else are just collateral damage as they try and fulfil these century old cravings.

Globalism and neoliberalism are here to stay. Geopolitical foreign policy demands it. Of course, why the economics of Colonial rent extraction was created in the first place. in true Orwellian fashion The ‘four freedoms’ the freedom of movement of goods, people, services and capital over borders. carried out at the end of a gun.

They are of course ” four freedoms” if you are a member of the leisure class and capital. For everyone else they are the ” four prisons” at the end of a gun. Unless, you are a Guardian reader and all the ” four freedoms” means to them is to be able to live in the sun after retirement. To be able to move away from the UK and create little England where it is not wanted. As they all seek each other out and live on top of each other in retirement camps . Squeezing in a couple of rounds of golf whilst complaining about the locals and their culture. Pushing house prices up so that the locals who serve them their cocktails have to travel an hour each way On public transport just to get to work. To serve people who are even too lazy to learn the language.

Like Derek Henry put it just two days ago, it’s a matter of “mental illness”.

The so-called “new keynesian” flawed macroeconomics drove the world to a dead end.

But the 1% keep searching for more and more “free lunches”.

“Free lunches” were taken from the 99% of the world population, by force if necessary (the Iraquis can tell us something about free lunches too).

But now, the 99% are saying “nevermore”.

The global south is screaming against “free-lunch” colonialism.

“And my soul from out that shadow that lies floating on the floor

Shall be lifted-nevermore!” (Edgar Allan Poe – The Raven).

” It all becomes clear once you see the central bank regime not as ‘controlling inflation’ but as ‘protecting our members from inflation’.

Those being those who do the lending and who own the banks. Transferring household savings buffers to them then makes perfect sense.

The central bank is the trade union for rentiers. ”

EXACTLY !

We have spent the last 20 years calling them stupid and wasted decades shouting ” they don’t know how it works ”

They know how it works alright and set it all up for themselves. The whole charade and circus has been nothing but a class war. As every history book shows it always has been and always will be. The liberal metropolitan middle classes keeps the show on the road. While the whole time screaming at the top of their voices that they are the victims. Infest everybody’s lives with their virtue signalling and greed and complete desperation to be a member of the leisure class. While the rest of us are driven into the servant quarters of Downton Abbey or a walk on part of the Handmaids Tale.

I agree with Barri mundee

Re. the average household saving ratio. My understanding is that this is the amount out of income that households don’t spend over some time period (monthly?). So for Australia, the average for the last two years is more than double that for the previous decade. But it isn’t measured net of hangover short term debt not paid off or even increased. Is that right? In that case, while it may have been a valuable statistic in the 1960s, I fail to see how it is of any use these days when spending is kept up on debt. Anybody help me with this?

As I have stated before, the central banks must “be seen to be doing something” about inflation, never mind that monetary policy is the wrong tool to control supply side inflation. And since all they have is the blunt instrument of rate hikes, they will go right on driving nails into labour until it’s crucified upon a recession.

It’s the same sort of logic that gave us “in order for the village to be saved it was necessary that it be destroyed.”

The whole architecture of economic management as currently constituted is a prison for labour, and the central banks are the screen behind which our duly elected representatives hide behind in order to escape accountability. That they work for their donors, not the electorate, closes the circle of perfidy.

And the corporate owned media in turn plays its part, dutifully parroting bank economists and the bought and paid for “think tank” complex both of which are staffed with miseducated drones straight out of Monetarist-infested, orthodox economics programs.

So it goes …

” The banks are laughing because while they have increased borrowing rates immediately, deposit rates remain low – result: massive gains in profits to an already profit-bloated sector.”

I think I know the answer, but as the subject has cropped up on a FB discussion, what would you say to the argument that the banks don’t need savers deposits to be able to lend and therefore there is no need for the banks to pay any interest at all?

Peter,

I would say it might look as if banks don’t need deposits to fund their lending business but take at look at any retail bank balance sheet.

Banks rely on getting their share of banking industry private deposits in the normal course of business and would attempt to optimize their funding sources to maximize their profits and minimize their risk structure.

Thanks for this article, Bill.

So, accepting all you have said, and current inflation is as it is, what should the RBA have done instead, if anything? What course would you chart and how would that play out, do you reckon?

(This is a serious question from an interested non-economist who is very concerned about the country and who is therefore trying to understand this topic)

Murray

Great post Bill.

RBA Governor looking like a bunny in the headlights.

Re second comment,If banks are getting 2-3 % more interest on the biggest part of their business, housing finance, then they make more money. Pretty obvious really.

Like the last 40 years on repeat: the solution to every economic problem is to increase profits and drive down the working class.

“345 Full-time equivalent jobs”, I take it 345 thousand? It’s amazing how large primary producers such as Oz & NZ (me) end up with these cost increases when we produce multiples of what we consume… Surely government could regulate stable prices for the local market?