It was only a matter of time I suppose but the IMF is now focusing…

The Merkel failure

Its seems the conservative economics press is going through a hard time as it tries to wrest itself from its past litany of errors of judgement, backing the wrong horse, whatever. The latest example is The Economist Magazine, which ran a Leader Article over the weekend (September 25, 2021) = The mess Merkel leaves behind. It eviscerates the Merkel period for leaving Germany with a legacy that will cause headaches for future leaders and for the German people. This runs counter to the usual stuff the Magazine has offered about the soundness of Germany over many years as a bastion of stability and good financial management. It also provides a dose of reality to the raft of ridiculous glowing assessments of the Merkel years. In my view, she has overseen a government that has undermined its own prosperity, deliberately disobeyed the very rules it enforces on other nations in the Eurozone, and bullied leaders of other nations to enact dreadful policy shifts that have impoverished defenceless citizens. It is a cause of celebration that she is going not because we laud her work, quite the opposite. One failure less in public office.

The Economist Magazine article considers “Mrs Merkel’s achievements are more modest” relative to the other long-serving German Chancellors – Otto Von Bismarck and Helmut Kohl.

I would take exception at the inference that Kohl was a great achiever for Germany – after all he took Germany into the euro, which has been a disaster not only for his nation but also the other 18 Member States.

But that point is an aside.

The Economist writes that:

… as Mrs Merkel prepares to leave office when a new government forms after an election this weekend, admiration for her steady leadership should be mixed with frustration at the complacency she has bred.

The complacency relates to “signs of neglect” that are “plain to see” and relate to the failure of the German state to “invest adequately or wisely, falling behind its peers in building infrastructure, especially the digital sort.”

German industry, once considered a power-house in Europe and the World, is now in decline.

A report from the German Economic Institute (IW) in 2020 concluded that peak of German motor industry strength is over as a result of the failure of German companies to invest in electric technology.

This DW Report (September 8, 2020) – Germany’s car industry struggles with transformation amid coronavirus crisis – provides more detail.

The reason for Germany’s decline?

Penny-pinching is hard-wired into the state. In 2009, on Mrs Merkel’s watch, Germany hobbled itself with a constitutional amendment that makes it illegal to run more than a minute deficit. With interest rates so low, sensible governments ought to have been borrowing for investment, not fainting at the first spot of red ink.

I have documented this austerity bias in several blog posts (see list at end for some links).

It is obvious that Germany has made several errors:

1. Entering the Eurozone.

2. Pressuring the other nations to accept the unworkable SGP.

3. Its own Schwarze Null constitutional amendment.

All of which have progressively crippled the German state as a provider of quality infrastructure upon which other sectors can leverage productivity growth from through their own investment.

The Economist Magazine documents Merkel’s many failures including its “sluggish” response to climate change, its reluctance to support a European-wide debt instrument, its insistence that most of the pandemic relief be in the form of loans rather than grants and its general dithering on important geo-strategic matters (like giving Russia a “a chokehold over European energy supplies by backing the new Nord Stream 2 gas pipeline”).

The reality is that the pandemic assistance, biased towards debt rather than grants, is “a one-off” and:

Worse, the “stability” rules that will force countries back into austerity to shrink their stocks of debt are ready to revive, unless amended.

There is no expectation that Germany will shift its position on the harshness of these rules, which will make it very hard for any European nation to come back strongly from the pandemic.

If you followed the German election campaign, none of the likely governing parties, in whatever coalition one can imagine, gave any impression that they were up for serious reform.

They all talked about fiscal responsibility, which in the German context is actually code for irresponsibility – undermining the future.

The final assessment of the Economist:

That is the mess Mrs Merkel has left behind.

The infrastructure problem

I wrote about this in this blog post (among others) – The German government celebrates its record surplus while infrastructure collapses (January 15, 2020).

It has been obvious that Germany’s public infrastructure has been deteriorating for many years now – dated, poorly maintained and inefficient.

On September 18, 2014, Spiegel International ran an article – A Nation Slowly Crumbles – where a senior German researcher opined about the “Die Deutschland Illusion” and said that Germany was on a:

… downward path … [living] … from its reserves.

He indicated that “Hardly any other industrialized nation is so negligent and tight-fisted about its future. While the government and the economy were investing 25 percent of total economic output in new roads, telephone lines, university buildings and factories in the early 1990s, the number declined to only 19.7 percent in 2013.”

Since Germany entered the Eurozone, its net public investment has been declining, even negative in some periods (which means the rate at which it was building capital was more than offset by the depreciation of existing public infrastructure).

Overall, growth in Germany’s capital stock has been among the weakest in the European Union.

The German Statistical Agency’s recent publication (in German) – – published detailed infrastructure investment data by Sector (see Chapter 3).

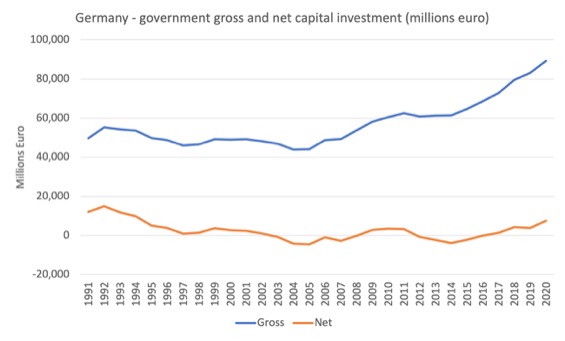

The following graphs show Gross and Net public investment (in millions euro and percent of GDP, respectively) since 1991 to 2020.

The first graph reveals that for most of the period shown, which includes the period of convergence towards Stage 3 of the accession to the common currency (pre-2000) when austerity really began as the Eurozone nations struggled to get close to the deficit criteria specified under the Stability and Growth Pact, the German government has been allowing the public infrastructure to contract (net negative).

And while the first graph shows gross investment grew from 2005 in nominal terms, once we scale that in terms of GDP, the situation is different.

In 2000, the share of GDP of gross investment was 2.3 per cent and in the pre-pandemic year 2019, it was still 2.4 per cent.

The net graph is a bit misleading because DeStasis rounded the negative numbers at zero.

But whichever way you want to spin it, this history of public investment is disastrous for the future of the nation.

The fiscal rules have crushed future prosperity in Germany and left the future generations (the ‘grandkids’ with a reduced quality of life).

The result has been declining productivity growth as shown by the following graph which indexes GDP per person employed at 100 in 2000 when the common currency began. The vertical red line marks the beginning of the Merkel period.

The average annual growth rates for the decades shown are 1.35 per cent in the 1990s; 0.31 per cent in the 2000s; and 0.47 per cent in the period since 2010.

The persistent violation mentality in Germany

Under Merkel’s regime (from 2005 onwards), Germany has been a serial offender in terms of the rules they claim should be enforced for others.

Of course, ‘claim’ is to weak. The Germany state has pressured the European Commission to enforce austerity in various nations to the end that some have been permanently impaired.

One of the stark persistent violations of EU rules is the external position of Germany.

I covered this issue in a number of blog posts including:

1. German trade surpluses demonstrate the failure of the Eurozone (April 24, 2017).

2. The European Commission turns a blind eye to record German external surpluses (October 31, 2016).

3. Germany’s serial breaches of Eurozone rules (May 11, 2015).

In the early days of the Eurozone, there were dramatic shifts in the current account balances (which reflect trade and income flows between nations).

Germany’s ‘mercantilist’ strategy dominated the early years and they started to record very large external surpluses which were mirrored by expanding external deficits in the peripheral economies.

What happens if a nation exports more than it imports (ignore, for simplicity, the income side of the current account)?

The net outflow of real goods and services would be accompanied by accumulating financial claims against the rest of the world.

This is because the demand for the nation’s currency to meet the payments necessary for the exports would exceed the supply of the currency to the foreign exchange market to facilitate the import expenditure.

How might this imbalance be resolved? There are a number of ways possible.

A most obvious solution would be for foreigners to borrow funds from the domestic residents. This would lead to a net accumulation of foreign claims (assets) held by residents in the surplus nation.

Another solution would be for non-residents to draw down local bank balances, which means that net liabilities to non-residents would decline.

Thus a nation running a current account surplus will be recording net private capital outflows and/or the central bank will be accumulating international reserves (foreign currency holdings) if it has been selling the nation’s currency to stabilise its exchange rate in the face of the surplus.

Current account deficit nations will record foreign capital inflows (for example, loans from surplus nations) and/or their central banks will be losing foreign reserves.

Large current account disparities emerged between nations in the 1980s as capital flows were deregulated and many currencies floated after the Bretton Woods system collapsed.

European nations such as Germany, the Netherlands and Switzerland were typically recording large and persistent current account surpluses and with a significant proportion of their trade being with other European nations, the imbalances grew within Europe as well as between Europe and elsewhere.

German government policy (Hartz reforms – see below) deliberately created widening imbalances in Europe by undermining the competitiveness of the other nations through the harsh attack on its own workers.

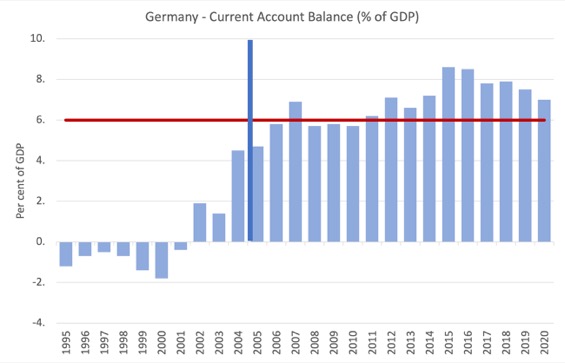

The next graph shows the evolution of the German current account balance (as a % of GDP) from 1995 to 2020.

Germany’s current account surplus was 7 per cent of GDP in 2020 and the most recent quarterly data suggests that figure will rise further in 2021.

As we see, when Germany entered the Eurozone, it was recording small external deficits but throughout the early part of the common currency, it clearly shifted focus and started to run ever increasing current account surpluses.

From a sectoral balance perspective, with an external surplus of 7 per cent of GDP and a constitutionally-required fiscal balance (more typically a surplus in Germany’s case barring the recent pandemic deficit), the private domestic sector must be running a surplus of around 7 per cent of GDP – a massive domestic saving amount.

The other aspect of the persistent external surpluses is that the strategy is depriving German citizens of some degree of material prosperity by ‘exporting’ German resources (products) for the enjoyment of foreigners.

I document the German turnaround with respect to trade in this post – The European Commission turns a blind eye to record German external surpluses (October 31, 2016).

What the data confirms is that Germany is continually ‘gaming’ its EMU partners and undermining prosperity in the rest of the Eurozone.

The persistent violations of EU rules come about because the on-going external surpluses are well above the limits set by the so-called Macroeconomic Imbalance Procedure, which was introduced as part of the ‘reinforced Stability and Growth Pact (SGP)’ that became operational on December 13, 2011.

Among other rules that were tightened, the European Commission introduced the ‘Imbalance Procedure’ under the so-called Excessive Imbalances Procedure (EIP), which aims to reduce macroeconomic imbalances (particularly unit costs and so on).

The European Commission claimed that it would force nations to submit “a clear roadmap and deadlines for implementing corrective action”.

The whole system was to be subjected to a huge surveillance operation (EU monitoring) with rigorous enforcement (fines equal to 0.1 per cent of GDP) and central intervention in a nation’s budgetary process.

They made the rules even harsher in 2012 with the – Treaty on Stability, Coordination and Governance in the Economic and Monetary Union (TSCG) – also known as the ‘Fiscal Compact’.

These changes were driven by the Germans, who in 2009 enshrined a ‘balanced budget rule’ or ‘debt brake’ in their Basic Law (Constitution).

The ‘Macroeconomic Imbalance Procedure’ embedded in the Six-Pack, exposes the inherent, anti-people biases that dominate European policy making.

I document that point in the blog post cited above.

In terms of trade, the upper warning threshold (for a surplus) is 6 per cent of GDP.

Germany persistently violates this limit, which is one reason that so much debt was incurred in Spain and elsewhere.

Germany’s huge surpluses and lack of domestic investment means it is supplying large flows of capital to the rest of the world.

Such surpluses rely on offsetting external deficits elsewhere.

While the European Commission concluded that Germany would have to find ways to ‘strengthen domestic demand and the economy’s growth potential”, it dodged the main issue and has failed to enforce the procedure.

Conclusion

Merkel has been in charge while Germany has maintained its destructive role in the Eurozone by suppressing domestic demand and forcing austerity onto its partner Member States, while hiding behind the common exchange rate.

If there was no common currency, the German mark would have been appreciating significantly and would have undermined it trade advantage by some margin.

What we are seeing is a sort of reprise of the fixed exchange rate system under Bretton Woods applied to the Eurozone.

The only adjustment possible for nations running external deficits in the face of the massive external surpluses being run by Germany is to repress domestic demand through wage suppresion, cutting pensions etc.

Clearly these policies are not allowing the other Member States to make relative competitive gains against Germany. It is a race-to-the-bottom – towards the impoverishment of European citizens.

That is another aspect of the mess that Merkel has created and is now leaving behind.

For reference: some prior blog posts tracing the failure of Germany

1. The monetary and fiscal normality of Wolfgang Schäuble – stagnation and entrenched unemployment (June 8, 2021).

2. Dr Die Schwarze Null still not thinking beyond more austerity (April 19, 2021).

3. Bundesbank remits record profits to German government while Greek health system fails (March 5, 2020).

4. Eurozone 2020. Don’t mention the War! (February 11, 2020).

5. The German government celebrates its record surplus while infrastructure collapses (January 15, 2020).

6. Germany to play smokes and mirrors again (September 12, 2019).

7. German external investment model a failure (August 19, 2019).

8. Germany is now suffering from the illogical nature of its own behaviour (August 13, 2019).

9. The German undervaluation obsession is resistant to ‘reform’ (March 26, 2019).

10. Die schwarze Null continues to haunt Europe (May 21, 2018).

11. Germany – a most dangerous and ridiculous nation (December 27, 2017).

12. Wolfgang Schäuble is gone but his disastrous legacy will continue (October 16, 2017).

13. The chickens are coming home to roost for Europe’s so-called powerhouse (August 10, 2017).

14. More Germans are at risk of severe poverty than ever before (July 6, 2017).

15. German trade surpluses demonstrate the failure of the Eurozone (April 24, 2017).

16. The European Commission turns a blind eye to record German external surpluses (October 31, 2016).

17. The reality of Germany and the buffoons in Brussels intervene … (February 3, 2016).

18. Germany should look at itself in the mirror (June 17, 2015).

19. Germany’s serial breaches of Eurozone rules (May 11, 2015).

20. Germany is not a model for Europe – it fails abroad and at home (March 2, 2015).

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

You don’t get a lot of requests to write obituaries, do you? But you are right. And someone needs to point these things out.

I know little of Merkel’s replacement, any chance the tide will turn with the election victory of the centre left?

After following the Labour conference over the weekend.

After being in Germany for 3 weeks in the run up to the election.

Following the Scottish independence debate very closely.

If you are from the left then it is imperative that..

a) Born again New Labour NEVER win an election and vote against them.

b) The SNP or Alba NEVER win Scottish independence in their current form.

c) The Greens are no different. They ARE the liberal left in disguise.

It is very clear it is geopolitics on steroids. EU uber alles, EU uber alles. All are still trying to overturn the Brexit result and then call themselves democratic. Blame everything on Brexit without a basic understanding of economics. All of them are a pathetic attempt at being the Lib Dems.

What would you do if you were the Greens and SNP who fully support the EU and all the rules that go with it ? What would you do apart from write the Growth Comission that was a cut and paste job of an EU convergence program ?

What would you do politically ?

How would you play it if you were the SNP and the Greens who support neoliberal globalist Europe?

a) Make the tough decisions now so it is easier to rejoin the EU. Fudge the reasons Why you have done so many U turns and why you have steam rolled over decisions from conference.

Doing a full 360 on a public energy company. Why did the Scottish ship builders not get the Calmac contract ? Why , are they adopting free market solutions all of a sudden ? Why is The investment bank being used the way it is? Why are they banning protest outside of the Scottish parliament and moving further right on the political spectrum?

Every decision you make from here on in would you consult with the treaty lawyers to make sure any policies you do introduce moving forward from here. Does not make it harder for you to rejoin the EU. Comply with what is expected as a new joiner of EFTA or the EU ?

Or

b) would you Introduce left wing policies now. Only to be shredded apart latter by the EU treaties and the decisions made by the EFTA court. Which would be highly embarrassing for you and make you lose more support than New Labour dud in Scotland. Would you allow Scottish voters to finally see what EFTA and the EU membership is all about.

Which certainly isn’t independence.

For me these massive U turns by the SNP and the Greens are just a warning of things to come under EU membership. The U turns are only the beginning.

For me the new version of New Labour which will be no different to what the SNP and Greens can offer the electorate because of neoliberal globalist Europe treaties and geopolitical ideology has to be stopped. If that means voting Tory because there is no alternative to defeat these liberal tribute acts so be it.

The conservatism of the german middle-class found in Merkel a perfect match.

We have to go back to 1932 to find a similar “love” for a german leader.

We can call it a sort of gregarious behavior and it has its roots in the dark ages of tribal Germany. They don’t argue with the leader; they just follow him.

But not all of them.

The CDU never had a majority in the bundestag.

So how did they manage to push forward the neoliberal agenda?

Well, just like Clinton and Obama in the US, just like Blair in the UK (Starmer is trying to emulate Blair, but…), just like Miterrand in France, and so many others in other places, the neoliberal agenda came by the hands of the so-called progressists – in Germany’s case, the SPD.

The SPD has shored up the CDU all along.

Before Merkel, the SPD, in Schroder tenure, was a sort of the german Clinton.

Some of those progressists even call themselves socialists, which obviously, they aren’t.

So what makes those “socialists” do exactly the opposite of they say they believe?

I can only find an answer to that question: oligarchs money!

What makes them unworthy to represent the people.

They only represent the elites.

They only represent the 1%.

Until people can’t understand this, Germany and the EU will continue to be a tumour in the earth’s biosphere.

Never voted since 1988 apart from to support Brexit. Never voted for Scottish independence because that was never on offer.

But I will vote to try and stop stop these liberals on the left who pretend to be the voice of the working class. I will lend my vote to the right just like the North Of England did to try and finally get rid of these charlitans once and for all.

The liberal left can label me as much as they like and call me a populist. I will wear it with pride. Under current circumstances that is playing out in full view .The union has to be saved. The return of New Labour decimated.

The liberal left were always the looney left to me as they keep voting for the middle of the right wing spectrum. That was until you deal with the left in Scotland They are bat shit crazy. Still don’t know what true independence actually means and struggle with the word trade.

Hopefully, now the left will split. Give me something worth voting for. You can only live in hope and the left says enough is ebough.

Both major German parties only garnered a miserable c.25% support; the Greens – c.15% – mainly supported by the young; the “pro-business small-government” mob (FDP) and the hard-right populists (AfD) both managed c.10%, while the hard left only won c. 4% (typical, since the demise of the USSR).

Fun times ahead trying to find a governing coalition in that confused and conflicted rabble.

Talk about a confused electorate; it’s why politicians are increasingly despised…while orthodox economists are the real villains (and the poor despised politicians can’t even see it!) .

No wonder the democracies are shaky….

“The reality is that the pandemic assistance, biased towards debt rather than grants, is ‘a one-off’.” This is only true if the pandemic is a “one-off.” If, on the other hand, it’s a new chronic crisis for humanity–constantly mutating, intermittently freezing portions of the global economy in its tracks–then “pandemic assistance” will be forced to become normal and necessary human assistance. Sickeningly strange, isn’t it?, how in the horror of Covid lies our hope, that a virus will do what we couldn’t or wouldn’t do politically, humanely, on our own.

“the private domestic sector must be running a surplus of around 7 per cent of GDP – a massive domestic saving amount”

During the 8 years from 2012 to 2019, the Rest of the World supplied 1,726 billion euros to the German economy, of which 1,293 billion went to German households (mainly the wealthier ones, presumably), 242 billion to the German government (in the form of budget surpluses) and 191 billion to German business.

That seems to be a reasonable interpretation of OECD data on the net acquisition of financial assets and liabilities in Germany during that period (confirming Bill’s point).

This germany move toward austerity, decreasing public investment in infrastructure, has to do with a growing deregulation of financial market?

This process whereby Germany immiserates its trade partners (after having depressed the wages and working conditions of its own labour class via the Hartz Reforms) is, I believe, described in considerable detail in Klein and Pettis’ “Trade Wars are Class Wars.”

And the disastrous effects of neoliberal capture of the former parties of labor all over the West are outlined in Piketty’s “Capital and Ideology” and Blyth and Lonergan’s “Angrynomics”

It must be the grand plan of the wealthy elites to ensure that the only political choice is between progressive social policies with neoliberal fiscal/trade policy and conservative/hard right social policies again with neoliberal fiscal/trade policy.

Syriza in Greece initially promised progressive policies in the best interest of it’s unjustly treated citizens but wimped out under pressure and chose to continue sucking on the poisonous EU teat. They are crap and the pro business right or far right are even worse.

Yes the political class are all failures in nearly all nations including the Green parties when it comes to macreconomics. The corporate mass media and powerful business groups and lobbyists ensure electoral failure for any that attempt a progressive path for example Corbyn and Sanders and to a lesser extent Shorten in Australia as well as for all Green parties.

The Greens are relatively more successful in Germany largely because the German mixed member proportional or MMP voting system provides fairer representation in parliament and government for smaller parties. The Greens do want more generous social welfare policies, much stronger environmental policies, more infrastructure spending and higher taxes on the wealthy when compared to the Social Democrats and especially the right. The Greens however still fail to realise the full fiscal capacity available to national governments and unworkable UBI’s remain stubbornly popular.

Voting Conservative or hard right or not at all will only accelerate the neoliberal decline.

At least Germany has been able to retain a sizable portion of its former welfare state, has not chosen to place one of life’s most important necessities – housing into the casino of speculation, still retains good (but deteriorating) infrastructure, has reasonable working conditions for most and has at least taken steps to address global warming. Germany despite heading down the same neoliberal path has in general been less neoliberal than the US, UK, Canada and Australia, as the trade surpluses have largely conteracted the totally stupid fiscal austerity.

Angela Merkel was a moderate conservative with moderate social and environmental policies but was a solid austerity enforcing neoliberal and harmed more than she helped both within Germany and throughout the EU. Money and the financing of governments is the starting point of most good national and EU policy and Merkel failed miserably here. Ultimately she was just another political puppet that delivered only what she was allowed to deliver and nothing more. Sociopaths like Wolfgang Schauble and his client base remain the real rulers where it counts.

Bill has presented all the credible evidence needed in this and all the linked articles on the inadequate performance of Merkel, Germany and the EU.

The Merkel failure. Ms Merkel was a bolshevic burocrat in the DDR and she will be it till her end. She is a liberal marxsist. She has destroyed the CDU (only on the paper her party), she invited millions of strangers and consequently caused enormous social trouble and criminality. Politically is Germany on the Waimar track. She was and is a Soros’s girl. A disaster.